AdrlnJunkie/E+ via Getty Images

Mallinckrodt plc (NYSE:MNK) recently reaffirmed its guidance for the year 2022, and commenced to trade in the NYSE, which may bring further liquidity. I don’t think that investors really take the time to understand the potential of the company after the recent chapter 11. In my view, even assuming very detrimental assumptions with no products approved by the FDA, the sum of future free cash flow would imply a valuation of close to $26 per share. With this figure in mind, I don’t really see why the company trades at its current market valuation. Even considering the risks, MNK appears undervalued.

Mallinckrodt

Mallinckrodt develops and markets specialty pharmaceutical products for autoimmune and rare diseases in specialty areas such as neurology, rheumatology, hepatology, nephrology, pulmonology, and neonatal respiratory critical care therapies among others.

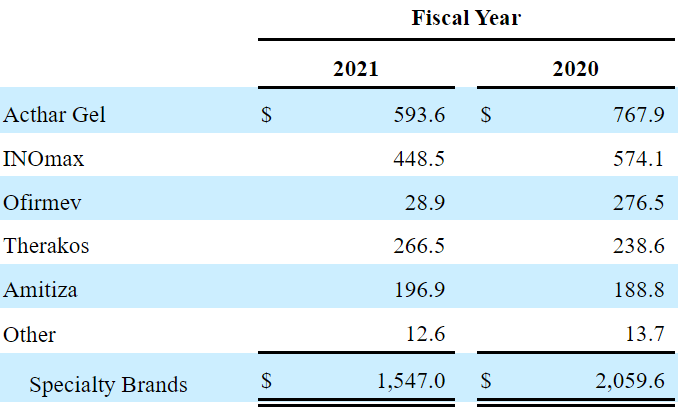

The company’s most relevant products are Acthar Gel for chronic inflammatory autoimmune conditions, INOMAX for oxygenation in term and near-term neonates, and Therakos. A significant part of the company’s revenue growth is derived from these drugs:

Source: 10-k

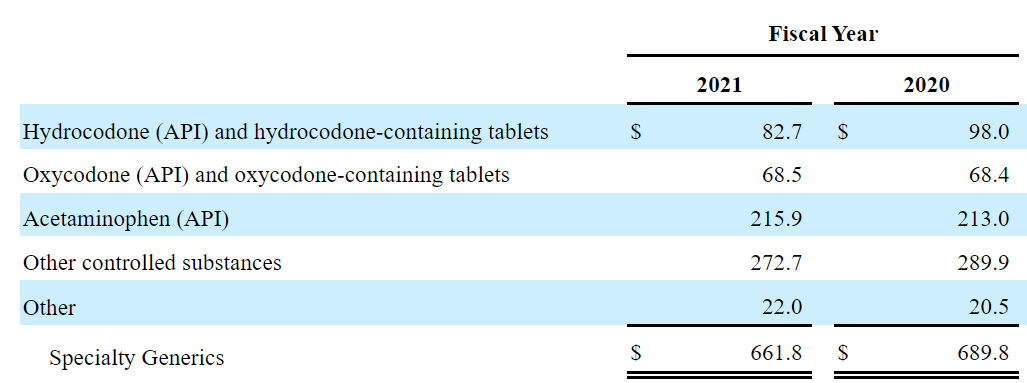

The company also reports a lot of revenue from Hydrocodone, Oxycodone, other controlled substances, and specialty generics, however most revenue comes from specialty brands.

Source: 10-k

In the past, Mallinckrodt initiated proceedings under chapter 11 to redesign the company’s debt structure as well as to find resolution of opioid-related claims and certain Medicaid lawsuits regarding Acthar Gel. In my view, investors really forgot about the potential future free cash flow that Mallinckrodt could generate. I believe that the stock price could be a bit undervalued.

