Bulgac/E+ via Getty Images

Investment Thesis

MarineMax, Inc. (NYSE:HZO) is a recreational boat & yacht retailer and superyacht services company. The company is acquiring high-margin businesses to counter the cyclicality of the business. The company has recently acquired IGY Marinas, which can contribute to the high-margin business portfolio. The company is also experiencing solid demand for its products.

About MarineMax

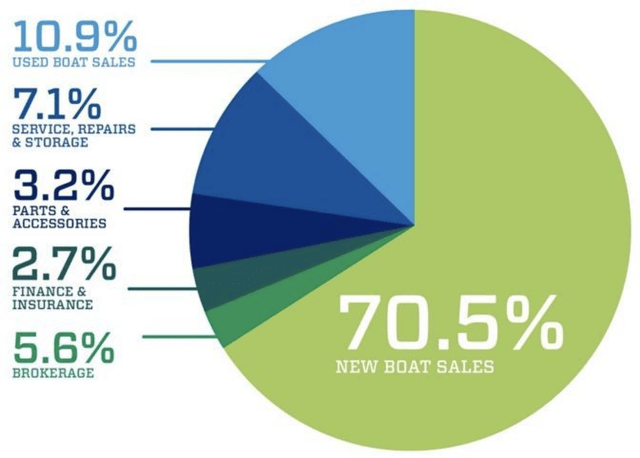

MarineMax is a recreational boat & yacht retailer and superyacht services business. The company sells both new and old recreational boats and marine-related goods like engines, trailers, parts, and accessories & maintenance services. The company also provides boat financing, extended service contracts, and insurance. The company generates 70.5% of its revenue from new boat sales, 10.9% comes from used boat sales, and parts & accessories and service repairs together generate 10.3% of the total revenue. The finance & insurance business generates 2.7% of total revenue, while the brokerage business earns 5.6% of the total sales.

Revenue Classification (Annual Report of MarineMax)

It operates its business through two segments: Retail Operations and Product Manufacturing. The retail operation segment includes selling new & used recreational boats and marine products, such as trailers, engines, parts, and accessories. The repair & maintenance, finance, and brokerage businesses are also part of the retail operations segment. Cruisers Yachts, a wholly owned MarineMax subsidiary, produces sport yachts, and its operations are included in the Product Manufacturing segment. The operation of Intrepid Powerboats is also part of the Product Manufacturing segment. The company is currently on a growth spree with the help of robust demand in the market.

Sales & Earnings Trends and Strong Balance Sheet

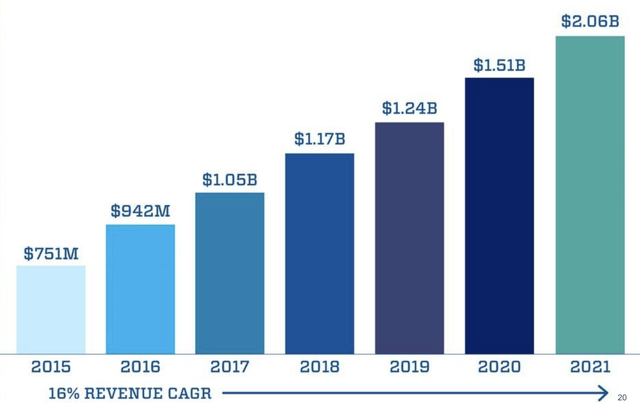

Revenue Trend of MarineMax (Investor Presentation: Slide No. 20)

The company has achieved strong growth in the last seven years with a 16% revenue CAGR. The company has grown through brand expansions, organic market share gains, acquiring high-margin businesses and marinas, and a 12.5% average same-store sales growth. I believe this growth might continue in the coming years as the company experiences a robust product demand in the market, which is highlighted by the dramatic increase in customer deposits. The customer deposits reached $138 million in Q3 FY2022, which is 60% YoY growth. We can observe the same solid growth in the EPS of the company.

