Elevator Pitch

I assign a “Neutral” rating to Singapore-listed commercial REIT, Mapletree North Asia Commercial Trust (OTC:MTGCF) [MAGIC:SP], which was formerly known as Mapletree Greater China Commercial Trust prior to May 2018.

The past one year has been a perfect storm for Mapletree North Asia Commercial Trust and its flagship property, Hong Kong’s Festival Walk, as it faced headwinds such as the coronavirus pandemic in 1Q2020 and social unrest in 2H2019. Going forward, the occupancy rate for Festival Walk is likely to still remain stable, but negative rental reversions in the near-term are unavoidable.

The REIT’s recent acquisition of two new office properties in Japan in end-February 2020 will help to partially reduce concentration risks associated with Festival Walk and the Hong Kong retail market. However, Mapletree North Asia Commercial Trust’s relatively high gearing of 39.3% implies limited debt headroom, and could restrict its capacity for further acquisitions to diversify its portfolio.

Taking into consideration the above-mentioned factors, I think that a “Neutral” rating for Mapletree North Asia Commercial Trust is justified.

Mapletree North Asia Commercial Trust trades at 0.63 times P/B, and it offers a consensus forward FY2021 distribution yield of 7.5%.

Readers are advised to trade in Mapletree North Asia Commercial Trust units listed on the Singapore Stock Exchange with the ticker MAGIC:SP, where average daily trading value for the past three months exceeds $7 million and market capitalization is above $2 billion. Investors can invest in key Asian stock markets either using U.S. brokers with international coverage such as Interactive Brokers, Fidelity, Charles Schwab, or local brokers operating in their respective domestic markets.

REIT Description

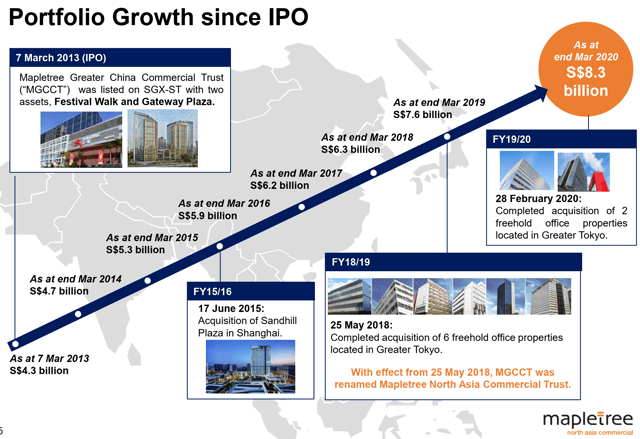

Listed on the Singapore Stock Exchange in March 2013, Mapletree North Asia Commercial Trust is a commercial REIT, which owns 11 properties in Hong Kong, Japan, Shanghai and Beijing with a total net lettable area of 5.2 million sq ft and a portfolio value of S$8.3 billion as of March 31, 2020. Mapletree North Asia Commercial Trust’s flagship property is Festival Walk, one of the largest shopping malls in Kowloon Tong, Hong Kong, which accounts for more than 60% of the REIT’s portfolio value.

Mapletree North Asia Commercial Trust’s Property Portfolio

Source: Mapletree North Asia Commercial Trust’s FY2020 (YE March) Financial Results Presentation Slides

Locations And Details Of Festival Walk Property In Hong Kong

Source: Mapletree North Asia Commercial Trust’s FY2020 (YE March) Financial Results Presentation Slides

Coronavirus Pandemic In 1Q2020 And Social Unrest In 2H2019 Were The Key Headwinds

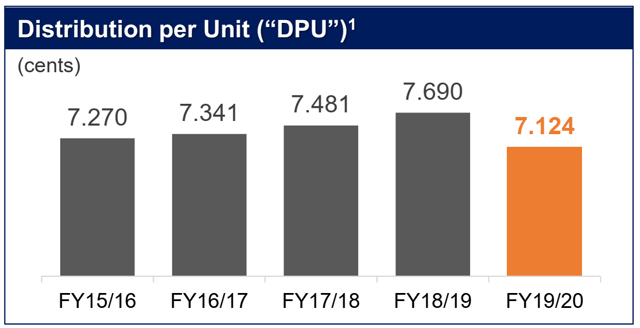

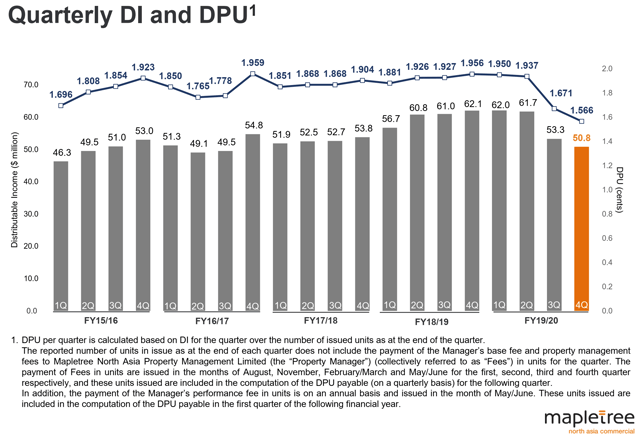

Mapletree North Asia Commercial Trust’s annual distribution per unit or DPU declined YoY for the first time in FY2020, as per the charts below. This is not difficult to understand, once one reviews the recent performance of Mapletree North Asia Commercial Trust’s flagship property, Festival Walk.

Mapletree North Asia Commercial Trust’s Historical Annual And Quarterly DPU

Source: Mapletree North Asia Commercial Trust’s FY2020 (YE March) Financial Results Presentation Slides

Social unrest in Hong Kong beginning since the second half of 2019 and the coronavirus pandemic in the first quarter of 2020 are the key reasons for the weak performance of Mapletree North Asia Commercial Trust and Festival Walk. Mapletree North Asia Commercial Trust’s quarterly DPU has been relatively stable in the past, prior to falling from S$0.01937 in 2QFY2020 to S$0.01671 in 3QFY2020 (October 1, 2019 to December 31, 2019 period).

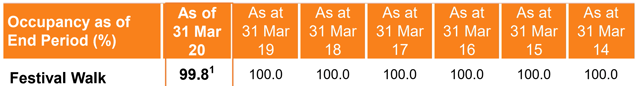

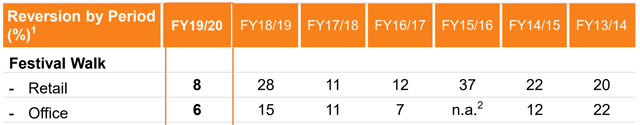

Festival Walk’s occupancy rate fell below 100% for the first time in seven years in FY2020, which Mapletree North Asia Commercial Trust attributed to the “pre-termination of two leases, both under the same group which closed all outlets in Hong Kong.” Festival Walk’s average rental reversions for the retail and office components of the property were +8% and +6% respectively in FY2020, which were much weaker compared with average retail and office rental reversions of +28% and +15% for FY2019.

Festival Walk’s Historical Occupancy Rate And Average Rental Reversions

Source: Mapletree North Asia Commercial Trust’s FY2020 (YE March) Financial Results Presentation Slides

Tourist arrivals in Hong Kong decreased by almost -40% YoY in 2H2019 due to the social unrest, compared with a +13.9% YoY increase in tourist arrivals in 1H2019. Declining tourist arrivals already had a negative impact on Festival Walk’s shopper footfall and retail sales in 3QFY2020, but the worst was yet to come. On November 13, 2019, Mapletree North Asia Commercial Trust announced that Festival Walk was closed for repairs after “extensive damage” on November 12, 2019 as “a few groups of protesters smashed the glass panels at entrances to the property.” Festival Walk’s office tower subsequently re-opened on November 26, 2019, but the retail shopping mall only opened its doors again on January 16, 2020.

Moody’s downgraded the credit rating for Mapletree North Asia Commercial Trust from Baa1 to Baa2 on December 9, 2019 and had a negative rating outlook on the REIT primarily due to “uncertainty surrounding the operating performance of Festival Walk owing to the protests in Hong Kong.” Moody’s brought down its credit rating for Mapletree North Asia Commercial Trust by another notch down to Baa3 on March 25, 2020, and noted in its report that the REIT’s “concentration in Festival Walk” makes it “susceptible to the shifts in consumer sentiment in these unprecedented times” referring to the coronavirus pandemic.

The coronavirus pandemic has had a significant negative impact on the retail property market in many markets, and Hong Kong is no exception. Retail sales in Hong Kong fell by -36.9% YoY in 1Q2020, and research from the Hong Kong Retail Management Association suggests that approximately 25% of retail stores in Hong Kong could close by end-2020.

At the REIT’s FY2020 earnings call on April 30, 2020 (audio recording and transcript not publicly available), Mapletree North Asia Commercial Trust acknowledged that “we obviously cannot expect that there would be good, positive (rental) reversions going forward for the retail side (of Festival Walk)” unless the Hong Kong retail market’s recovery is “sooner and faster and much, much quicker than what we expect.” Mapletree North Asia Commercial Trust also disclosed at the recent earnings call that Festival Walk’s retail passing rent for 4QFY2020 was S$158.7 per sq ft per month which represented “a slight downward movement compared to the last quarter.”

Festival Walk has a weighted average lease to expiry (by gross rental income) period of 2.3 years, and leases expiring for Festival Walk in FY2021 account for 15.9% of Mapletree North Asia Commercial Trust’s total gross income for its entire portfolio.

Mapletree North Asia Commercial Trust did not disclose the exact amount of rental rebates it is offering to its tenants, but the REIT did highlight that other shopping malls in Hong Kong are offering “temporary rent relief of 30% to 50% on a rolling month basis.” Apart from additional rental relief for an extended period of time, another key concern is that social unrest seemed to be making a comeback in Hong Kong, with protests in the city on Labor Day last week.

