dani3315

Investment Thesis

We have long been keen on Marubeni (OTCPK:MARUF) for its coal, natural gas, fertilisers and grains businesses, arguably rare winners in a turbulent 2022 so far.

We have conviction that the company will be reporting handsome results for the upcoming half-year reporting period, yet feel this is being unnoticed by the market. Coupled with compelling valuations, we are optimistic that upside gains will come when its impending strong performance is acknowledged later this year and beyond.

Whilst OTC tickers are available for US-based investors we have our exposure through its equivalent on the Tokyo Stock Exchange (TSE:8002).

The Company

Marubeni is one of the 5 large Japanese trading company, but smaller in size compared to market leaders Mitsubishi Corporation (OTCPK:MSBHF) and Itochu (OTCPK:ITOCF). We have discussed the characteristics of these larger peers previously – in our opinion Marubeni’s business model aligns closer to Mitsubishi’s in its significant exposure to resources, and weighting towards international operations. The key point of differentiation is that Marubeni also has strong presence in the agricultural and food sectors.

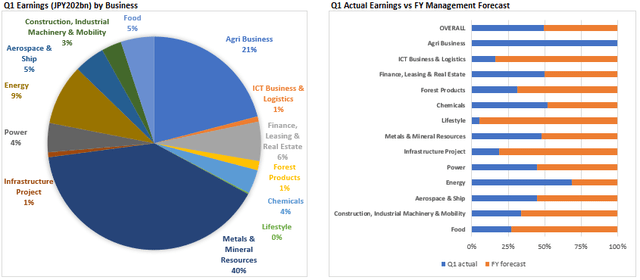

Of the Japanese trading companies, we like Marubeni most because of its sizable exposure to major commodities that have remained strong throughout 2022 so far despite the economic headwinds, namely coking coal (through its Metals & Mineral Resources business), LNG (Energy), fertilisers (Agri Business) and grains (Food). All of these four are inadvertent beneficiaries of the Ukraine conflict, and have demonstrated enduring resilience in the face of a weakening global economy which has weighed on most of its other commodity brethren. Earnings for Q1 FYE 2023 came in at JPY202bn mostly due to strong contributions from the abovementioned businesses. This represented a 50% meet of its full year forecast of JPY400bn.

The strongest contributors are enjoying tailwinds from underlying commodity prices. These areas (particularly Metals/Minerals and Agri) are on track to hit budget by half-year, and will lead the company to exceptional full year earnings in our view. (compiled from financial results presentation)

We fully expect this forecast to be exceeded by half-year (September), and revised full-year guidance of around JPY650bn in the upcoming reporting period, on the back of continued favourable markets in Q2. In line with this, we also predict the full year dividend floor to raise to JPY75 (US$0.50), which would represent a dividend yield of at least 5% – half of this to be paid as an interim dividend.

Valuation

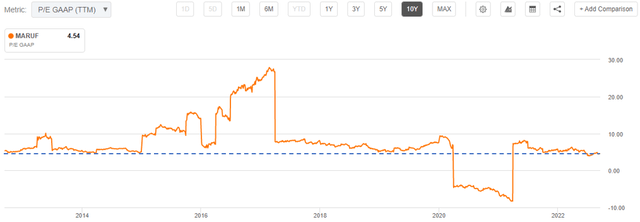

Current P/E ratio on a trailing basis is at 4.5x, which is lower than historical levels closer to 5-7x. Half-year earnings which come in at our predicted revised levels will push the ratio closer to 4x, and supports our call that the stock price will rise to JPY1,700 (US$12) when P/E multiples normalise.

Its current P/E ratio (blue dotted line) is lower than most of the last decade. If half-year earnings are as strong as we expect, this would push the multiple closer to 4x. (Seeking Alpha)

We also note that the stock price action this year has decoupled from the fundamentals of the company. We think the market ignored the impact of the conflict to Marubeni, and even as strong commodity prices have prolonged for the entirety of this year, the stock has not retested its 52-week highs from March. We attribute the disconnect in prices with our expectations as a sign the company is under-followed.

We notice the lack of a spike at the breakout of the Ukraine conflict (yellow circle) as market indifference to its impact to Marubeni. It contrasts to the reactionary movement when the company reported strong Q1 earnings (pink circle). We expect a similar response again early November, and the stock to be retesting 52-week highs (blue line) again soon after (Interactive Brokers)

Risks

We think that favourable conditions for Marubeni subsides when the tight supply of commodities affected by the Ukraine conflict resolves itself. We note that for example, Wheat prices have weakened lately, and expect to see this softening reflected in the coming results. Marubeni’s exposure however is largest in coking coal (which have just hit record highs), so we’d look to a meaningful drop in coal spot prices as a sign that its tailwinds have deserted them.

We also think that Marubeni will experience resistance longer-term in a prolonged global economic downturn, so are concerned of weaker returns if commodity price strength doesn’t prolong through a recessionary backdrop. However, the low P/E multiple reflects a commanding margin-of-safety, further enhanced by current business conditions appearing conducive to frontloading gains and building in additional buffer for potentially rougher times later.

Conclusion

We advocate for interested investors to gain exposure to Marubeni before ex-dividend date of September 30. We are looking for a substantial beat to earnings expectations for half-year reporting due the first week of November, and a subsequent pop in the share price at that time. Before the end of the year, we are hoping that it hits new 52-week highs and will move closer to JPY1,700 (US$12).

Long-term we are looking to hold onto the stock unless the outlook for its exposed commodities changes dramatically, or that we sense significant damage to its prospects in a recessionary environment. We also see that expected dividend yields of 5% is merely a short-term lower bound, and future capital returns at an even higher rate.

(USDJPY=144 assumed in analysis)

Be the first to comment