Cristian Borrego Sala/iStock Editorial via Getty Images

Investment Thesis

I’ve covered A.P. Møller – Mærsk A/S (OTCPK:AMKBY) (OTCPK:AMKAF) several times during the past year, again and again calling it overvalued. I’m notoriously long in my picks, so I’d like to view my analysis in that light, but time doesn’t offer that benefit just yet. However, my last piece covering the company was a bit more on point, with Maersk having experienced an 18.6% decline in its stock price since then. It also paid out a massive dividend, resulting in a total negative return of 8.5%, while the S&P500 has only declined by 1.6% in the same period.

In total, however, I’ve been wrong, big time, but I’m once again throwing my opinion out there regarding the situation concerning Maersk. I’ve previously favored a sell rating, and I’m not willing to provide a buy rating here, but management has done well. It will have another year of strong FCF to secure strategic acquisitions and growth related to its vision. The period of supernatural profitability has allowed management to shore up the balance sheet in combination with supporting the company vision via acquisitions, while the company as a whole may benefit from high value long-term contracts for quite a while.

However, uncertainty is showing up in the macro environment, and to truly become a global end-to-end provider, Maersk will require a lot more capital. All these positives elevate the “bottom” for the stock price as I see it, making it a hold for now. For new potential investors, I’d like to see the stock take another haircut before becoming interesting. Currently trading at price to book of 1.12, the stock would be interesting somewhere around P/B of 0.9 to 1.0. The market cap would then stand around $45 billion with a forward P/E of 5 for 2023 and forward P/E of 6.75 for 2024.

Maersk’s FY2021 Performance, 2022 Guidance & Market Outlook

Maersk and its peers had a ridiculous FY2021 from a financial standpoint. Profitability was at unseen levels in company history and way beyond what management considers the fair expectations under normal industry conditions.

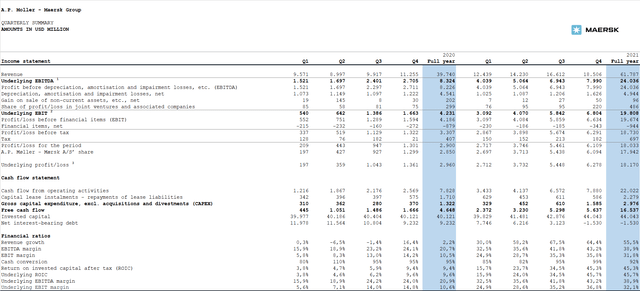

Let’s have a look at some of the highlights

- Revenue grew 55% from $39.7 billion to $61.8 billion YoY

- EBITDA grew 288% from $8.3 billion to $24 billion YoY

- EBIT grew 468% from $4.2 billion to $19.8 billion YoY

- Net income grew 621% from $2.9 billion to $18 billion YoY

On top comes the fact that management in essence is guiding for a repeat of FY2021 for the current 2022 with an expected EBITDA of around $24 billion with EBIT of $19 billion. Having seen how Q1-2022 has looked so far, with continued elevated freight rates and continued lockdowns in areas of China in combination with existing contracts securing high prices for the foreseeable future, there is almost no chance that management would have to revisit their guidance for this year in a negative manner. As such, Maersk is about to shower themselves in gold once more.

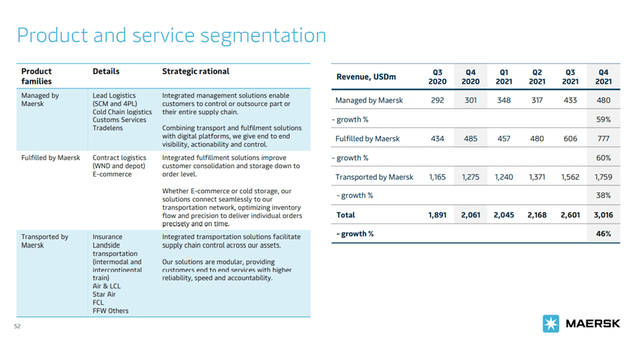

One thing is key to note, however, and that is how revenue and profitability is distributed internally in the Maersk Group. It is made up of several business units. The largest unit is “Ocean,” which contains all the container freight. The second largest is “Logistics & Services,” which is the main expansion area of the group and where acquisitions are supporting growth on top of strong organic growth. The third spot belongs to “Terminals & Towage,” where Maersk operates a global network of terminals catering to cargo freight services primarily existing of on- and off-loading of containers.

