VioletaStoimenova/E+ via Getty Images

I like investing in insurance businesses. I own a lot of NA and European insurance and reinsurance businesses, with a focus on quality, dividends, forward prospects, and current valuation. To that end, almost 10% of my portfolio is specifically in the insurance sector.

However, none of that exposure is in the Markel Corporation (NYSE:MKL). There are reasons for this – and in this article, I’ll go through them one by one, and also look up some of the positives here. The company is solid – with great fundamentals – but it might not be the best investment possibility out there.

Let me show you why.

Markel – What Does The Company Do?

Markel is an insurance business, or as it describes itself, a “diversified financial holding company” in a variety of smaller markets. The company can be viewed as an ambition to use three financial methods in order to deliver alpha, of which insurance is one of these areas.

The other areas that the company is involved in are Investments, which focus on investments primarily related to the underwriting operations of Markel, where investable assets come from premiums paid by policyholders, as well as shareholder funds. Aside from these, the company also focuses on Market ventures, operating outside of the insurance marketplace.

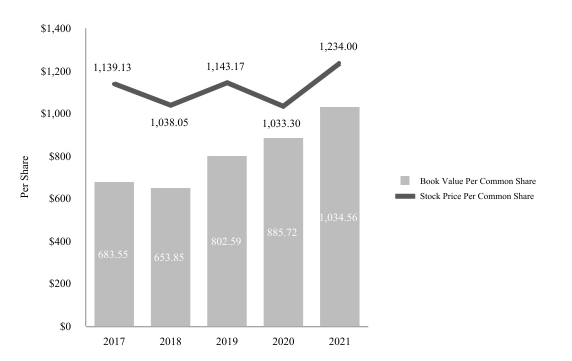

Markel is BBB rated, making it investment-grade. It does not pay a dividend, nor has it ever done so. This means that RoR is strictly a product of capital appreciation, and the results have been good. An investment in Markel 20 years ago would have generated 747% RoR or 11.1% annually. This is better than the average return of the market. From this perspective, Markel has delivered excellent Alpha as an investment.

The company has a market cap of nearly $20B, and the recent years have seen Markel successfully grow its book value on a YoY basis. Even COVID-19 barely slowed them down in any sort of way, instead driving higher returns.

Markel Returns (Markel 10-K)

Markel isn’t a traditional insurance company. While it does describe its operations as insurance, it’s more like a company that puts capital in PE-style investments as opposed to reserve, as would be considered normal by other businesses in the same field.

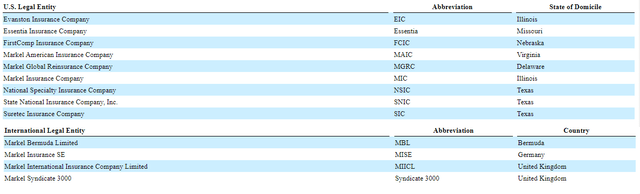

Markel is sometimes called one of the best capital allocators in America due to the massive, historical growth rate of revenues. The company owns a large number of both domestic and International insurance subsidiaries in US states and Bermuda, Germany, and the UK.

Markel Insurance entities (Markel 10-K)

The inherent values and ambitions of a quality company such as Markel imply what sort of shareholders the company is looking for. Companies with a higher-than-average share price and that lack a yield are more likely to attract long-term shareholders. Berkshire (BRK.B) is the penultimate example of this. You don’t buy a BRK.B share unless you’re serious and intend to stay in for some time, usually. A similar thing is true with Markel. At almost $1,500 per share and zero yield this isn’t an investment that should be made likely – but one that should be made for life.

A company such as this survives on the transparency of its board, CEO and management. Shareholders need to be made to feel secured not only by the standard 10-Ks but other documents. Warren Buffets’ shareholder letters are a good example – because the Co-CEO of Markel actually writes the same thing.

Such a thing, and I especially refer you to the 2020 version of this letter, implies that shareholders can trust management long term. Markel, as it happens, is also a long-term shareholder of Berkshire. There are interesting articles on the nature of “quality shareholders” and what results they can get from long-term investments. Warren Buffet himself made the importance of long-term shareholders clear in several of his shareholder letters and communications.

