PeopleImages

How Was October’s Jobs Report?

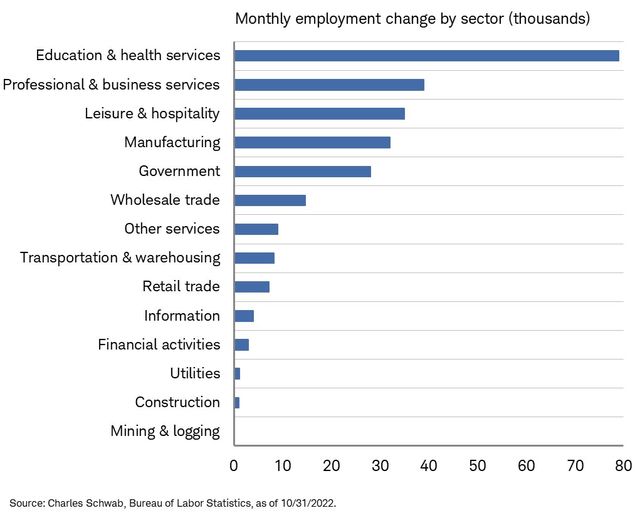

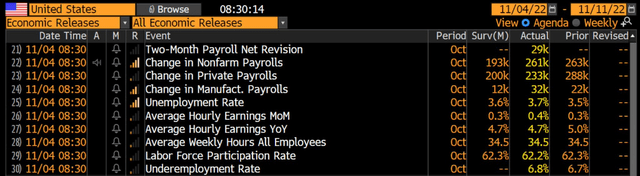

The Labor Department reported an October jobs gain of 261,000 vs. a consensus forecast of 193,000. Private payrolls increased by 233,000. Average hourly earnings rose by 0.4% while the unemployment rate increased from 3.5% to 3.7% last month – the highest since February.

Importantly, the September job gain was revised from 263,000 to 315,000. It remains to be seen how many tech-industry layoff announcements might impact upcoming payrolls reports. Still, the employment picture appears robust, much to the chagrin of the U.S. Federal Reserve.

October Jobs Report Leans To The Warm Side

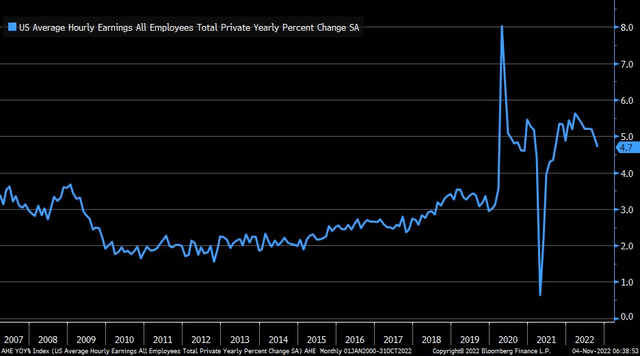

The 4.7% year-on-year rise in hourly earnings continues its declining trend and remains well below the headline inflation rate which is expected to have been roughly 8% in October. We’ll get a fresh read on CPI next Thursday.

U.S. Average Hourly Earnings Rate Falls To 4.7%

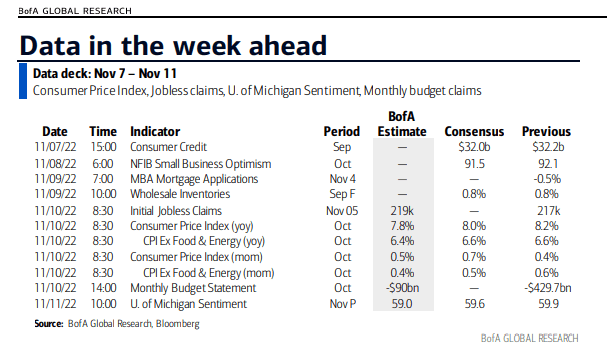

CPI Next Week. Consensus 8.0% YoY Headline Rate.

BofA Global Research

The Labor Force Participation Rate ticked down unexpectedly from 62.3% to 62.2% as fewer workers are now seeking work or are employed. Finding quality workers remains a challenge for corporate America and small businesses. The Leisure & Hospitality segment remains about one million jobs short of its pre-pandemic high.

Education & Health Services Jobs Gain The Most In October

Liz Ann Sonders, Charles Schwab

Interest rates rose in response to the somewhat hot employment report with the 2yr yield jumping to nearly 4.8%, a fresh cycle high. The 10yr rose to 4.18%. Meanwhile, the swaps market now prices in a 5.25% Fed terminal rate. The U.S. Dollar Index maintained its premarket loss while crude oil hover at multi-week highs near $92.

Stocks took the news in stride. Futures were solidly higher ahead of the NFP number following positive re-opening news out of China. After a brief dip in S&P 500 futures to near the flat line, buyers stepped back in.

