Falcor

It’s been a tough start to the year for the Gold Juniors Index (GDXJ), with the ETF down over 20% year-to-date, massively underperforming the gold price. Fortunately, outside of Argonaut (OTCPK:ARNGF) and a couple of others, some laggards can hang their hat on the fact that their returns look great when stacked up against McEwen Mining (NYSE:MUX). After a 70% plus share decline in barely a year and a recent share consolidation, some investors might be anxious to go bottom-fishing, believing this is finally the spot where an investment in MUX might pay off. While miracles do occur, I see continued degradation in the investment thesis and believe there are dozens of better places to park one’s money.

Black Fox Operations (Company Website)

While some analysts have suggested that MUX should be “accumulated” at prices ranging from $5.00 to $10.50, I have continually warned against owning the stock. This is because the company has one of the worst track records of share dilution sector-wide and has been unable to consistently meet production targets. Worse, even in satisfactory quarters, costs are coming in above $1,500/oz on an all-in cost basis, translating to razor-thin margins in a strong gold price environment. In a weak gold price environment (like the 18% correction we saw recently), it’s hard to justify mining at these prices. If we factor in labor tightness and materials/fuel inflation, MUX’s future looks bleak. Let’s take a closer look below:

McEwen Mining Article (Seeking Alpha Premium – August 2021)

Operating Costs

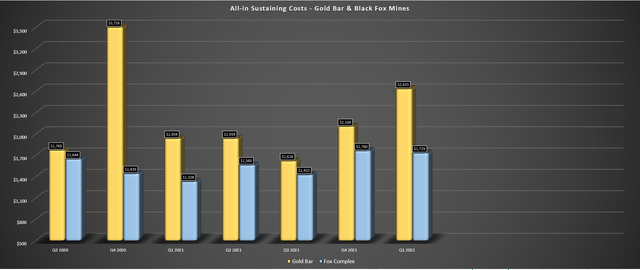

Looking at the chart below, we can see that McEwen Mining’s all-in sustaining costs [AISC] have averaged ~$2,070/oz at Gold Bar on a trailing-twelve-month basis and ~$1,620/oz at Black Fox in the same period. While these figures are above McEwen Mining’s guidance of $1,570/oz to $1,690/oz, I am not optimistic that McEwen Mining will be able to deliver on this guidance. The reason is that more than 30% of producers reporting in Q2 have raised their cost guidance, and not by an immaterial amount (5% plus).

McEwen Mining – All-in Sustaining Costs (100% Owned Operations) (Company Filings, Author’s Chart)

Historically, most of these companies raising cost guidance this quarter have a much better track record than McEwen Mining of meeting guidance. In addition, nearly all of them operate larger mines and have much stronger balance sheets. Hence, they can invest at a level that McEwen Mining cannot to combat inflationary pressures, and they still misjudged the impact of inflationary pressures on operations. Additionally, as we’ve heard in separate conference calls this year from Barrick (GOLD) and Newmont (NEM), the labor situation is tight in some areas of Nevada and Ontario (Canada), which is where McEwen Mining has its operations.

It is possible that McEwen Mining might be the exception here, and somehow it will manage to avoid labor shortages in Q2 and the remainder of 2022 to avoid productivity losses. However, the company already discussed labor shortages in Q1 related to COVID-19. Besides, I would argue that when it comes to choosing who to work for, McEwen Mining is one of the least attractive choices for employees. The reason? It has some of the shortest mine lives and the highest operating costs within the sector.

This combination (short mine lives, high costs) does not provide much visibility into long-term employment if there is a risk of operations being curtailed or temporarily suspended. Hence, if large operators are dealing with a tough labor market in Ontario/Nevada, I would expect similar for MUX, potentially leading to productivity losses and higher labor costs. In summary, this could lead to slightly lower production than planned, and if the company can’t beat its guidance mid-point, it becomes much harder to offset inflationary pressures on a unit cost basis.

