monsitj

Investment Thesis

Masco Corporation (NYSE:MAS) looks cheap trading at 12.72x FY22 consensus EPS estimates. While investors are worried about the housing slowdown, the repair and remodel category is comparatively less cyclical. The consumer balance sheet is also much stronger than pre-pandemic levels which should provide downside support. While some categories such as DIY paint, faucets, showers, and hardware lighting have started moderating from mid-Q2 FY22, demand for other categories, such as pro paint and spa, remained healthy. This should impact the volume growth of the company to some extent, but the higher net selling price from price hikes that the company implemented to offset inflation, should support the sales growth in 2H FY22. Additionally, structural tailwinds such as higher home equity and aging homes should benefit the repair and remodel business of the company in the long term. The margins of the company should be impacted in Q3 FY22 due to inflation but should improve in Q4 and beyond due to easier comps and price hike benefits.

Masco’s Q2 FY22 Earnings

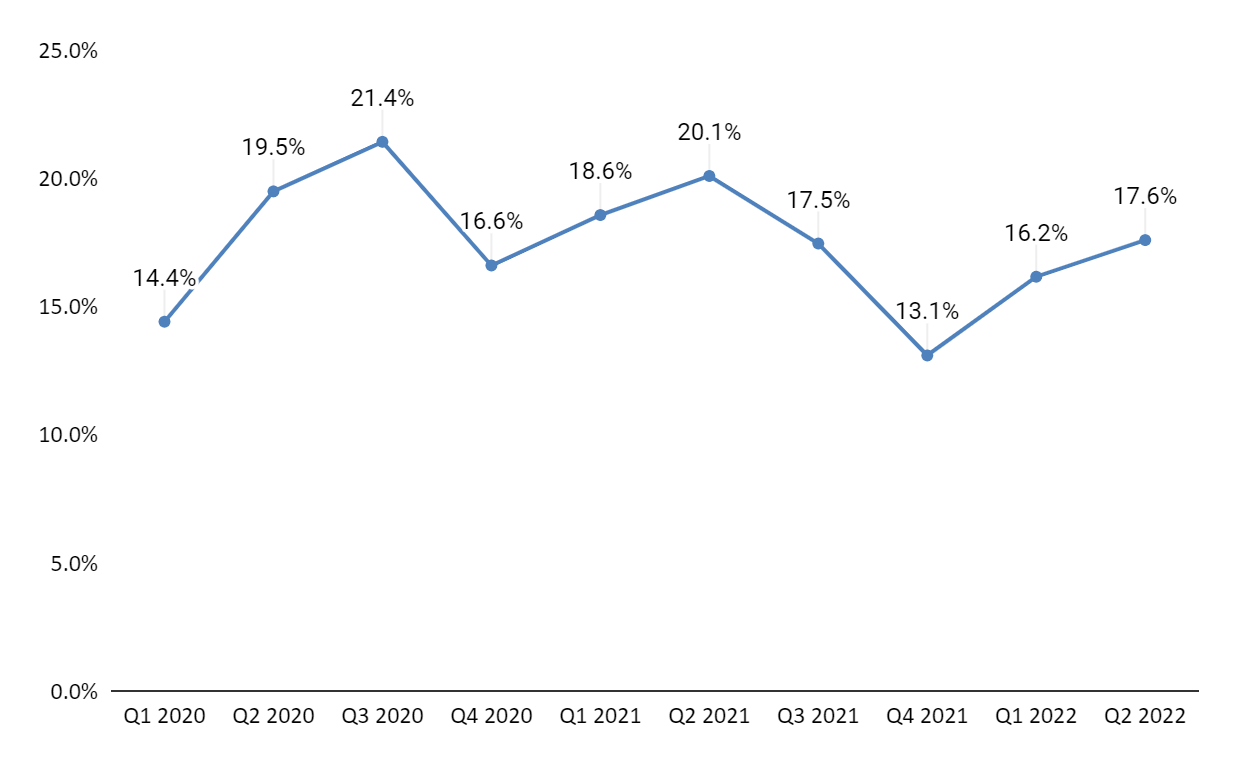

Masco recently reported its second quarter FY22 financial results that were lower than the consensus estimates. The net sales in the quarter grew 8% Y/Y to $2.35 bn (vs. the consensus estimate of $2.37 bn), whereas the adjusted EPS remained flat Y/Y at $1.14 (vs. the consensus estimate of $1.20). Higher net selling prices and volumes increased sales by 10% and 1%, partially offset by an unfavorable currency impact of 3%. The adjusted operating margin in the quarter declined 250 bps Y/Y to 17.6% due to higher supply chain costs, marketing spending, and unfavorable currency translation, partially offset by higher net selling prices and incremental volume. However, the EPS growth remained flat Y/Y due to a lower share count.

