da-kuk

Originally posted on November 18, 2022

Markets were solidly locked in tight ranges this week, with many cryptocurrencies winding down in tight coils. We reminded our MarketLife members that, while such patterns always lead to great breakouts in trading books, in real life sometimes no breakout happens and the market just flatlines for a line time.

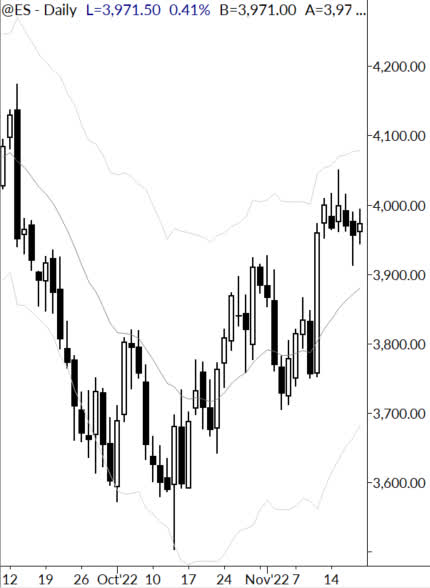

Stock indexes are also holding tight ranges on daily charts (see chart), and these patterns are starting to tilt toward bull flags. There’s likely a slight bullish bias from this point, at least for a retest of recent highs.

From a structural perspective, we think a solid case can be made for the near term in either direction. It’s important to remember that “I don’t know” is a solid answer when someone asks you about market direction. Of course, this flies in the face of financial media, which features talking heads talking with absolute certainty… and usually about absolutely nothing.

We’ll continue to watch for short-term setups, though the longer-term bearish overhang persists. In the meantime, we thought it would be fun to look at some stats around the US Thanksgiving holiday.

Thanksgiving day bias and seasonality

One good way to think about this is to imagine you made a trade. Let’s say you bought the close of the Tuesday before Thanksgiving, so you’re looking to be in the market for the pre-holiday session and then the Friday session. Looking at data from 2002-today, we find that:

You would be up (from your trade entry on Tuesday’s close) 72% of the time on Wednesday’s close, 76% on Friday’s close, but only 42.9% on Monday’s close. (Compare this to 66% upward close for any random day in the sample.)

The returns for this trade are 0.33% on Wednesday’s close, 0.29% on Friday’s close, and -0.19% on Monday’s close. These numbers are not statistically significant due to variability (the wide range of outcomes) and sample size, but you can compare to 0.03% average daily return in the sample.

Though we’d never trade a seasonal pattern like this as a standalone, they do reaffirm something we’ve seen over the years: there’s a bullish bias ahead of the Thanksgiving holiday, and often a disappointment to follow!

The week ahead (potentially market-moving data releases)

- Monday: None

- Tuesday: None

- Wednesday: Jobless numbers, Durable Goods, PMI Manufacturing & Services, New Home Sales, FOMC Minutes

- Thursday: Thanksgiving Day Holiday

- Friday: None (NYSE early close)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment