NicoElNino

A Quick Take On Maximus

Maximus (NYSE:MMS) reported its FQ4 2022 financial results on November 21, 2022, beating expected revenue and EPS estimates.

The company provides business process outsourcing services to U.S. and state government health and human services administrations.

For investors seeking a mid-single-digit growth stock and who believe the worst of inflation is behind the U.S. economy as it enters a slowdown or recession, MMS may be a safe place in the coming downturn, while getting a 1.85% dividend yield in the process.

My outlook on MMS is a Buy between $65.00 – $68.00 per share.

Maximus Overview & Market

Tysons, Virginia-based Maximus was founded in 1975 to provide business process outsourcing services via three segments:

-

U.S. Services

-

U.S. Federal Services

-

Outside the U.S.

The firm is headed by Chief Executive Officer Bruce Caswell, who was previously Vice President Public Sector at IBM and Manager, Office of Government Services at Price Waterhouse.

The company acquires customers through federal and other contract bidding processes.

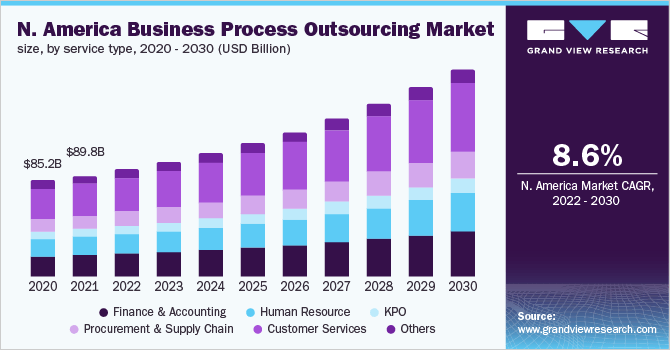

According to a 2022 market research report by Grand View Research, the global market for all types of business process outsourcing was an estimated $246 billion in 2021 and is forecast to reach $530 billion by 2030.

This represents a forecast CAGR of 9.1% from 2022 to 2030.

The main drivers for this expected growth are a growing focus on organizations and agencies in obtaining greater business efficiencies and an increase in the use of technology to drive such efficiencies.

Also, the chart below shows the historical and projected future trajectory of the North America business process outsourcing market:

N. America BPO Market (Grand View Research)

Management views its total addressable market size at $150 billion.

