lechatnoir

Introduction

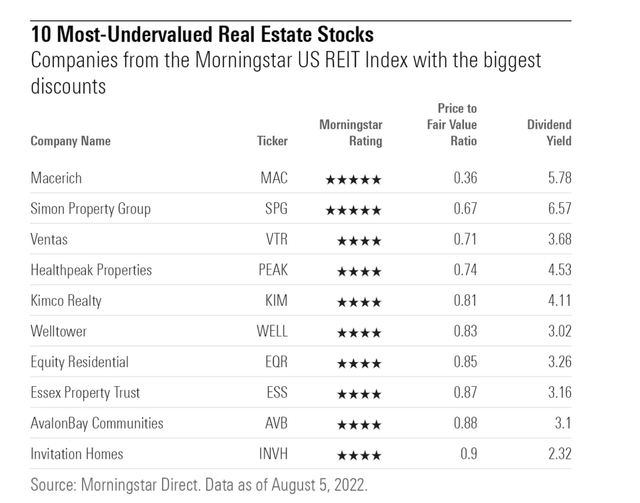

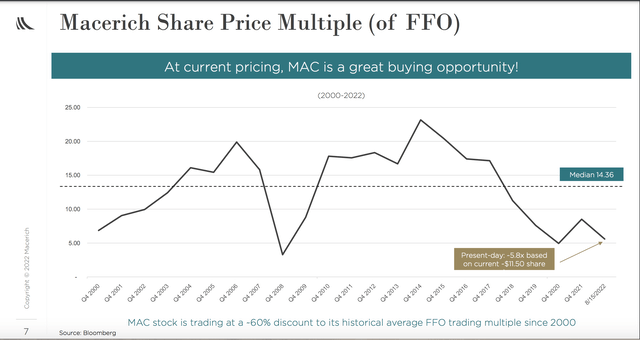

The Macerich Company (NYSE:MAC) is a real estate investment trust (‘REIT’) that owns and operates a portfolio of Class A malls. Their malls are considered to be of the highest asset quality in the United States, alongside Simon Property Group (SPG). The company trades at a 58% discount to its historical FFO multiple of 14.36x, a 59% discount to net asset value (liquidation value of the underlying real estate) of $29.45 per share, and was rated as Morningstar’s Number 1 most undervalued REIT, with Morningstar’s fair value of $27.50.

Underpricing due to the retail apocalypse that has not affected Class A malls

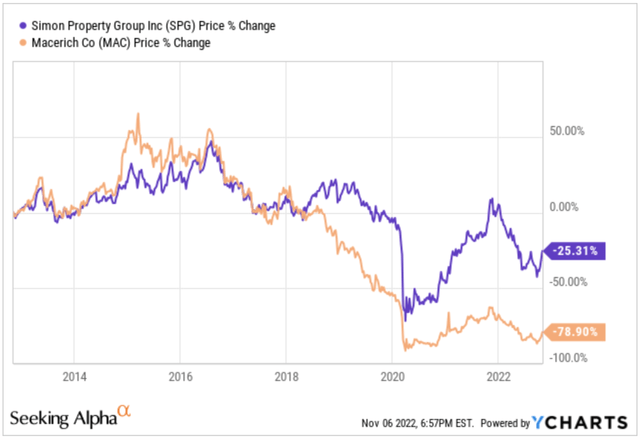

Market sentiment turned against mall REITs in 2015, when MAC and Simon Property Group started a multi-year decline continuing into COVID. MAC has had a much more pronounced decline, down 79% over the past 10 years while SPG is down 25% over the same time period.

Despite similar asset quality to SPG, MAC experienced a much sharper decline due to its higher levels of leverage. The market narrative is that the malls are dying, which is substantiated by the recent bankruptcies of mall REITs Washington Prime Group (WPG), CBL Associates (CBL & Associates Properties), as well as the current state of Pennsylvania REIT (PEI), which filed for and then quickly emerged from bankruptcy in 2020.

