Pranita Thorat

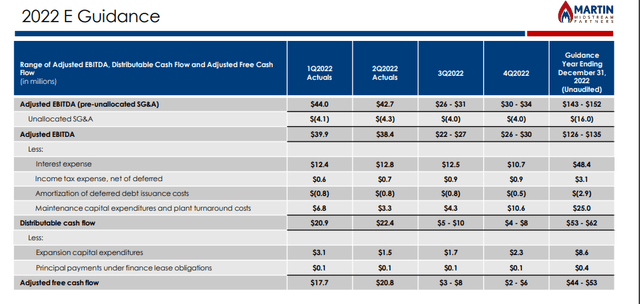

Martin Midstream Partners (NASDAQ:MMLP) reported excellent Q2 2022 results, allowing it to boost its full-year adjusted EBITDA guidance to a range of $126 million to $135 million. This was in-line with my previous expectations, where I believed that Martin would exceed the high-end of its prior guidance range of $110 million to $120 million for adjusted EBITDA in 2022.

The strong performance in 2022 plus the significant decline in Martin’s unit price since April has changed my view on its common units. I am now bullish on Martin’s common units from a valuation perspective, although significant risks remain due to its upcoming debt maturities.

Q2 2022 Performance

Martin delivered very strong results in Q2 2022, with the $38.4 million adjusted EBITDA exceeding the high-end of its guidance range for the quarter by $13.4 million. Martin also boosted its Q3 2022 adjusted EBITDA guidance (at midpoint) by $4 million, although it reduced its Q4 2022 adjusted EBITDA guidance by $2.5 million.

Much of Martin’s strong performance during the first half of 2022 can be attributed to its fertilizer business, which has seen strong margins due to the war in Ukraine. This segment generated $21.8 million in adjusted EBITDA during the first half of 2022. The fertilizer business is seasonal though, and has less impact in the second half of the year, contributing to expectations for lower adjusted EBITDA in the second half of the year. As well, Martin expects its butane margins in Q4 2022 to be lower than its butane margins in Q4 2021.

Overall, I believe that Martin will end up reaching the upper half of its revised $126 million to $135 million adjusted EBITDA guidance for 2022.

Notes On Debt

Hitting the upper half of its revised adjusted EBITDA guidance may allow Martin to reduce its credit facility debt to approximately $110 million by the end of 2022. This would also give it $455 million in net debt, or leverage of approximately 3.4x.

If adjusted EBITDA falls back to more typical levels (such as $115 million) during 2023, Martin may end up with around $420 million in net debt at the end of 2023. This would put its leverage at 3.65x.

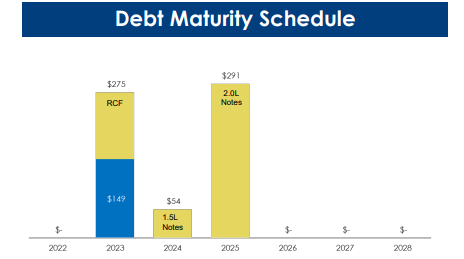

Martin has some debt maturity challenges to work through over the next few years. Martin’s credit facility matures in August 2023, and it also has note maturities in 2024 and 2025.

Martin’s Debt Maturities (mmlp.com)

Of note is its $291 million in 11.5% second-lien notes due 2025. These notes traded around par or above from early 2021 to mid-2022. However, these notes dropped down to around 90 cents on the dollar in mid-July before rebounding to 97 cents on the dollar now. There does not appear to be a company-specific reason for the drop in the price of those bonds, but it may reflect some concern about the potential for a recession.

The second-lien notes will likely be Martin’s biggest challenge to deal with due to its relatively large size. Martin’s estimated value is higher than its debt (value estimated at 1.6x projected net debt at the end of 2023), but economic conditions will likely influence the success of the debt refinancing.

Notes On Valuation

A 6.0x EV to adjusted EBITDA multiple would make Martin worth $690 million, assuming $115 million per year in adjusted EBITDA in the longer-term. Subtracting $420 million in net debt (year-end 2023 projection) would leave $270 million in value for its common units, or around $6.95 per unit in value based on its current unit count.

This does assume that Martin can navigate its near-term debt maturities without dilution. There is a risk that Martin will end up issuing more units or issuing warrants as part of its debt refinancing plans. If there is a significant economic downturn, Martin would also be at risk of restructuring.

Conclusion

Martin Midstream’s results for the first half of 2022 were quite strong, boosting its full-year guidance to a range of $126 million to $135 million for adjusted EBITDA. If economic conditions hold up reasonably well, Martin should be able to deal with its upcoming debt maturities without dilution. This is a scenario where its common units could be worth close to $7 per unit.

However, if economic conditions deteriorate, there is a risk of dilution (or even restructuring depending on the extent of the economic deterioration) as Martin attempts to deal with its debt maturities.

Be the first to comment