SB/iStock via Getty Images

When I wrote my original article, Matterport (NASDAQ:MTTR) was trading at over 50x their lowered guidance and had a market cap over $5.5 billion. Since then, Matterport’s price has collapsed over 85% and currently sits with a market cap of $1.17 billion. With $598 MM in cash and investments on the balance sheet, resulting in an enterprise value ~$572 MM, Matterport is trading at some of its lowest valuations since entering the market through a SPAC deal.

For a growth company in a highly competitive market, I am still cautious on buying this name. Since a purchase of Matterport is buying into the future vision of 3D models, below I have delved into how 3D models are created and a handful of use cases.

Creating Digital Models from 2D

The basic steps to create a 3D model are simple; capture digital data about a space, feed the data into software, and then use the 3D model. First, let us talk about three methods to capture digital data.

Photogrammetry, which I think is the hardest method, builds the 3D model from 2D photos, meaning the software needs to stitch a collection of 2D photos together to figure out the space. Unlike other methods we will look at, photogrammetry does not require any special sensors. I believe this is how Matterport has been able to get 3D models from devices like Androids and iPhones. MTTR is not alone in this ability, though, as other software such as Autodesk’s (ADSK) Reality Capture can also create models from 2D photos.

Next is Structured Light, which involves projecting a known pattern onto a 3D surface. The distortions in the pattern are measured to collect the 3D data. Matterport’s PRO2 camera uses this method by projecting an infrared light pattern while simultaneously capturing 2D photos. With this method, the PRO2 camera can provide 99% accuracy out to its maximum range of 4.5 meters.

Finally, LiDAR or “light detection and ranging,” uses a laser to scan the surrounding environment. These highly detailed and accurate scans provide some of the best data to create 3D models. These sensors are becoming smaller, cheaper, and are included on certain iPhones and iPads. Matterport supports the Leica BLK360, which has a LiDAR sensor with a 45m range and four 13-megapixel cameras. Although, a few LiDAR cameras can have ranges out to 1km.

Along with other competitors, Matterport uses all three of these methods. As you can imagine, having software create 3D models from 2D photos is a challenge, but LiDAR sensors are becoming cheaper making their highly detailed point cloud data more available. I must believe this type of rich data is easier to work with and will fuel more competition into the space for Matterport.

Digital Twin Use Cases

The metaverse has driven investor’s interest in Matterport, but I believe this attention has overshadowed the use cases for 3D models that exist right now. Let us look at some use cases for 3D models, keeping in mind that other competitors can provide these services, too.

- Real Estate – Potential buyers can explore the space digitally, including taking measurements, without having to set foot in the property. Imagine combining this with future VR headsets to create a very realistic experience.

- Hospitality – Providers such as Spas, Hotels, and Airbnb hosts can create models for visitors to view before booking. Other business can also benefit here, such as Doctor’s offices, gyms, etc., with extra benefit when linked into sites like Google Maps.

- Property Management – Models can reduce employee time by minimizing travel to properties and serve as documentation, allow floor plan creation, measurements, and remote viewing.

- Homeownership – Imagine, you are at Home Depot (HD) finishing your latest project and realize you need a measurement. You pull out your phone and take the measurement right there on your home’s 3D model.

- Event Planning – Explore venues remotely and allow the event planner to take measurements.

- Interior Design – Interior designers could manipulate the model, mocking up potential designs for customers to view before a single can of paint is cracked open. Imagine combing these modified models with future VR headset and retailers providing 3D objects of products they sell.

- Insurance Claims – Properties are documented before and after a loss has occurred. They can also document the remediation work.

- Architecture – Ability to create a building information model (BIM), as well as work within a model to design and view changes.

- Construction – Along with ability to check measurements, 3D models can be used to improve requests for information (RFIs) and document progress. Also, imagine having a scan of your house before drywalling, forever allowing you to peak into the walls to check out framing, wiring, and plumbing.

- Manufacturing and Chemical Plants – Ability to gather measurements, document the state of your facility over time, and generate a model for placement of new equipment.

For every use case, there is value to the user, but that value needs to balance against the cost of the model, including equipment, time to scan, software, and subscription fees. Software features a homeowner would want are different than what the engineering firm working on a 100,000 sq. ft. office complex would need. For the investor looking at this space, the question becomes; can one platform meet the needs of all use cases? I believe it is a big ask for one platform, and we will need to monitor how Matterport grows their offering to support all use cases.