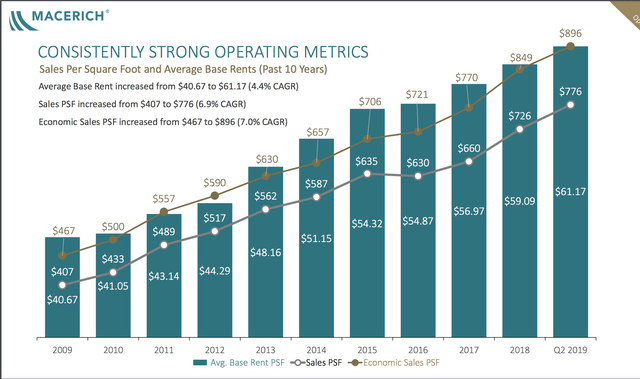

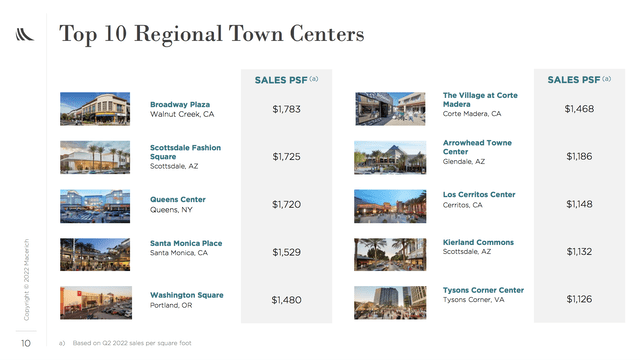

However, the truth of the matter is that Class A malls such as the ones run by MAC and SPG are only getting stronger by every relevant metric. Sales per square foot in the MAC portfolio has only grown rapidly since 2009, when it was $407/square foot. In 2019, average sales per square foot was $776/square foot, and now MAC’s average sales per square foot is $877 as of Q3 2022.

Macerich Investor Presentation 2019

This represents a sales per square foot CAGR of 6.1% over the past 13 years. Rent per square foot for leases executed in the past year now stands at $61.40, which is now slightly above the 2019 level.

If demand for Class A mall space was decreasing, sales per square foot and base rent per square foot should have also decreased. Looking at the facts over this past decade, the idea of a “retail apocalypse” in class A malls has been an absolute myth.

How many times must history repeat?

When you see the same pattern over and over again, it becomes hard to ignore. In 2008, MAC got hit harder than the broader market, generating a return of -72.5% versus the S&P 500’s return of -38.5%. The following year of 2009, MAC far outperformed the S&P 500, producing returns of 128.8% versus 23.5% for the S&P 500. MAC then once again outperformed in 2010 returning 39.2% versus 12.7% for the S&P 500.

| MAC | S&P 500 | |

| 2008 | -72.5% | -38.5% |

| 2009 | +128.8% | +23.5% |

| 2010 | +39.2% | +12.7% |

Having this knowledge, I entered into a large position in MAC at $9.40 in November 2020 and exited at ~$17 in January of 2022.

MAC once again had a larger draw-down versus the market in 2020, such that it ended the year down 56.7% versus +16.3% for the S&P 500, which recovered quickly after the initial COVID crash. The following year, MAC far outperformed the S&P 500, returning 68.5% versus 26.9% for the S&P 500.

| MAC | S&P 500 | |

| 2020 | -56.7% | +16.3% |

| 2021 | +68.5% | +26.9% |

The same play is once again on the table, with MAC down 48.6% from its 52-week high versus the S&P 500 down 22.6%, setting MAC up for a stronger rebound than the broader market once again.

| MAC | S&P 500 | |

| 2022 YTD | -30.8% | -21.2% |

| % off 52-week High | -48.6% | -22.6% |

The market rewards those who can identify and capitalize on patterns, but an obvious pattern is not enough to invest.

Clear undervaluation on FFO and NAV basis

It is rare for management teams to express their thoughts on their company’s stock price, so I appreciate the repeated messaging from MAC’s management with regards to the current stock price.

MAC’s Q2 Investor Presentation mentions that their stock is trading at a ~60% discount to its historical median P/FFO multiple since 2000, with the stock currently trading at ~6x FFO and a median P/FFO multiple of ~14.36x.

I think 14.36x is ambitious given that market sentiment has turned against malls starting around 2016, and that MAC has been trading below this median multiple since Q4 2017. I think 10-12x P/FFO is a reasonable target, with the stock trading at around 11-12x FFO in late 2021 and early 2022. This would put MAC at a $20-24 range without any FFO growth.

