EvgeniyShkolenko

Investment thesis

In March, I wrote an article about Maxar (NYSE:MAXR) with a “Hold” rating. I was skeptical mainly because of not increasing profitability, much share dilution, and high debt. Since then, the stock price has fallen 40%, and I now want to examine whether the points on which I was skeptical have improved. And, of course, also look at the current valuation and outlook. Overall, I’m still not convinced, as the debt is now leading to high capital costs, while at the same time the new Legion fleet keeps getting postponed.

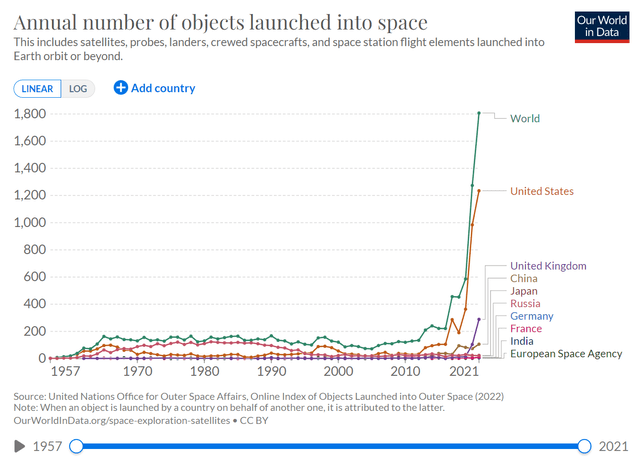

Industry Overview

In my first article, I wrote about the growing use cases of satellites and the estimated future market size. Although satellites have been playing a role for decades, it is above all, the much cheaper launches into orbit and better image resolution have opened up entirely new application possibilities in recent years. You can find more information about this on the Maxar website under use cases.

Reasons for the share price drop

As I said, the stock has been down 40% since March, which seems surprising given the Ukraine war. The earth intelligence business accounts for about two-thirds of the company’s revenue. I’ve been paying a lot of attention to the war, and I’ve seen the Maxar logo on almost every satellite image. But it didn’t boost sales; more on that later.

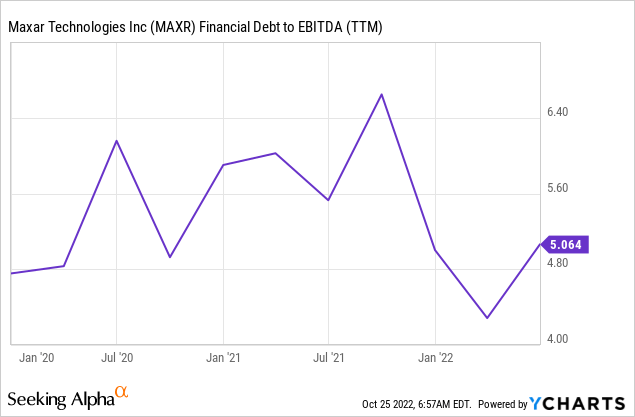

Debt

What has hurt the stock is the interest rate policy. The company has taken on a lot of debt and invested in CapEx to launch the LEGION satellite program. This will then provide significantly higher cash flow, resulting in the leverage ratio falling and debt being repaid. So much for the theory. In practice, however, this has yet to happen. So far, the debt is there, but higher cash flows are not. And since the stock market is generally very volatile right now and investors are more cautious, it is understandable that this increased risk does not please market participants.

Debt/EBITDA is currently around five but could be significantly lower next year when EBITDA is supposed to go up. Another problem with the debt is the rising interest burden. This was $76M in the second quarter instead of $24M in Q2 2021. The revenue in Q2 is only $438M, so this interest expense is enormous. So you can see that EBITDA is a metric you must be very careful with. It’s easy to borrow money and generate more EBITDA, but you shouldn’t exclude interest payments when debt is very high. Q2 EBITDA was $119M, and interest payments were already $76M. The FY 2022 guidance is $165 million in interest payments and $450M to $500M EBITDA.

In addition, debt was restructured in the second quarter, and debt that would have been maturing in 2023 was rescheduled for 2027.

One of our key priorities this year has been to address our upcoming debt maturities to provide the financial flexibility needed to execute on our long-term strategy. When combined with the recent award of the EOCL program by the NRO, we have significantly improved the visibility of the business for all Maxar’s stakeholders.

Biggs Porter, Chief Financial Officer.

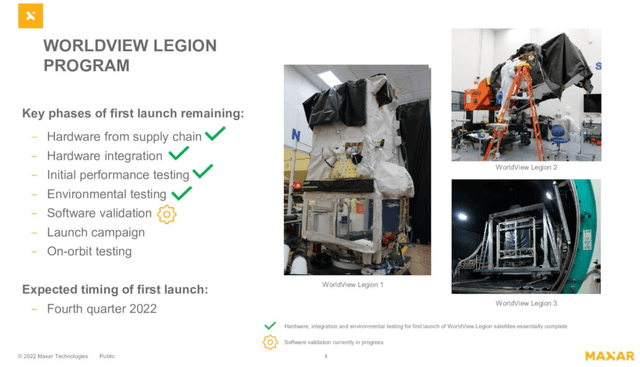

More delays of the Legion fleet

The long-awaited WorldView Legion constellation has now been postponed several times. The launch was initially scheduled for September 2021. First, it was delayed to the beginning of 2022, then to September 2022, and finally to the fourth quarter of 2022. The last excuse for this was “software validation.” And so far, there is no exact launch date, although it is already the end of October. Therefore, I believe there is a strong indication that this will not happen in the fourth quarter.

How much revenue will it add?

The Legion satellite constellation is seen as a game-changer in most articles and comments. But is that the case? First of all, these are only six satellites, which together could cover the area of India every day and, according to Maxar, 60% of the earth’s surface per month. In a presentation from March 2021, Maxar itself estimated that these satellites would contribute $165M annually to EBITDA. This was stated under the “Financial outlook 2023.”

Even if we add another 10% to that because we assume they may be able to charge higher prices now, it’s still only about $180M. That’s only slightly more than the interest costs this year for debt that was taken on, among other things, to finance this project in the first place. However, the same presentation also assumes that after successful implementation, CapEx costs will drop by $180M per year, directly contributing to increasing free cash flow.

Whether this whole calculation works out is not entirely clear from the data I can see. Indeed, more satellites in space will bring more revenue, but how much remains on the bottom line? Will this be enough to pay the enormous interest and reduce the debt burden? At the same time, the company started to pay a small dividend of $0.01 per share per quarter. Probably the company also has increased costs for employees, like many other companies. When the company originally planned, they probably didn’t anticipate inflation and rising interest rates, which now changes the calculus a lot. This is not an attack on the management but an attempt to assess where we are now.

Valuation

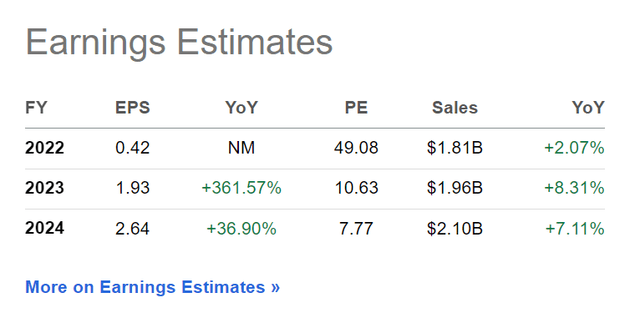

Nevertheless, the market expects earnings per share to increase strongly in the next few years due to increased revenue and improved margins. The Earth Intelligence business, which will include the new LEGION fleet, achieved a strong adjusted EBITDA margin of 45.4%.

Non-GAAP EPS in Q2 was positive at $0.38, but GAAP earnings were negative at $0.41. The bottom line is that the company lost money in the second quarter, even if they want to sell this as a profit and find explanations such as “net loss stood at $30M compared to net income of $45M led by an increase in interest expense of $52M driven by a $53M loss on debt extinguishment” (source). However, non-recurring costs are also part of regular business. There are always new one-time costs. Especially if you have taken on debt in the past and now have to pay for it in one form or another. For my taste, too many companies are pretty creative with their numbers and call them “adjusted.”

