wdstock/iStock Editorial via Getty Images

Introduction

Macy’s (NYSE:M) is a stock I’ve covered a couple of times now, and the last piece was crafted just before the Q1 results in late May; whilst the results did initially serve as a useful fillip for M’s stock, the period from mid-June to early August was quite underwhelming. Yet still, developments over the last few days have been quite positive, with encouraging results from peer Dillard’s proving to be a fine trigger. Overall, despite a broadly volatile backdrop, the stock has still ended up delivering decent returns of 13% or so.

In another week’s time, we will come across another catalyst- Macy’s Q2 results, which will be announced on the morning of 23rd August followed by a call at 8:00 a.m. EDT.

What To Expect From The Q2 Results?

Whilst investors can always be hopeful, I think it would be unrealistic to expect a blowout Q2, particularly considering the comps that were in play last year; last year’s Q2 saw the full benefit of the stimulus payment effect coupled with an accelerated economic recovery. So, whilst M delivered topline growth of 14% in Q1, in Q2, analysts’ estimates point to an annual decline of -2.4%, with an expected revenue figure of $5.51bn; note that this is somewhere close to the middle of the guidance ($5.48-$5.55bn) provided by Macy’s management during the Q1 earnings call. Besides the base effect, the elevated inflationary backdrop is also likely to have curtailed consumers’ ability to wholly engage with discretionary purchases.

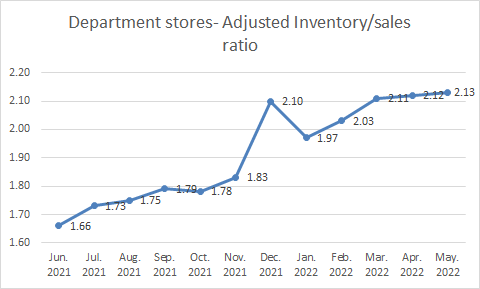

Then, in Q1, whilst Macy’s delivered an impressive 100bps improvement on the gross margin front (39.6%), this is likely to be pressured in Q2 with an expected figure closer to the Q2-19 levels of 38.8%. Much of this is on account of ample inventory build (they had almost $5bn of merchandise inventory on their books at the end of Q1, up by 17% on an annual basis and 13% on a quarterly basis) which will be needed to be wound down at lower prices, particularly in some overstocked categories such as activewear and soft home categories. Note that accelerated inventory build isn’t limited to Macy’s alone; if anything, the inventory/sales ratio of US department stores has only continued to trend up in recent months and is currently at 2.13x. With the industry-wide inventory scenario, expect high promotions to be a dominant facet.

US Census

Elevated fuel costs too will likely leave their mark on Macy’s cost dynamics, although I do suppose it helps that they have a lower amount of digital sales versus what it was last year. Also consider that Macy’s higher minimum wage of $15 (per hour) for around 100,000 US employees would have come into play by May (the average base pay will be closer to $17 an hour)

Macy’s will look to mitigate the pressure from markdowns and higher fuel costs by increasing its focus on greater private label penetration (in Q1 they spoke about realigning and reimagining their private brand portfolio and team), which can be manufactured at much lower costs relative to big brands. What could also help Macy’s EBITDA trajectory is a greater share of credit-card-related revenue (costs tied to this are virtually nothing), particularly with their co-branded cards which has continued to gain traction.

All in all, consensus expectations for the bottom line point to an EPS figure of 0.889 (management guidance of 0.84 to 0.94), which implies an annual decline of 31%; just for some perspective, the Q1 EPS had grown by 176% so as far as the sequential trajectory is concerned, that’s quite a drop-off!

Some other ancillary things to look out for would be some clarity on their curated Macy’s digital marketplace which is due to go live in Q3. The initial focus of this endeavor will typically be oriented towards categories such as pets, gardening, electronics, home improvement, etc.

I’d also be looking for some clarity with regards to the consumer health of higher-income and middle-income customers, both of whom were noted to be fine in Q1. With the economy the way it is, I would expect some weakness in the middle-income segment and that could maybe also impact the bad debt trajectory of Macy’s credit card portfolio.

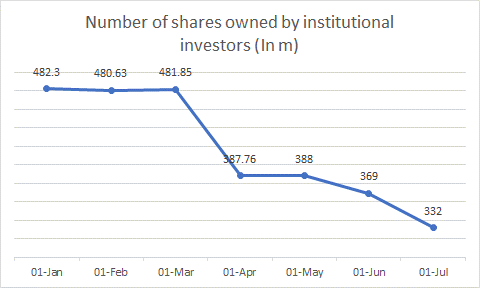

At the moment, it’s fair to say that the analyst community is broadly neutral on Macy’s prospects. 59% of the Wall-Street analysts who cover the stock have a HOLD rating on the stock. The lack of ample enthusiasm for the Macy’s stock is also reflected in the manner in which the influential institutional investor community is positioned; do note that since the turn of the year, they have gradually reduced their stake in Macy’s, so much so, that on a YTD basis, the aggregate shares held by these institutions are down by 31% and currently stand at 332m.

YCharts

The number of institutional investors who own the stock too has dropped off quite significantly; at the start of the year, 937 institutions owned it; currently, it is just 870.

Closing Thoughts- Is Macy’s a BUY, SELL or HOLD?

Whilst the smart money may not be overly enthusiastic about Macy’s and even though the Q2 results are unlikely to be overly special, I would be disinclined to alter my previous ‘BUY’ stance.

Firstly, despite moving up by around 13% since my last article, Macy’s stock still offers very attractive risk-reward relative to its peers in the retail space, as represented by the XRT ETF. The ratio still trades well below the long-term mid-point of 0.725.

Stockcharts

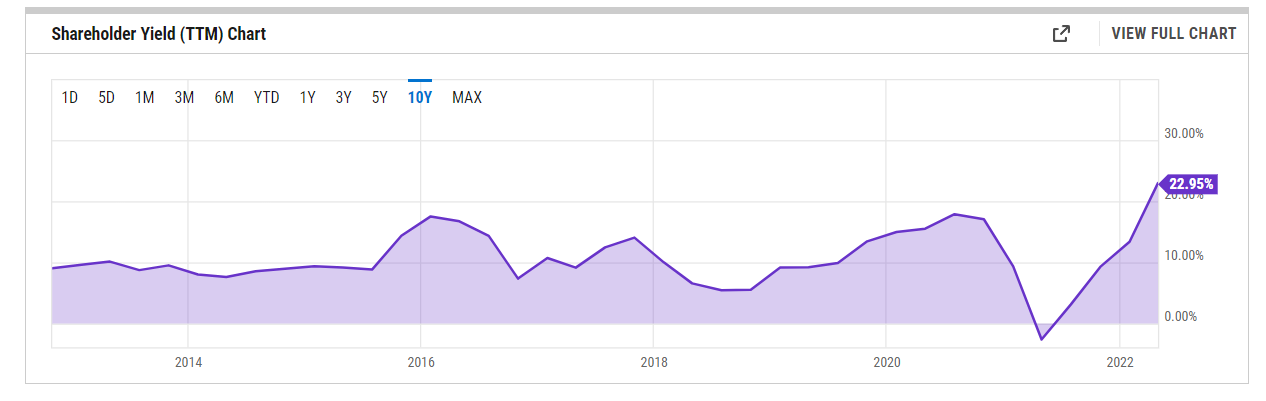

Also consider the extremely lucrative shareholder yield which has only continued to improve since I last wrote about it. Incidentally, at nearly 23% (it was around the 13% levels just before the Q1 results), it is well above the average of 10-11% and at its highest point in 10 years!

YCharts

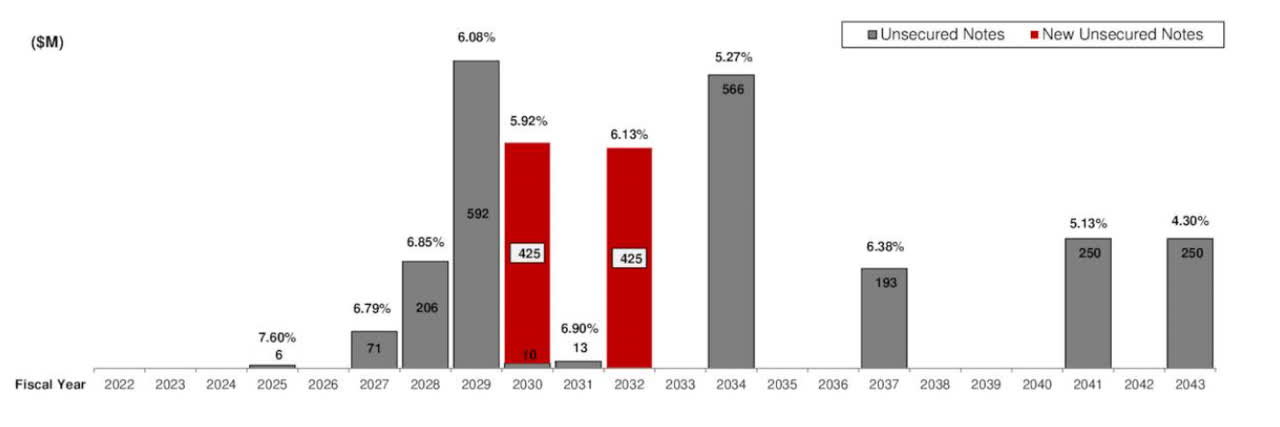

Recently, this has been primarily driven by the level of debt paydowns and buybacks. Last quarter, they were able to pay back $1.1bn of their debt maturing in 2023 and 2024 (a year ago they could only pay back around half a million). Whilst they did issue around 0.8bn of debt to pay this off, note that the maturity of the new debt is a lot longer (due in 2030 and 2032). In effect, they now have no major debt due until 2028, which opens up ample room to either invest in the Polaris transformation or return more to shareholders by way of dividends (dividends are still 60% lower than the pre-pandemic levels) and buybacks (at the end of Q1, they still had around $1.4bn of buyback ammunition left). What also enhances Macy’s flexibility is that they were recently able to remove the collateral on their second-lien bonds, which now effectively makes all their long-term debt unsecured.

Q1 Presentation

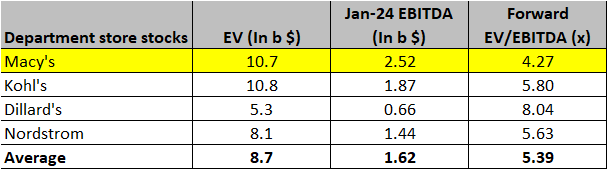

Finally, you also have the enticing valuation backdrop based on the Jan ’24 EBITDA estimates. Whilst Macy’s forward EV/EBITDA multiple has grown pricier by 6% (4.27x) since the May 2022 update (4.01x), its discount relative to its peers in the department stores arena has only widened; previously Macy’s could be picked up at a 19% discount to the average multiple of its peers (4.94x); now it can be picked up at a 21% discount (5.39x).

Seeking Alpha, YCharts

Macy’s is still a BUY.

Be the first to comment