Photon-Photos

Instead of getting a direct exposure to the explorers and producers of natural resources, e.g., Occidental Petroleum (OXY) or Vale S.A. (VALE), investors may consider investing in pick-and-shovel plays that provide specialized services to the operators, as pointed out by fellow Seeking Alpha authors. It makes sense to invest in contractors because operators tend to deploy an increasing amount of capital toward finding and developing new resource as the commodity cycle swings higher. The capital expenditures of these operators are the revenue of the service providers.

Oil industry examples of such service vendors include Schlumberger (SLB) and Total Energy Services (OTCPK:TOTZF), which I discussed in previous articles. In this piece, I’d like to present Major Drilling Group International Inc. (OTCPK:MJDLF), a leading drilling contractor catering to the mining industry.

A leader in mining drilling

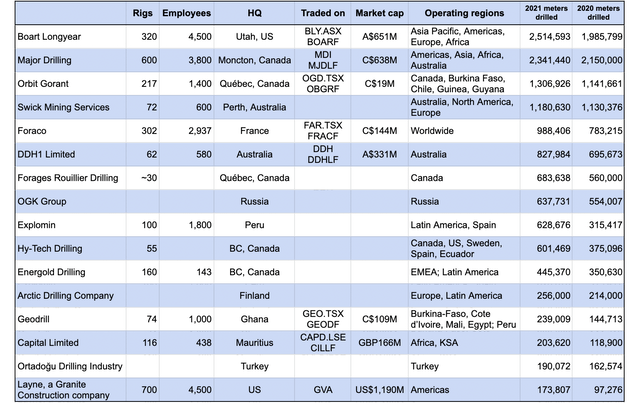

With regard to equipment capability and client selection, Major Drilling commands an advantageous competitive position in the mining drilling patch, which also includes publicly-traded Boart Longyear (OTCPK:BOARF), Orbit Garant (OTCPK:OBGRF), Foraco (OTCPK:FRACF), DDH1 Limited (OTCPK:DDHLF), Geodrill (OTCQX:GEODF), Capital Limited (OTC:CILLF), and Layne (GVA), as shown in Table 1.

Table 1. A list of select mining drilling contractors, as of September 23, 2022 (compiled by Laurentian Research, with annual meters drilled from Coring Magazine)

Firstly, the fleet of Major Drilling consists of 296 specialized, 188 underground, and 116 conventional drill rigs. Its chosen niche of specialized drilling has significant barriers to entry for smaller drilling companies. Specialized drilling may include directional drilling, deep-hole drilling, or mobilizing to tough physical environments such as the arctic regions, remote locations or high altitudes, where an increasing number of new mineral deposits are found these days.

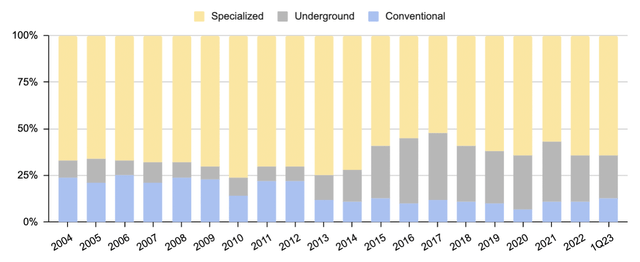

- Major Drilling derived some 64% of its revenue from specialized rigs as of the fiscal 1Q2023 ended July 31, 2022. Over the last 20 years, Major has built a reputation as the go-to firm for specialized drilling, with its specialized rigs pulling in on average 65% of sales (Fig. 1).

Fig. 1. The percentage of revenue earned by different types of drill rig of Major Drilling (compiled by Laurentian Research for The Natural Resources Hub, based on financial filings of Major Drilling)

Secondly, Major Drilling has maintained long-standing relationships with senior or intermediate mining companies, including some of the world’s largest miners such as Barrick Gold (GOLD), Newmont (NEM), Rio Tinto (RIO) and Fortescue (OTCQX:FSUMF), which can afford to drill across cycles. Major sourced 75% of its revenue from senior or intermediate mining companies in fiscal 1Q2023.

Thirdly, the management at Major seems to be really good in capital allocation. Capital allocation is important for mining drilling because of its capital-intensity. In each of the last 17 years, Major spent on average 8.44% of its total assets or, due to the 0.94X asset turnover, 8.39% of annual revenue on the acquisition of new drill rigs to replace worn-out and outdated ones.

- To make an entry into new markets, initiate customer relationship, build technical capabilities, and recruit talents, they made acquisitions opportunistically. For example, it acquired McKay Drilling in 2021, Norex in 2019, Taurus Drilling Services in 2014, Bradley Group in 2011, Forage à Diamant Benoît in 2008, Paragon del Ecuador S.A. and Harris y Cia Ltda. in 2007, Longstaff Group of Companies in 2006, and Raematt Drilling and Dynatec Drilling Services in 2004. These acquired competitors brought to Major established customer relationships and trained personnel, yet only average C$1.12 per rig, while it costs an average of C$1.49 per unit to purchase brand-new rigs.

- Meanwhile, the team made great calls on strategic exit from non-core business division or underperforming markets. For example, at the peak of the last cycle in 2007, Major sold its manufacturing division UDR to Sandvik AB (OTCPK:SDVKF) and closed its operations in China.

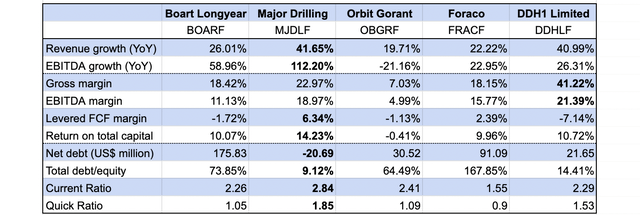

Thanks to the afore-mentioned strategic choices and execution by the management, Major boasts performance metrics head and shoulders above its peers, in terms of growth, profitability, and balance sheet health (Table 2).

Table 2. A comparison of Major Drilling with select industry peers in terms of growth, profitability, and balance sheet quality (compiled by Laurentian Research for The Natural Resources Hub based on Seeking Alpha data)

Where is Major in the mining cycle?

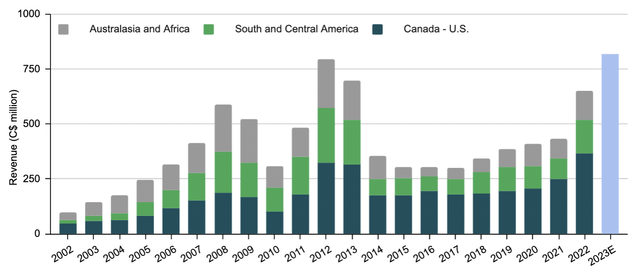

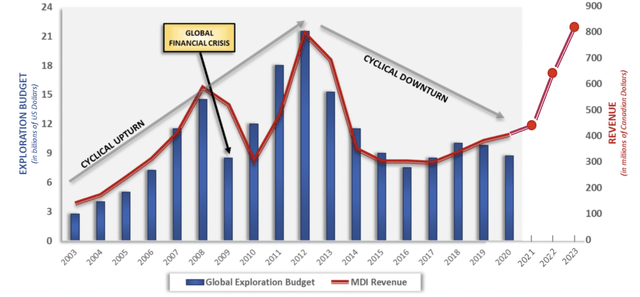

Despite its leading position in the mining drilling space, Major performed cyclically in sync with its host industry, as can be seen in its annual revenue (Fig. 2) and EBITDA margin (Fig. 3).

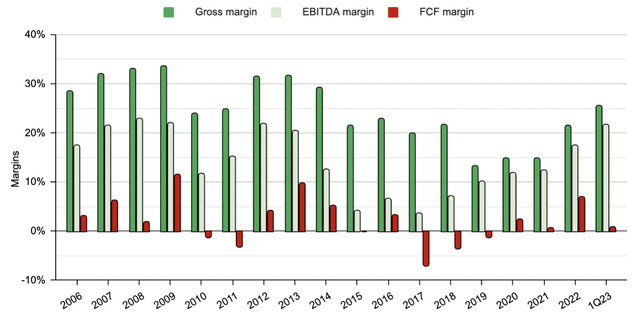

Fig. 2. Revenue of Major Drilling by operating region, actual (2002-2022 fiscal year) and expected (2023 fiscal year) (compiled by Laurentian Research for The Natural Resources Hub based on Major Drilling financial filings) Fig. 3. Gross, EBITDA and FCF margins of Major Drilling (compiled by Laurentian Research based on Major Drilling financial filings and Seeking Alpha)

Behind the cyclicity of its operations is the expansion and shrinkage of global mining exploration budget (Fig. 4).

- From 2013 to 2019, the mining industry has – for the most part – frozen the exploration budget.

- By 2020, senior gold producers began to address the issue of depleting reserves in spite of the Covid-19 pandemic.

