anita2020

When looking at US markets on Tuesday, one of the biggest losers ended up being Coinbase (NASDAQ:COIN). The cryptocurrency firm lost more than 21% after it was reported that the company is under investigation by the SEC regarding its digital asset listing process. While investors are feeling plenty of pain already, it might not help short term sentiment that one of the firm’s biggest backers sold a chunk of its stake during Tuesday’s trading.

The probe apparently involves whether or not Coinbase improperly let Americans trade digital assets that should have been registered as securities. Last week, Bloomberg reported that a former employee violated insider trading rules by leaking information to help his brother and a friend buy tokens just before they were listed on the platform. Coinbase is the largest US trading platform with more than 150 tokens, but the company has stated it does not list securities.

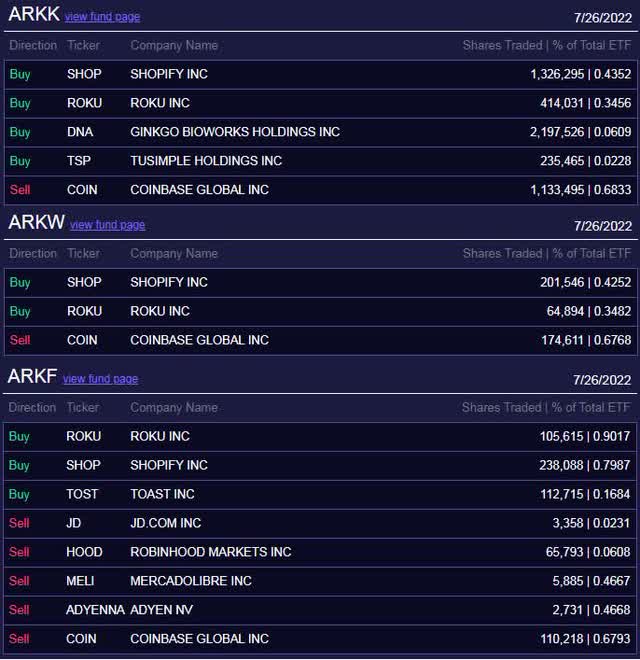

There certainly appeared to be a lot of sellers for the day, but perhaps the most notable one we know of so far was Cathie Wood and the Ark Invest team. The active ETF manager jumped into Coinbase right away once the company started trading publicly last year, and has increased her position significantly over time. As of Monday’s close, Ark Invest owned more than 8.6 million shares of Coinbase, which represented just under 5.0% of all of the outstanding Class A common shares. The following three Ark Invest active ETFs own the stock:

Normally investors might expect Cathie Wood and her team to scoop up shares of a name like Coinbase when it plunges like this. However, as the image below shows, the firm sold more than 1.4 million shares on Tuesday, which represented just under 1 in 6 shares it had previously owned. The flagship ARKK ETF itself sold more than 1.1 million shares, more than 18.5% of its position, which was the largest block sold among the three funds in terms of sale percentage.

Ark Invest July 26th Trades (Ark Invest)

It was clear what the Ark team wanted to do on Tuesday, as all three of the above active ETFs used their Coinbase sale proceeds and or other funds to buy both Roku (ROKU) and Shopify (SHOP) that also saw their shares drop. Roku dropped on an analyst downgrade, while Shopify fell on reports it was slashing a chunk of its workforce. Shopify is set to announce its quarterly results before the bell on Wednesday, while Roku is scheduled for Thursday after the close, so more volatility in these names is expected in the coming days.

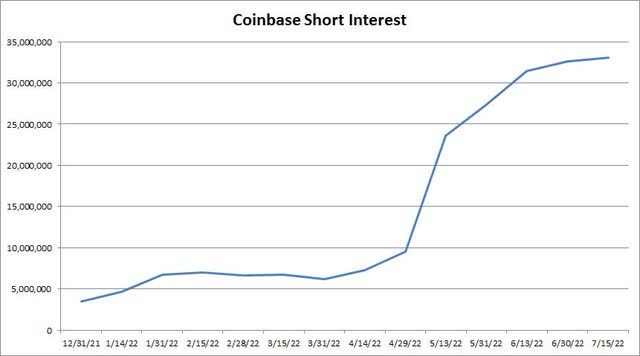

There has been a lot of negativity surrounding Coinbase in recent months. I mentioned a month ago that short interest in the name had skyrocketed so far this year to a new all-time high. Well, as you can see in the chart below, the number of bets against the stock has continued to increase. With more than 33 million shares short at the mid-July update, short interest is up almost 843% so far this year.

Coinbase Short Interest (NASDAQ)

I mentioned in my previous article that a lot of the negativity had to do with the fall in many cryptocurrencies. With Bitcoin losing two-thirds of its value, for instance, Coinbase was seeing lower trading volumes. Analysts have been slashing revenue estimates for months, with the street looking for the company to report a more than 61% plunge in its top line (year over year) for Q2 2022. At the same time, the average price target on the street now sits just over $100 per share, down another $20 plus in the past month alone. Remember, it was back in April 2021 that the average target was more than $500, and we’re now just one price target cut away from the average being in double digits.

With shares of Coinbase having a terrible day on Tuesday thanks to the report of a SEC investigation, major supporter Cathie Wood sold a large block of her shares. All three active ETFs at Ark Invest sold at least 10% of their prior day positions, with the flagship ARKK fund selling more than 18.5% of its stake. With a number of Ark components set to start reporting quarterly results in the coming days, we could see more sales of Coinbase shares from the Ark team if they want to add further to their other positions.

Be the first to comment