onurdongel

On Tuesday, July 26, 2022, Permian-based independent exploration and production firm Matador Resources Company (NYSE:MTDR) announced its second quarter 2022 earnings results. As has been the case with most energy companies over the past few quarters, the headline numbers were quite encouraging as Matador Resources delivered strong year-over-year growth and beat the expectations of its analysts in terms of both revenues and net income. There is a lot to like here besides the headline numbers, however, as Matador Resources also made substantial progress in strengthening its balance sheet and growing its production. Strangely, the stock price certainly does not reflect this impressive financial performance, although it was up in after-hours trading alongside the release of the results. As such, Matador Resources appears to be substantially undervalued at the current price so there still appears to be time for any investor to get in and grab some profits for themselves.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Matador Resources’ second quarter 2022 earnings results:

- Matador Resources Company reported total revenues of $943.930 million in the second quarter of 2022. This represents a phenomenal 164.09% increase over the $357.427 million that the company brought in during the prior-year quarter.

- The company reported an operating income of $594.989 million in the most recent quarter. This represents a dramatic 310.04% increase over the $145.106 million that the company reported in the year-ago quarter.

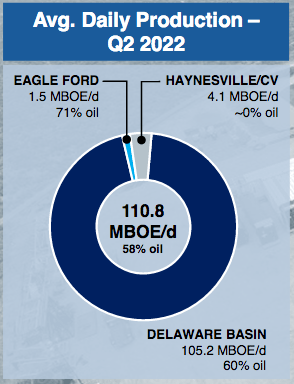

- Matador Resources produced an average of 110,750 barrels of oil equivalents per day in the reporting period. This compares quite favorably to the 93,210 barrels of oil equivalents that the company produced per day on average last year.

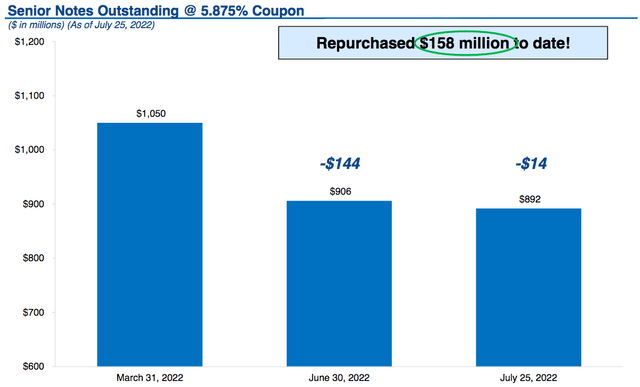

- The company repurchased $144 million of its outstanding senior notes, reducing its debt.

- Matador Natural Resources reported a net income of $415.718 million in the second quarter of 2022. This represents a very impressive 292.53% increase over the $105.905 million that the company reported in the second quarter of 2021.

It seems quite certain that the first thing that anyone reviewing these highlights will notice is that Matador Resources saw every measure of financial performance improve substantially compared to the prior-year quarter. It is unlikely that this is a surprise to anyone reading this as the price of both crude oil and natural gas has increased substantially over the past year. During the past twelve months, West Texas Intermediate crude oil is up 32.06% and natural gas at Henry Hub is up 119.27%, which is a very dramatic increase. Of the two, crude oil is more important for Matador Resources since its second-quarter production was 58% crude oil:

Matador Resources

This is a reasonably attractive production mix since it does a fairly good job of providing Matador Resources with exposure to the fundamentals of both crude oil and natural gas. With that said, I would prefer to see a bit heaver of a weighting to natural gas. This is because, while all fossil fuels except for coal have reasonably attractive fundamentals, natural gas has a much stronger future ahead of it than crude oil. We might at some point see Matador Resources’ production shift slightly towards natural gas though since its reserves are only 56% crude oil. Thus, the company is currently overproducing crude oil compared to what it has in the ground so at some point it will have to shift towards natural gas to correct that problem.

