FinkAvenue/iStock Editorial via Getty Images

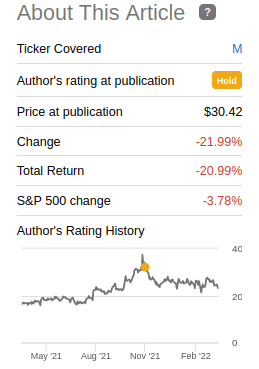

We are upgrading our rating on Macy’s (NYSE:M) to Buy again, mostly based on valuation, but also thanks to decent guidance provided by the company for this year. Since our previous downgrade, shares have had a total negative return of roughly -21%, while the S&P 500 returned -3.78%. While shares are incredibly cheap, we understand investor concern about potential headwinds the company can encounter in the near future. Especially a weaker consumer with less disposable income due to increased gas prices, high levels of inflation eating away at their purchasing power, and some consumers opting to travel again instead of spending on clothing or personal articles.

Seeking Alpha

Macy’s Financials

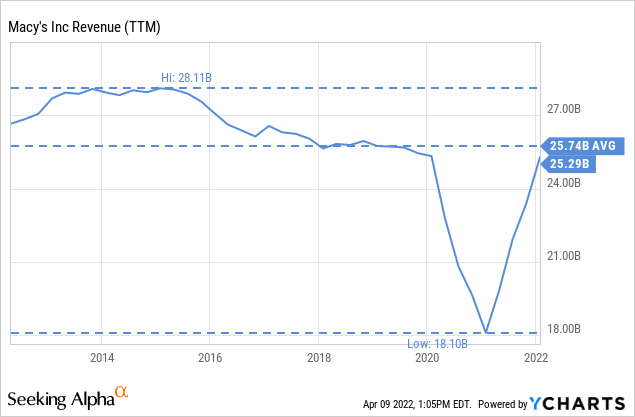

Macy’s has not managed to increase revenue much in the last ten years, with peak revenues actually around 2015. During the worst of the Covid crisis revenue crashed to ~$18 billion, but has since recovered to ~$25.2 billion, which is still below its ten-year average, but the current trend is positive.

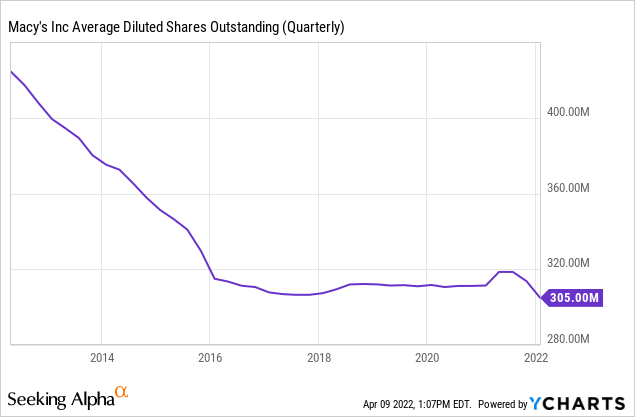

At least thanks to share repurchases, you get a lot more revenue per share than you did ten years ago. As can be seen below, Macy’s has managed to significantly reduce the number of shares outstanding, and given the current buyback authorization, this number should decrease even more.

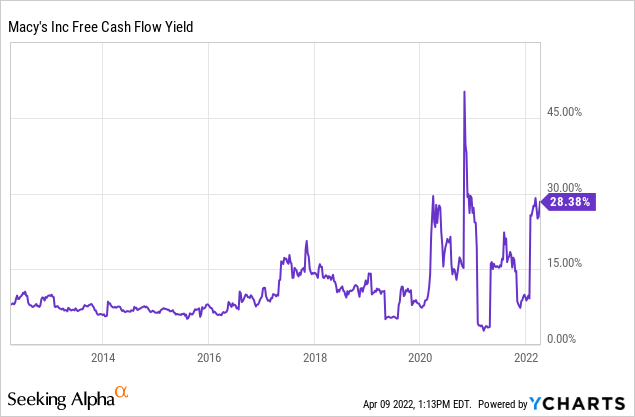

We think that at the current low valuation, share repurchases are certainly one of the best uses management can make the company’s capital. Shares are currently cheap with a free cash flow yield of ~28%. We don’t think there are many operational investment opportunities with that type of IRR, so management should certainly try to buy as many shares as possible as long as it does not reach a point where it weakens the business.

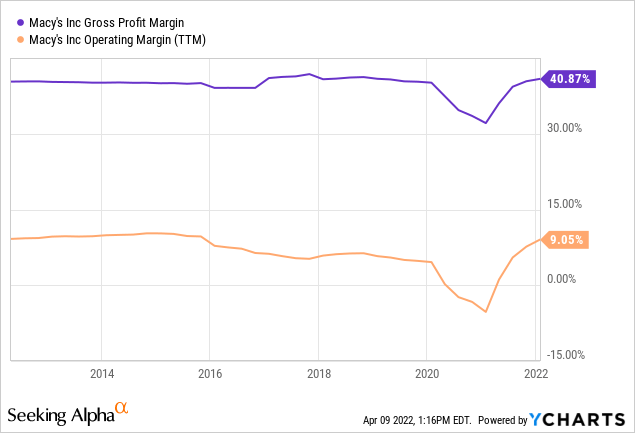

Margins have recently rebounded and appear to have changed direction after many years of constantly decreasing. The recent operating margin of 9.05% is the highest since at least 2015, and gross profit margins have been improving recently as well.

