FatCamera

Introduction

I give BioNTech (NASDAQ:BNTX) a sell rating. BioNTech greatly contributed to society during the COVID-19 epidemic through its vaccine efforts. As a result, its share price rocketed from the teens during its 2019 IPO to the mid-400s in the middle of 2021. This incredible over 20x return will not be repeated. However, we have yet to see if BioNTech can maintain consistent growth for its shareholders, considering that they only successfully launched their COVID-19 vaccine to market. This is where the tale of two companies comes in, the old company is the company that launched this stock initially on the back of their COVID-19 vaccine, and the new company is an unproven biotech company looking to be a consistent drug developer. Now the company sits right around its 52-week lows, and investors are looking for the new company’s legacy. Currently, the street does not believe in the future, as evidenced by the company’s incredibly low current P/E of 2.92.

Financials

From the company’s latest presentation, the company generated 3.2 Billion euros of revenue in Q2, equating to 2.2 Billion euros of operating income. The company had an after-tax profit of 1.7 Billion euros, which led to 6.86 euros of earnings per share. The company plans to make between 13-17 Billion euros in revenue from COVID-19 by the end of 2022. Currently, the company has already earned 9.1 Billion euros of that figure. Finally, the company has 9.3 Billion euros of cash and 10.4 Billion euros of trade receivables.

The Old Company

I will not dive too deeply into this because of how well and in-depth this has been covered across numerous articles on this site. However, I will touch on how it currently affects the company. From the company’s 2nd quarter investor presentation, we know that the company pulled in 3.2 Billion euros of COVID-19 vaccine revenue in Q2 and an impressive 9.1 Billion euros over the 1st half of 2022. That fragment of revenue dropped from 5.9 Billion euros to Q2’s 3.2 Billion Euros. Going back to Q4 of 2021, this same revenue figure was $5.5 Billion, which means that the COVID-19 vaccine’s revenue is starting to fade. While I believe it will be a consistent revenue generated for many years to come, I also think this trend will continue. It will be exciting to see this result for Q3. A bounce back could turn the narrative around, and a continual decline would further show that the old company is losing its limelight. I will be watching this closely.

The New Company

As the old company fades, the new company must start to shine. The difference between a successful biotech company and a pharmaceutical giant is the ability to produce revenue-generating products consistently. Which one will BioNTech be?

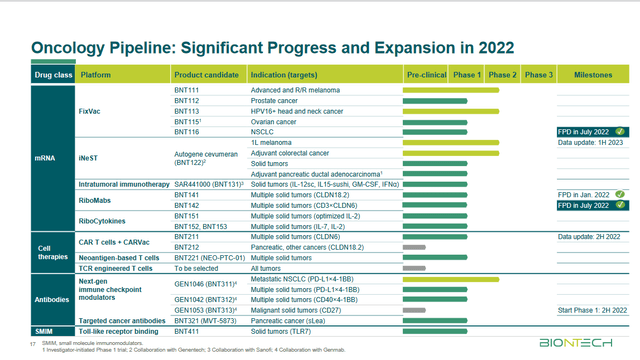

The company has 11 drugs in preclinical stages, 16 in phase one, 5 in phase two, and 1 in phase 3. The company mainly works in Oncology. Each level of the development process has a failure rate, with the hardest progression step being from phase 2 to phase 3. However, out of all the fields, Oncology has the lowest percentage of successful trials from phase one, at 5.1%. Only 62.8% of Oncology phase one trials advance to phase 2; of those, only 24.6% advance to phase 3; of those, only 40.1% even lead to an NDA/BLA. Finally, of the ones that are applied for, only 82.4% are approved. The road to approval is a very steep uphill battle in Oncology. Below is the company’s Oncology pipeline as pictured in the Q2 presentation.

The pipeline is spread across four drug classes in many profitable indications. Any approval will help the company start to become a consistent revenue machine. As previously mentioned, this will be a difficult task, and until I start seeing continuous progression between drug trial phases, I will not become bullish on the company. I will look back further into the pipeline once some trials are in phase 3 trials, as I will have more data to look into specific trials.

Risks and Conclusions

The company’s COVID-19 revenue is fading. The question is whether or not the company will be able to find new sources of revenue. The significant growth is gone. Now the company needs to prove it can be a consistent revenue generated, which hinges on the company’s pipeline or potential acquisitions. Until the company shows it can move drug trials along, I want to wait on the sideline. The risk of waiting is missing out on some gains. The risk of investing is the stock slowly fall as revenue from the COVID-19 Vaccine leave and the pipeline continues to attempt to progress.

Overall, I gave BioNTech a sell rating. The future is too unknown for me, and I do not feel good enough about the company’s pipeline to initiate a buy rating. However, the company will have money coming in for a while, allowing them to fund their pipeline and potentially bring in new revenue after approval. BioNTech is an exciting company to continue to watch.

Be the first to comment