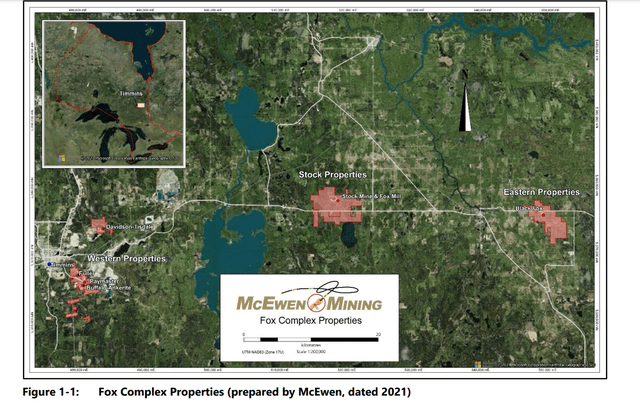

Black Fox vs. Stock Mill (Company Presentation)

Meanwhile, from a fuel and consumables standpoint, McEwen Mining is trucking ore more than 25 kilometers to the Stock Mill, which is not that significant but becomes more significant when diesel prices rise to the extent they have this year. Given that McEwen Mining provided guidance shortly after the invasion of Ukraine, it might have baked in some assumptions related to higher fuel prices. However, given their aggressive nature with previous forecasts, I would be surprised if they were conservative enough.

Meanwhile, at Gold Bar, McEwen Mining operates one of the least attractive types of operations in a rising cost environment: a heap-leach operation. This is because heap-leach assets operate at much lower grades, moving considerably more tonnes of rock per ounce of gold produced. When they benefit from economies of scale like Marigold, Round Mountain, and Fort Knox, these operations can operate at all-in costs below $1,300/oz. However, Gold Bar is a tiny operation, producing less than 40,000 ounces of gold per annum.

So, with rising cyanide costs reported by some operators, rising fuel costs, and a tight labor market, I’m less optimistic about Gold Bar being able to operate at below $1,600/oz on an all-in cost basis. This is especially true when the company reported higher costs related to mining carbonaceous material at Gold Bar in Q1, which was later classified as waste. So, with neither of its operations being in great shape to endure a period of extreme inflationary pressures, it’s not clear how sustainable these operations will be long-term without a rise in gold prices.

Gold & Silver Prices

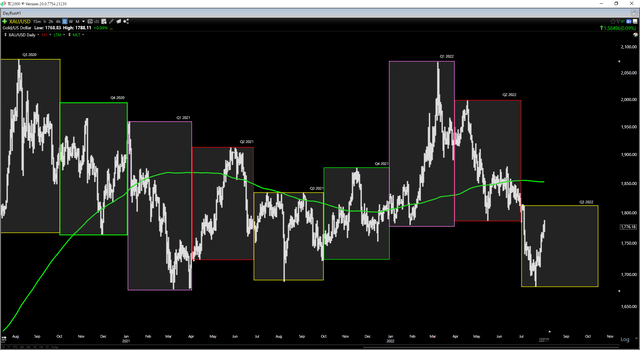

In a rising gold price environment, operators can get away with operating relatively high-cost mines with inconsistent performance. This is because the gold price is bailing them out, allowing them to generate profits. McEwen Mining is unique in that it didn’t generate a profit in Q1 2022 despite the sharp rise in the gold price, reporting a cash gross loss of $2.3 million and a gross loss of $6.0 million. Unfortunately, if it can’t make money at a $1,895/oz gold price, it will be very difficult to generate profits at an average realized gold price below $1,800/oz in Q3 (barring a sharp recovery in gold).

Gold Futures Price (TC2000.com)

In fact, even if we assume that McEwen Mining manages to meet the mid-point of its FY2022 cost guidance ($1,630/oz – I would gladly bet that it won’t), its AISC margin outlook has taken a beating. This is because, at a $1,900/oz FY2022 gold price assumption as of the Q1 rally, AISC margins would have come in at $270/oz this year. Under a more conservative outlook ($1,800/oz average price), AISC margins will come in at just $170/oz. This translates to less than 10% margins which are not viable in this business, given that AISC does not incorporate corporate G&A costs. In fact, I believe it’s best to avoid any producer with sub 20% AISC margins, let alone sub 10% AISC margins.

Finally, while McEwen Mining has benefited from dividends from its investment in its 49% interest in Minera Santa Cruz [MSC], which refers to the San Jose Mine operated by Hochschild Mining (OTCQX:HCHDF), the outlook for dividends here isn’t great at current silver prices. In 2021, McEwen Mining received just shy of $10 million in dividends, but this was when the average realized silver price was above $25.00/oz vs. all-in sustaining costs of $16.70 – a great year for the asset that certainly benefited MUX in another disappointing year for its 100% owned operations.

However, all-in sustaining costs are estimated to come in above $19.00/oz in FY2022 at San Jose based on Hochschild’s guidance, leaving little room for margins at the one asset that actually has been benefiting McEwen Mining’s bottom line. Like gold, we could see a sharp increase in the silver price, and I don’t think sub $20.00/oz silver prices are sustainable. However, with AISC margins at this asset looking like they’ll shrink from $8.00/oz to $3.00/oz or less year-over-year, this should lead to a decline in MUX’s attributable profits from this asset.

To summarize, McEwen’s cost guidance looks too ambitious (in my opinion) due to rising costs, and it’s getting hit on the other end with declining metal prices. When it comes to large companies operating Tier-1 assets that can buy in bulk, invest in technology/innovation, and are employers of choice, I’m not worried about their ability to wade through a weaker gold environment. However, I would be quite worried about MUX’s ability to avoid additional share dilution in this environment, especially given that it’s a serial diluter even in a stronger gold price environment. Let’s take a look at the valuation:

Valuation

Following its share consolidation, McEwen Mining has ~48 million shares, translating to a market cap of ~$192 million at a share price of US$4.00. This might seem like a dirt-cheap valuation for a ~160,000-ounce producer, with a valuation of barely $1.0 million per 1,000 ounces produced per annum. However, there are two issues with this view. The first is that McEwen Mining is not generating any consistent profits from its 100% owned operations, so this production profile isn’t doing anything for its bottom line. Secondly, for a company that regularly dilutes shareholders due to its inability to be self-sufficient from operations, it’s not possible to comfortably rely on the current share count for the denominator.

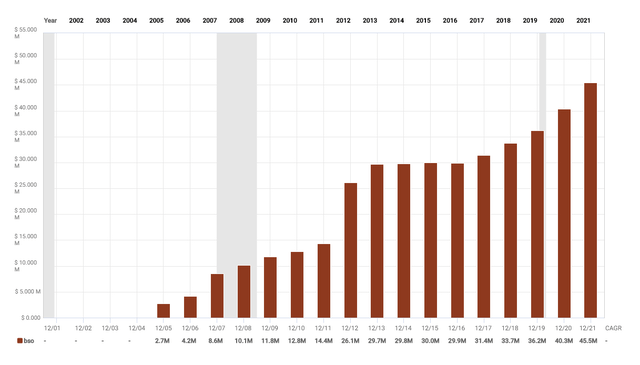

Based on my view that this will be another year of net losses per share for McEwen Mining, I would expect additional share dilution by Q3 2023 as its working capital (~$30 million) declines. So, with limited confidence in the share count remaining at current levels, it’s not easy to value the company. If MUX were to raise $15 million next year to pad its balance sheet, this would translate to ~3.3 million shares at a share price of $4.50, MUX would continue to be one of the largest diluters on a percentage basis among its producing peers (historical dilution shown below). This is precisely the reason I warned against owning Argonaut Gold because it was impossible to tell if the stock was cheap when the share count was a moving target.

McEwen Mining Shares Outstanding (FASTGraphs.com)

Some investors will argue that McEwen Mining’s valuation is justified by its 82% ownership in Los Azules alone, a massive copper project in Argentina. While this is certainly an impressive project that some copper majors might be interested in, it has little value in MUX’s hands with zero way for the company to fund the upfront capex. Meanwhile, if a major was looking to buy MUX to gain a controlling interest in the project, it might make more sense to let MUX continue to fall in value to get the project even cheaper. The reason is that there’s no catalyst for MUX to go higher when it’s unprofitable, and its share price is hitting new all-time lows in a period when the gold price has doubled (2022 vs. 2008).

Summary

McEwen Mining is undoubtedly cheap on most metrics. Still, one of the best ways to lose money in this sector is by buying cheap producers with low-quality operations and razor-thin margins. When we add a track record of steady share dilution and questionable capital allocation (like buying Black Fox), these companies are even less likely to generate positive returns for investors. Based on this, I see MUX as un-investable, especially in a sector where several producers are paying attractive dividends and buying back shares. So, unless an investor is comfortable with being regularly diluted and is intent on underperforming the GDX over the long run, I think there are better places to park one’s money if one wants exposure to the gold price.

Be the first to comment