Splitting the units, Ocean makes up 78% of revenue for FY2021 but secures 89% of EBITDA and 91% of EBIT for the group. In other words, it’s the prime center of profitability, and therefore also the guiding unit as to how the top- and bottom lines will develop for Maersk over the coming years as management grows the logistics arm in parallel. This also means, that the development within its Ocean business will impact valuation heavily.

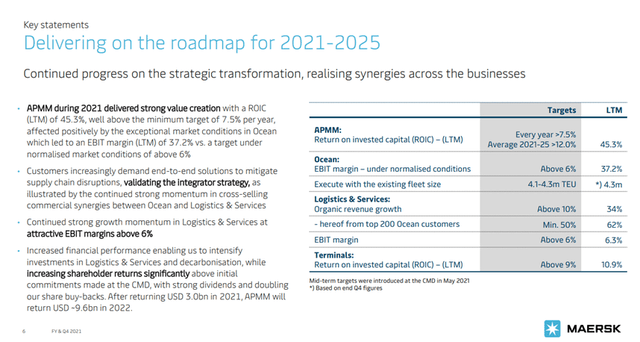

Here it is interesting to look at how management is guiding for the company, and for Ocean in particular, once normal market conditions have returned. We can’t know when that might be, but management is expecting a normalization in Ocean in the early second half of 2022. That guidance was issued several months ago, and we are closing in on the second half of 2022 while we still have shutdowns in China and an ongoing war on the European continent. While these two isolated incidents may not impact global trade to the extend the worldwide shutdown did during the early stages of the pandemic, it doesn’t speak in favor of returning to normal, or perhaps not as soon as management guided during early 2022.

However, if we consider the >6% EBIT margin as proposed by management in normalized market conditions, we can see the following transformation in Maersk’s earnings as a whole

- Ocean secured FY2022 revenue of $42.3 billion with EBIT of $17.9 billion growing 94% and 562% respectively YoY. Ocean exhibited an average EBIT margin of 44.4% for the full year while being lowest in Q1 with 36.7% and highest in Q4 with 50.3%.

- In a situation where Ocean would secure the same revenue and deliver an EBIT margin of 6%, the EBIT would come in at $2.9 billion corresponding to a 84% reduction in EBIT. The same scenario with a 10% EBIT margin would result in $4.8 billion. However, in a normalized market, the revenue would also diminish as freight rates would be lower, effectively meaning the 6-10% margin would come from a lower revenue base, suggesting that EBIT would be lower than what was just shown here for either scenario. Maersk has been an industry leader with high efficiency for many years so odds are, that management can secure an EBIT margin at the top percentile of the industry.

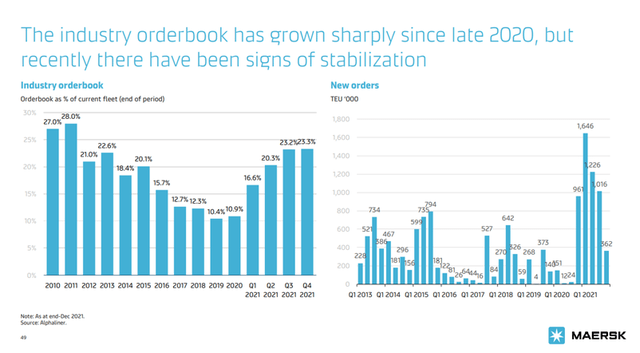

During 2021, management guided that the container market would have normalized by now, and they were wrong. So, they could be wrong about the timing again this time. With the world returning to normal in many parts of the world, however, it’s suggesting that we are closer than before to entering a phase where new contracts will be signed with substantially lower freight rates as their basis.

