adaask

Both Magellan Midstream Partners (NYSE:NYSE:MMP) and Enterprise Products Partners (NYSE:NYSE:EPD) are investment-grade midstream businesses that pay out high yields of 8.1% and 7.2%, respectively.

In this article, we will compare them side by side and offer our take on which one is a better buy.

Magellan Midstream Partners Vs. Enterprise Products Partners – Business Model

MMP owns some of the best refined products assets in the industry, combining with management’s penchant for prudent capital allocation to produce midstream-leading 16% 15-year average annualized returns on invested capital.

In addition to generating high returns on investment, MMP generates cash flow within a fairly narrow range, regardless of macro conditions. This is due to the fact that its assets are generally contracted on a long-term basis and over 85% of its cash flows are fee-based.

While MMP is more of a concentrated play on refined products, EPD is a well-diversified investment in midstream infrastructure across geographies and energy commodities. However, similar to MMP, EPD has generated above-average returns on invested capital over the course of its history (consistently in the double-digits across energy industry conditions) and also benefits from the vast majority of its cash flows being derived from fee-based contracts.

Overall, we give a very slight edge to EPD here merely due to its superior scale and diversification but recognize that MMP’s assets are very high quality as well.

Magellan Midstream Partners Vs. Enterprise Products Partners – Balance Sheet

Both businesses also have solid balance sheets and boast industry-leading BBB+ credit ratings.

Overall, we award EPD the superior balance sheet here as its leverage ratio is lower and its weighted average term to debt maturity is longer. With a 3.1x leverage ratio (below the 3.25x low end of its target range), $4.1 billion in liquidity, and a 21-year weighted average term to maturity, EPD not only has little to nothing to worry about when it comes to financial solvency, but it is also in strong position to invest aggressively as attractive growth opportunities present themselves.

While not quite as impressive, MMP’s balance sheet still lives up to the strength implied by its BBB+ credit rating. For example, none of its long-term debt matures until 2025 and 83% of its total net long-term debt matures in 2030 or later. In fact, a significant majority of its debt is not due until 2042 or later, positioning it very well for the current rising interest rate environment. When combined with its ample liquidity, low leverage ratio, and strong free cash flow generation, MMP is in little danger of facing financial distress for many years to come.

Magellan Midstream Partners Vs. Enterprise Products Partners – Growth Potential

While its growth investment prospects are fairly weak at the moment, MMP’s management has indicated several times that it expects its core refined products business (which is currently generating over 70% of MMP’s cash flow) to continue to enjoy strong pricing power for many years to come. This is due to the fact that it enjoys strategic geographic positioning of its assets. On top of that, its contracts are inflation-indexed, providing a strong tailwind in the current environment.

Meanwhile, EPD has been investing more aggressively in high-return, low-risk organic growth projects as well as opportunistic M&A.

MMP is expected to grow its distribution per share at a 1.1% CAGR through 2026, whereas EPD is expected to grow its distribution per share at a much more robust 4.1% CAGR over the same time frame according to consensus analyst estimates.

On a distributable cash flow per share/unit basis, MMP is expected to generate a solid 5.5% CAGR between now and 2026 whereas EPD is expected to generate a 2.0% CAGR over the same time frame. That said, we expect EPD to significantly outpace this growth rate and post growth numbers that are roughly in-line with MMP’s over that time frame given its superior growth investment budget.

We give the slight edge to EPD here given that its superior diversification, vastly larger growth CapEx budget, and higher retained distributable cash flow yield should enable it to put more into growth in the coming years. That said, between inflation boosting its refined products business and its aggressive unit buyback program, we are bullish on MMP’s per unit DCF growth prospects as well.

Magellan Midstream Partners Vs. Enterprise Products Partners – Track Record

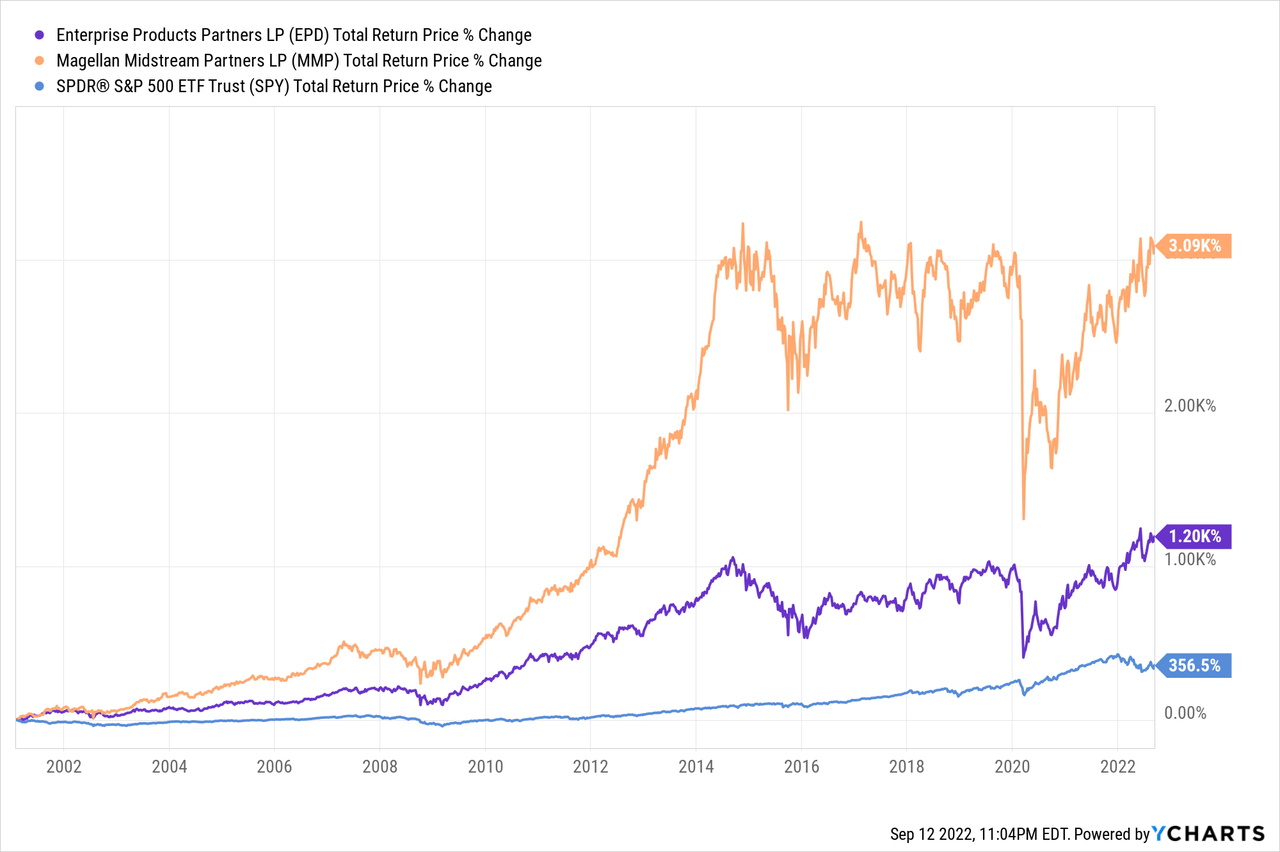

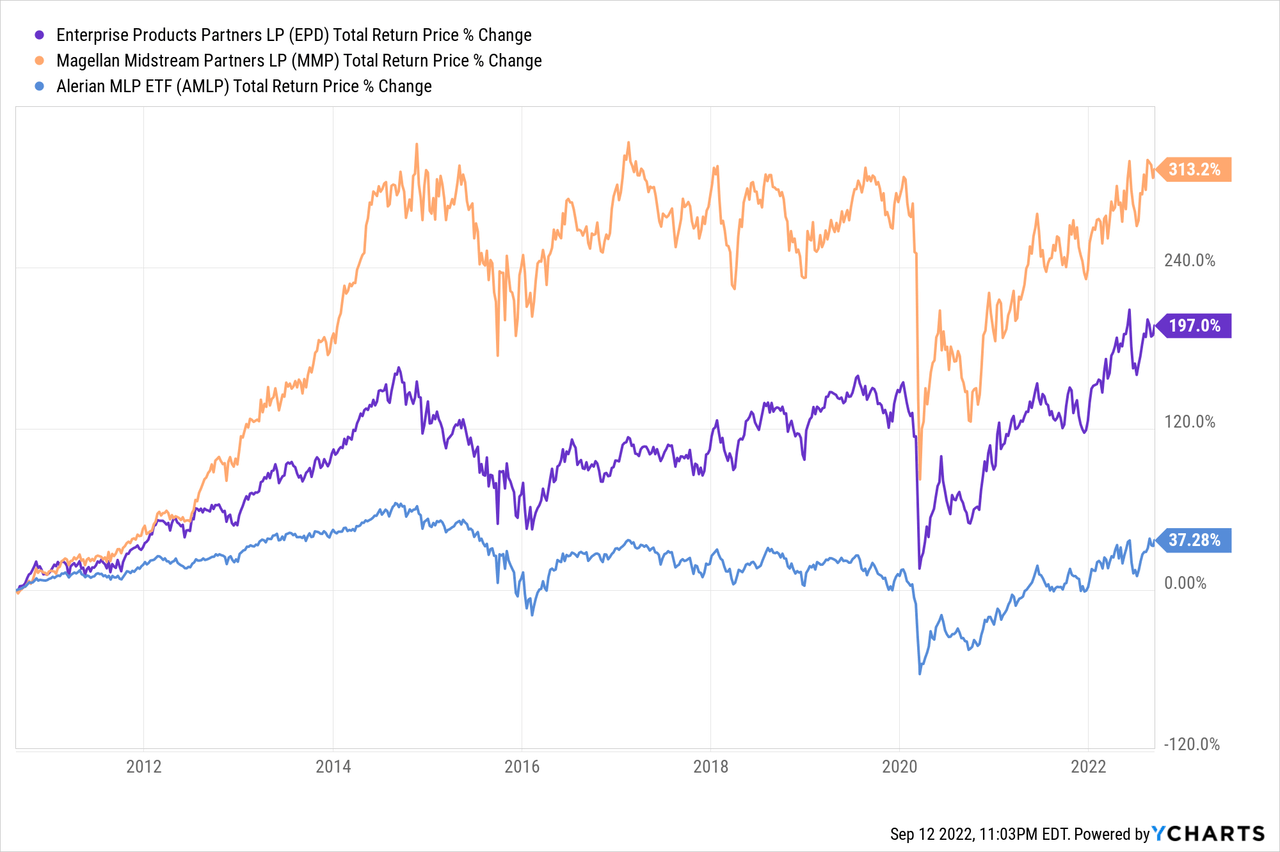

When it comes to track record, both businesses have posted market and sector crushing returns over the long-term:

That said, MMP’s total returns have outpaced EPD, largely due to the fact that it has pursued higher returning projects with its CapEx dollars and returned excess cash to unitholders. In contrast, EPD has pursued a more aggressive growth strategy with slightly lower returns. While this has also generated market-beating returns for unitholders, it has not generated quite the same total returns for unitholders as MMP’s approach has.

While EPD’s track record is not quite as impressive as MMP’s, investors should be able to rest easy that management is not only capable but also highly incentivized to generate strong returns for unitholders as about one-third of the partnership’s common equity is owned by insiders.

Overall, however, we give the edge to MMP here.

Magellan Midstream Partners Vs. Enterprise Products Partners – Distribution Safety

MMP is currently paying out a $4.15 annualized distribution and is expected to generate $5.20 in distributable cash flow this year, putting its coverage ratio at 1.25x.

Meanwhile, EPD is currently paying out a $1.90 annualized distribution and is expected to generate $3.48 in distributable cash flow this year, putting its coverage ratio at 1.83x. As a result, we give the edge to EPD here, though neither partnership is in danger of having to cut their distribution anytime soon, especially when considering the strong balance sheets, stable cash flowing business models, and distribution growth track records.

Magellan Midstream Partners Vs. Enterprise Products Partners – Catalysts And Risks

