Sundry Photography/iStock via Getty Images

On Wednesday, April 20, 2022, troubled midstream partnership Martin Midstream Partners L.P. (NASDAQ:MMLP) announced its first-quarter 2022 earnings results. Admittedly, these results were very respectable as the company managed to grow its revenue considerably year-over-year and managed to reduce its leverage down to a very reasonable level. It looks as though the company may be overcoming some of its past mistakes. The market seemed pleased with these results too as the company’s partnership units shot up in after-hours trading, a trend which has been continuing as of Thursday morning. With that said though, things were far from perfect here and Martin Midstream Partners still remains a second-tier choice in the midstream sector. The improvements that we see in these results do provide some cause for optimism about the company’s future, however.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Martin Midstream Partners’ first quarter 2022 earnings report:

- Martin Midstream Partners reported total revenues of $279.201 million in the first quarter of 2022. This represents a significant 38.92% increase over the $200.974 million that the company reported in the prior-year quarter.

- The company reported an adjusted EBITDA of $39.954 million in the most recent quarter. This represents a 29.30% increase over the $30.901 million that the company reported in the year-ago quarter.

- Martin Midstream Partners boasted an adjusted leverage ratio of 3.87x at the end of the reporting period. This is a significant improvement compared to the 4.19x that the company had at the start of the year.

- The company reported a distributable cash flow of $20.854 million in the most recent period. This represents a significant 62.78% improvement over the $12.811 million that the company reported in the corresponding quarter of last year.

- Martin Midstream Partners reported a net income of $11.478 million in the first quarter of 2022. This compares very favorably to the $2.511 million that the company reported in the first quarter of 2021.

It seems essentially certain that the first thing that anyone reviewing these results is likely to notice is that every measure of Martin Midstream’s financial performance showed considerable improvement compared to the prior-year quarter. This is a very positive sign that shows us that the company may finally be overcoming the struggles that it faced back in 2020. Interestingly, the company managed to accomplish this without any increase in throughput volumes. In fact, Martin Midstream saw the volume of resources handled by its terminal infrastructure come in identically to the prior-year quarter. This is not unusual since the company’s contracts with its customers specify a volume of resources that the customer has to send through the terminals. Martin Midstream Partners did see its revenues from providing its handling services increase slightly year-over-year but this is also not unusual since the contracts also include a small annual price increase (typically a few percentage points) per unit of resources handled.

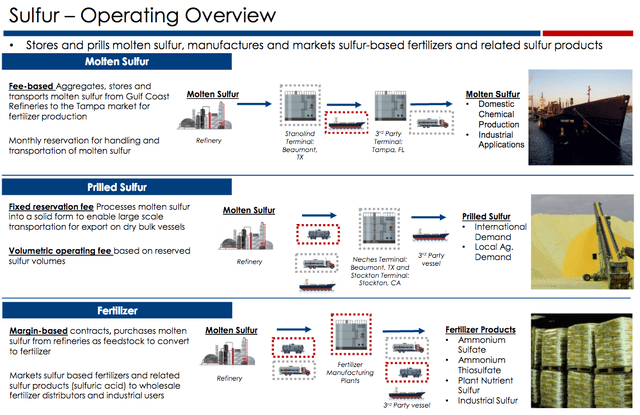

The area where Martin Midstream Partners saw substantial year-over-year improvements was in its sulfur services business unit. This is an area of the company’s business that greatly differentiates it from other midstream companies since most of them have no involvement in this business. The company’s sulfur services unit manufactures sulfur-based fertilizers and byproducts, such as sulfuric acid:

Martin Midstream Investor Presentation

This business saw a substantial increase in volumes relative to the prior-year quarter. As we can see here, the volume of sulfur that the company handled was up substantially year-over-year, although fertilizer volumes declined somewhat:

| Q1 2022 | Q1 2021 | |

| Sulfur (long tons) | 114 | 73 |

| Fertilizer (long tons) | 84 | 95 |

| Total Sulfur Services Volumes (long tons) | 198 | 168 |

These higher volumes were sufficient to increase the business unit’s revenues by 70% and its operating income by a whopping 96% year-over-year. Interestingly, the company’s management provides essentially no insight into the cause of the volume increase, other than to simply state that the demand for agricultural products increased year-over-year. The fact that the company’s management tends to be less than transparent is one of the things that has always concerned me about Martin Midstream Partners. It seems likely that this increase in volumes was caused by much more than an increase in demand for agricultural products, however, particularly considering that fertilizer production and sales were actually down. The more likely explanation here is that refineries increase their production of refined products since the demand for these was up substantially relative to the first quarter of 2021. Sulfur is produced as a byproduct of refining high sulfur crude oil (sour crude oil) such as that produced in Canada, Alaska, and the Middle East. Refineries pay Martin Midstream Partners to take away this sulfur. It thus seems highly likely that a significant proportion of the improved performance that this unit delivered was caused by higher refinery activity. With that said though, higher fertilizer prices would certainly have a positive impact on cash flows here.

One of the nicest things that we see in these results is that the company managed to significantly improve its adjusted leverage ratio, which is a measure of how easily the company can carry its debt. The adjusted leverage ratio (defined here as debt-to-adjusted EBITDA) basically tells us how many years it would take the company to completely pay off its debt if it were to devote its entire pre-tax cash flow to that task. As noted in the highlights, this ratio stood at 3.87x at the end of the quarter, which is very reasonable. Although analysts typically consider anything under 5.0x to be reasonable and sustainable, I typically like to see this ratio under 4.0x in order to add a measure of safety to the position. Indeed, one of the trends that we have been seeing in the midstream sector lately is that a growing number of companies have been aggressively trying to get their ratios down under 4.0x. It is nice to see that Martin Midstream Partners now meets this requirement as the company’s high debt load was one of the problems that I pointed out in my last article on the company. Thus, this represents a very significant improvement, particularly if the company can get it down under 3.75x as management stated it wants.

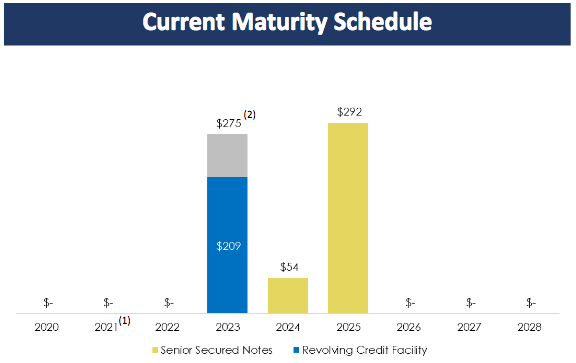

Unfortunately, the improvements that we see with respect to the company’s ability to carry its debt do not completely solve its debt problems. This is because essentially all of its debt matures within the next three years:

Martin Midstream Investor Presentation

The reason why this could be a concern is that it means that the company will need to come up with a substantial amount of money in a relatively short timeframe. This could mean that Martin Midstream Partners will not increase its distribution in the near future since it will likely want to hold onto as much cash as it can get in order to maximize the likelihood that it will be able to roll over this debt as it matures. It may actually be planning to do this since management upped its guidance for both adjusted EBITDA and distributable cash flow but made no mention of raising the distribution. Fortunately, if the company does manage to get its leverage ratio under 3.75x as management is planning it should have no real difficulty rolling over its debt as it matures. Thus, while the company’s current maturity schedule does pose a very real risk, it is probably a manageable one barring a severe economic contraction in the near future.

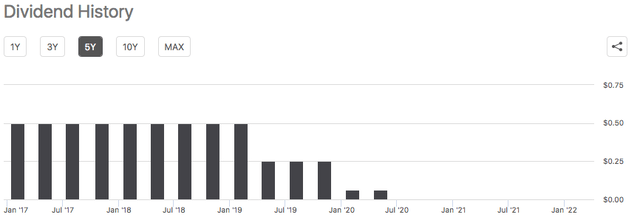

One of the biggest reasons why investors purchase units of midstream companies like Martin Midstream Partners is because of the high distribution yields that they tend to possess. Unfortunately, Martin Midstream Partners is very much an outlier in this industry as it only yields 0.36% as of the time of writing. The company’s track record also leaves a lot to be desired as it has cut the distribution multiple times over the past few years:

Although many midstream firms had to cut their distributions in response to the events of 2020, the fact that Martin Midstream had to cut twice prior to the lockdowns is highly concerning. With that said though, someone investing today would be receiving the current distribution and would likely be most concerned with the company’s ability to maintain the distribution going forward. The usual way that we judge this is by looking at the distributable cash flow, which is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the limited partners. As stated in the highlights, Martin Midstream Partners reported a distributable cash flow of $20.854 million in the first quarter of 2022 but it only pays out about $200,000 per quarter in distributions. Obviously then, the company can easily cover its distribution with a great deal of money to spare but due to its need to control its debt, it seems unlikely that Martin Midstream Partners will increase its distribution anytime soon.

In conclusion, Martin Midstream Partners has certainly been making a great deal of progress in resolving some of the problems that were plaguing it a few years ago. In particular, it appears that the company has begun to get its debt under control and is beginning to once again see cash flow growth. It still has a way to go, but there may now be a reason to be optimistic. I continue to be worried about management’s general lack of transparency and when this is combined with the company’s substantial amount of maturing debt over the next few years, Martin Midstream Partners continues to be a second-tier choice in the industry.

Be the first to comment