Maximus’ Recent Financial Performance

-

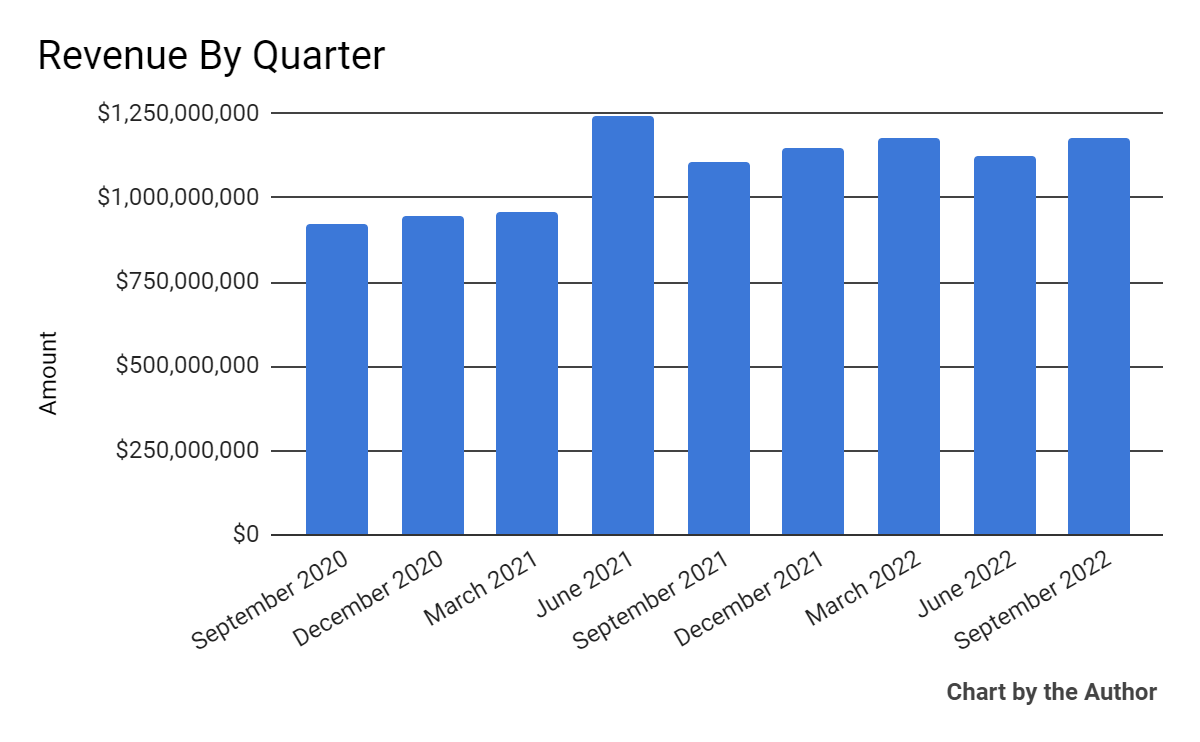

Total revenue by quarter has followed the trajectory below:

9 Quarter Total Revenue (Seeking Alpha)

-

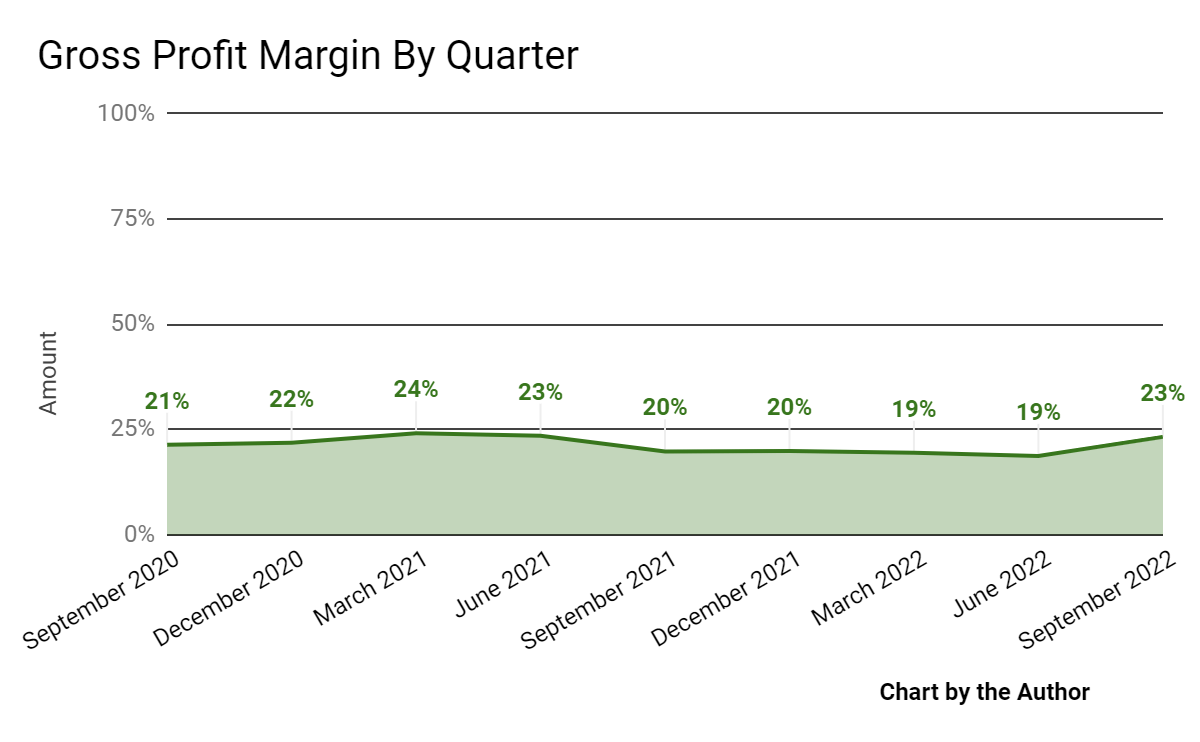

Gross profit margin by quarter has increased in Q3 2022:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

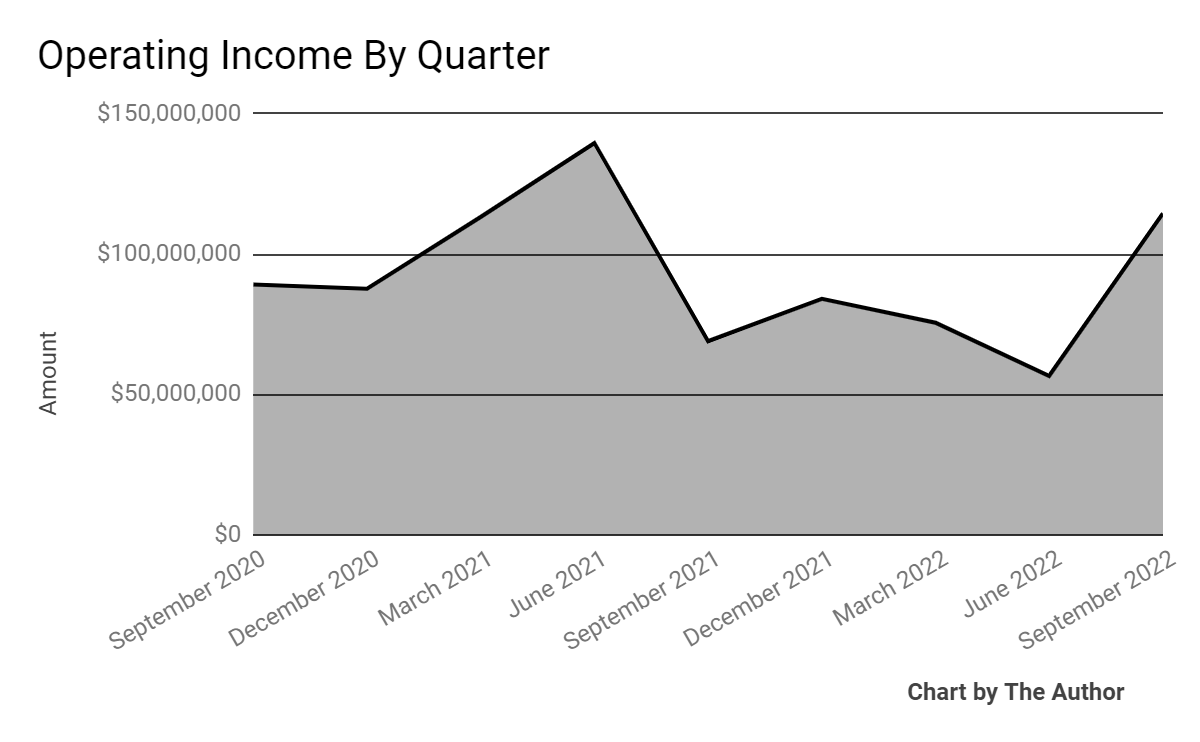

Operating income by quarter has fluctuated in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

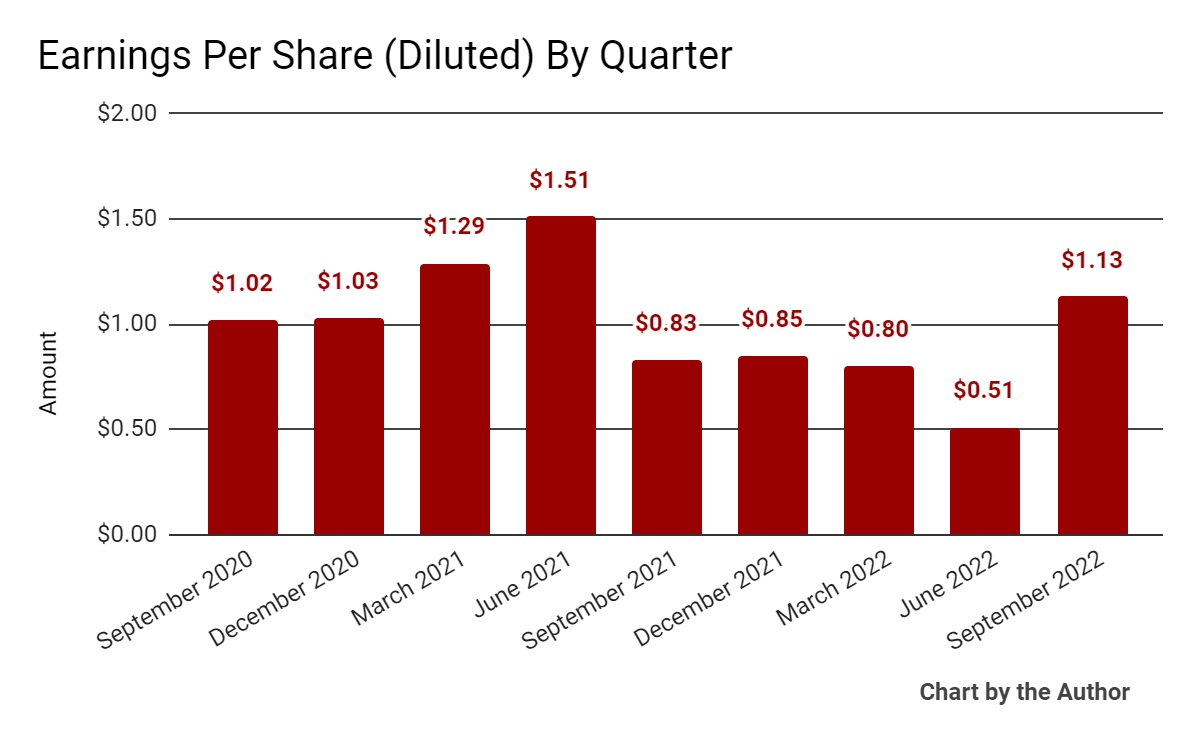

Earnings per share (Diluted) has also varied materially, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

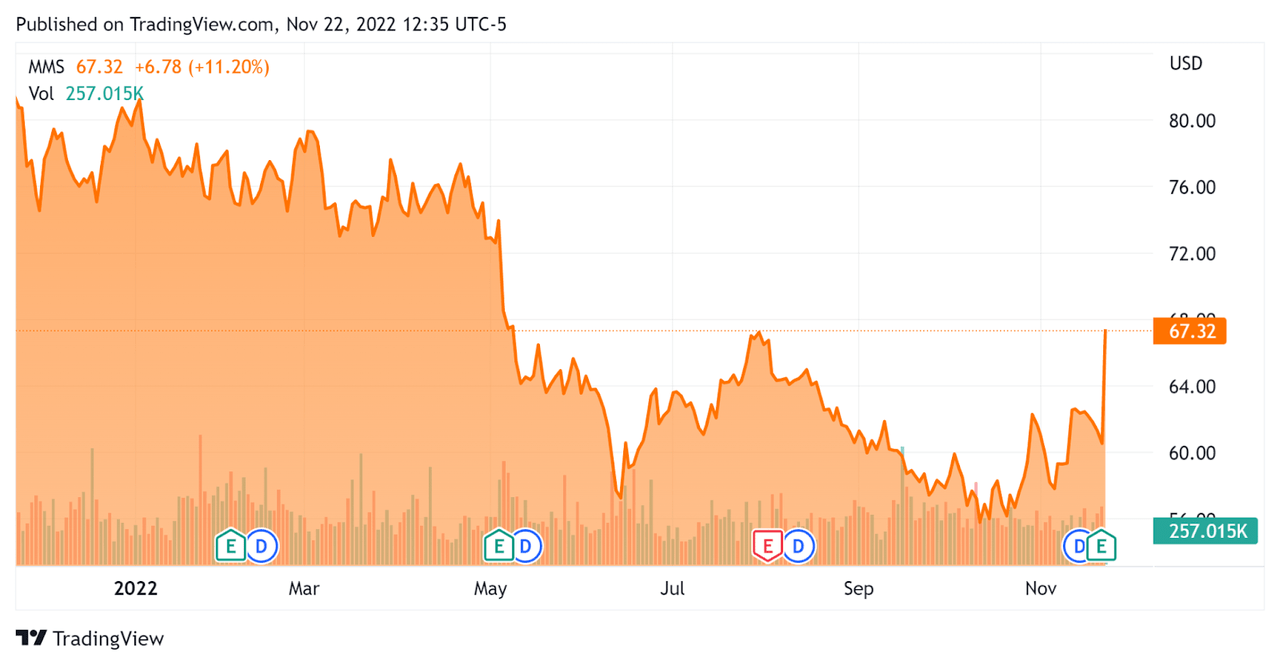

In the past 12 months, MMS’ stock price has fallen 17% vs. the U.S. S&P 500 index’ drop of around 15%, as the chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Maximus

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.2 |

|

Enterprise Value / EBITDA |

12.9 |

|

Revenue Growth Rate |

12.0% |

|

Net Income Margin |

4.1% |

|

GAAP EBITDA % |

9.0% |

|

Market Capitalization |

$3,710,000,000 |

|

Enterprise Value |

$5,240,000,000 |

|

Operating Cash Flow |

$440,440,000 |

|

Earnings Per Share (Fully Diluted) |

$3.29 |

(Source – Seeking Alpha)