Net Asset Value (Net Value of Underlying Real Estate) of $21.14 to $34.74 a share

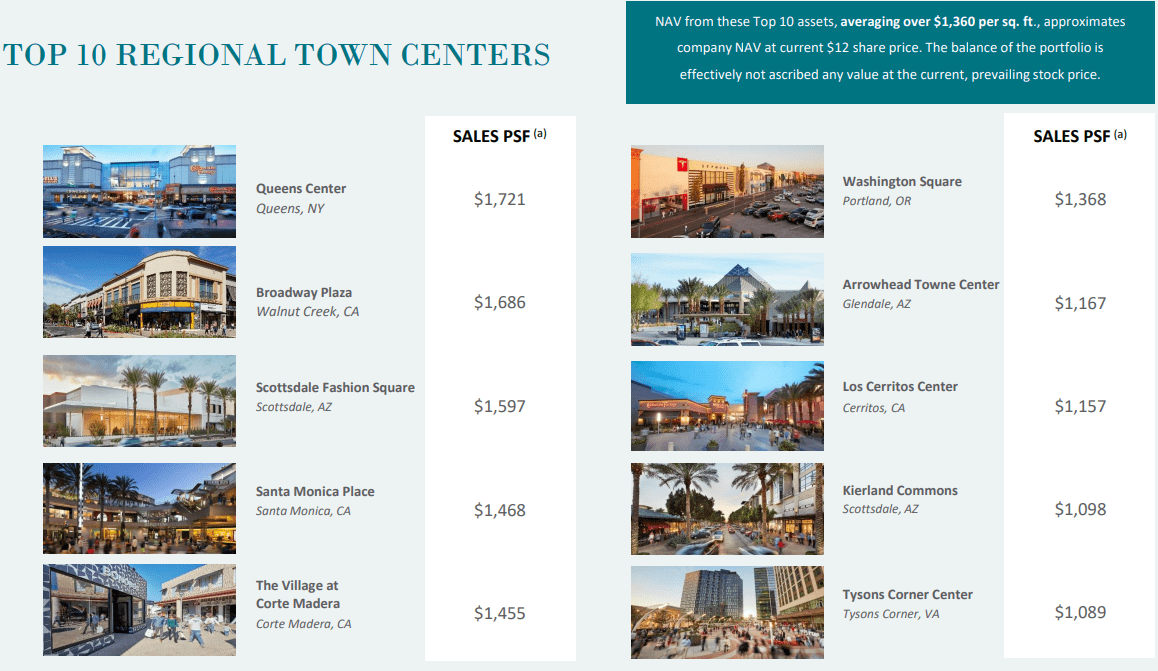

In a previous version of the company’s investor presentation, MAC made a note that the company is trading at any “extremely discounted valuation” and that at $12 a share, the company is trading at just the net asset value of their top 10 assets, effectively not ascribing any value to their remaining 37 properties.

Article from SA Contributor Jussi Askola

Source: Article on Macerich from SA Contributor Jussi Askola

It appears that this version of the investor presentation has since been modified, with the latest version of the Q2 Investor Presentation not having this note.

Morningstar also rates MAC as the number 1 most undervalued REIT as per its August 2022 Top 10 Undervalued REIT Report citing a 0.36x Price to Fair Value ratio and a Fair Value of $27.50.

Morningstar The 10 Most Undervalued REITs

I believe the net asset value of the underlying real estate is $29.45 at a cap rate of 6%. While mall transactions have been limited over the past few years, Unibail-Rodamco-Westfield (OTCPK:UNBLF) just sold a mall in California for a sub 6% cap rate. While an A rated mall at sales per square foot of $611, MAC’s malls are overwhelmingly of higher quality with a portfolio average sales per square foot of $877 as of Q3 2022, and would also therefore warrant an even lower cap rate on the private market.

NOI in 2021 was $787M, and I am expecting 2022 NOI to be slightly lower as total NOI in the first 3 quarters is down 0.7% against the first 3 quarters of 2021 due to the sales of a few assets. Forecasting this 0.7% drop into the fourth quarter yields a $781.5M 2022 NOI. Same store NOI is up 9.8% year-over-year due to increases in occupancy and sales per square foot.

Using a 6% cap rate, NAV is $29.45 a share.

| Property Value at 6% cap rate; $781.5M 2022 NOI | $13.024B |

| Other Assets (Cash, Receivables) | $335M |

| Total Assets | $13.36B |

| Total Debt | $6.77B |

| NAV | $8.27B |

| NAV per share | $29.45 |

Sensitivity analysis

NAV is sensitive to cap rate assumptions. I believe that the range of realistic cap rate assumptions is in the 5.5%-7% range, putting NAV between $21.14 and $34.74 range. However, I believe there is a very substantial margin of safety, with 24% upside to NAV even at an extremely conservative 8% cap rate and zero NOI growth.

| Cap rate | Asset Value | NAV | NAV per share |

| 5% | $15.97B | $10.87B | $41.09 |

| 5.5% | $14.54B | $7.77B | $34.74 |

| 6% | $13.36B | $8.27B | $29.45 |

| 6.5% | $12.36B | $7.27B | $24.98 |

| 7% | $11.5B | $6.41B | $21.14 |

| 7.5% | $10.76B | $5.67B | $17.81 |

| 8% | $10.1B | $5.01B | $14.90 |

Insiders put their money where their mouth is: Strong insider buying

MAC insiders have been overwhelmingly bullish on the stock, with the CEO Thomas O’Hern most recently buying 25,000 shares at $9.49, 11,100 shares at $8.97, 11,100 shares at $8.99, and 12,820 shares at $7.77 for a total investment of ~$536,000 over the past 5 months. President Edward Coppola has been purchasing even more aggressively, buying 50,000 shares at $7.98, 60,000 shares at $8.75, and 40,000 shares at $10.28 for a total investment of ~$1,335,000.