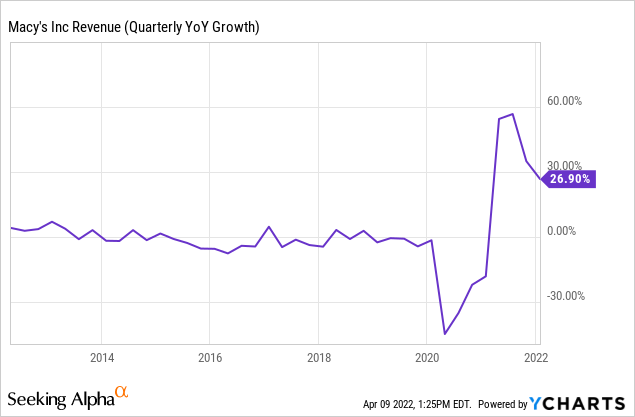

One of the weak points for Macy’s has been revenue growth. But that seems to have somewhat improved, with the company quickly recovering from the Covid downturn, and most recently posting ~26.9% year over year growth. However, it is important to note that this big increase is over the Covid pandemic period, and that for 2022 management is guiding for a net sales increase between flat to +1.0% growth vs. 2021.

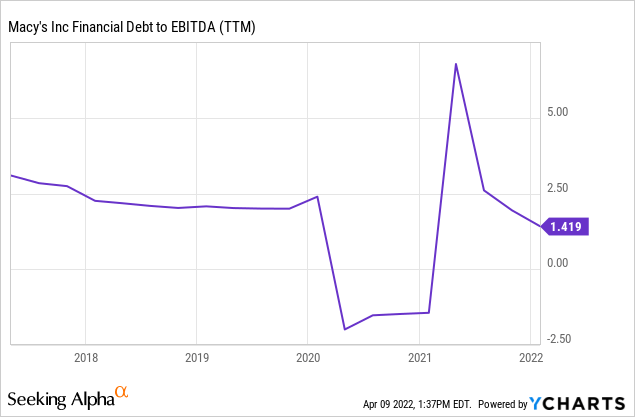

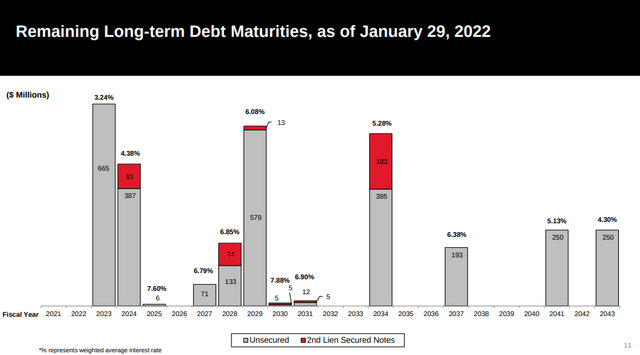

Macy’s leverage got to worrying levels during the Covid pandemic, but has since quickly recovered to a much more reasonable 1.4x debt to EBITDA. We hope the company learns the lesson that things can get bad really quickly and that it seeks to operate with low levels of debt moving forward.

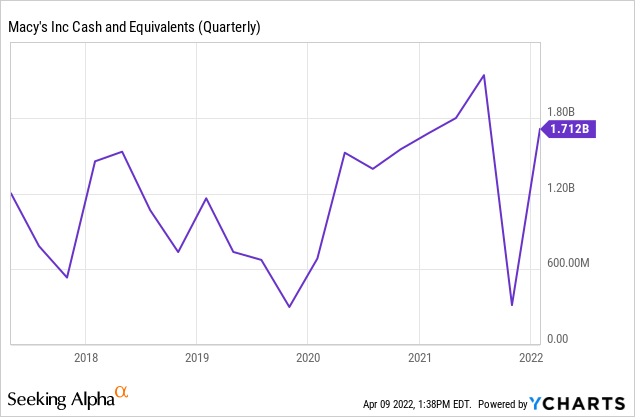

The company also has good levels of liquidity with ~$1.7 billion in cash and equivalents, which it can use to retire debt maturing in the near term or to reinvest in business as necessary. It is likely that some of this excess liquidity will be used for share repurchases as well.

Macy’s has about a billion dollars’ worth of debt maturing in the next two years, but then nothing significant until 2029. This should give it a good amount of financial flexibility.

