We Are

I bought the dip in Main Street Capital (NYSE:MAIN), a business development company whose stock price has dropped from around $45 to $32 in just two months.

Even though Main Street has a high book value valuation, I believe the current valuation provides investors with an opportunity to access a higher margin of safety while the actual dividend payout is more than secured by net investment income.

Main Street may also continue to pay supplemental dividends to distribute excess portfolio income.

High Margin Of Safety For A Quality BDC

When times are tough and the market becomes more volatile, I prefer to buy high-quality business development companies that are likely to maintain and, preferably, grow their dividends.

Main Street, in my opinion, is one of those business development companies that can continue to grow its dividend payout during a downturn while also appealing as a BDC that can pay special dividends.

Despite the fact that Main Street’s stock is no longer oversold, I was able to buy the dip last week and establish a long position at $33.30.

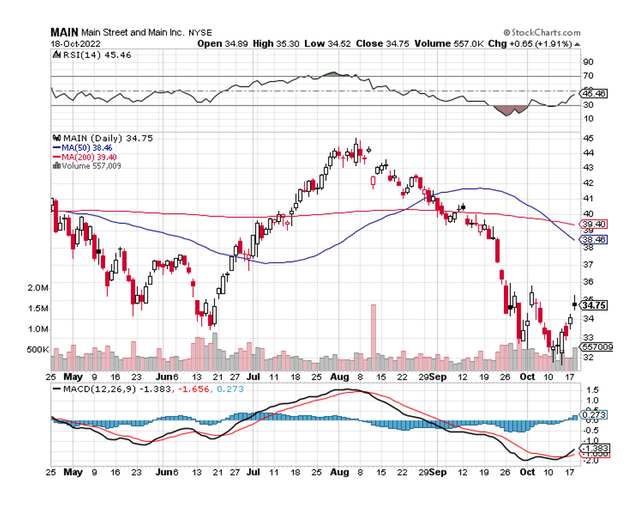

As shown in the chart below, Main Street’s stock has dropped since the first week of August, owing to high inflation and the central bank’s commitment to raising interest rates, and I believe the drop represents a good buy opportunity for income investors, even if they must still pay a high multiple for the BDC.

MAIN Share Price (Stockcharts.com)

Hawkish Central Bank Leads To A More Sensible Valuation

With few exceptions, Main Street has consistently sold for a premium multiple in the past, owing to the fact that the business development company has been an anchor of stability for dividend investors.

The BDC recently announced its preliminary estimate for its 3Q-22 net asset value, which ranged from $25.92 to $25.97 per share. Based on the preliminary estimate of its net asset value, Main Street’s net asset value increased 2.2 to 2.4% QoQ. At the end of the second quarter, the net asset value per share was $25.37.

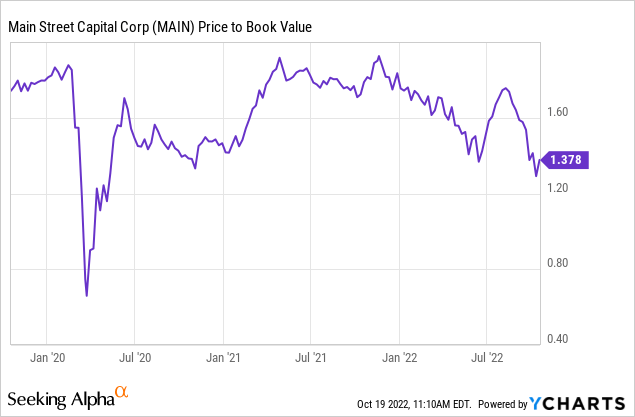

Main Street still has a high valuation, equal to 1.37x net asset value, at the current stock price of $34.75, but it is no longer as extreme as it was in August, when I advised caution.

While Main Street has always traded at a significant premium to net asset value, I believe the current valuation is much more reasonable and provides investors with a high margin of safety.

Main Street reported $0.82 to $0.84 per share in net investment income in the third quarter, translating to a dividend payout ratio of 78% in its preliminary earnings update. Main Street consistently covers its monthly dividend payment, and as a result, the BDC increased its fourth quarter monthly dividend payment by 2.3%.

Increased Dividend Yield

When the stock price falls, the dividend yield obviously rises, all else being equal. Given that Main Street pays a monthly dividend of $0.22 per share for a total annual dividend payout of $2.64 per share, the yield has increased from less than 6% in August to 7.6% today.

Main Street also pays special dividends to distribute excess portfolio income, but the payment of such dividends is difficult to predict. Main Street declared two special dividends of $0.075 per share and one dividend of $0.10 per share in 2022.

Why Main Street Could See A Lower Valuation

Main Street’s falling stock already reflects recessionary expectations, but the BDC, with its well-performing loan portfolio and excellent dividend coverage, should be able to maintain its dividend payout regardless.

After all, Main Street has done it before. A rise in non-accruals, on the other hand, may result in a drop in the BDC’s book value and, potentially, the suspension of special dividends.

My Conclusion

Main Street has always traded in its own sphere, owing to income investors’ appreciation for the BDC’s past strong returns and the consistency of the monthly dividend.

Furthermore, net investment income has adequately covered the dividend, and the business development company has successfully increased its monthly dividend over time. This predictability is extremely valuable for income investors, particularly retirees, in choppy markets that appear to be becoming increasingly difficult to predict.

Even though Main Street still sells at a 34% premium to net asset value, the premium is minor in comparison to when the premium was as high as 70% not long ago. Right now, the 7.6% yield (excluding special dividends) is an appealing buy for income investors.

Be the first to comment