MarketBeat: Macerich Insider Buying MarketBeat: Macerich Insider Buying

Potential passive income machine: A look at dividend history

MAC has a history of paying out strong dividends and maintaining a high dividend payout ratio, paying out most of its FFO through dividends. From 2016 to early 2020, MAC paid out between $0.68 and $0.75 in dividends per quarter, or an annualized $2.72 to $3.00 range. The dividend was cut 80% from $0.75 to $0.15 in 2020 to focus on deleveraging, which I believe is the right move in order to achieve higher P/FFO multiples and close the discount to NAV.

MAC just announced a 13.3% increase in the quarterly dividend from $0.15 to $0.17. The messaging in the news release appears to be that future dividend increases are likely in the future.

Although there is no certainty, the Company’s goal is to resume a regular cadence of dividend increases while maintaining a conservative Funds from Operations (FFO) payout ratio.

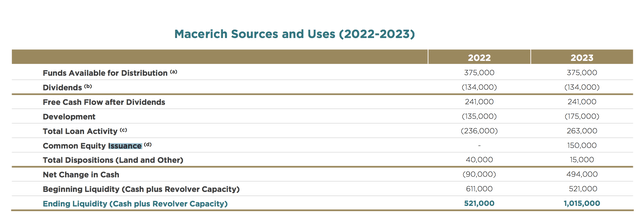

With a quarterly dividend of $0.17 and average quarterly FFO of $0.49, the dividend payout ratio is still a very conservative payout ratio of 34.7%. While I prefer that the company continues to pay down debt, there is significant run-way to increase the dividend. It is possible that the company will return to its historically high payout ratios of 70-85% after reaching its leverage targets by reducing debt, in which case the dividend would be $1.40 to $1.70 annually per share assuming no FFO growth.

While I would not expect this sort of a high payout ratio any time in the near future given the focus on reducing debt, I do think that long-term investors will be rewarded with strong dividends at a 5.67% yield today along with potential for their dividend yield on cost to grow into the double-digits.

Primary risk is dilution via future equity issuance

I believe the primary risk of this investment is the potential for additional dilution. In March 2021, MAC announced that it had raised $487.3M through the issuance of 36 million shares at an average price of $13.54 per share. In the earnings call for the 4th quarter of 2020, an analyst asked about the filing of the ATM (at-the-market) program. The response of CEO Thomas O’Hern was the following.

Should we be in position to see a stock price that we like, we would consider it. But again, it’s just a shelf because we’re putting it out there doesn’t necessarily mean they’re going to use it…”

I was listening to this earnings call live and got the impression, as did other investors, that the ATM program was meant for use only in the case of an attractive share price that would be accretive rather than value-destroying. We now know that MAC is willing to issue shares at a price as low as $13.54.

The company is slightly more transparent this time, with a pro-forma sources and uses page in their latest investor presentation indicating the possibility of a $150M equity issuance in 2023.

They include the following footnote in the investor presentation regarding the possibility of an equity issuance.

This is illustrative of available capacity on the Company’s ATM facility but should not be deemed a commitment to issue common equity at prevailing stock prices.

Given the explicit mention of common equity issuance in the investor presentation, I would not be surprised at all to see additional dilution in 2023. However, I would not expect anywhere near the amount raised in 2021.

A secondary risk is the possibility that we are entering into a long 5+ year period or permanent period of elevated rates, rather than a shorter 1-2 year period to quickly bring inflation back down to Earth. In the event of an extended period of elevated rates, MAC would have to refinance its debt at substantially higher interest rates upon maturity, regardless of its status as fixed or variable rate debt. This scenario would also likely increase cap rates for the underlying real estate, negatively affecting the company’s valuation.

However, this would be trouble for all REITs, and for the broader market with a more long-lasting elevated risk-free rate.

A final word

I hope to continue providing my investment ideas to Seeking Alpha readers, including more opportunities in companies trading at deep discounts to liquidation value. Best of luck in your investing endeavors.

Be the first to comment