Alina Lyssenko/iStock via Getty Images

Investment summary

Following another period of strength in Q2 FY22 we reiterate that Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI) is a buy. Noteworthy is that investors have shifted onto rewarding characteristics of profitability and bottom-line fundamentals in FY22, with the asymmetry in low-quality and high-quality business models continuing to widen. Curiously, the market has overlooked MRVI in favour of more systemic risks and therefore has missed the idiosyncratic risk premia ready to harvest, by estimation. We advocate investors maintain a relative value and quality weighting across portfolios for resiliency in FY22. Hence, with our MRVI valuation of $25, we rate the stock neutral.

Exhibit 1. MRVI 6-month price action

Q2 earnings illustrate profitability features

Second quarter earnings came in strong with upsides at the top and bottom line versus consensus. Quarterly revenue was up ~11% to $242 million and was underscored by strength across all divisions. The cost on these revenues was down ~200bps YoY to 15.4, and the lift fed down to gross margin of 84%, up ~200bps YoY.

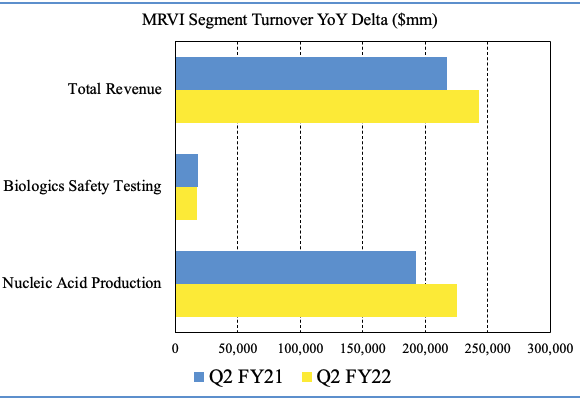

Segmentally, the nucleic acid production business grew 17% YoY as seen in Exhibit 2. This excludes the impact of an estimated $178 million ($1.35/share) of CleanCap revenue in Q2 FY22. In total nucleic acid production turnover came in at $225 million, when baking this in, up 17% over the year. Management note the uptick in sales stems on the back of CleanCap analog demand, that is required for Covid-19 vaccine production. Meanwhile, the biologics safety testing segment printed a 400bps YoY decrease in revenue to $17.5 million ($0.13/share).

Exhibit 2.

Data: HB insights, MRVI

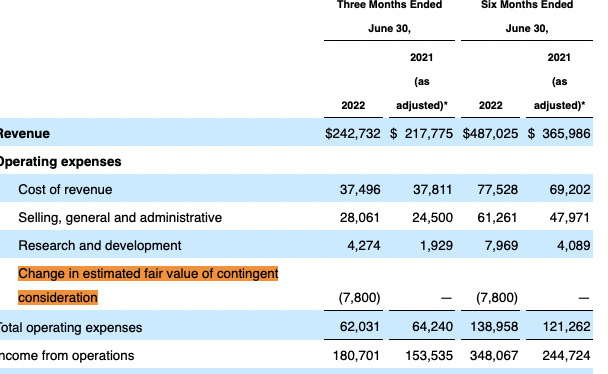

Moving down the P&L, the company saw a 340bps YoY reduction in OPEX for the quarter to $62 million, despite a circa. $4 million headwind at the SG&A line. In addition, R&D costs were up by roughly $3 million. MRVI booked the change in estimated fair value of performance payments related to the acquisition of MyChem LLC [completed January FY22] as income from operations, as seen in Exhibit 3. Consequently, operating income lifted by ~18% YoY to $180 million, up from $153 million the year prior. Removing this accounting adjustment out from GAAP earnings we see OPEX increase to $69 million and operating income narrow in to $110.8 million for Q2 FY22. This is a factor we’ll need to keep an eye on looking ahead.

