Cheryl Ramalho/iStock via Getty Images

Marvell Technology (NASDAQ:MRVL) reported Q3 Non-GAAP EPS of $0.57 that missed by $0.02. Revenue of $1.54B, which increased +27.3% YoY, missed by $20M.

According to Matt Murphy, Marvell’s President and CEO:

“Inventory reductions, in particular at our storage customers, are impacting our near-term results and guidance, and we are working closely with them to manage their change in demand in an orderly fashion to clear the path to a resumption of growth.”

Storage is synonymous with HDDs (hard disk drives) and SSDs (solid state devices). Marvell’s storage products are used in customer products and applications in its Data Center and Consumer end markets. Its other markets are Carrier Infrastructure, Enterprise Networking, and Automotive/industrial.

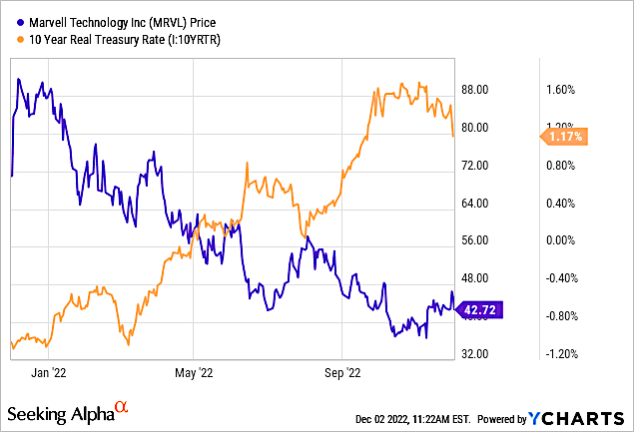

Shown in Table 1 are revenues for the recent quarter (ending Oct 29, 2022) and associated QoQ and YoY revenues by end markets. I also added estimated Q4 revenues ended January 20, 2023 and QoQ revenues.

Data Center Analysis

According to Table 1, Data Center, Marvell’s largest sector based on revenue, dropped 3% in the recent quarter, and company guidance is pointing to a significant drop in the next quarter. January quarter revenue dropping to $1.4B (-9% QoQ), is well below the Street’s $1.62B as customers push out shipments and reschedule orders to manage their inventory levels.

As I will show in this article, Data Center consumes a significant amount of memory for storage and has been a stable sector for memory companies, which have been impacted by plummeting sales from Consumer Electronics products. Marvell ends its fiscal quarter one month or more later than memory companies, and thus the metrics from its Data Center could be a harbinger to predict the financial outcome of earnings for memory companies.

According to CEO Murphy in the earnings call:

“In particular, we are projecting a very large reduction in shipments of our HDD controllers and preamps, as HDD OEMs deal with a broad-based inventory correction.”

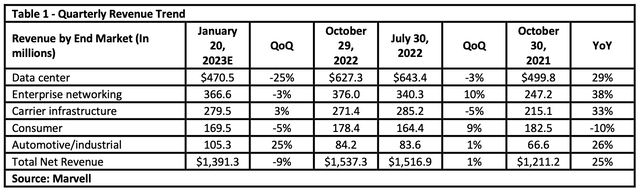

Chart 1 shows the importance of HDDs and SSDs on Marvell’s Storage Business, primarily associated with its Data Center sector.

Chart 1

SSDs are made from NAND chips made by Micron (MU), SK Hynix (OTC:HXSCL), and Samsung Electronics (OTCPK:SSNLF). They are replacing HDDs, primarily in client and mobile devices such as notebooks.

The important fact that HDD business is dropping is not recent. According to The Information Network’s report entitled “The Hard Disk Drive (HDD) and Solid State Drive (“SSD”) Industries: Market Analysis And Processing Trends,” HDDs have been dropping for the past decade as SSDs have increased for a variety of reasons. However, HDDs are dominant in servers because of lower cost and greater bit density.

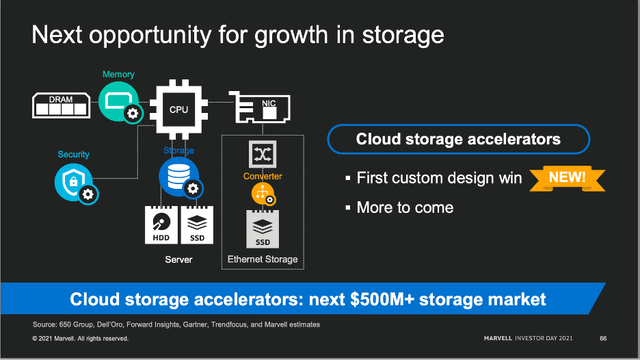

Analysis of Companies Making NAND for SSDs

Memory companies have also been impacted by a slowdown in consumer electronics products, but so far the impact on cloud servers and data centers has been minimal through the last earnings call from these memory companies. Nevertheless, To counter oversupply and high inventory, memory companies have talked about plans to reduce capex spend (combination of construction and equipment). Significant capex cuts on memory expansion by Micron and SK Hynix will negatively impact Applied Materials (AMAT) and Lam Research (LRCX), according to The Information Network’s report entitled “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts.”

- Micron indicated it would reduce 2023 capex by 30%, which includes 50% equipment and 50% building, which would imply a 15% cut in equipment. But MU is actually cutting back WFE equipment 50% purchases in fiscal 2023, a significant impact on equipment suppliers to the company.