On October 12, 2020, Mallinckrodt plc and certain of its subsidiaries voluntarily initiated proceedings under chapter 11 of title 11 of the United States Code to modify our capital structure, including restructuring portions of our debt, and to resolve potential legal liabilities, including but not limited to a proposed resolution of all opioid-related claims against us (the “Amended Proposed Opioid-Related Litigation Settlement”) and a proposed resolution of various Acthar® Gel (repository corticotropin injection) (“Acthar Gel”)-related matters (the “Proposed Acthar Gel-Related Settlement”), including the Medicaid lawsuit with the Centers for Medicare and Medicaid Services, an associated False Claims Act lawsuit in Boston and an Eastern District of Pennsylvania FCA lawsuit relating to Acthar Gel’s previous owner’s interactions with an independent charitable foundation. Source: 10-k

Management Reaffirmed Its Guidance For 2022, And The Median EBITDA Margin Would Be Close To 37.1%

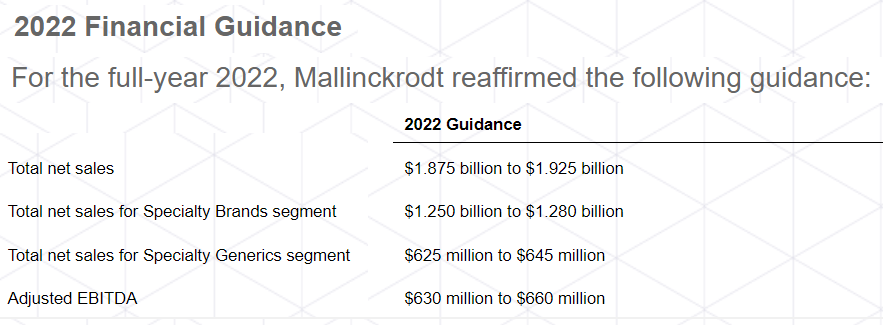

The first beneficial announcement that I received from the company came in the most recent quarterly report. Management reaffirmed its 2022 guidance, which included close to $1.87 billion in net sales and an adjusted EBITDA close to $630-$660 million. It means that the company is expecting an EBITDA margin around 29%, approximately the percentage reported in the past.

We are pleased to reaffirm our 2022 guidance following solid performance in the third quarter Source: Quarterly Press Release

Source: Quarterly Press Release

It is also worth noting that Mallinckrodt commenced trading on the NYSE, which could, in my view, offer significant liquidity in the near future. If demand for the stock comes back, cash in hand may increase again, which may help the company reduce its debt.

More recently, we received approval and commenced trading on NYSE American, providing enhanced liquidity and access for our shareholders. Source: Quarterly Press Release

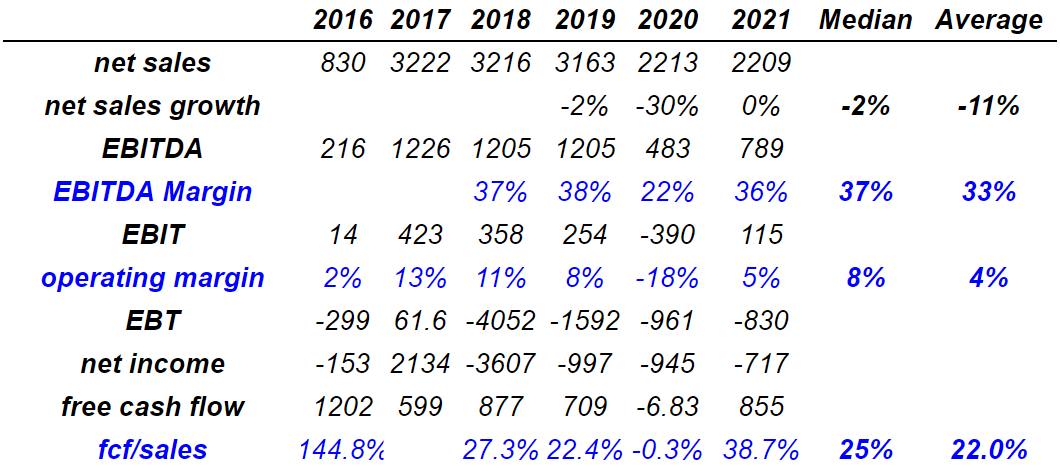

I believe that the previous figures will interest investors. Management reported 2021 net sales of $2.2 billion with EBITDA worth $789 million and an 2021 EBITDA margin of 36%. In addition, EBIT was $115 million together with an operating margin of 5%. EBT was -$830 million with a net income of -$717 million. Finally, the 2021 free cash flow was $855 million with FCF/sales of 38.7%.

In my view, the long-term picture appears more interesting than the numbers reported in 2021. From 2018 to 2021, the median EBITDA margin was close to 37.1%, and the median operating margin stood at 8%. In my view, the company’s figures may not be very far from that reported in the past. Considering that not many analysts offered their opinion about the stock, I used some of these figures in my FCF models.

Source: Seeking Alpha

Balance Sheet: Investors Will Most Likely Study Carefully The Total Amount Of Debt And The Litigations

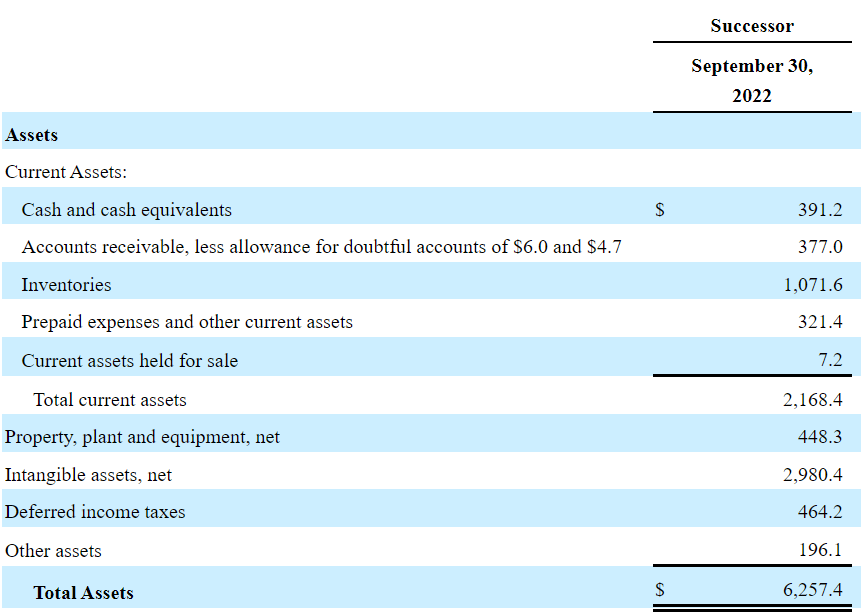

As of September 30, 2022, the balance sheet included cash and cash equivalents equal to $391.2 million in addition to accounts receivable of $377 million. The inventories were worth $1.071 billion with prepaid expenses and other current assets of $321.4 million.

With regards to non-current assets, property stands at $448.3 million with intangible assets worth $2.9 billion. Finally, total assets were $6.257.4 billion. With total current assets of $2.168 billion and an asset/liability ratio of close to 1x, I believe that the balance sheet appears in good shape.

Source: Quarterly Report

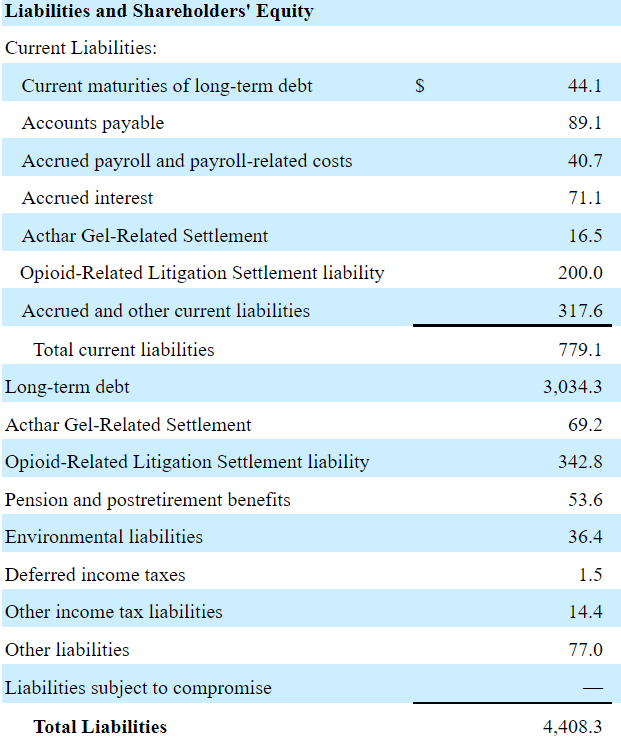

Accounts payable were $89.1 million with accrued interest of $71.1 million, opioid related litigation worth $342.8 million, and total current liabilities of $779.1 million. The company reported long-term debt of $3 billion and the total liabilities worth $4.4 million. If we take into account that the 2021 FCF was more than $850 million, in my view, the long-term debt of $3 billion does not seem that worrying. If debt reductions take place as management receives more cash, I believe that the demand for the stock would increase.

Source: Quarterly Report

In The Last Quarter, The Company Reported Positive Cash Flow From Operations

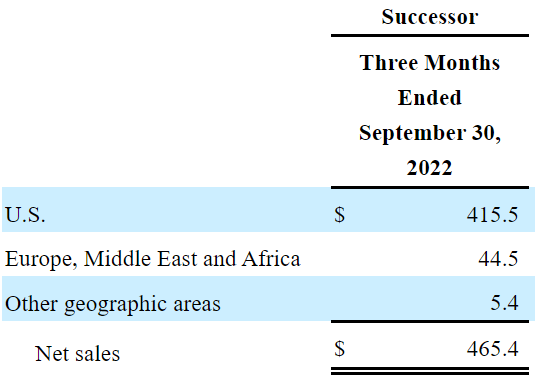

In the three months ended September 2022, the company reported net sales of $465.4 million with cost of sales of $449.9 million and a gross profit of $15.5 million. With selling and general administrative expenses of $129.2 million and research and development expenses of $28.3 million, the company reported an operating loss of $144.2 million.

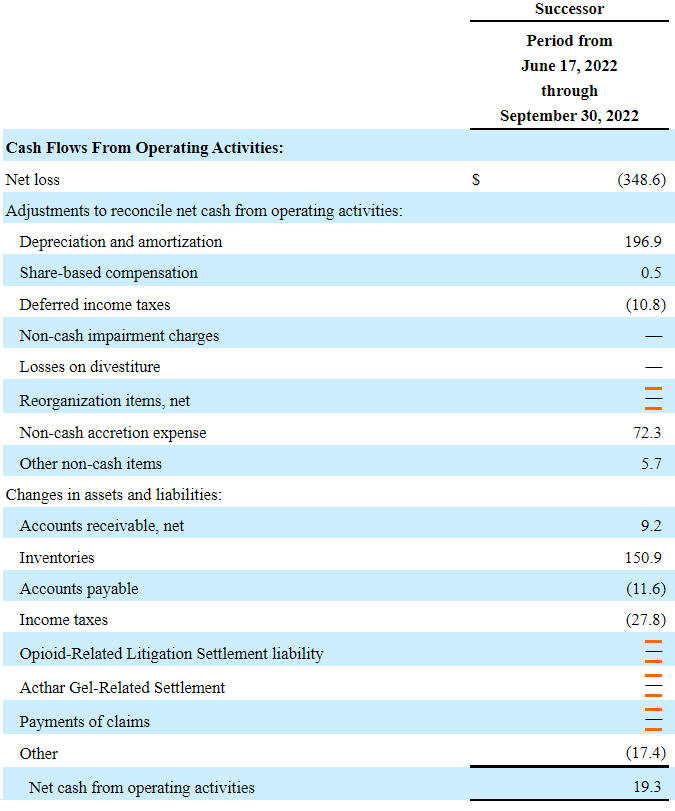

The cash flow statement appears a bit better than the income statement. From June 17, 2022 to September 30, 2022, the company reported cash flow from operations of $19 million. In my view, further generation of cash flow will likely enhance the company’s stock fair value.

Source: Quarterly Report

Even If The Company Does Not Receive Revenue From New Products, I Believe That The Stock Could Be Worth More Than $26 Per Share

Under a scenario without new FDA-approval of products, I believe that revenue growth would not decline significantly because Mallinckrodt works with a significant number of sales representatives. If the company’s sales force successfully convinces new physicians, future financial figures will likely be better than expected.

We promote our branded products directly to physicians in their offices, hospitals and ambulatory surgical centers (including neurologists, rheumatologists, nephrologists, pulmonologists, ophthalmologists, oncologists, neonatologists, surgeons and pharmacy directors) with our own direct sales force of almost 350 sales representatives as of December 31, 2021. Source: 10-k

I believe that thanks to working with more independent wholesale drug distributors, Mallinckrodt’s financial figures would be quite beneficial. Let’s also assume that Mallinckrodt’s international revenue increases thanks to more agreements with distributors. Considering the small amount of international revenue reported by Mallinckrodt, expecting more international sales makes, in my view, a lot of sense.

These products are purchased by independent wholesale drug distributors, specialty pharmaceutical distributors, retail pharmacy chains. Source: 10-k

Source: Quarterly Report

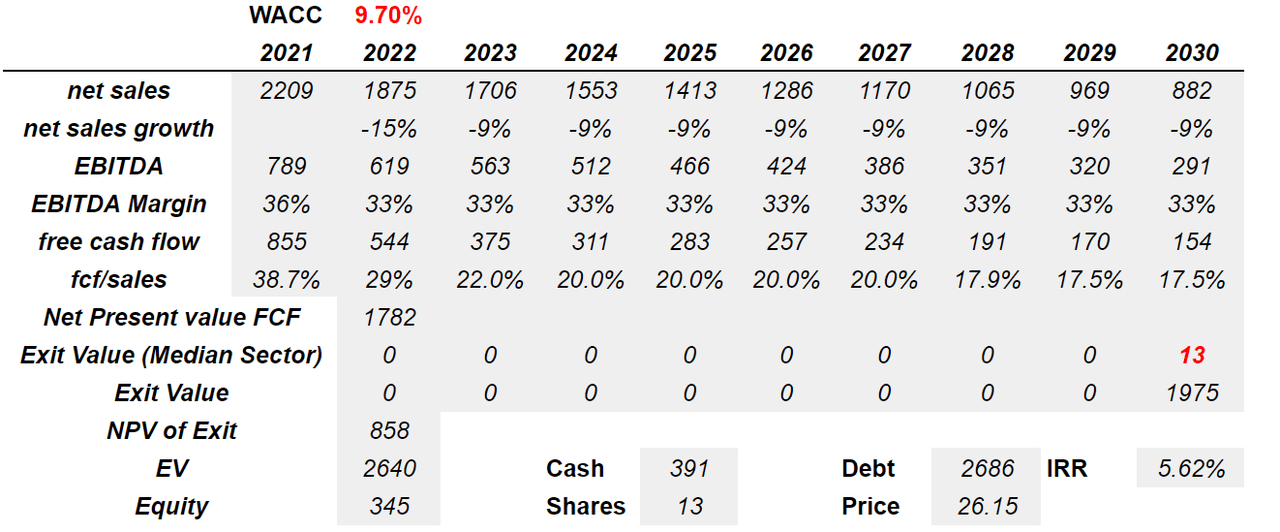

If we assume that the company’s research and development is not successful, I would say that net sales growth would be negative for a long time. Under this scenario, I assumed sales growth close to -15% in 2022 and -9% from 2023 to 2030. I also included an EBITDA margin of 33% between 2022 and 2030, which is close to what the company reported in the past. If we also assume a bearish decline in FCF/Sales of 29%-17%, with a WACC of 9.7%, I obtained a net present value of free cash flow of $1.7 billion.

Now, with an exit multiple close to that of the median in the industry of 13x, the exit value would stand at $1.9 billion in 2030. Finally, the implied enterprise value would be $2.6 billion, and the fair price would be $26.15 per share with an IRR of 5.6%.

Source: Author’s Work

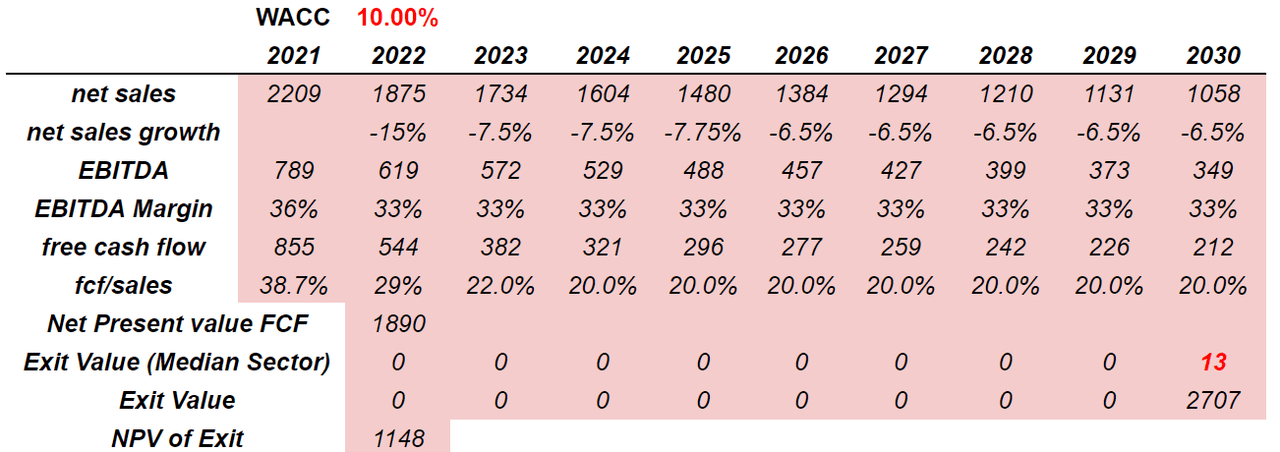

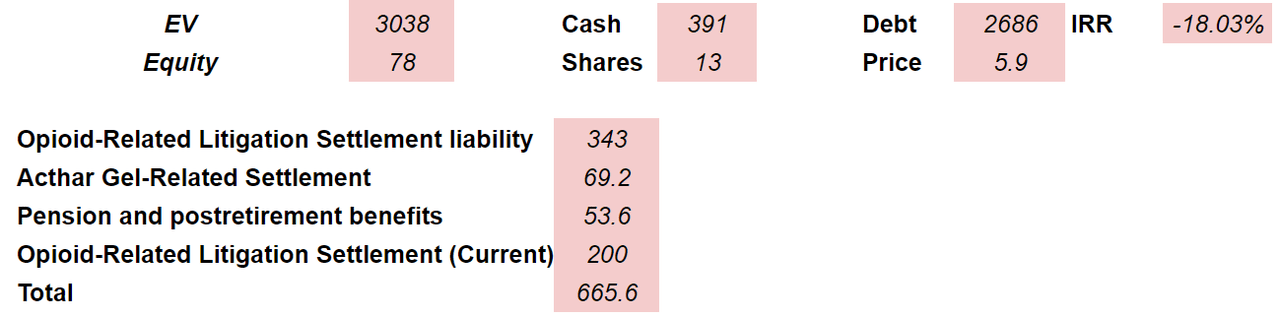

The Litigations Could Bring The Fair Price To $5 Per Share Or Lower

Under a different case scenario, in which the company has to pay 100% of the opioid-related litigation settlement liability, the Acthar gel-related settlement, and the pension benefits, the implied valuation would be closer to $5 per share.

My numbers included net sales growth of -7.5% from 2023 to 2029 because I am assuming that the research and development may not be successful. I also assumed an EBITDA margin of 33% and FCF/Sales close to 20%. Finally, including an exit multiple of 13x EBITDA and a WACC of 10%, the implied enterprise value would be close to $3 billion.

Source: Author’s Work

If we subtract the liabilities noted above from the enterprise value, the implied equity valuation would be $78 million. Finally, if we also assume 13 million shares outstanding, the implied price would be $5 per share. I believe that my numbers are the worst possible outcome for the company.

Source: Author’s Work

Risks

I believe that Mallinckrodt’s shareholders may suffer from different risks, which shareholders may be willing to know. First, the company may be subject to investigations from governmental investigations because of the commercialization of opioids. As a result, the company’s reputation could be damaged, which may lower the demand for the stock.

Governmental investigations, inquiries, and regulatory actions and lawsuits brought against us by government agencies and private parties with respect to our historical commercialization of opioids could adversely affect our reputation, business, financial condition, results of operations and cash flows. Source: 10-k

Mallinckrodt could also be affected by changes in the reimbursement practices of health administration authorities. If governmental agencies all over the world decide that Mallinckrodt’s products are not necessary, future revenue growth may be lower than expected.

Sales of our products are affected by, and we may be negatively impacted by any changes to, the reimbursement practices of governmental health administration authorities, private health coverage insurers and other third-party payers. In addition, reimbursement criteria or policies and the use of tender systems outside the U.S. could reduce prices for our products or reduce our market opportunities. Source: 10-k

Takeaway

Mallinckrodt recently commenced trading in the NYSE, and the company reaffirmed its guidance for the year 2022. In my view, even considering traumatic case scenarios that don’t include new FDA approvals, the current stock price is undervalued. I believe that future free cash flow may be sufficient to pay the total amount of debt outstanding, and would imply a valuation of $26 per share. Under my worst-case scenario, the price may be equal to $5 per share, but I see it very unlikely. In sum, I believe that market participants are too pessimistic about Mallinckrodt.

Be the first to comment