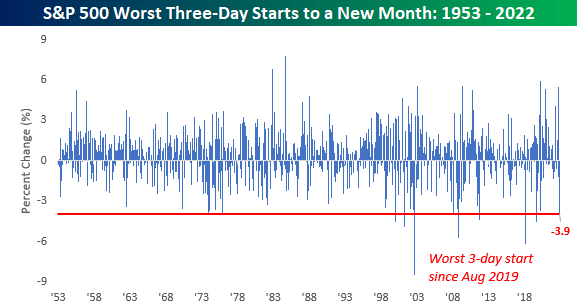

A 1% advance pre-market follows the worst three-day stretch to kick off a November for equities since at least 1952, according to Bespoke Investments. We will see if we get another positive Friday to recover those losses that were exacerbated by Chair Powell’s hawkish FOMC press conference.

A Nasty 3-Day Stretch To Start A Seasonally Bullish Period

Bespoke Invest

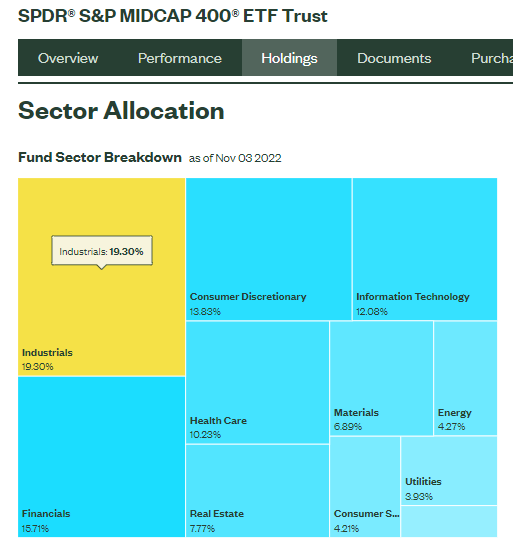

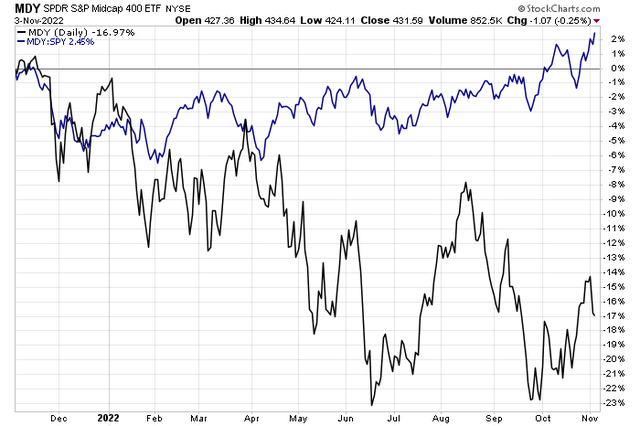

One area that might benefit from a broader strong trend in domestic job growth are midcaps. They’re exposed to the U.S. economy which continues to appear better positioned than international markets given a strong dollar. Moreover, negative real wages and declining raw material prices could be a tailwind for mid-sized companies. Investors should consider an overweight to this slice of the equity market.

According to SSGA Funds, the S&P MidCap 400 Index (NYSEARCA:MDY) provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. With an expense ratio of 0.22% annually, the MDY offers exposure to an often-overlooked swath of the domestic equity market. With a forward price-to-earnings ratio of just 12.2, the group is less expensive than large caps with perhaps less volatility than the Russell 2000. For perspective, the weighted average market cap of MDY is $6.6 billion as of Nov. 3.

Midcaps generally benefit from an outperformance of value versus growth. The cyclical Industrials sector and Financials sector make up more than one-third of MDY whereas the so-called “TMT” tech-media-telecom sectors including Information Technology, Consumer Discretionary, and Communication Services together are 28% of the ETF compared to 45% of the S&P 500.

Midcaps’ Value Focus

SSGA Funds

Mid-caps have outperformed the S&P 500 this year with strong relative performance so far in the second half. Moreover, MDY successfully held its June low during a September retest while the S&P 500 briefly notched a fresh 2022 low. I continue to like midcaps on a relative basis, and this morning’s jobs report should back up that thesis.

MDY Shines vs SPY in H2

When Will The Next Jobs Report Be Released?

Employment reports are generally released at 8:30 am ET on the first Friday of a month. The November jobs release is slated for Friday, Dec. 2.

The Bottom Line

The October jobs report verified slightly stronger than economists expected despite a higher unemployment rate. Fed policy likely won’t change much in the wake of the numbers. All eyes will now focus on next Thursday’s CPI report while the midterms should not cause much excess volatility.

Be the first to comment