Macy’s Q4 2021 Earnings Presentation

Macy’s Stock Valuation

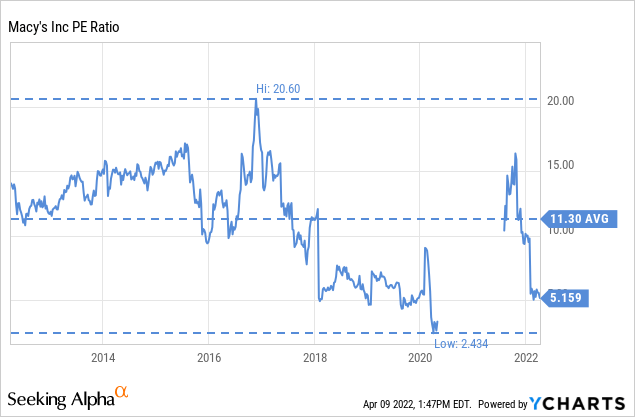

Below we show the historical P/E valuation for the last ten years, which has averaged a multiple of 11.3x. Shares are currently trading at less than half this average, showing that shares are indeed undervalued with respect to historical multiples.

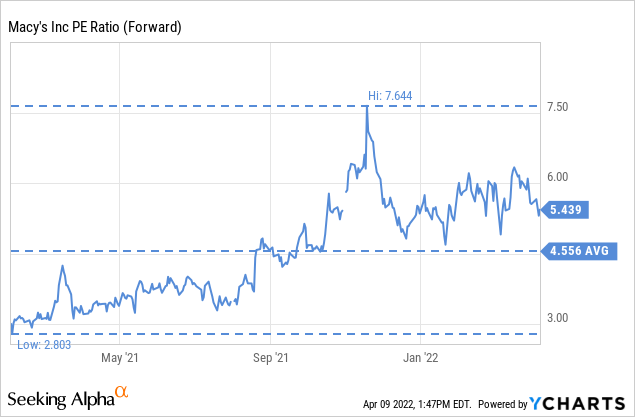

Zooming in on last year and using the forward earnings multiple, we see that shares were much cheaper a year ago, at one point trading barely with a 3x forward P/E multiple.

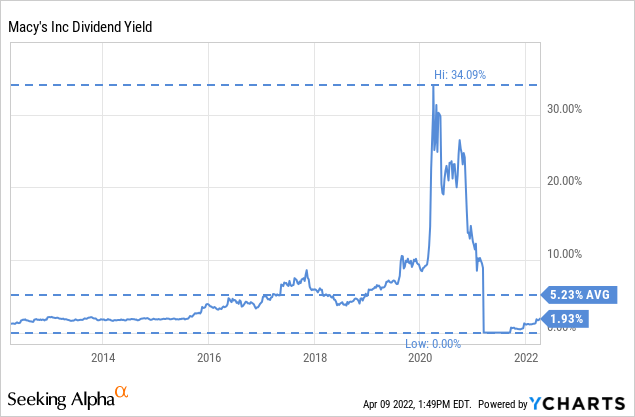

The one indicator that doesn’t make Macy’s look cheap is its dividend yield, but only because it was cut during the Covid crisis and restored at a much lower level. Historically, shares have yielded ~5%, and currently they are closer to 2%, but hopefully with some time, the management of the company will feel confident enough to increase it to the previous level and higher.

Headwinds And Tailwinds

As we stated at the start of the article, Macy’s shares are cheap but they look cheaper than they really are. And that is because discretionary consumer spending is likely to wane, with record gasoline prices and high-inflation affecting consumer’s purchasing power. Even Macy’s CFO recently warned that consumers might have to choose between taking a vacation or spending on discretionary items that Macy’s sells. At the J.P. Morgan’s annual Retail Round-Up event he said, “The biggest challenge that we’ve had in terms of thinking about managing through the beginning of 2022, is where is the demand going to come from.” He added, “We do believe the demand is out there. We do believe that the consumer is going to be spending. But are they going to be spending on discretionary items that we sell, or are they going to be spending on an airline ticket to Florida or travel, or going out to restaurants more?”

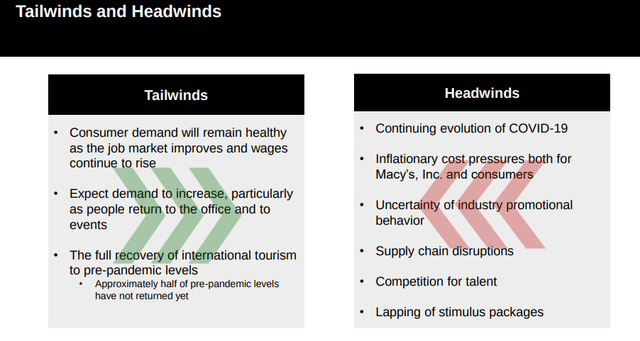

The company also listed a series of tailwinds and headwinds that it sees during its Q4 2021 earnings presentation. Among the tailwinds, it sees a strong job market and people returning to the office and to events. The headwinds include inflationary pressures, supply chain disruptions, lapping of stimulus packages, etc.

Macy’s Q4 2021 Earnings Presentation

Conclusion

With a stronger balance sheet and trading at a low multiple of earnings, Macy’s shares are cheap. However, they are not as cheap as they appear given the number of headwinds that are coming the company’s way. Investors shouldn’t expect earnings to grow much beyond the effect from share buybacks. The biggest catalyst to help shares trade closer to its fair value will be the $2 billion share repurchase authorization starting in 2022.

Be the first to comment