On the positive side of things, Hong Kong has started to ease social distancing restrictions in the city, with schools, movie theaters and gyms allowed to reopen this week, which is positive for the Hong Kong retail market. More importantly, Mapletree North Asia Commercial Trust emphasized at the REIT’s FY2020 earnings call on April 30, 2020 that “from a longer view standpoint, we do have confidence that the occupancy level in Festival Walk will still be maintained at very high levels”. The REIT also noted that “we have got quite a few of the long-standing clients” which are “larger retail chains whereby we think that we should all be able to work with each other to get through this period.”

Recent Japan Acquisition To Partially Reduce Concentration Risks Associated With Festival Walk

Festival Walk has been a key driver of Mapletree North Asia Commercial Trust’s DPU growth since the REIT’s IPO in March 2013, as Festival Walk has consistently delivered double-digit rental reversions between FY2014 and FY2019 while maintaining full occupancy. But Mapletree North Asia Commercial Trust’s reliance on Festival Walk and the Hong Kong retail market has hurt the REIT since 2H2019 when social unrest became an issue in the city.

Mapletree North Asia Commercial Trust was solely a Greater China play prior to May 2018, until the REIT acquired six freehold office properties in Greater Tokyo which promoted a change in the name of the REIT which was formerly known as Mapletree Greater China Commercial Trust.

On December 4, 2019, Mapletree North Asia Commercial Trust announced the proposed acquisition of an additional two freehold office properties located in Greater Tokyo, a transaction that was subsequently completed on February 28, 2020. Mapletree North Asia Commercial Trust expects Festival Walk’s net property income contribution by asset to be reduced from 61.8% in 1HFY2020 to 58.1% on a pro-forma basis.

Putting diversification considerations aside, it is notable that Mapletree North Asia Commercial Trust has only completed three acquisitions in the past seven years. On one hand, this could be reflective of Mapletree North Asia Commercial Trust’s conservative approach and its high hurdle rates for new acquisitions. On the other hand, it could also imply that Mapletree North Asia Commercial Trust has had difficulty in making yield-accretive acquisitions, given the low yields for commercial assets in Mainland China and the REIT’s own high trading yield.

Mapletree North Asia Commercial Trust’s Past Acquisitions

Source: Mapletree North Asia Commercial Trust’s FY2020 (YE March) Financial Results Presentation Slides

Limited Debt Headroom

Mapletree North Asia Commercial Trust’s gearing as of March 31, 2020 is 39.3%, which is slightly below the statutory gearing limit of 45% for Singapore-listed REITs. This implies that the REIT has approximately debt headroom of S$400 million and S$900 million based on gearing ratios of 42% and 45% respectively.

At the REIT’s FY2020 earnings call on April 30, 2020, Mapletree North Asia Commercial Trust noted that “we are comfortable with hitting between 40% or even slightly more than 40% in terms of gearing.” This suggests that Mapletree North Asia Commercial Trust either has no plans for additional acquisitions in the near-term or needs to rely on equity financing to fund any new acquisitions.

Valuation And Distributions

Mapletree North Asia Commercial Trust trades at 0.63 times P/B based on the REIT’s net asset value per unit of S$1.412 and its unit price of S$0.89 as of May 6, 2020. In comparison, the REIT’s historical three-year and five-year mean P/B multiples were 0.88 times and 0.86 times respectively.

Mapletree North Asia Commercial Trust offers a historical FY2020 (YE March) distribution yield of 8.0%, and a consensus forward FY2021 distribution yield of 7.5%. The REIT’s distribution per unit or DPU declined by -7.4% YoY from S$0.07690 in FY2019 to S$0.07124 in FY2020, and market consensus expects Mapletree North Asia Commercial Trust’s DPU to further decrease by another -5.6% YoY to S$0.06728 in FY2021.

In the company’s FY2020 results media release published on April 29, 2020, Mapletree North Asia Commercial Trust noted that the REIT “may use its discretion to amend the distribution policy (of paying a minimum 90% of distributable income”, considering “the rapidly evolving COVID-19 situation and with the significant uncertainty over its duration and severity.”

However, Mapletree North Asia Commercial Trust subsequently clarified at the REIT’s FY2020 earnings call on April 30, 2020 that “we just wanted to make clear that it is not our intention that it (reduction in distribution payout ratio) will be done”, but the REIT highlighted that it has “to assess the situation going forward” depending on how the coronavirus pandemic situation evolves.

Risk Factors

The key risk factors for Mapletree North Asia Commercial Trust are a longer-than-expected time taken to contain the coronavirus pandemic, the return of social unrest in Hong Kong, and a cut in the REIT’s distribution payout ratio going forward.

Asia Value & Moat Stocks is a research service for value investors seeking value stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment