damircudic

Investment Thesis

Marqeta (NASDAQ:MQ) is a fintech company founded by Jason Gartner back in 2009. It specializes in modern card issuing and processing through its API and platform. In other words, Marqeta helps businesses create their own card that caters to their needs. Its modular API approach allows clients to easily customize their products with features such as virtual cards, JIF (Just-in-Time) funding, dynamic spend controls, and more. It has a strong customer base which includes Block (SQ), JPMorgan (JPM), Uber (UBER), and more.

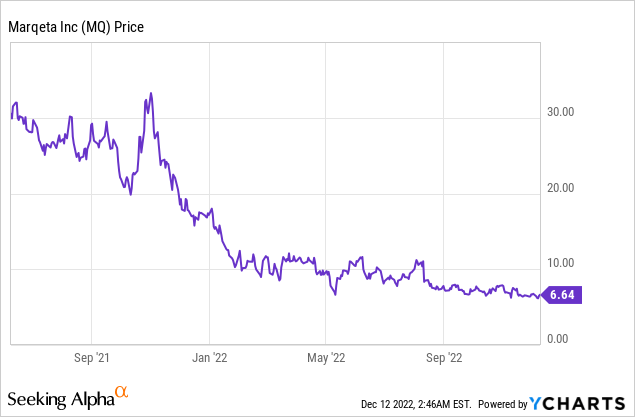

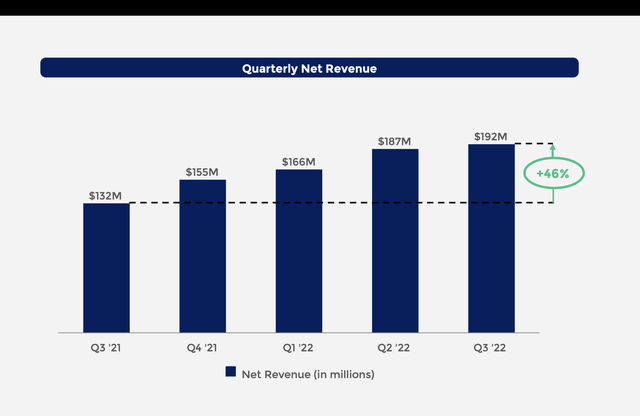

Marqeta went public late last year but it quickly got caught in the broad market selloff and the share price is now down over 70% from its all-time high. I believe the massive sell-off presents a good buying opportunity for long-term investors. Though the macroeconomy is weakening, Marqeta is continuing to perform with revenue up 46% in the latest quarter. The market also seems to be ignoring its expansion into the banking space, which should be a strong growth driver. The company is also now trading at a very compelling valuation when compared to peers. Therefore, I rate Marqeta as a buy at the current price.

Expansion Into Banking

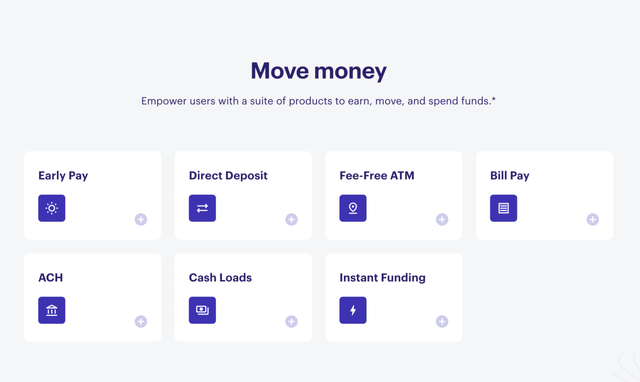

I believe Marqeta has strong growth opportunities as it continues to expand its platform and reach. Marqeta has been gaining strong traction but its offerings are solely focused on card issuing which limits its TAM (total addressable market). However, this has changed as the company recently announced the launch of Marqeta for Banking, a portfolio of seven banking products that provide bank account and money movement features including bill pay, direct deposit with early pay, fee-free ATM, and more. This expansion beyond card issuing is able to provide a much more comprehensive and compelling offering for customers. Unlike traditional banking products, Marqeta’s offerings are modular and flexible. Customers can easily integrate these new products into their existing portfolios. Coinbase (COIN), a long-time Marqeta customer, is already using the company’s new banking product for its deposit accounts.

The new set of products is also going to significantly improve the bottom line as it comes with much higher margins compared to the existing products, as mentioned during the latest earnings call. The management team said that they will continue to roll out new Marqeta for Banking features and products and the opportunity here is huge in my opinion.

Mike Milotich, CFO, on banking product margins

We expect it to be significantly higher margin than our current business. A lot of these services might be charged on a per-user basis or a per-transaction basis. So it really is just incremental revenue and potentially cost of revenue for the existing transactions and volume are getting already.

Financials and Valuation

Marqeta recently reported its third-quarter financial earnings and the results are very encouraging in my opinion, especially when considering the gloomy macro environment.

The company reported revenue of $191.6 million compared to $131 million, up 46% YoY (year over year). The growth was broad-based, with twenty of its top thirty customers growing revenue by over 40%. The increase in revenue is driven by strong TPV (total processing volume), which was up 54% from $27.6 billion to $42.5 billion. Block’s Cash App was one of the main growth drivers for the quarter. Cash App saw a nice bump in active users and 35% of those users now have a Cash App card, up from 31% last year. This along with higher deposit inflow boosted overall card spending. Gross profit was $80.1 million compared to $59.1 million, up 36% YoY. Gross profit margin dipped slightly from 45% to 42%, due to a one-off catch-up incentive payment. I expect margins to normalize in the coming quarter.

The bottom line remains negative as the company continues to invest in growth. Adjusted EBITDA was negative $(17.6) million compared to negative $(4.9) million, representing an Adjusted EBITDA margin of (7)%. Net loss also widened 16.4% YoY from $(45.7) million to$(53.2) million, while net loss per share was $(0.10) compared to $(0.08). The increase in loss was largely attributed to higher operating expenses for technology and professional services, which were up 44.3% and 40.7% respectively. Total operating expenses increased 33.3% from $104.7 million to $139.6 million. The increase in net loss also impacted the company’s operating cash flow, which went from $1.4 million to negative $(27.9) million.

While the bottom certainly doesn’t look pretty, I totally understand why the company continues to invest heavily. When looking at the balance sheet, Marqeta currently has over 1 billion in cash, which is almost 30% of its current market cap. This gives the company a lot of dry powder to reinvest into the business and grab market share while competitors stay conservative. Given the strong liquidity and minimal cash burn, I am not too worried about the bottom line at the moment.

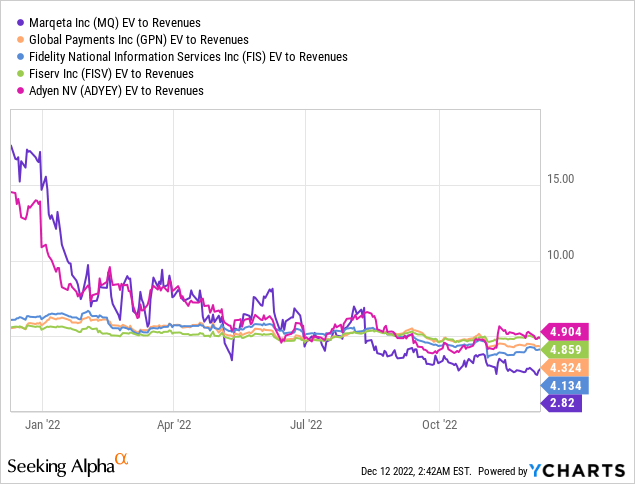

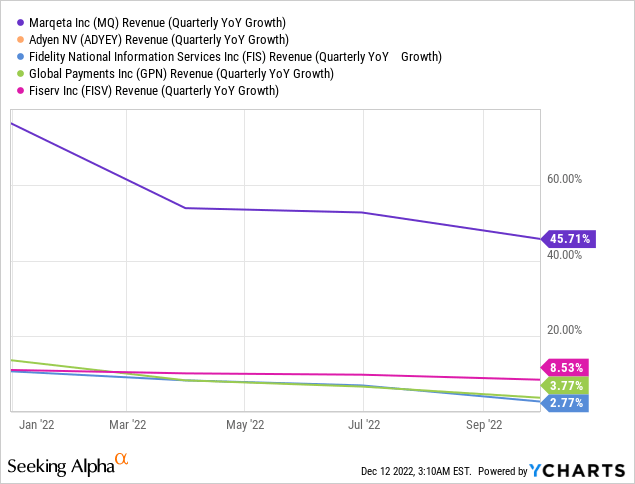

After the substantial drop in share price, I believe Marqeta’s valuation is now very attractive. I am using the EV/sales ratio here as the company is still unprofitable and enterprise value can take the business’s cash position into account as well. The company is currently trading at an EV/sales ratio of 2.8x, which is significantly lower than peers such as Adyen (OTCPK:ADYEY), Fiserv (FISV), Global Payments (GPN), and Fidelity (FIS), as shown in the first chart below. The peer group is currently valued at an average EV/sales ratio of 4.55, which is 61.3% above Marqeta. From the second chart below, you can also see that Marqeta’s revenue growth north of 40% is much higher than others with single digits growth rates. I believe the current valuation is very discounted and it should at least be trading at a similar multiple to its peers. A reverse back to the peer group’s average valuation will offer a roughly 60% upside potential.

Risks

The biggest risks in regard to Marqeta are customer concentration and recession. Customer concentration has been a problem for a long time and continues to pose substantial risks to the company. Block currently accounts for 72.5% of Marqeta’s total revenue, up from 69% in the prior quarter, which is unreasonably high. While Block has shown strong growth in the past few quarters, especially around its Cash App, it is always very risky to bet on one single customer to succeed. I think investors should keep a close eye on the percentage moving forward as the current level is way too unhealthy. I personally believe the company’s new banking offerings should attract more new customers and diversify its customer base.

The other risk is a recession, which has been a hot topic recently. The broad economy has weakened substantially since early this year as the Fed started tightening. As a result, more and more companies are slashing guidance and announcing layoffs. Recent employment figures seem strong but should start to weaken as the effect of QT starts to be felt. Marqeta is very exposed to the macroeconomy as it relies heavily on payment volumes. Its presence is also mostly in emerging spaces such as BNPL (buy now pay later) and crypto, which makes it even more vulnerable. Therefore a recession will likely post an outsized impact on the company’s financial performance.

Conclusion

In conclusion, I believe the current share price offers a good buying opportunity for Marqeta. The company continues to execute at a high level with revenue up over 46% in the latest quarter despite facing a weakening economy. Its expansion into the banking space is huge and should open up a lot of new growth opportunities moving forward. The current valuation is very compelling as it is trading at a much lower multiple compared to peers while growing the top line much faster. It is facing customer concentration and recession risk but a lot of pessimism is already priced into the share price in my opinion. Therefore I rate the company as a buy.

Be the first to comment