- SK Hynix announced in late October it plans to reduce its investment next year by more than 50% due to poor demand in the memory chip business. The move comes after the company’s third-quarter operating profit fell to 1.7 trillion won ($1.2 billion), missing analysts’ estimates of 1.87 trillion won. Revenue fell 7% to 11 trillion won.

Chart 2 shows that these companies have been cutting back on production of NAND and DRAM memory chips as macro forces have impacted inventory.

Chart 2

Analysis of Companies Making HDDs

Western Digital (WDC) issued weaker-than-expected results and guidance in its FQ4 2022 earnings call, prompting a sell-off in related semiconductor stocks. Shares fell more than 7%. In the following FQ1 2023 earnings call, the company reported revenue of $3.74B, with a -26.7% YoY growth.

Two weeks earlier, on July 21, 2022, Seagate Technology shares plunged 12% after the hard-disk drive maker posted fiscal fourth-quarter results that missed expectations and issued weak guidance while announcing production cuts. In its latest FQ1 2023 earnings call, the company reported revenue of $2.04B, with a -34.6% YoY decline.

Analysis of Cloud Capex

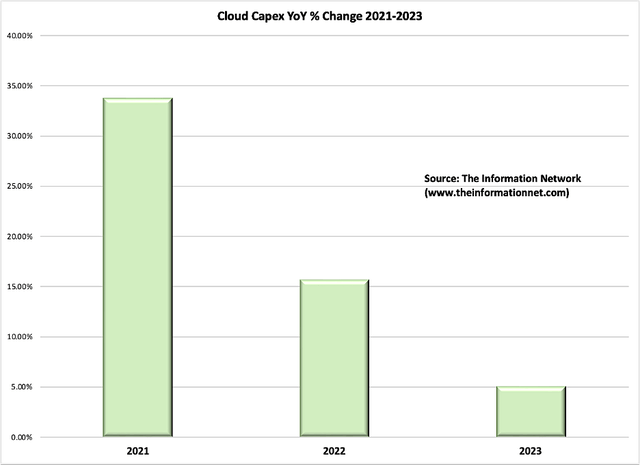

Overall demand for servers has decreased as customers reduced their purchasing budgets. Chart 3 shows the YoY change in cloud capex spend for 2021 and estimates for 2022 and 2023 by global hyperscaler companies. Similar to semiconductor manufacturers whose capex spend is a combination of equipment and building construction, cloud capex spend is a combination of computers (servers) containing memory chips and the real estate to house them.

Chinese hyperscalers, particularly Tencent (OTCPK:TCEHY) (-59.1% QoQ Q2 2022 versus Q1 2022) and Baidu (BIDU) (+1.6%). Chinese companies have been hit by Covid lockdowns and will be impacted by U.S. restrictions on AI GPUs from NVIDIA (NVDA) and AMD (AMD) into China, which I discussed in a September 6, 2022 Seeking Alpha article entitled “Nvidia: Biden Targeting China On The AI Front.“

Meta (META) announced after its recent earnings call it will increase capex by another 10% or so, even as its revenue declines, leading to a substantial bump in capex as a percentage of revenue. As Meta plans a significant increase in its AI and Machine Learning investments, I will continue to monitor the effect on competitors in the cloud arena.

Chart 3

Investor Takeaway

There are significant headwinds facing Marvell in its Data Center sector, and both HDD and SDD manufacturers are being impacted by macroeconomic factors that have already impacted consumer electronic prices such as PCs and smartphones. While our analysis shows that cloud capex spend is slowing, strong evidence is presented by Marvell’s reporting that “In particular, we are projecting a very large reduction in shipments of our HDD controllers and preamps, as HDD OEMs deal with a broad-based inventory correction.”

On a positive note, while Marvell can’t control customer spending on HDD and SSD products, the company is making important technological improvements in its products in the sector. For example, in the third quarter, MRVL started ramping its cloud-optimized silicon design wins into production and is planning to launch multiple additional products in fiscal year 2024 and 2025.

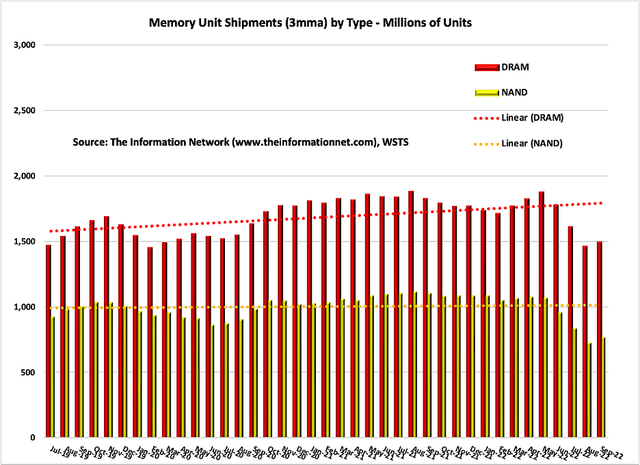

Macro forces are impacting share price of Marvell, as a Fed-driven strategy of increasing interest rates has been negative for technology stocks, including Marvell.

In Chart 4, I show the share price of MRVL for a 1-year period compared to the 10-year Treasury Rate. We see an inverse relationship for the past year, as MRVL share price has changed in an opposite direction to the 10-year. I have discussed this relationship in numerous Seeking Alpha articles.

Chart 4

YCharts

Once economic drivers no longer impede growth, Marvell is well-positioned to resume its strong growth in the Data Center sector. However, Capex spend for the Data Center from hyperscaler companies could decrease 50% YoY in 2022 and another 50% in 2023. As a result, I maintain a Hold on MRVL.

Be the first to comment