courtneyk/E+ via Getty Images

Matterport (NASDAQ:MTTR) has a promising future in spatial data reshaping the commercial real estate sector, but the company is still struggling to grow subscriptions meaningfully. The stock got too cheap trading into the $2s, but the big revenue gains in the recent quarter were due to an acquisition. My investment thesis is still Neutral on the stock after Matterport fell substantially from the previous call at $6.

Subscription Struggles

Matterport relies on the capture of a digital twin in the property market to drive recurring subscriptions by providing customers with online spaces offering virtual tours, security and space management. The company struggled most of the last year to deliver the cameras needed to capture these digital spaces, leading to slower growth.

The company reported Q3’22 that revenues jumped to $38.0 million, but the big revenue gain was mostly due to the acquisition of VHT Studios. The business helps Matterport expand their efforts around capturing digital spaces for clients unwilling or unable to utilize Pro 3D cameras or smartphone apps.

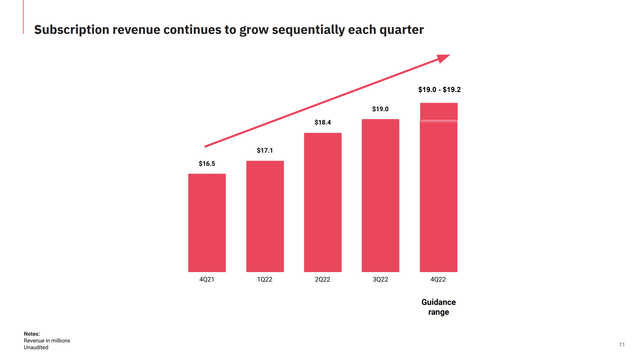

The Services revenues tripled to $10.0 million, but the total only grew $5.0 million from the Q2 level. The VHT Studios acquisition provided $4.5 million in additional revenues for the quarter, accounting for the vast majority of the revenue gain in Q3’22. The key subscription revenues only grew marginally sequentially from $18.4 million to $19.0 million. In addition, Matterport only guided to Q4’22 subscription revenues mostly flat at $19.1 million in Q4’22.

Source: Matterport Q3’22 presentation

The frustrating part about the company is that the CFO described the Services growth on the Q3’22 earnings call as extraordinary without correctly pointing out the VHT impact:

Services revenue for the third quarter was a record $10 million, an extraordinary 204% increase year-over-year. Our services revenue continued to grow during the quarter, exceeding our expectations and the acquisition of VHT, which met our expectations, provided the strength in this revenue line.

The Subscription business has 77% gross margins while Services and Products (cameras) have margins below 40%. The cameras are mostly sold at costs, with Products only offering 13% gross margins in the last quarter while Services have decent 35% gross margins. Generally though, the focus on the business is for Services and Product to help onboard customers leading to quicker subscription starts and larger recurring revenues.

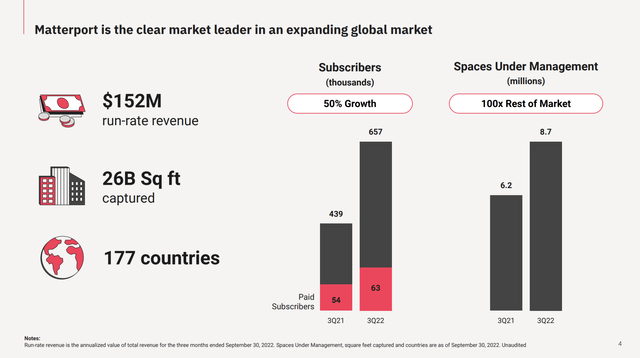

Matterport continues to have a strong funnel with 657,000 subscribers using the platform for basic space management, but the company only has 63,000 paid subscribers. Over the year, the funnel expanded at a 50% clip, but actual paying subscribers were only up ~17% from 54,000 subscribers last Q3. Hence, the company has only guided to Q4 Subscription revenue growth of 20%.

Source: Matterport Q3’22 presentation

Valuation Struggles

While Matterport has a lot of promises with managing digital spaces, the company is spending wildly compared to the actual gross profit picture. Matterport only produced $16.4 million in gross profits in Q3, up just fractionally from the $14.2 million produced last year.

The digital spaces company reported a non-GAAP loss of $26.8 million due to operating expenses of $75.4 million and $45.4 million when excluding stock-based compensation. The huge disconnect is problematic in valuing Matterport much above the current market cap.

After the big 25% rally following Q3’22 results, the stock now has a market cap reaching $1.1 billion. Matterport has a revenue run rate at just $152 million, and nearly half this revenue is low-margin business.

The company does have $495 million in cash with no debt. The stock had traded down towards the cash balance, but the large losses will burn a lot of this cash before the company reaches cash flow positive, making any inclusion of cash into the valuation equation unwise.

The company guided Q4 revenues to ~$40 million with most of the sequential revenue gains coming from the Product and Services categories offering no real financial benefit to the business.

Takeaway

The key investor takeaway is that Matterport has a promising business opportunity, but the company can’t deliver the subscription growth necessary to make an investment in the stock. Investors should continue to watch from the sidelines for a stock return to the $2s or until signs exist for faster subscription growth to cut operating losses.

Be the first to comment