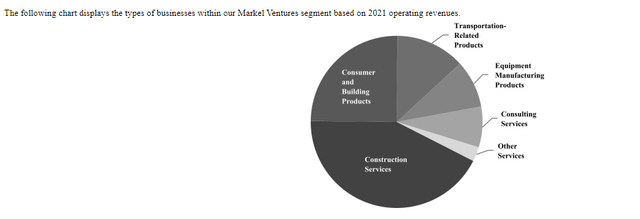

The company is an appealing play on its basic insurance, underwriting and insurance subsidiary ownerships, but also its ownerships in the market ventures segment. This is where much of the Berkshire play comes in, viewed as distinctly separate businesses to the core operations. Market ventures reported revenues of $3.6B in 2021 to an operating income of just over $272M and EBITDA of around $400M.

Currently, the market ventures portfolio looks like this.

Markel Market Ventures (Markel 10-k)

What sort of companies are we looking at here? All across the board, including things like:

- Brahmin, Luxury Handbags

- Buckner, Heavylift Cranes

- Captech, Tech-company

- CostaFarms, Plants/Agri

- Eagle, Home builders

- Elicott Dredges, a builder of dredges

- Havco, Flooring

- Markel Food Group

- RetailData, focusing on Retail Intelligence

And others. So, you see that it goes from A to Z, again with the focus on Alpha.

The company has shown impressive 10-20-year profitability numbers, improving its operating revenues by a factor of 3X in less than 10 years. Because it’s tripling of premiums, Markel has been able to differentiate itself from what typically isn’t a high-growth field (Insurance).

It is quite possible to clearly point to a trend where Markel does not grow revenues without growing its profitability in the long-term – and this is a very appealing company trait to be able to showcase.

The company has a combined ratio is perhaps the one problematic area due to the pandemic. At 98% combined for 2020 during the pandemic, it has been able to improve this in 2021 – and management targets are to grow insurance premiums to $10B in five years, while growing underwriting profits to $1B with a 90% combined ratio – at the highest – in 2025/2026. The recent combined ratio has dipped below 93%, confirming this forward possibility.

Historically, Markel’s three segments have all performed exceedingly well – as have the valuations for the company. The company’s capital allocation and leverage practices are extremely conservative. Current LT debt is less than 22% to capital, and Markel will not move on M&As unless it thinks that it has truly found something for its portfolio.

Much of the appeal of such a company, is individually based. Just as Berkshire has Mr. Buffet, Markel has Mr. Thomas S. Gayner. During his tenure, Markel has improved its results and portfolio markedly, reflecting very well on Mr. Gayner’s ability to execute and allocate. Their forward goals are extremely ambitious, but the company has shown itself as being able to execute in accordance with these goals.

The company’s most recent and most significant move was an investment in the now-publicly listed automotive enthusiast insurer Hagerty (HGTY). Hagerty was listed publicly back in December, and while it hasn’t exactly delivered alpha at a -33% move since IPO, Markel owns 23% of the company through both A and B-shares. I haven’t yet done a review on Hagerty, but my view of the company at current valuation is positive.

There are many moving parts to Markel. There are many business lines. In some ways, the company is a much larger version of investments done by Exchange Income Corp (OTCPK:EIFZF), a Canadian aerospace play I invest heavily in. Markel is more conservative, but they also go into market ventures and construction.

Let’s try valuing Markel here.

Markel’s Valuation

There are a few ways to value Markel. We can look at peers – of which there are few. We can look at book value multiples or growth estimates. Analyst consensus for Markel is tricky because the company is very underfollowed. Only 3 analysts follow the company with a range of $1,180 to around $1,550, with an average PT of around $1,375.

The general consensus when looking at analysts is that the company’s valuation has shot up “too much” as part of a positive-direction correction some time ago, with current multiples reflecting an earnings premium that really isn’t sustainable.

2021 was, as mentioned, an excellent year for Markel. The company has seen 1-year share price appreciation of close to 25% at this point, with a recent slow bounce up to around $1,400.

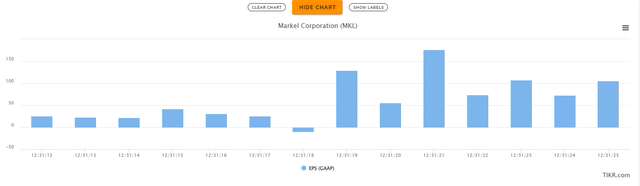

Current forecast estimates don’t call for this EPS growth trend to continue in the next few years, but rather reverse direction to less than half of 2021 levels. The company’s historical numbers have been quite volatile due to some M&A, but have recently taken a turn for the better. These are S&P Global’s expectations for earnings going forward.