Exhibit 3. Accounting adjustments for operating income

Data: MRVI 10-Q

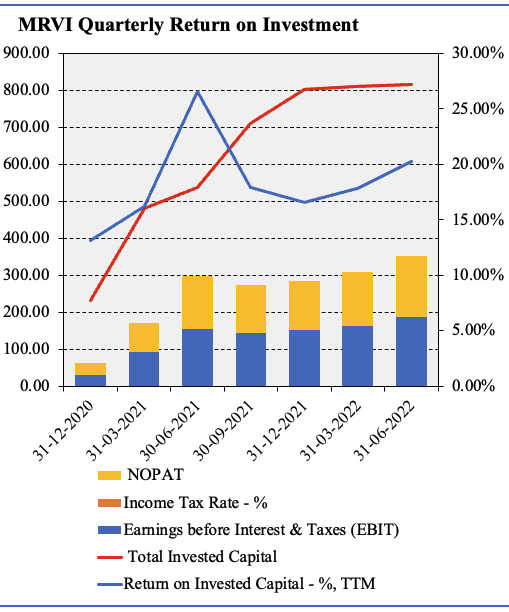

It carried this down to a net income of ~$157 million representing growth schedule of 17% for the 12 months and a non-GAAP EPS of $0.54 per share. Impressively, it also continued its run in generating consistent profitability. Here we examined how much quarterly NOPAT MRVI has generated from the previous period’s invested capital. As seen in Exhibit 4, the company continues to generate substantial return on investment. It compounded ~20% in Q2 FY22, above the previous 3 quarters. Since listing, quarterly ROIC normalizes to 18.3% whereas it has averaged $117 million in quarterly NOPAT conversion in that time.

As such MRVI compounds capital at an average quarterly return of 18.3%, more than double its WACC of 8.44%, on a ROIC/WACC ratio of 2.16x. Simply, ongoing trends in operating profit, average return on investment in the double-digits and growing shift in revenue towards the higher margin nucleic acid production business, are the kind of equity premia investors are paying a premium for in FY22. We believe the market has overlooked these features in MRVI in favour of more systematic risks.

Exhibit 4.

Data: HB Insights, MRVI SEC Filings

Guidance revised upward

With results coming in ahead of expectations management has updated FY22 full-year guidance. It now expects revenue growth of ~10-14%, calling for $888-910 million at the top this year. It projects non-GAAP EBITDA of $660 million in the upper bound, and non-GAAP EPS to land within a range of $1.70-1.80, signifying ~15% YoY growth at the upper end. However, the bottom-line assumptions also presume that all units of Marvai Topco will be converted to shares of Class A stock. It also forecasts interest expense to be in the range of $22-25 million although this is well covered by operating cash flows.

Valuation

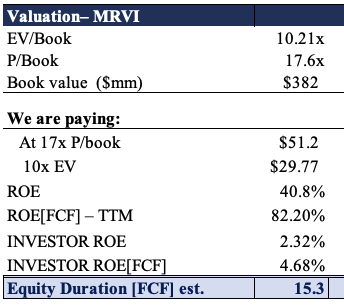

Shares are quite richly priced trading at ~17x book value which is well above the GICS peer median of 6.1x, but below the sector mean of 18.6x. MRVI is also priced at around 10.2x enterprise value (“EV”) to book value at the current standing. As such, if we were to pay this multiple, we’d theoretically be paying ~$29, or in other words a circa. $3 premium to the current share price, as seen in Exhibit 5. Moreover, shares are now trading at ~14x forward P/E, below the sector median of ~17.3x forward P/E, suggesting investors are expecting a below market result at the bottom line for the company. At its FY22 EPS estimates, this values MRVI at $25.20. This asymmetry to the downside doesn’t really feed the kind of value appetite we are searching for in FY22.

Moreover, the company produces a gold-standard return on equity (“ROE”) of ~41% with a FCF ROE of 82%. However, this is MRVI’s ROE, and not ours. We overpaid by 10x-17.7x, meaning our FCF ROE is around 4.7% at the upper end. This gives an estimated equity duration of 15.3 years, and perhaps not the most attractive return on capital schedule. We price MRVI at $24-25, confirming the neutral stance.

Exhibit 5. Valuations are unsupportive and the stock looks richly priced at its current levels.

Further downside is warranted before considering entry. The market is pricing in a slowdown for the company in the coming 12 months.

Data: HB Insights,

In short

As MRVI continues to exhibit high return on investment and other profitability features, it will always remain attractive in the forward looking landscape. It averages ~18% quarterly ROIC and continues to grow pre-tax earnings.

However, valuations are unsupportive of entry at the current share price, as we’d be overpaying by ~$3 per share at a multiple of 10.2x EV/book value. Further, forward earnings targets are equally as unsupportive of entry at the current price. With measures of value increasingly important for investors to maintain a level of quality and resiliency in portfolios, MRVI misses the boat for us on this one. Rate neutral on a price target of $25.

Be the first to comment