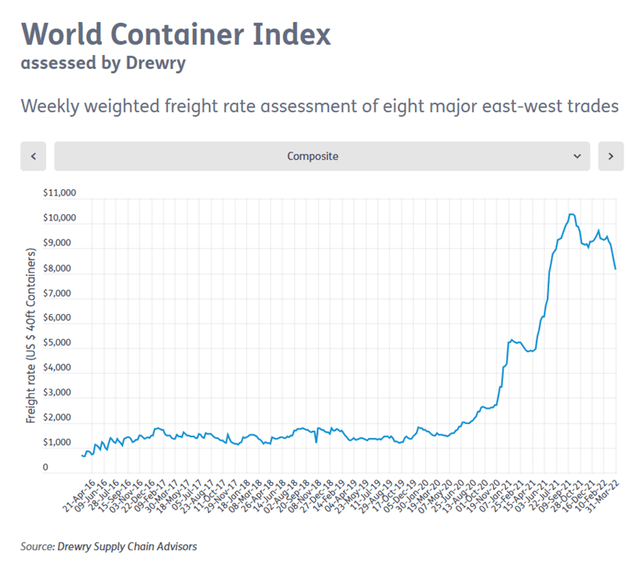

Taking a look at the composite freight rate index above consist of eight major trade routes, including Rotterdam – Shanghai, Shanghai – Rotterdam, Shanghai – Los Angeles, Los Angeles – Shanghai, we see what appears to be a peak, which would also go well in hand with what management is describing. The only route that has experienced price increases or managed to hold its current level since the peak seen above is the route between Rotterdam – New York and New York – Rotterdam.

As mentioned before, 2022 is history and Maersk can already expect to pocket the same massive returns as seen during 2021. But, going forward, contracts appear to be signed at lower values for the major trade routes, while we’ve also seen Maersk’s share price fall off a bit – perhaps the investment community is preparing itself for what will finally be a return to what once was, or at least close to.

The joker here is that we don’t know if the routes will come down quickly or require an extended period of time due to the massive disruptions we’ve seen in global trade over the past two years. Furthermore, Maersk will also benefit from the tail income of existing contracts driving high levels of revenue and earnings for a period of time that will last beyond the normalization and provide benefits for each month the rates stay at their current level. Maersk has, of course, also been playing their hand well, by catering more to their long-term contractual customers during volume squeezes in the market, luring customers into the contractual setup compared to a spot-marked setup, something management is also reporting on, where the transition to a LT focus is evident.

However, management is starting to see evidence that the market is normalizing as demand is stabilizing.

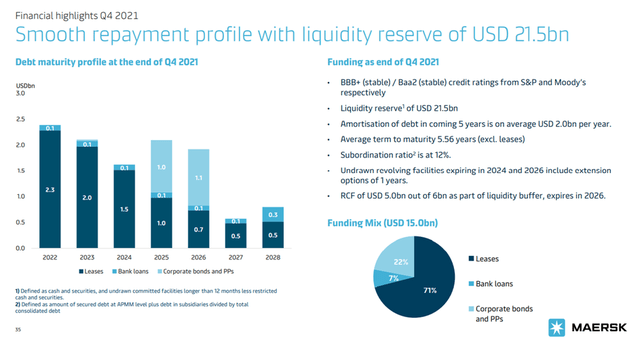

The Balance Sheet: Debt, Liquidity & Opportunities

In a situation where income grows substantially, it also results in a strong and growing FCF. In this situation, it resulted in Maersk growing its FCF by 256% YoY to a total of $16.5 billion. Go back to 2017 and Maersk had a cash position of $2 billion, while long-term debt stood at $12.7 billion. Compare this to FY2021, where the cash position has grown to $11.8 billion and long-term debt diminished to $4.3 billion. Naturally, this presents opportunities to conduct aggressive moves in terms of considering new business opportunities.

Maersk has a rich history of establishing new business units that grew into billion-dollar revenue-generating opportunities, such as the existing Terminals business that was established in 2001. Some of the significant acquisitions include the €2.3 billion acquisition of P&O Nedlloyd, a container shipping company with a 6% global market share back in 2005, when Maersk’s own share of global freight trade made up 12%. This effectively increased its share to 18%, which it is still close to today, coming in at around 17%.

This was followed by the acquisition of Hamburg Süd in 2017, a $4 billion price tag for what was the 7th largest shipping company at the time.

The less-known logistics brands of Maersk include what was once known as Damco, stemming back to 2009, a part of the P&O Nedlloyd acquisition and land-based, which has since been rebranded into “logistics & services.” It secured $9.8 billion of revenue in FY2021 and $623 million in EBIT. It is also here that we will find Maersk’s expansion plans, as the Ocean business has become too large to really expand as Maersk’s market share inhibits it from deploying cash in terms of significant acquisitions. We have also seen reduced investments in a part of the business where Maersk consistently deployed the largest container ships in the world. Management has in recent years focused on operational efficiency, a smart move.

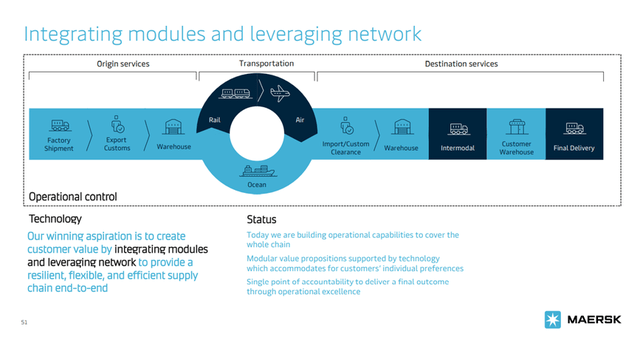

Back in 2016, Maersk revealed the new strategy to become a global integrator of container logistics, effectively reorganizing away from being a conglomerate to become more focused on logistics. This involved a number of divestitures as the company rid itself of its oil & gas assets, readying itself to expand its land and air-based logistics business.

As has been evident from previous investor presentations, and also this one, Maersk is striving to become an end-to-end provider. This is also clear when observing the scramble to acquire competences from outside the company today. Within just the recent years, there are numerous examples of Maersk strengthening its offering, such as the acquisition of LF Logistics, a deal which was closed in December 2021 with the purpose of strengthening fulfilment services, e-commerce support and inland transport in the Asia-Pacific region. Maersk also acquired Visible Supply Chain Management, a B2C logistics company as well as B2C Europe Holding, with a focus on B2C parcel delivery, both of the deals announced in conjunction back in August 2021. As late as February 2022, Maersk announced the acquisition of Pilot Freight Services, a last-mile logistics company.

In total, Maersk has splashed more than $5 billion on these transactions. While not evident in the most recent P&L statement, it’s clear that management is going full throttle to support the already strong growth in its logistics arm.

Most recently, and no more than a week ago, it was announced that Maersk launched “Maersk Air Cargo” with its own ambitious expansion plans. Based upon Maersk’s existing Star Air operations, fifteen 767s will be transferred to the new operations. It also already has penned a deal to add new planes through 2024, by adding two new 777s and leasing three 767-300s. As such, Maersk will also bet on offering customers air transport.

In essence, Maersk is putting all that cash to good use, aiming to achieve the same >6% EBIT margin for its logistics operations as is the aim for its ocean business. However, for a long period, it will still be Ocean setting the tone for Maersk and also impacting the valuation the most.

Valuation & Conclusion

Speaking of valuation, I’d prefer to take the word of management and bet that once we look towards 2023, we will start to see profitability come down. Not a collapse, but a contraction as rates would have come down and with new contracts being signed at lower rates. 2023 could very well be another strong year, but it appears that profitability will have peaked for Maersk on the back of the Covid-19 pandemic-related issues. We also see Maersk down 30% from its peak, but I believe it will have to come further down as profitability contracts.

However, Maersk will be in much better shape from an operational and financial standpoint. Debt levels have come down, and the strong financial performance has allowed Maersk to make value-adding acquisitions and accelerate its growth in a manner that would otherwise have required an expansion in debt.

The industry tailwinds have allowed Maersk to leap-frog and skip years of debt accumulation associated with its growth vision. However, to truly become and end-to-end provider, there will be a lot more capital required, as we are talking real assets and ownership of those. This is also why management has allocated $9-10 billions’ worth of CAPEX investments during 2022 and 2023.

Trading at a P/E just shy of 3, Maersk doesn’t immediately appear expensive, and I won’t argue that it is. However, forward analyst consensus expectations for net income for FY2023 is $9.6 billion and $6.1 billion for FY2024. Both would be substantially above the historical profitability levels, but far from the current peak for FY2021 and FY2022. Respectively, this would result in a P/E-2023 of 5.5 and P/E-2024 of 7.

However, we also have to respect that forward-looking profitability levels could be higher than what the rearview mirror tells us, not least due to the tail effect of high-value long-term contracts that, once they expire, will be made up for to some extent by the growth and profitability of Maersk’s logistics arm. Currently trading at a price to book of 1.12, I’d like to see the stock take another haircut to become interesting for prospective investors. As such, a P/B of 0.9 to 1.0 could prove an interesting starting point as it would also result in a forward P/E for 2023 of 5.0 and forward P/E for 2024 of 6.75. This should give some cushion to the uncertainty related to the longevity of the current market conditions as well as the macro environment.

An unknown in the current scenario is how global trade will respond to the FED policy change, there is always the risk of a policy error in a tightening monetary environment, which would impact global trade negatively and could contract freight rates sooner than expected.

What will be particularly interesting however, is to listen in on management’s expectations for 2023 once we get into the later stages of Q2/Q3-2022. We shouldn’t forget that Maersk is operating in a number of arenas characterized by perfect competition and where the macro environment also plays a factor.

Be the first to comment