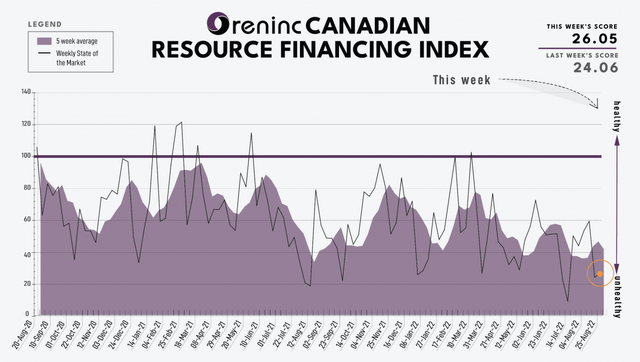

- Junior gold exploration financing started to warm up in 2021; however, sentiment soured again in July 2022, as shown by the Oreninc junior resource financing index (Fig. 5), due to strengthening U.S. dollar, Fed funds rate hikes and the ensuing weak gold price. By September 2022, even such high-quality junior mining names as Skeena Resources Ltd. (SKE) and Lion One Metals (OTCQX:LOMLF) received poor equity financing terms. As a matter of fact, Beaver Creek precious metals conference attendants observed palpable bearish mood among junior mining executives who left the meeting with a plan to dig in for some tough time ahead.

Fig. 4. Major Drilling revenue in the industry backdrop of the early 2000s-2012 upcycle, 2012-2016 downturn, and a new upcycle being nurtured since 2016 (modified from Major Drilling based on information from Seeking Alpha and Major Drilling) Fig. 5. Oreninc Canadian resource financing index as of August 29, 2022 (Oreninc)

The critical question is whether the headwinds in junior mining financing of late will have any material impact on Major Drilling going forward. I believe little negative impact will be felt by the operations of Major Drilling for the following reasons:

- As discussed above, some 75% of Major’s revenue was from senior or intermediate mining companies as of 1Q2023. Senior and intermediate producers fund their exploration programs with endogenous cash flow, with is still strong under today’s gold price, as opposed to junior companies that rely on the equity placements in the market. Major CEO Denis Larocque allowed,

“A slowdown in junior mining financing is being offset by a desire from senior customers to continue to grow their reserves, both in precious and base metals. With metal prices remaining at levels well above what is needed to support exploration, we are already in discussions with several senior customers for their calendar 2023 programs, with many looking to book their rigs early.”

- Indeed, from 2015 to date, Major Drilling derived on average 54% of its sales from gold projects and 22% from copper projects. Senior gold producers have been feeling the pinch of depleting reserves after six years of underinvestment. In reaction, Barrick CEO Mark Bristow said of reserve replacement through exploration, “…we believe finding our ounces is always better than buying them. That’s why we’re still discovering real value at the end of our drill bits.” Meanwhile, automobile electrification requires an enormous volume of copper, the red metal that has been called the new oil in the age of energy transition, which will mostly be found in harsh physical environments, where Major is the preferred driller.

- Although gold and base metal prices have declined since the beginning of 2022, the price of lithium remained at elevated levels. Major Drilling is working with clients drilling for lithium in high-altitude in Argentina.

Judging from the still subdued global exploration spending, the mining upcycle appears to be in the early innings (Fig. 4). It is my belief that, in the next few years, Major Drilling will reap great benefits as the mining industry ramps up exploration budget and, as a result, will likely deliver continued growth in revenue and improved margins. If a global recession occurs thanks to the Fed or China, a transient setback in the operations of Major Drilling may result; however, I expect the company to resume growth shortly thereafter, driven by the sustained supply-demand dynamic of commodities, as having happened after the Global Financial Crisis (Fig. 4).

Upside and risks

For fiscal year 2023, I estimate Major Drilling will report strong growth in sales and profit.

- In the last 17 years, Major generated 25.35%, 27.38%, 21.24%, and 26.03% of annual sales were in each of the four fiscal quarters. Applying such seasonality to the fiscal 1Q2023 sales of C$199.8 million, Major will likely report C$818 million in top line for fiscal year 2023, an all-time high that surpasses the revenue of 2012 – the peak year in the last cycle (Fig. 2).

- EBITDA margins vary from single digits in percentage in the years of downturn (e.g., 2015 and 2016) to as high as ~22% in the latter half of an upcycle (e.g., 2007-2009, 2012), and average 13.31%. Assuming the 2022 EBITDA margin of 17.55%, Major is estimated to generate C$144 million EBITDA in fiscal year 2023, posting an annual growth of 25.8%.

Major currently trades at an EV/EBITDA multiple of 4.34X on a trailing twelve month basis, in line with its peers (3.75-5.63X) but substantially lower than its own historical median at 10.32X. At the median EV/EBITDA multiple of 10.32X, the stock is supposed to trade at C$18 per share or an implied discount of 56%. That seems to be large enough a margin of safety for those who anticipate a number of years of growth in revenue and profit as the mining drilling upcycle swings higher.

In other words, there are supposed to be two forces operating in the investor’s favor, namely, a possible rerating from the current EV/EBITDA to the historical median multiple and cyclical growth in the next few year. Even under a conservative assumption that today’s drill rig day rate will stay flat further into the mining upcycle in an inflationary environment, an improvement of equipment utilization from 53% of the late quarter to 75% watermark reached in previous cyclical peaks will lead to a revenue of C$1,158 million or, at a 22% margin, an EBITDA of C$253 million, which implies a share price of C$31.5 at an EV/EBITDA multiple of 10.32X or an upside of 330%.

That upside comes with a slew of risks:

- It is uncertain how long the ongoing improvement in drilling activity will last, in spite of the prevailing supply-demand dynamic characterized by tight commodity supply due to years of underinvestment and rising demand driven by energy transition. The investment thesis presented here will cease to be valid when the mining drilling upcycle runs its course.

- Going forward, fluctuating commodity prices will likely cause the operators to adjust capital spending from time to time, adding uncertainties to Major’s financial performance, although the management did point out senior miners – which contribute the majority of Major’s revenue – looked to book drill rigs early for their calendar 2023 programs, which gives some clarity as to the near-term outlook of the top line.

- Increased industry activity may cause shortage in skilled labour, particularly in North America, which will require Major to invest in training as more equipment is reactivated.

- Mining drillers tend to overinvest in drill rigs when the mining cycle swinging to the fullest, leaving them with under-utilized equipment and heavy debt load in an industry downturn. That said, Major management, led by Larocque since 2015, seems to have been exceptionally prudent in managing its balance sheet. The company has never allowed the total long-term financial liabilities to go beyond 1.3X of EBITDA. As of fiscal 1Q2023, the company was in a net cash position of C$8.5 million and had C$136 million of liquidity (C$75 million in cash and C$61 million in undrawn credit facility). Given the current equipment utilization of 53%, the company has plenty of headroom to grow the top line without having to spend capital on the expansion of its recently-refurbished, well-maintained, and modern rig fleet.

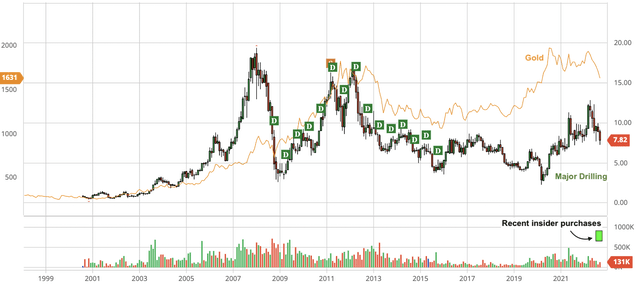

Multiple directors and executives of Major Drilling have been actively buying the stock in public market beginning in July 2022 and as recently as last week, suggesting their firm belief that the business is deeply undervalued (Fig. 6).

Fig. 6. Stock chart of Major Drilling, historical dividends back adjusted, shown with stock split and dividend payments as well as the gold price (modified after Seeking Alpha and Barchart)

Investor takeaways

Major Drilling leads the pack of mining drilling contractors in terms of strategic positioning and financial performance. In my opinion, it is the pick-and-shovel play of choice for those who seek to bank on the unfolding mining upcycle.

Fortunately, the market is yet to give due credit to the company for its rapidly improving operational metrics and financial performance, as evidenced by its low EV/EBITDA multiple and seen in the wide gap between the prices of Major shares and gold (Fig. 6). Such a deep undervaluation means an adequate margin of safety for investors waiting on the sidelines for an entry, which the insiders have confirmed with their recent buying.

Major Drilling thus checks the necessary boxes of value investing as applied to resource investing, as I discussed in Seeking Alpha interviews in 2021 and 2022.

In consideration of the above, I plan to build a position in Major in the near future. To that end, I look forward to its share price being further depressed by fear of a global recession and commodity price weakness.

Be the first to comment