Some Revenue Headwinds But It’s Not That Bad

The net sales in the North American region increased 11% Y/Y, excluding the impact of currency, as the sales growth in the DIY and pro paints business remained strong along with growth in spas, faucets, and showers businesses. The strong growth was driven by increased net selling prices and higher sales volume, contributing 10% and 1% to the total region’s sales, respectively. International sales grew 8% Y/Y or 11%, excluding the divestiture of the Huppe business in Q2 FY21, driven by net selling prices and higher volumes, contributing 7% and 4% to the total sales, respectively. The company was able to deliver a solid performance in China despite the lockdown impacting its sales in the quarter. Chinese sales were helped by good execution, focusing on the higher-end segment with less volatility, and selling into project businesses or hotels, multifamily, etc., which saw a jump right after the lockdown got lifted.

The plumbing segment grew 7% in local currency against a comp of 48% in Q2 FY21. The sales grew 8% Y/Y, excluding the impact of currency, acquisitions, and divestitures, with pricing contributing 7% and volumes contributing 1%. Sales in North America grew 7% in local currency due to strength in the Watkins Wellness brand and growth in the Delta business against a double-digit comp. International plumbing sales increased 8% in local currency, or 11% excluding divestiture, as the Hansgrohe business grew in almost all its markets including Germany, China, France, and the U.K.

Decorative Architectural segment sales increased 15% Y/Y in the quarter, with the pro paint business delivering 40% growth and the DIY paint business growing in the low teens. The DIY sales growth was predominantly due to increased pricing as the volume growth remained flat. The flattish volume growth was better than its peers, such as Sherwin-Williams (SHW), which had a low single-digit decline in DIY sales.

Looking forward, the plumbing segment is experiencing a healthy demand for its products and the backlog for big-ticket items is high. The backlog for the spa business was around 25 weeks at the end of the second quarter of FY22. Also, the company’s Hansgrohe business, which generates a majority of its revenue from project sales in Asia and the Middle East, should support the revenue growth even when the consumer market turns down as these projects need to be finished. Within the Decorative Architectural segment, specifically in the paint, the pro-business should be facing tougher comps in Q3 FY22 as the growth in Q3 FY21 was ~45%. However, pro-business demand is still strong, which should support revenue growth in 2H FY22, though not at the same rate as the previous three to four quarters. The DIY business should be driven primarily by prices in 2H FY22.

While some categories such as pro paint and spa are experiencing a healthy demand, the company experienced some moderation in the demand trend across certain product categories such as DIY paint, faucets and showers, and hardware lighting from mid-Q2 FY22 and the demand trend has remained flat since then. Additionally, the comps in Q3 are difficult for the plumbing and decorative segments. Therefore, the volumes should be flat to down modestly in 2H FY22 with pricing more than offsetting its impact.

