Evgenii Mitroshin/iStock via Getty Images

Magnolia Oil & Gas (NYSE:MGY) is now looking like it could generate around $957 million in positive cash flow during 2022 at current strip prices. This would allow it to boost its dividend (I’ve assumed that it remains relatively conservative with its dividend and boosts it to a semi-annual $0.40 per share amount), while also potentially repurchasing over 30 million shares during 2022.

Magnolia’s shares are currently pricing in a scenario where it can boost production by high single-digits in 2023 and where long-term oil and gas prices average around $75 and $3.75 respectively.

Potential 2022 Outlook

I am now modeling Magnolia’s 2022 production at around 72,000 BOEPD (46% oil). This is 8% production growth compared to 2021, in-line with Magnolia’s expectations for high-single digits production growth (with Giddings production growth around 20%).

At current strip (including high-$90s WTI oil), Magnolia should be able to generate $1.715 billion in oil and gas revenues in 2022. Magnolia remains unhedged, so it would fully benefit from the strength in near-term commodity prices.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 12,088,800 | $97.50 | $1,179 |

| NGLs | 6,386,040 | $38.00 | $243 |

| Gas | 46,830,960 | $6.25 | $293 |

| Total | $1,715 |

Source: Author’s Work

Magnolia is budgeting $350 million for its D&C capex for 2022, so I have assumed that its total capex will be around $355 million. I have also allocated $70 million for cash income taxes.

| $ Million | |

| Lease Operating | $115 |

| Gathering, Transportation and Processing | $55 |

| Taxes Other Than Income | $89 |

| Cash G&A | $50 |

| Cash Interest | $24 |

| Capex | $355 |

| Cash Income Taxes | $70 |

| Total | $758 |

Thus Magnolia is now projected to generate $957 million in positive cash flow in 2022 before any dividends or share repurchases.

Notes On Dividend

Magnolia has been conservative with its dividends. Magnolia’s most recent semi-annual dividend payment was $0.20 per share, and it based that on a $55 WTI oil and $2.75 NYMEX gas scenario, which approximated its long-term views on commodity prices at the time.

The rise in near-term commodity prices may also translate into some increase in Magnolia’s long-term commodity outlook. If Magnolia increases its semi-annual dividend payment to $0.40 per share, its dividend payments would add up to $184 million per year (based on its year-end 2021 share count).

This would leave $773 million for share repurchases, debt reduction and acquisitions during 2021.

Notes On Share Repurchases

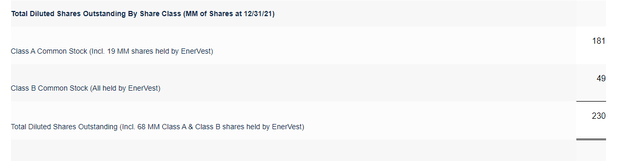

Magnolia had approximately 230 million diluted shares outstanding at the end of 2021. It also increased its share repurchase authorization by 10 million shares, bringing it up to 15.8 million Class A common shares that it is authorized to repurchase on the open market.

Magnolia’s Outstanding Shares At End Of 2021 (magnoliaoilgas.com)

This does not include Class B common share repurchases from EnerVest, which gets separate approval from Magnolia’s Board of Directors. Magnolia repurchased 2.5 million Class B common shares in March 2022 for approximately $54.3 million.

Given the large amount of positive cash flow that Magnolia is expected to generate in 2022, I’d expect its share repurchase authorization to be increased again later this year.

At $24.90 per share, Magnolia could repurchase around 28.9 million Class A common shares with the remainder of its positive cash flow in 2022.

Notes On Valuation

If we assume that Magnolia further increases production levels by high-single digits from 2022 levels, then it would generate approximately $1.06 billion EBITDA in a long-term $75 WTI oil and $3.75 NYMEX gas scenario.

If Magnolia has 200 million common shares outstanding at the end of 2022 along with $33 million in net debt (the same as it had at the end of 2021), then a $24.90 share price would be approximately 4.7x EBITDAX at long-term $75 WTI oil and $3.75 NYMEX gas. A 4.5x multiple would value it at approximately $23.70 per share, while a 5.0x multiple would value it at approximately $26.35 per share.

A $5 change in long-term oil prices combined with a $0.25 change in long-term natural gas prices affects Magnolia’s estimated value by approximately $2 to $2.25 per share.

Conclusion

Magnolia Oil & Gas looks capable of generating close to $1 billion in positive cash flow in 2022 at current strip prices, helped by its lack of hedges. Magnolia has been quite active with share repurchases and may be able to reduce its outstanding share count to around 200 million by the end of 2022.

Overall, Magnolia seems roughly fairly priced for a long-term $75 WTI oil and $3.75 NYMEX natural gas price currently. Its share price usually takes a minor hit when it announces a proposed sale of shares by EnerVest, so those announcements may provide a bit of a buying opportunity.

Be the first to comment