monticelllo/iStock Editorial via Getty Images

The market looks dismal these days as the Federal Reserve continues to raise interest rates to combat high inflation. So, investors need to tread carefully on which individual stocks to buy, sell, or hold. One that I choose to hold in this current economic environment is McDonald’s (NYSE:MCD).

Less Volatile than Many Stocks

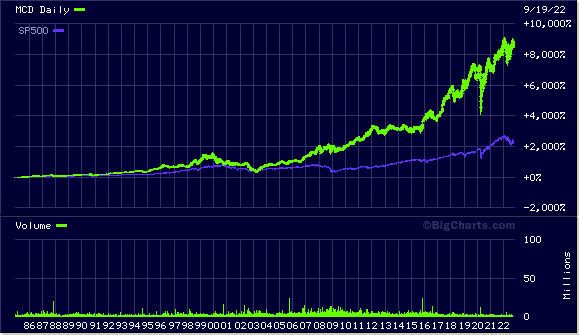

McDonald’s stock tends to hold up well during economic downturns and even through recessions. Sure, the stock may experience some declines, but it tends to perform better than cyclical companies and stocks with high beta during downturns. McDonald’s has a beta of 0.57. The S&P 500 (SPY) has a beta of one. Therefore, McDonald’s stock usually experiences significantly less volatility than the broader market.

On the other end of the spectrum, there are stocks that have high betas. This includes some of the high growth stocks that I tend to cover. Stocks with betas above one tend to be more volatile with large swings in price in both directions. While I like to capture the swings on the upside, I would like to avoid large swings to the downside. However, when I consider making portfolio changes, McDonald’s is one stock that I haven’t considered selling. Less volatility is one reason for this.

bigcharts.com

As the chart above shows, McDonald’s stock significantly outperformed the S&P 500 over the long-term. It may not beat out many of the high growth stocks over time, but MCD does tend to perform well.

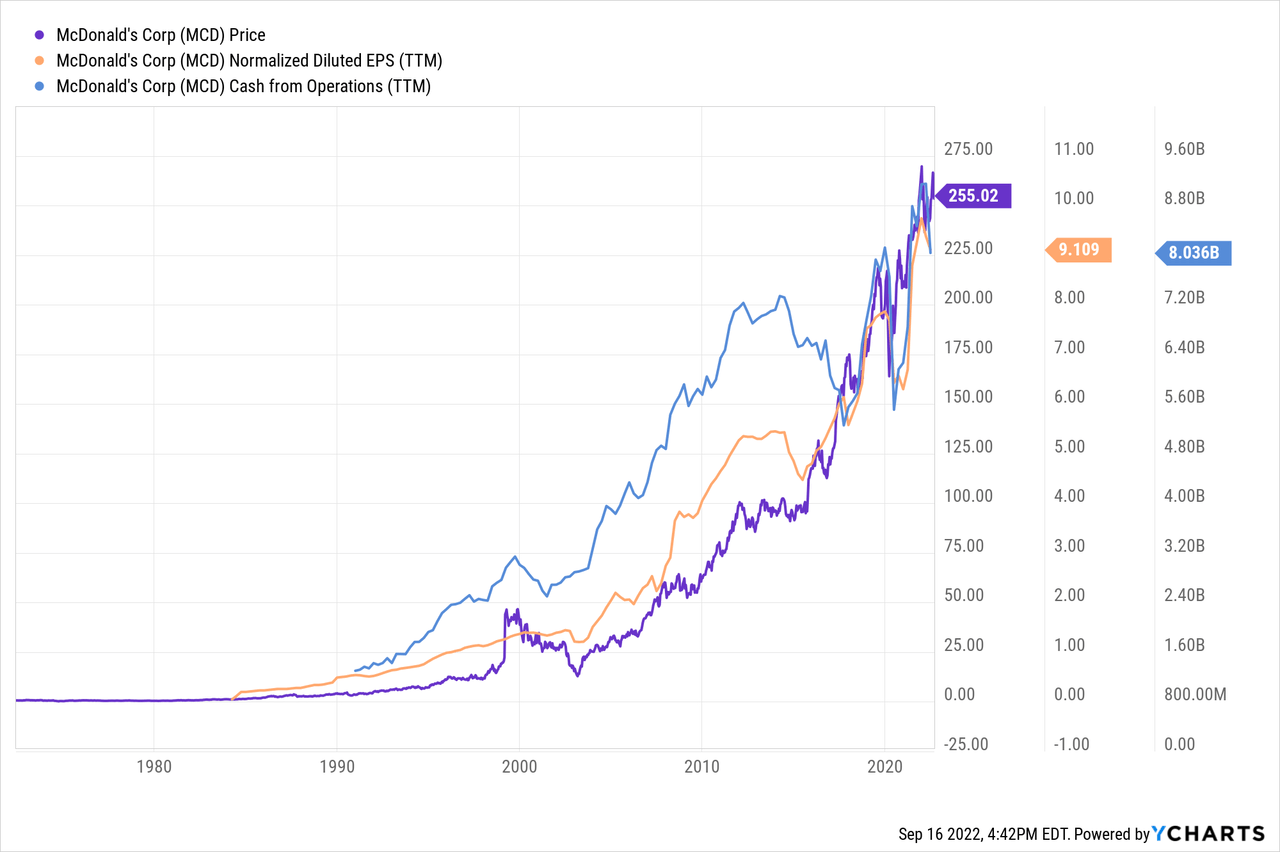

Steady Earnings and Cash Flow Growth

McDonald’s rising stock price and increased dividends have been supported by the company’s increasing earnings and cash flow over time. There is a good chance that these increases continue since MCD is expected to grow earnings at about 7.25% annually over the next 3 to 5 years. Operating cash flow is expected to grow at about 14% annually in 2022 and 2023.

There is more to the business than just selling food and beverages. MCD’s growth is supported by a business that operates like a real estate company or REIT. While MCD does not officially operate as a REIT, the company does earn franchise fees from its franchisees. McDonald’s also owns the properties that are leased to the franchisees. Therefore, the company acts as a real estate company as it earns revenue from the franchisees.

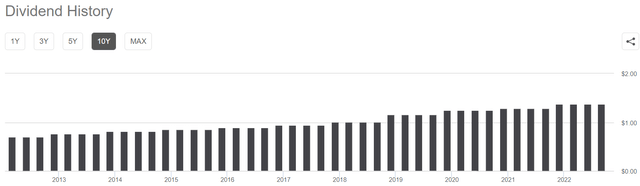

Steady Dividend Growth

McDonald’s increased the dividend every year for the past 20 years. The average dividend growth rate was 7% per year over the past 10 years. That is a great track record. Dividend growth can continue as MCD increases cash flow going forward. The company brought in over $8 billion in operating cash flow and had $5.4 billion in levered free cash flow over the past 12 months. Free cash flow per share is expected to grow at about 17% annually in 2022 and 2023. That should support future dividend increases.

Valuation

McDonald’s looks overvalued at the moment with a forward PE of 25.9 and price to sales ratio of 8. This is above the Restaurant industry’s forward PE of 24.3 and price/sales of 3. Given MCD’s high valuation, I wouldn’t recommend buying the stock at these levels. However, I am not recommending selling it either. I am neutral on the stock at the moment.

Potential investors can be patient and may be able to pick up the stock at a lower valuation as the current bear market continues.

Balance Sheet

McDonald’s balance sheet has some strengths and weaknesses. One strength is that MCD has 1.4x more current assets than current liabilities. However, a weakness is that the company has 1.13x more total liabilities than total assets with a negative shareholder equity of $6.4 billion. The company has about $1.9 billion in cash and equivalents. One major weakness is that MCD carries a high amount of total debt of $47.6 billion.

While the total debt looks troubling on the surface, MCD’s steady positive cash flow allows the company to effectively pay it off. MCD paid $2.7 billion of debt off over the past 12 months.

Moody’s has a rating of Baa1 for MCD with a stable outlook. Moody’s (MCO) has a view that McDonald’s will be able to maintain solid credit metrics and strong liquidity even in the face of higher inflation, staffing shortages, and supply chain issues. The Moody’s rating also takes into consideration that MCD temporarily closed its stores in Russia and Ukraine due to the war.

Cultural Adaptations

One of the key aspects of the food side of MCD’s business is the way the company offers meals that are specific to each region of the world. For example, while coffee is big in the U.S., a beverage known as milk tea is offered in Hong Kong where tea is a local favorite. The menu in India has numerous spicy meals and vegetarian offerings which suits the taste of consumers there. MCD in Canada offers poutine, which are french fries covered in gravy and cheese curds. Thailand offers a coconut sticky rice pie as a desert item. McDonald’s in China has a honey chicken rice bowl since rice is a staple there. The Philippines menu offers fried chicken with McSpaghetti because I guess they must like that type of thing there. The U.S. offers fruit and maple oatmeal for those looking for a healthy breakfast option.

There are many other examples from around the world where McDonald’s offers menu items that are designed to satisfy the taste buds of the locals. The important thing regarding this is that MCD can add or subtract from the menu based on changing consumer tastes and by what sells the best. The company can test new products on a small scale and roll them out on a wider scale if they are a success. They can also eliminate poor sellers as needed. This flexibility can drive long-term sustainable success.

Bottom Line Thoughts Regarding McDonald’s

McDonald’s may not be the most attractive company to invest in for the long-term, but the stock can have its place in a balanced portfolio. Investors should keep in mind that MCD acts like a real estate investment due to the franchise business structure. Investors do get rewarded with dividend payments that are typically increased each year. They are also rewarded with a stock that rises steadily over the long-term with less volatility than the broader market.

While I’m not recommending MCD as a buy right now due to the high valuation, I think current investors should hold the stock. Those who are considering starting a position will probably get a better opportunity within the next year.

Be the first to comment