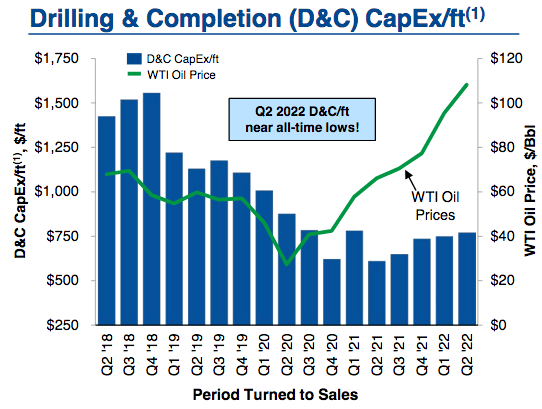

Matador Resources has other ways to generate growth besides depending on energy price increases, which is good because the company has no control over commodity prices. The main way that it can generate this growth is by increasing its production. It should be obvious why this would result in growth. After all, the more products that it produces, the more that it can sell for revenue. Assuming that the company can produce profitably, this will result in higher cash flows and profits all else being equal. Unfortunately, Matador Resources does not disclose exactly what its breakeven point is for its production but obviously, it can produce profitably with prices at today’s levels based on its results from the second quarter. Matador Resources has actually been increasing its profitability at every oil price. As we can see here, Matador’s drilling and completions costs have been generally declining since the fourth quarter of 2018:

Matador Resources

There may be some readers that note that the trend started reversing back in 2021, although it still remains well below pre-pandemic levels. While this may be concerning, it is not unusual. In fact, all upstream producers have been seeing their costs of production increase over the past year. This is being caused by rising steel and diesel prices, which are necessary items for drilling a well. Fortunately, the increase in crude oil prices has been more rapid, which has allowed companies like Matador Resources to maintain and even increase their margins.

The fact that Matador Resources is seeing its margins increase is quite nice to see because it improves the company’s ability to generate free cash flow. Free cash flow is the money that is generated by a company’s ordinary operations that is left over after it pays all its bills and makes any necessary capital expenditures. It is therefore the money that is available to provide value for the shareholders by conducting actions such as buying back stock, paying down debt, or paying a dividend. In the second quarter, Matador Resources reported a free cash flow of $453.8 million, much of which it used to repay its debt. This is actually quite nice to see because it addresses one of the biggest concerns that I mentioned in my last article on the company. As stated in the highlights, Matador Resources repurchased and retired $144 million worth of its own senior notes during the second quarter. The company then repurchased another $14 million of its own notes in July, bringing it to a total of $158 million of outstanding debt retirement so far this year:

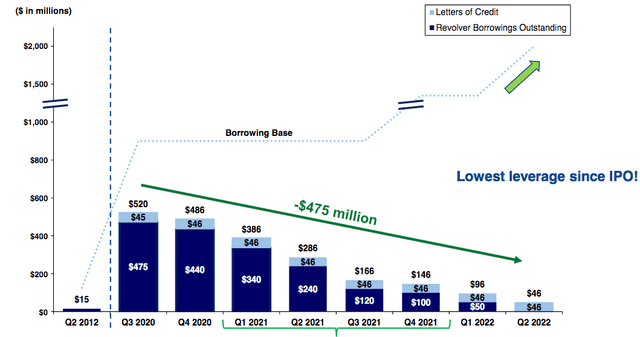

This is not all that the company did to strengthen its balance sheet during the quarter, however. Matador Resources also completed paying off its revolving line of credit, which is something that it has been trying to accomplish for the past few years:

This admittedly completely addresses my concerns about the company’s leverage since it now has one of the strongest balance sheets in the industry. We can see this by looking at the company’s leverage ratio, which is defined as net debt-to-trailing twelve-month adjusted EBITDA. This ratio essentially tells us how many years it would take for the company to completely pay off its debt if it were to devote all its pre-tax income to that task. As of the end of the second quarter, this ratio stood at 0.5x based on the company’s trailing twelve-month adjusted EBITDA. As I have pointed out in various previous articles, I like to see this ratio below 1.0x in order to be comfortable with the company’s ability to carry its debt. As we can see, Matador Resources easily beats that figure and in fact, it now has one of the lowest ratios in the entire energy industry. Thus, the company appears to be easily capable of carrying its debt and there is nothing to worry about in this report anymore.