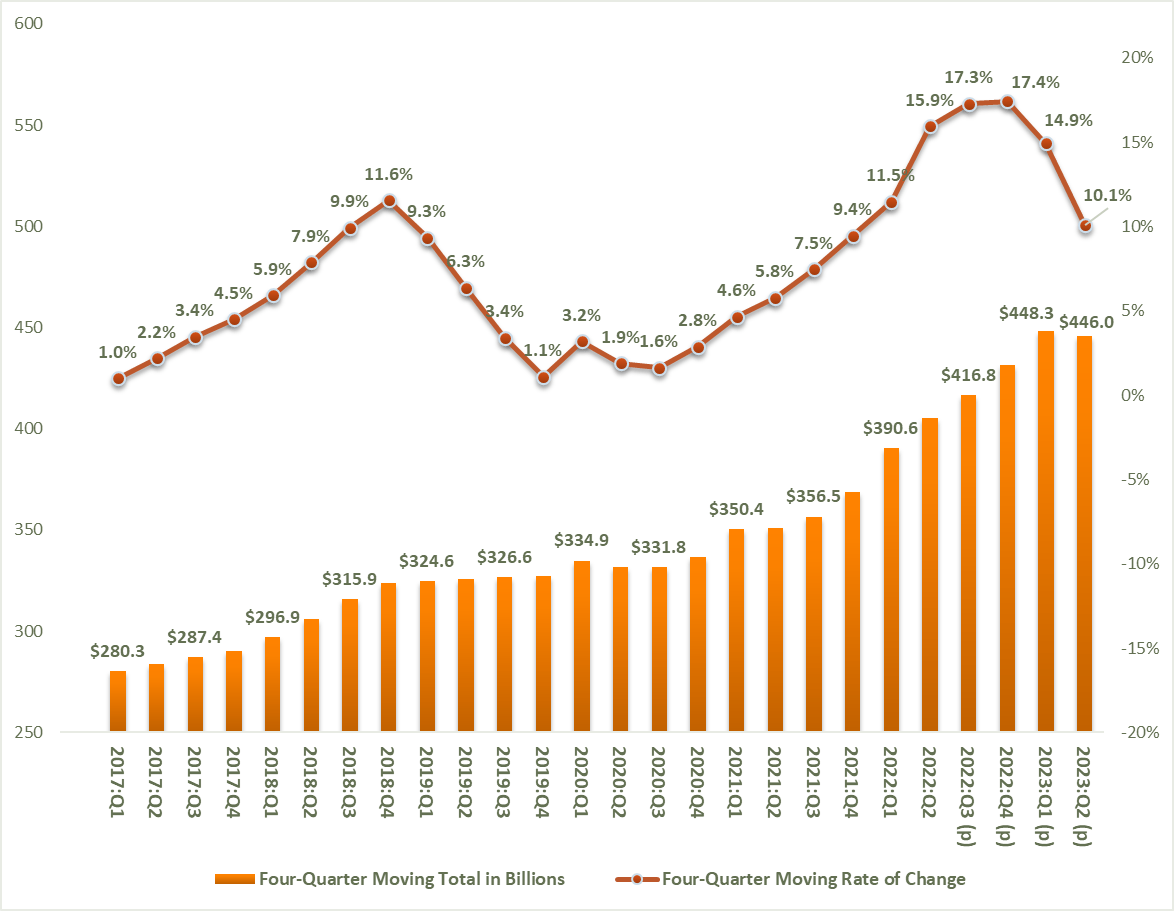

LIRA index (Joint Centre of Housing Studies (Harvard), GS Analytics Research)

While many investors are worried about the company’s outlook beyond FY22 due to the downturn in the housing market, I believe the company’s business will prove more resilient than what investors are giving it credit for. Masco generates ~90% of its revenue from the repair and remodel industry channels, which is less cyclical compared to new housing construction. Additionally, the LIRA index (Leading Indicator of Remodeling Activity) shows that the Y/Y remodeling expenditure is expected to remain strong for the next four quarters. Further, consumers and homeowners have strong balance sheets with more than $2 trillion in excess savings vs. pre-pandemic levels and home equity values that are at an all-time high. These structural factors should provide tailwinds to the company’s repair and remodel business in 2H FY22 and beyond offsetting some of the macroeconomic headwinds. The pricing actions taken by the company to offset the inflationary cost pressures are benefiting the company’s sales growth and should continue to benefit moving forward even if the volume growth moderates due to a slowdown in the economy.

The company has lowered its full-year sales growth for FY22 from 6% to 10% of its previous guidance range to its new range of 5% to 7% due to the moderation in demand and foreign currency headwinds. The plumbing segment is expected to be in the range of 3% to 5%, including the impact of unfavorable currency translation by 3% or $165 mn. The decorative architectural segment is expected to grow in the range of 9% to 11% with mid-single-digit growth in DIY paint sales and strong double-digit sales growth in pro paint.

Margins

The margins of the company were impacted due to higher Y/Y commodity and logistics costs in Q2 FY22. A 5% increase in inflation impacts the margin by 100 bps, and in Q2 FY22, the company faced mid-teen inflation, which compressed its margins. I believe commodity and other inflation have reached peak level as the company is seeing declines in certain input costs in the spot market. The costs of copper and zinc, which get into the plumbing products have begun to decrease. The impact of these cost decreases takes approximately six months to flow through the company’s financials. So, the positive impact of the decline in some of the commodity prices should be reflected in the late Q4 22 and beyond. Ocean freight has also begun to moderate, which should benefit the margin growth, partially offset by the higher over-the-road trucking costs (freight costs). The company plans to take additional price hikes if necessary to offset the headwinds related to inflation.

Masco’s adjusted operating margin (Company data, GS Analytics Research)

While the cost pressures are expected to continue in Q3 FY22, trends in Q4 FY22 should improve due to easier comps, slightly lower input costs, and pricing actions. Beyond FY22, the company’s margin should benefit from reducing inflation and supply chain headwinds as things normalize. The company has also laid out its contingency plans to deal with the margin headwinds during the downturn in the economy. This plan includes reducing headcounts, reducing workers’ shifts, and lowering advertising costs, travel, and entertainment. For the long-term investors, who can look beyond the current cyclical headwinds, I believe the company can post adjusted operating margins in the low 20s on the other side of this cycle.

Valuation & Conclusion

The stock is currently trading at 12.72x FY22 consensus EPS estimate of $4.17 and 12.16x FY23 consensus EPS estimate of $4.36 which is lower than the five-year average forward P/E of 16.67x. While the demand across certain product categories has started to moderate for the company which should impact the volume growth slightly in the back half of this year, the pricing actions and backlog in high-end products should support the sales growth in the second half of FY22. The margins should improve in Q4 FY22 and beyond due to easier comps, input cost reduction, and normalization in supply chain headwinds. Investors are assigning the company a low valuation as they are worried about the impending housing slowdown but I believe the resiliency in repair and remodel coupled with a strong consumer balance sheet to help limit the downside. I believe the risk-reward is favorable at these levels and, hence, have a buy rating on the stock.

Be the first to comment