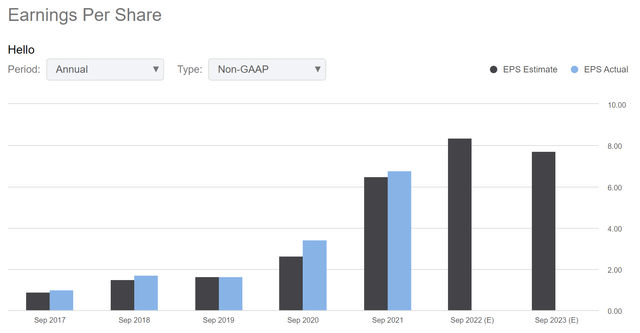

EPS Trend of MarineMax (Seeking Alpha)

Over the last five years, the company has achieved strong EPS growth. The company’s EPS has grown from $1.00 in FY2017 to $6.78 in FY2021 resulting in a 5-year CAGR of 46.64%. The solid EPS growth was driven by the high margins, which the company has achieved by investing in high-margin businesses. I believe the EPS growth might continue in the coming years as the company has strong operating leverage and a strong balance sheet to acquire high-margin businesses in the future, which will complement existing businesses. I believe the strong balance sheet is a competitive advantage for the company because, according to the third quarter result, the company’s cash and cash equivalents position was $281.3 million, which is 43.1% of its current market capitalization. The company’s current ratio is 1.78x, and with a total tangible net worth of $495 million, the total liabilities to tangible net worth ratio is 1.17x. I think the company might keep acquiring new high-margin businesses which complement existing businesses of the company as it is focusing on countering the business cyclicality with margin enhancement. The company has recently announced the acquisition of IGY Marinas.

Acquisition of IGY Marinas

Recently, the company announced the acquisition of Island Global Yachting LLC (IGY Marinas), which owns and manages a portfolio of famous marina properties and a yacht management platform in prominent international yachting hotspots. I think this acquisition can increase the earnings of MarineMax significantly in the coming years as IGY Marinas is expected to generate more than $100 million in revenue. But that is not the only benefit of this acquisition. I believe the addition of IGY Marinas can strengthen the global presence of MarineMax as it will provide a network of 23 curated marinas in the Americas, the Caribbean, and Europe. This acquisition can provide a new platform for the products and services of MarineMax’s Fraser Yacht and Northrop & Johnson superyacht, as these businesses complement perfectly with the IGY Marinas business. The management has stated that the IGY Marinas can expand the high-margin business, countering the business cyclicality. I think the investors can expect robust growth in the coming years as the integration of IGY Marinas can provide a recurring source of revenue and cash, which the company might use to expand the high-margin business.

What is The Main Risk Faced by the MarineMax?

Economic Conditions and Consumer Spending Patterns

Consumer buying habits and general economic conditions may have a negative effect on the company’s operating results. Consumer spending in the markets the company serves may decline due to unfavorable economic developments or doubts surrounding future economic prospects, which can hurt demand and revenue. Consumer discretionary spending levels typically decrease during economic downturns, which occasionally causes sales of luxury products to plummet by abnormally significant amounts. Even when the economy is doing well, consumers may spend less on luxury products due to decreased consumer confidence. Due to its strategic focus on the higher end of the market, the company could be more affected by an economic downturn than its rivals. Inflation has risen more recently, domestically and internationally. The rates the corporation charges clients and the prices manufacturers charge are increasing as a result of rising inflation. If the inflation continues, increases, or both, it may decrease margins and negatively affect the company’s earnings.

Valuation

The company is experiencing strong market demand and expanding its high-margin business portfolio. These factors can drive the growth of the company in the coming years. The company trades at $30.99 with a trailing P/E ratio of 3.68x. After considering the growth driven by the strong demand and acquisition of high-margin businesses like IGY marinas, I believe the EPS of FY2023 to be $8.70, which gives the forward P/E ratio of 3.56x. After comparing the forward P/E ratio of the company with the sector median of 12.77x, we can clearly say that the company is undervalued. The company’s forward P/E ratio is 72% below its sector median P/E ratio, and I think the reason behind this is low momentum due to the rising inflation. I believe in the best-case scenario; the inflation might be controlled in the next year, and the company can achieve the EPS of $8.70 and might trade at its 5-year P/E ratio of 10.41x, which gives the target price of $90.6, representing 192% upside from the current share price. In the bear-case scenario, if the inflation keeps rising in the coming years, the company’s EPS might be $7.10 and trade below its 5-year average P/E ratio. I think the company might trade at a P/E ratio of 6.5x in a bear-case scenario which gives the target price of $46.15, representing a 49% upside from the current share price.

Conclusion

The company is experiencing strong demand in the market. The company is focusing on acquiring high-margin businesses to counter the cyclicality of the business. Recently, the company announced the acquisition of IGY Marinas, which can strengthen its position in the global market and can become a source of recurring revenue and cash flow. The company’s forward P/E ratio is 72% below its sector median P/E ratio. After considering all these factors, I assign a buy rating for MarineMax.

Be the first to comment