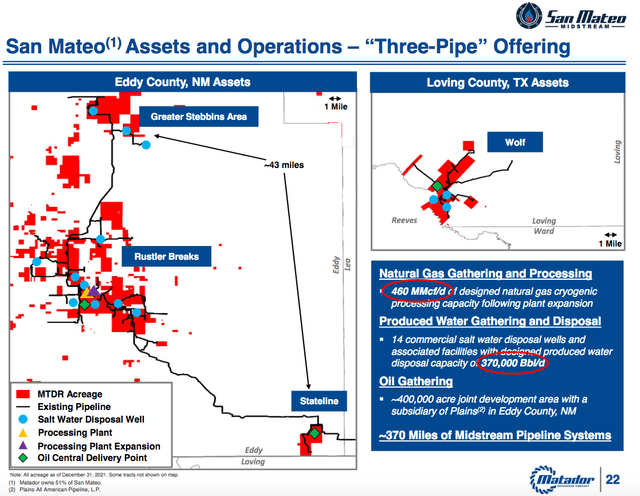

One of the unique things about Matador Resources is that the company is more than just an upstream crude oil and natural gas producer. The company also owns 51% of San Mateo Midstream, which operates in New Mexico and Texas:

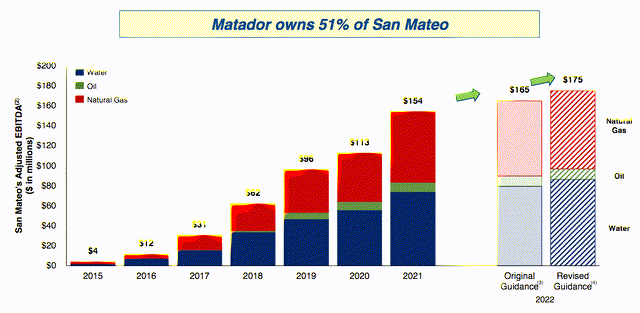

San Mateo Midstream also reported very good results, which naturally propped up Matador Resources’ results further as Matador is the majority owner. As might be expected for a midstream company, San Mateo’s solid results were driven by rising volumes of natural gas, crude oil, and water. In fact, San Mateo had record volumes of all three products during the quarter:

We can also see above that based on the results from the second quarter, the midstream company is now expected to see higher volumes than originally projected. As San Mateo’s cash flows directly correlate with volumes, this should result in the company delivering higher cash flows than expected, which will then be proportionally delivered to Matador Resources. The nice thing is that we can be fairly confident in these upwardly revised volume projections. This is because San Mateo’s midstream assets are primarily gathering pipelines. A gathering pipeline is a relatively short pipeline that grabs the produced hydrocarbons from the wellhead and then transports them to the first stop on their journey to the end-user. As the gathering pipeline needs to connect to the well, the producing oil company will share its drilling plans with San Mateo so that the midstream company will be able to have the gathering infrastructure in place. This updated volume guidance clearly indicates that there will be more drilling within the company’s footprint than what was expected earlier in the year. Thus, San Mateo Midstream should be able to contribute more money to Matador’s cash flow than we thought. Any investor should be able to appreciate this.

It is critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of Matador Resources, we can see that it is undervalued by looking at the forward price-to-earnings ratio. This ratio tells us how much we have to pay today for each dollar of earnings the company will generate over the next year. According to Zacks Investment Research, Matador Resources currently has a forward price-to-earnings ratio of 4.74. This is incredibly low in today’s market; indeed, there are very few companies with a ratio below 10. As I have pointed out in the past though, pretty much everything in the traditional energy industry looks tremendously undervalued right now so it may make sense to compare Matador Resources to a few of its peers in order to see which company offers the most attractive valuation:

| Company | Forward P/E |

| Matador Resources | 4.74 |

| Continental Resources (CLR) | 5.54 |

| Pioneer Natural Resources (PXD) | 6.59 |

| Diamondback Energy (FANG) | 4.60 |

| APA Corporation (APA) | 3.40 |

| Occidental Petroleum (OXY) | 5.92 |

Admittedly, Matador is not the absolute cheapest company out of its peer group using this metric. However, it does compare fairly well and when we consider the company’s low leverage relative to a few of the others in this list, it may represent a more attractive risk/reward proposition. Overall, the company looks to be selling for much less than it is truly worth.

In conclusion, Matador Resources’ latest results were quite impressive. The company delivered a massive year-over-year improvement in pretty much every financial metric and it used its increased free cash flow to substantially improve the balance sheet. When we combine this with the company’s attractive valuation, there are a lot of reasons to consider purchasing it today.

Be the first to comment