Markel Earnings Estimates (Tikr.com/S&P Global)

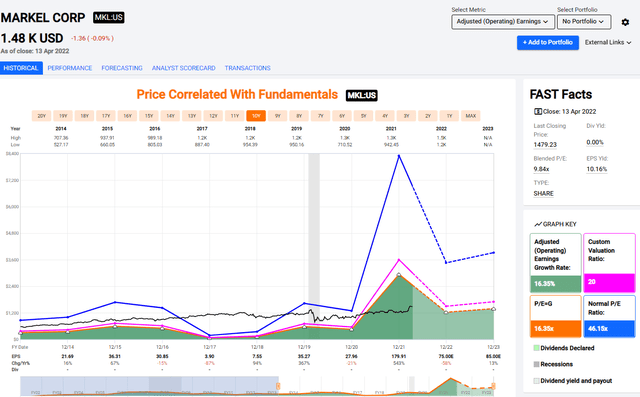

The sentiment that Markel has risen “too far too quick” can be expressed in the company’s historical earnings to valuation graph.

F.A.S.T graphs Markel (F.A.S.T graphs Markel)

While 2021 earnings were superb, we can see this was a trend-breaking year from set of relatively low results since 2016. Furthermore, future returns are expected to drop by nearly 60%, only to then pick up again.

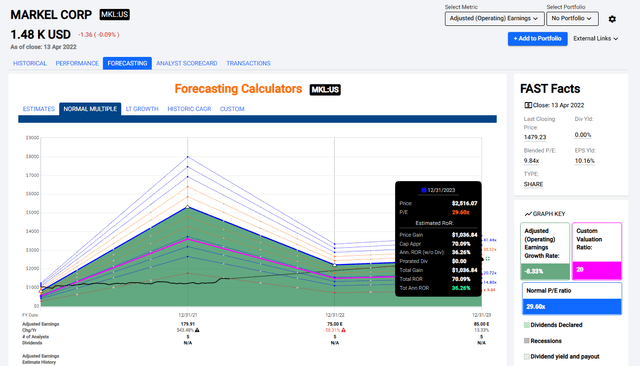

Despite the 2023-2025 estimates, the currently expected RoR by investing today on a 15X P/E ratio is negative 8% until 2023E. While the company currently trades at a premium, the 18-year average for this business is around 30X P/E. Considering a 30X P/E, which is closer to historical accuracy, the company’s upside is 36% annually until 2023E.

Markel Upside, 30X P/E (Markel)

So where is the truth and the likely upside for Markel, it being a qualitative and long-term sort of business? That’s hard to say. Analyst accuracy isn’t exactly stellar here, with analysts coming in at a negative miss over 60% of the time with a 10% margin of error. That doesn’t bode well for looking at this company’s near-term results.

Of course, making a quick buck is not why you get into Markel or similar businesses. These are essentially “lifetime” type investments. If I ever were to buy a BRK.A share, I probably wouldn’t be selling it, as it represents my confidence in the management of the company.

Investing in Markel is something I view as very similar. Only based on a current conservative P/E multiple and the way the company has been bouncing up in what I view as non-recurring earning advantages due to 2021.

Markel was valued for the assumption of a sequential decline in profits in the past few years. This assumption has turned out to be false. However, following a 25% share bounce in 2022, I view this company as having recovered most of the lost ground. What I would be looking for here would be a sub-2X tangible BV/share. On that view, the company is around 10% overvalued at this point, which means we’d be looking for it to fall below ~$1,350 before investing if we were so inclined.

I have also looked in the potential of options for Markel – but these are extremely prohibitive for most investors given the amount of capital exposure inherent to a contract for a company at a share price of $1,480. At a strike of around $1,150, you can get 13% annualized selling a PUT option to a capital exposure of over $111,000. This obviously takes quite a bit of consideration – and it’s not something I would consider valid.

Barring this, my best choice is to wait for the company to get cheaper.

Here is my thesis for Markel.

Thesis

- Markel is a fundamentally solid insurance and investment company. Its holdings are appealing, and it has very aligned management with a solid track record and 20-year returns of over 700%, beating the market average.

- However, a recent bout of recovery has sent the share price up more than 24%, resulting in what I would view as uncharacteristic premium to its book value and multiples.

- I would view Markel as a “BUY” at less than $1,350 – and preferably closer to $1,100 for a decent, conservative upside.

- Investing in Markel also, in my mind, necessitates a very long-term conservative holding assumption. This is not a stock to trade – but one to hold permanently.

- Based on this background, I view Markel as a “HOLD”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you, however, want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Markel is a “HOLD” here.

Thank you for reading.

Be the first to comment