Moat and Competition

I believe Matterport has an extremely narrow moat that can be conquered as technology becomes cheaper and competitors fully develop their products. Multiple competitors exist in nearly every vertical, ranging from 3D tours for real estate all the way to scans for construction projects. I also believe with the number of competitors in the space, there is a non-trivial risk that 3D models become commoditized.

Hardware Moat

I believe manufacturing a camera is not going to provide a long-lasting moat. While the Matterport PRO2 camera captures great photos and works extremely well with their service, Matterport has continued to add support for third party devices. Additionally, with LiDAR becoming smaller and cheaper, it will be available on more devices giving users easy access to highly detailed point cloud data for creating 3D models. Matterport has also been suffering from supply chain issues for several quarters and has taken a loss on their product categories for the last two quarters. I believe their own camera products will help service providers have a better workflow for creating Matterport models, but any moat in this category will not last.

Network Effect Moat

There are potentially two network effects: users and spaces under management. For users, I am talking about the service providers; the photographers who can capture spaces. With the popularity of the PRO2 and people knowing how to use Matterport, it creates a support network for the product. I think this has been helping Matterport, but as more cameras become available and providers purchase alternatives, it will weaken.

Imagine, you have a Matterport model of your house and now your neighbor has made one for their house. Is your model now better? Is it more valuable to you? I cannot think of an added benefit and see no network effect here. I believe Matterport is trying to find a moat in this area right now, especially with property management and commercial spaces. Their terms of service supports Matterport using model data for analysis and they have recently acquired Enview, a technology provider who built AI for analyzing building space. This type of analysis can help with another potential moat, the Matterport Ecosystem.

Ecosystem Moat

Matterport lacks a highly integrated ecosystem. Think about word processors. You have options including free choices, but the popularity of Microsoft’s (MSFT) Word is not because it is the best or the cheapest, but because it is in Microsoft’s Ecosystem. For Matterport, they do not yet have that ecosystem built for 3D models such as software to manipulate 3D models or BIM software.

With the Enview acquisition, they might be working toward building a better ecosystem, one where they create the model and allow people to perform analytics. Right now, Matterport can create and display the models, but they want to do more. In fact, with Amazon Twinmaker, they are helping someone else build their ecosystem.

Matterport Add-Ons (Matterport’s Support)

Source: Support Community

While the latest acquisition of VHT Studios grow the service offering, I would include it as part of their ecosystem. Recalling the three steps to create a 3D model, service helps provide the first step, collection of data from the 3D space. Customers can outsource work straight to Matterport. As an extra benefit, VHT Studios claims they have helped over 200,000 Realtors, allowing this acquisitions to serve as a sales funnel to Matterport subscriptions.

Easily Made, Beautiful 3D Models

In the end, I see Matterport’s current moat being that they allow users an easy-to-use product that creates great looking, easy to share 3D tours and models. These models can be exported to other services or shared through Matterport’s own viewer software. Other “3D Tours” lack in one or more areas, including some that are barely more than a collection of 360-degree photos.

But this narrow moat leads to challenges for Matterport. Competitors are catching up and at least one creates a similar dollhouse model. Large competitors with many resource are also in the space, including Autodesk with their Reality Capture product. Additionally, big spaces spanning tens of thousands of square feet or even city blocks push the limits of Matterport’s technology. Verticals such as real estate and hospitality already contain many competitors, including Zillow (Z), Metareal, Asteroom, Eyespy360, and 3DVista. Even on the insurance side is HOVER and construction is Cupix.

Additionally, LiDAR sensors are becoming cheap and the data more common. This highly detailed point cloud data will be more available for competitors to leverage. In fact, these scans are becoming common for engineering, architecture, and construction projects. Even today, LiDAR data combined with free or open-sourced software drastically lowers the barriers to entry. In fact, Apple (AAPL) has released their RoomPlan Swift API. While this API is not something for a casual user, you can see a path for Apple or other competitors to leverage this tech to create a consumer product.

Guidance and Revenue

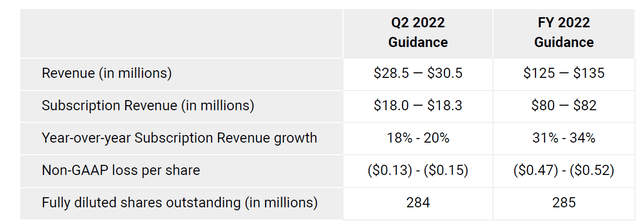

Matterport’s Guidance for FY 2022 (MTTR Q1 2022 Investor Presentation)

Momentum was generated early from the 87% revenue growth experienced in Q2 of 2020. This growth had three main drivers: the release of the Matterport iPhone app, the addition of the free subscription tier, and the start of the COVID home buying craze. Since that spike in revenue, growth has been more tepid, but Matterport’s latest guidance is predicting robust growth for the rest of the fiscal year.

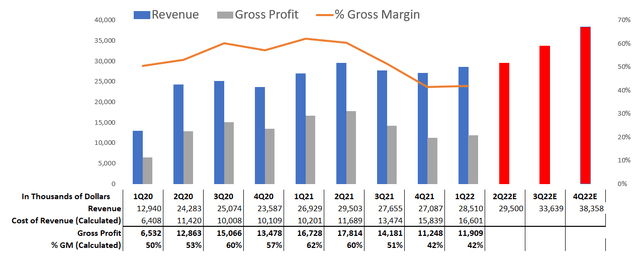

Trend of MTTR’s Revenue (Author’s Chart from MTTR SEC Filings)

The chart above shows revenue and revenue estimates in red, which I based on guidance. Matterport is guiding to a FY 2022 revenue of $125 – $135 MM and EPS of ($0.47) – ($0.52). The midpoint of the revenue guidance represents a 16.9% growth over FY 2021 revenue. The EPS, while still negative, is a significant improvement over the ($2.58) from FY 21. For the chart, the Q2 2022E revenue is the mid-point of the guidance. For the Q3 and Q4, I calculated Matterport would need a 14.03% revenue growth in each quarter to reach the mid-point of the 2022 guidance.

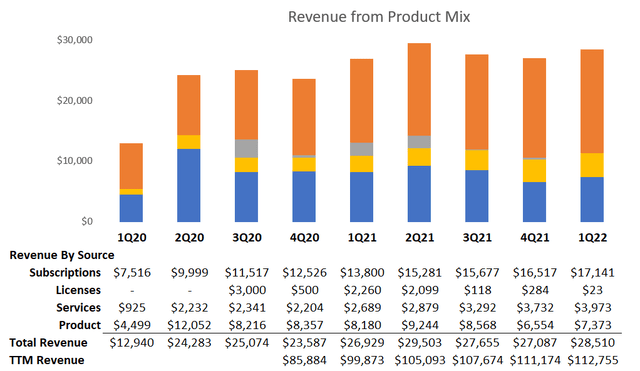

Matteport Revenue of Product Mix (Author’s Chart from MTTR SEC Filings)

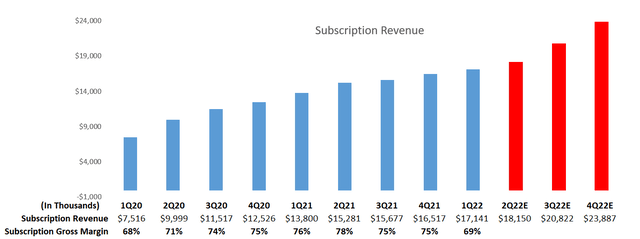

The chart above shows revenue from product mix. A consistent message from management is they are growing subscription revenue and they are fulfilling that promise quarter after quarter. This recurring revenue will be extremely valuable to the company and can drive long-term profitability. In the chart below, I have plotted their subscription revenue and estimates based on guidance. The estimates were calculated similarly to the revenue estimates earlier.

Matterport Subscription Revenue Growth (Author’s Chart from MTTR SEC Filings)

Checking on Dilution

In my first article on MTTR, I provided the following warning to investors:

The lock-up period will end on Jan. 18, 2022, and will allow insiders to sell their shares. On the same day, six earn-out tranches become active at the following share prices: $13.00, $15.50, $18.00, $20.50, $23.00, and $25.50. To trigger an earn-out, the share price must maintain the price for 10 out of 30 consecutive days. At the current price all the tranches could potentially trigger, representing 23.4 million new shares.