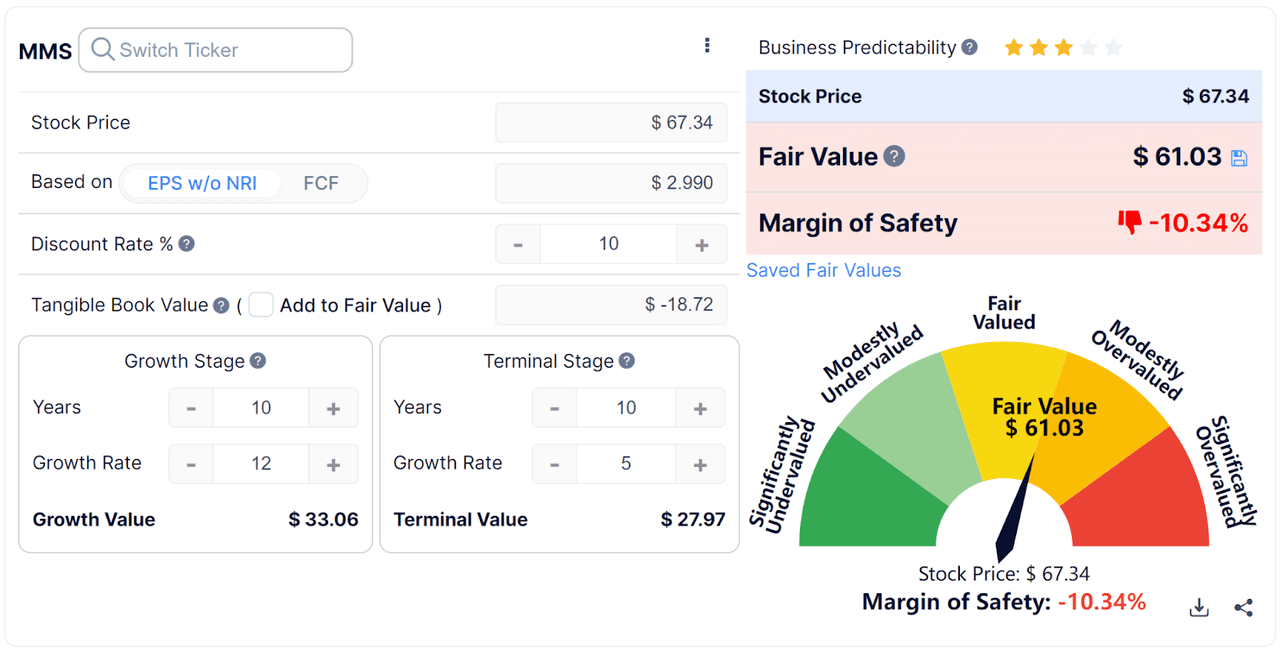

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

MMS Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $61.03 versus the current price of $67.34, indicating they are potentially currently modestly overvalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Maximus

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted the growth of its U.S. Federal Services segment, at 19.4% over prior year results.

Its outside U.S. segment grew by 9%, net of currency headwinds which lowered the figure by 6% due to the strong US dollar.

Its U.S. Services segment contracted by 3.3% due to a reduction in COVID response work. Without the COVID response work, this segment would have grown by 30%.

As to its financial results, total revenue for full fiscal year 2022 increased by 8.9% and adjusted operating income margin was 9.0%, despite a decline in COVID response work over the previous year.

Notably, management plans to reduce its M&A activity in the short term to ‘prioritize debt paydowns using [its] free cash flow.’

This is likely to reduce interest expense in a rising cost of capital environment.

For the balance sheet, the firm finished the quarter with cash and equivalents of $41 million and debt of $1.37 billion. Debt to pro forma EBITDA was 2.6x at quarter end.

Over the trailing twelve months, free cash flow was $233.7 million, of which $56.7 million was capital expenditures.

Looking ahead, management expects fiscal 2023 revenue to be $4.82 billion at the midpoint of the range, which is a mid-single-digit growth rate, and adjusted operating income to be $403 million at the midpoint.

The primary risks to the company’s outlook are the tapering or end of public health emergency-related revenue and the rise in labor costs due to a challenging labor market.

While 30% of the firm’s contract base is a ‘cost plus’ contract type, for much of its contract base it is exposed to limited or no labor rate escalators, negatively impacting margins in high inflation environments.

Management seeks to continue driving cost reductions through technology enhancements and process improvements.

The stock has responded well to the firm’s current quarterly results and fewer contract programs up for bid in the coming fiscal year, which adds stability to its forecast.

For investors seeking a mid-single-digit growth stock and who believe the worst of inflation is behind the U.S. economy as it enters a slowdown or recession, MMS may be a safe place in the coming downturn, while getting a 1.85% dividend yield in the process.

My outlook on MMS is a Buy at between $65.00 – $68.00 per share.

Be the first to comment