I was very surprised that the YoY revenue even decreased, although Maxar seems to have been used a lot by the US government. “Earth Intelligence” remained flat in terms of revenue, but the Adjusted EBITDA margin dropped from 46.3% to 45.4%.

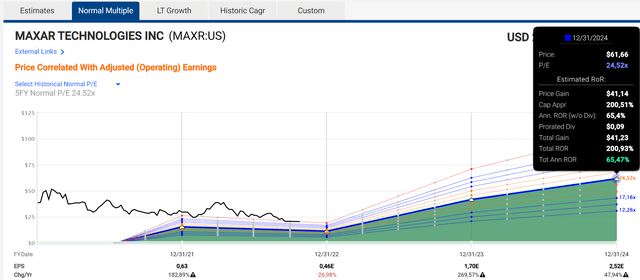

If these EPS estimates were to materialize, the stock would be easy to buy. These estimates show the hoped-for margin improvement, CapEx reduction, etc.: Although sales are not expected to increase as much, earnings per share are forecast to explode.

According to FastGraphs, even an enormously high annual return of 65% would be possible by the end of 2024.

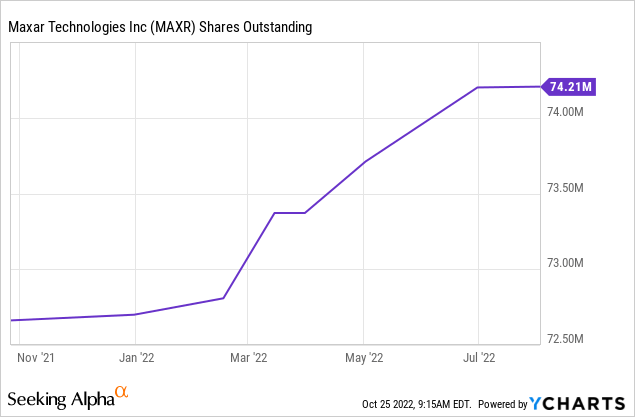

Share dilution and insider selling

One thing I always want to look at, especially with companies that are not yet or hardly profitable, is stock dilution and whether there is insider selling. There was only one insider sale this year and only a tiny dilution, so nothing spectacular.

Risks

Given the EPS estimates and the FastGraphs, you would think this stock is the easiest buy. However, I would like to remind you that these are only estimates and can be revised downwards, especially in times of crisis. Essential for these estimates is that the Legion fleet of Maxar is launched as planned, which, as I said, is not sure at this point and has already been postponed several times. What if it takes until mid-2023? Then, on the one hand, a lot of revenue would be lost and, on the other hand, costs would be higher than expected.

I also want to point out another risk that we will never experience. Theoretically, in case of an escalation of the Ukraine war (or any other war, because it is a world power question, USA vs. China), a company like Maxar should profit a lot. However, these satellites are also one of the first objects to be taken out. By the way, this does not necessarily mean shooting them out of the sky, but it could instead belong to the area of soft warfare and possibly take place via hacking or other methods.

Conclusion

Overall, I feel similar to my first article. I would love to love the shares because the business model is easy to understand, and theoretically, enormous margins and a wide moat should be possible. However, a closer look reveals a few negative aspects, which for my taste, are also presented a bit too positively in the presentations and quarterly results. Overall, it’s still too much risk for me. I don’t think it’s clear whether these six satellites can contribute so much additional profit to finance the enormous financial costs plus dividends plus debt reduction plus further growth. Because even when they are in space, the CapEx costs will not go down to zero, but Maxar will have to continue research and will want to shoot up even more satellites. Overall, I think it is best to wait and see. If the company is successful, you might miss out on some of the gains, but in this case, Maxar would be an investment for years or even decades. At the moment, there are other attractive investments in the market that have less risk of missing their own ambitious goals.

Be the first to comment