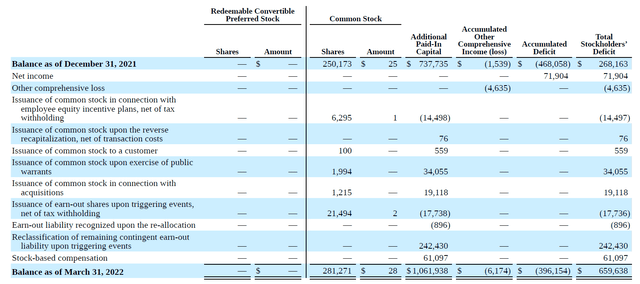

Lock-up, while it does not dilute share count, allows insiders to sell and increases the float, which provides downward pressure as supply increases. There are valid reasons for insiders to sell though, including needing money for taxes. It does not always mean they are headed for the door. The earn-out trances, on the other hand, dilute share count. As you can see in the Stockholders’ Equity chart below, 21.4MM share appear to have been issues from earn-out tranches, representing a little over 7% of total share count.

STATEMENTS OF REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (10-Q, 2022 Q1)

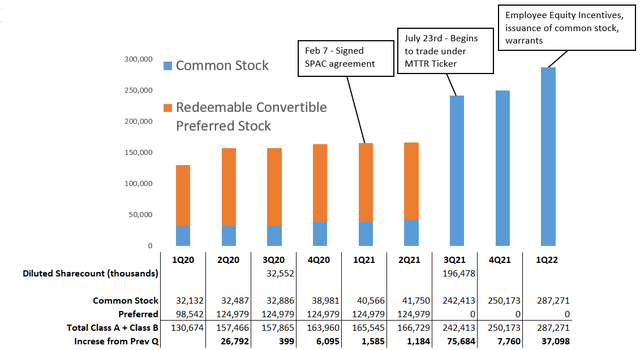

The chart below shows Matterport’s share count along with key events. It is good to watch dilution and monitor all share classes. I recently covered OneWater Marine (ONEW), a company that has 2 share classes, but also appears to have diluted share count over 125%. The reality is the bulk of this dilution came from conversion of Class B to Class A shares, and not issuance of new common stock. If you were not watching both classes, then the dilution could have been confusing.

Matterport Sharecount Trend (Author’s Chart from MTTR SEC Filings)

Valuation

Matterport, with a share price of ~$4.15, currently has a market cap of ~$1.17 B. Combined with a $112 MM in TTM Revenue, they have a P/S around 10.3. This is respectable number for a growing company and much improved compared to November 2021, when I initially covered this company. At that time, their market cap was ~$5.5 B with $107 MM in TTM revenue, putting their P/S ratio at 51, an extremely high value in historical terms even for a rapidly growing company. The mid-point for their FY 2022 guidance is $130 MM and puts their potential future P/S at 8.61.

In their last earnings, Matterport had over $598 MM in cash, short-term and long-term investments on their balance sheet, giving them an EV value of roughly $570 MM. This lower EV helps to push their EV/S value down to 7.45. Long-term, it will be interesting to see how this ratio changes. They are already burning cash between normal operations and acquisitions, but also expecting to grow revenue.

Even at these lowered valuations, Matterport is still unprofitable and working in a competitive space. Investors who believe in Matterport will be excited about the current valuation, while those hesitant to invest in an unprofitable company will still be uncomfortable.

Matterport EV/S Trend (Seeking Alpha Charting)

Buy, Sell, Hold or Watch?

Matterport is arguable stronger than it has ever been despite sitting near the 52-week low and trading at its lowest valuations since entering the public market. While their growth is not rocket fast, they are growing paid subscribers, subscription revenue, and strengthening their product. Many investors likely purchased shares at much higher prices and still hold them, which leads me to believe what an investor should do with their shares lies with one question: Do you believe in Matterport’s ability to navigate a very competitive, but growing market?

Since I do not currently hold shares, then I can take the easy way out and continue to watch, as I am still uncertain about the condition of their moat. Additionally, management is starting to make acquisitions and I would like to watch their record with M&A develop.

On the other hand, growth stocks have been punished by the market. While low prices can give investors a great entry price to wait for the next rally, it makes raising capital more difficult. In MTTR’s situation, they are hopefully still sitting on a large cash reserve that can sustain them until the end of this downturn. With good management, this cash can fuel their growth for years and allow them to strengthen their moat. With the acquisitions of Enview and VHT studios, they are already digging a deeper moat.

Be the first to comment