EPD and MMP are both heavily exposed to oil and refined products, so the long-term demand for these energy products is crucial to the total return performance of both businesses. While both enjoy fairly stable and commodity price-resistant cash flows in the short term, if demand plummets for oil and refined products for a sustained period of time, both would take a hit. However, MMP would likely get hit harder given that EPD is also well diversified into natural gas and NGLs.

Magellan Midstream Partners Vs. Enterprise Products Partners – Stock Valuation

On a valuation basis, EPD appears to be clearly cheaper, as its EV/EBITDA multiple is cheaper compared with MMP’s current multiple. EPD is also much cheaper on a P/DCF basis, though its distribution yield is 90 basis points lower.

|

MMP’s Metrics |

Current | 5-Yr. Average |

| EV/EBITDA | 10.9x | 12.1x |

| P/DCF | 9.9x | NA |

| Distribution Yield | 8.1% | 7.8% |

| EPD’s Metrics | Current | 5-Yr. Average |

| EV/EBITDA | 9.5x | 10.8x |

| P/DCF | 7.7x | NA |

| Distribution Yield | 7.2% | 7.5% |

That said, MMP also looks discounted relative to its five-year averages, but overall we give the edge to EPD here.

Investor Takeaway

While both businesses are high quality in virtually every respect and well-suited to the current macroeconomic environment, EPD wins this competition due to its slightly lower risk profile and convincingly cheaper valuation. Yes, MMP has a better track record and a higher distribution yield, but EPD’s distributable cash flow yield is higher and its EV/EBITDA ratio is lower. It is using that excess retained cash flow prudently to invest in high return, lower risk growth projects that surpass the returns MMP is generating from unit buybacks. Meanwhile, EPD’s balance sheet is in stronger shape than MMP’s and its business model is better suited to the ongoing energy industry transition towards renewable energy.

We rate both businesses a Buy at the moment.

Be the first to comment