Murdock48/iStock via Getty Images

I once heard a saying among investment advisors that in times of difficulty, investors tend to sell yield last. That’s because when push comes to shove, income bearing investments are what will help pay for everyday living expenses, not growth stocks that simply look nice in a portfolio when everything is going well.

This brings me to Main Street Capital (NYSE:MAIN), which I view as being a “golden goose” of sorts that has “laid” an uninterrupted and growing stream of dividends since inception, through two recessions. In this article, I highlight why MAIN remains an attractive option for income investors amidst its recent share price volatility, so let’s get started.

Why MAIN?

Main Street Capital is one of just a handful of internally managed BDCs, with $6 billion in capital under management at present. It’s been public since 2007, having survived 2 recessions and countless market corrections in between. It mainly focuses on investments in the lower middle market, as defined by those companies with $10 to $150 million in annual revenue.

MAIN’s focus on the lower middle market space is a competitive advantage, considering that this space is more fragmented and generally underserved, as much larger BDCs such as Owl Rock Capital Corp. (ORCC) and Ares Capital (ARCC) are too big for this space, resulting in more attractive investment yields for MAIN.

Plus, the LMM space is large and highly fragmented, with over 195,000 individual businesses in the U.S., giving MAIN plenty of greenfield opportunities. Capital preservation is key for MAIN, as it primarily invests in first-lien secured debt along with an equity kicker for more upside potential. MAIN also has a portfolio of private loans, which are debt investments in privately held companies that were directly originated by MAIN or through strategic relationships with other credit funds. MAIN targets 8 to 12% gross yields, and currently carries a healthy weighted average effective yield of 9.9%.

Meanwhile, MAIN is demonstrating solid results, with distributable net investment income per share growing by 16% YoY, to $0.88, and net asset value rising by $0.74 YoY to $25.94, despite volatility in mark to market valuations in the private investment space. MAIN has also been rather active on the investment front, completing $112 million in total LMM portfolio investments, and $234 million in Private Loan investments. Investments on non-accrual also remain low, representing just 0.8% of portfolio fair value.

Moreover, true to form, MAIN has industry leading efficiency, due to its internal management structure. This is reflected by MAIN’s operating expense to assets ratio of just 1.4% over the trailing 12 months. To put that into perspective, many externally-managed BDCs exceed that expense ratio on basis of their base management fee alone.

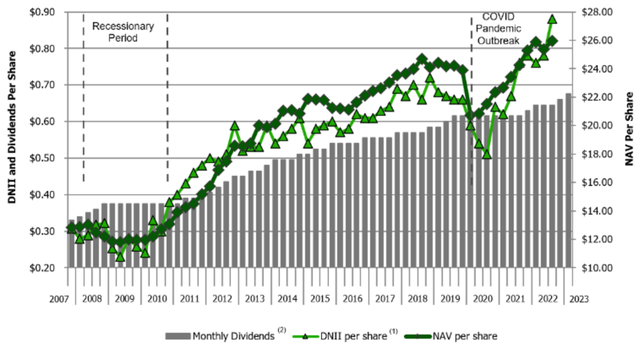

This enables more capital returns to shareholders and also positions it well for economic adversity, including a 105% increase to the monthly shareholder distribution since inception in 2007. MAIN recently upped its regular monthly dividend by 2.3% to $0.225 per share and declared a $0.10 supplemental dividend. The regular dividend is well covered by a 77% payout ratio based on the aforementioned DNII per share of $0.88 in Q3. As shown below, MAIN’s NAV/share and DNII per share now both sit above pre-pandemic levels.

MAIN NAV, DNII and Dividends (Investor Presentation)

Looking forward, MAIN is well positioned from a balance sheet standpoint, as it carries a regulatory debt to equity ratio of 0.86x, sitting well below the 2.0x statutory limit, and it maintains $420 million of liquidity including cash on hand and availability on its credit facility.

While potential for economic adversity is a headwind for MAIN, just as with any other BDC, it also stands to continue benefiting from higher interest rates. That’s because 76% of MAIN’s debt investments are floating rate, while 73% of its outstanding debt is fixed rate, enabling continued higher investment spreads, especially if rates tick higher.

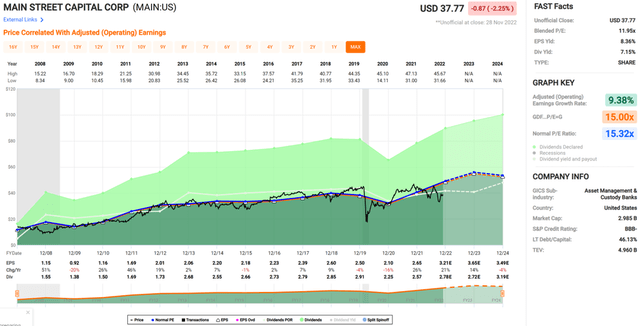

Turning to valuation, MAIN trades at a reasonable price at $37.77 with a forward PE of 11.8, sitting below its normal PE of 15.3. I believe MAIN deserves at least a 14x PE given its efficiency, track record, and positioning with higher interest rates. Analysts have a consensus price target of $41.25, implying a potential total return in the mid-teens including the dividend.

Investor Takeaway

MAIN is well positioned to leverage its competitive advantage in the LMM space and realize attractive investment yields. It has demonstrated solid results while maintaining a healthy leverage, and continues to have industry leading operating efficiency. While MAIN isn’t cheap, I see relative value compared to its historical valuations, all while paying a high and well-covered distribution. As such, I find MAIN to be a sound buy at present for sleep better at night returns.

Be the first to comment