Warchi/E+ via Getty Images

Investment Thesis

Matterport (NASDAQ:MTTR) reminds me of that saying, ”if you find yourself in a hole, stop digging”.

I’ve consistently argued that this investment isn’t worth the premium. And every time readers have pushed on my ”lack of imagination”.

And this is not a ”I told you so” piece. On the contrary, this is an analysis that offers you high-quality investment insight that you can act on right now.

It’s time to call it a day on MTTR.

Investor Sentiment Continues to Contract

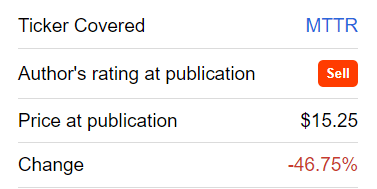

Author’s coverage of MTTR

Back in mid-January, I said,

Matterport stock price falls 40%, but you shouldn’t rush to buy this dip.

As you can see above, since I wrote that statement the stock is down more than 40% in 4 months. For investors to break even from that point in January, this stock needs to rally more than 85%. How long will that take?

When investing, a lot of people believe that you need to make your return the same way you lost it. That’s called the gambler’s fallacy. Indeed, you don’t need to make your money the same way you lost it. There are better opportunities out there right now.

Let’s press ahead and discuss Matterport.

Revenue Growth Rates Slow Down

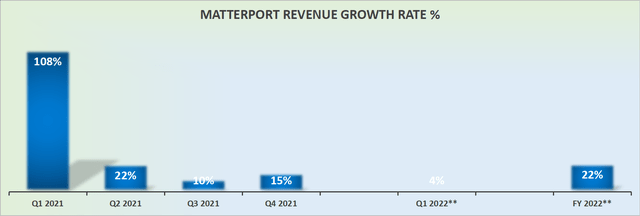

Matterport revenue growth rates, **guidance

Keep in mind that in 2020, Matterport’s revenues increased up 87% y/y. Then, for 2021, revenues ended up 29%. And now, as we look ahead to 2022 revenues are expected to be around 22% at the high end of Matterport’s guidance.

Even if this young company ends up with its topline growing by 22% to 25% CAGR this year, I believe that few investors would objectively contend that this is a disruptive high-tech company, is reporting high growth rates.

Why Matterport? What’s the Opportunity?

Matterport provides services for the digitization and datafication of physical spaces. Matterport provides technology for digitizing, accessing, and managing buildings online.

Matterport Q4 2021 presentation

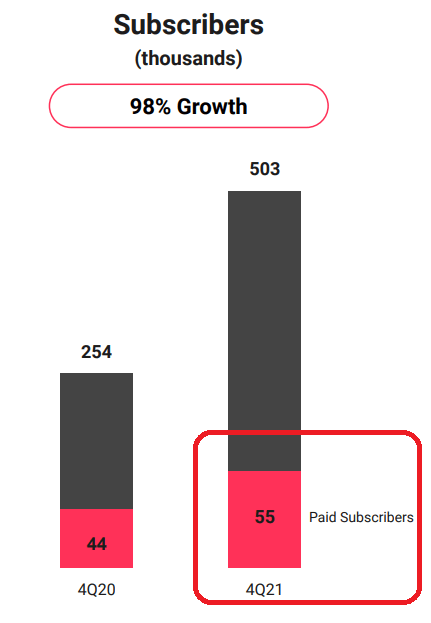

The one area where Matterport is succeeding is in getting subscribers to rapidly adopt its platform. I’ve often declared that investors would do well to follow the subscriber adoption curve. If the subscriber adoption curve is up 98% y/y, the business has to be doing something right.

Matterport investor presentation

Yet, the problem here isn’t so much in the growth of subscribers, but getting those subscribers to actually pay for the underlying platform.

As you can see above, as of Q4 2021, paid subscribers were only up 25% y/y. However we appraise the situation, this is not a high growth business and it shouldn’t be priced as a high growth business.

Path to Profitability is a Long Way Away

As investors, we become intoxicated with the ”investing for growth” narrative. In a period where the biggest successes of the past decade have all aggressively been investing for growth, we’ve come to build practically every bullish thesis on that characteristic.

Before discussing its path to profitability, allow me to take a moment to highlight Matterport’s increasing number of shares.

Matterport finished Q4 2021 with 245 million shares outstanding. Then, for Q1 2022, it’s expecting to increase its total number of shares outstanding by 13% sequentially.

Consequently, at this rate, it’s conceivable that Matterport finishes 2022 with at least 295 million shares outstanding. That means that between Q4 2022 and the same period this year, the total number of shares outstanding will increase by approximately 20%.

Thus, it could be said that for Matterport to grow its top line by roughly 20% to 25%, shareholders are getting diluted by approximately 20%. Hardly worthwhile investing in this setup.

Now, consider the following. Matterport is guiding to finish 2022 at approximately non-GAAP losses of $135 million. This figure is at the high end of its guidance.

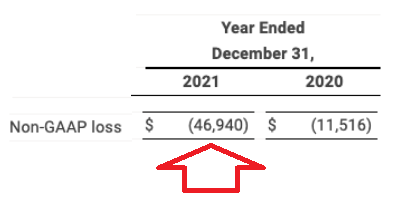

Q4 2021 results

This means that relative to 2021, losses are expected to increase by more than 2.5x times in 2022, for Matterport to grow its revenues by 20% to 25%.

As we look at this from many different angles, I find it difficult to argue that this investment is attractive, even now.

MTTR Stock Valuation – Put Your Hand In the Air

As it stands right now, this unprofitable business is priced at approximately 17x forward sales. I ask you, in all seriousness, how does paying 17x forward sales for a business that’s expected to grow at slightly more than 20% CAGR this year afford you a margin of safety?

And I know that the last thing we do when discussing a tech stock is to talk about a margin of safety. But perhaps, if we had been more actively discussing a margin of safety this past year, we wouldn’t find ourselves where we are.

And let me make this perfectly clear, it’s not that I haven’t made a lot of mistakes this past 12 months. I absolutely have been wrong countless times. But at least now, I can look myself in the mirror and be mature enough to put my hand up and admit that I was wrong.

The Bottom Line

For the sake of our discussion, let’s say that I’m wrong, and Matterport does rally strongly back 85% over the next two years from this price point.

The urge here is to buy the dip. I get that. But the experience that I’ve gained as an investor doing this for a while tells me that this is a seriously high-risk strategy. But more importantly, if you are already invested in this name, you already carry exposure here.

When it boils down to it, it’s this, are you here to make money or to satisfy your ego?

If you need to average down to satisfy your ego, you won’t last long as an investor. If you are here to make money, there are easier ways. This is coming from the person that’s been calling MTTR correctly for months. Whatever you decide, good luck and happy investing.

Be the first to comment