Devonyu

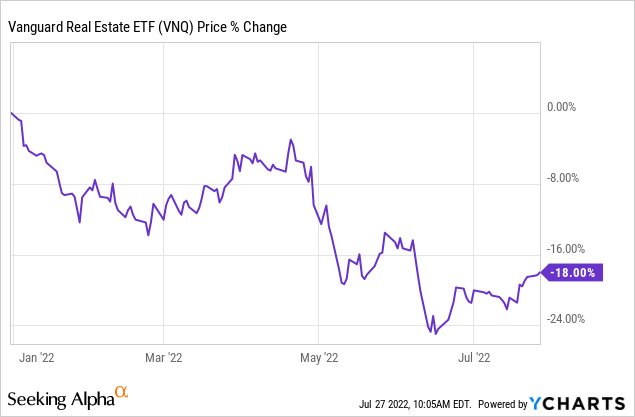

REITs have sold off heavily this year. On average, they are down by nearly 20% as represented by the Vanguard Real Estate ETF (VNQ):

But some REITs are down a lot more than others.

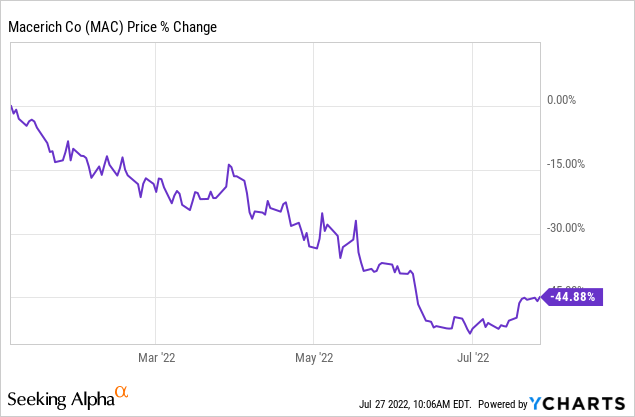

Macerich (NYSE:MAC) is down among the most, losing nearly half of its value since January:

Normally, when a REIT drops so much in such a short amount of time, it is because the company has probably released some very concerning results and also cut or eliminated its dividend.

But in this case, the opposite is true.

The company has beat expectations by a wide margin, increased its guidance for the full year, and management noted that its malls are now doing better than ever before:

We are pleased to report another outstanding quarter, with virtually all our operating metrics trending very positively. Retailer demand is at a level we have not seen since 2015. Tenant sales per square foot… came in at an all-time high of $843 per square foot.

Some of the quarterly highlights included occupancy at quarter end of 91.3%. That’s a 280-basis-point improvement from a year ago.

Many retailers have strengthened their balance sheets and are financially in a much better position to expand their store openings than they were pre-COVID. Bankruptcies are at a record low. The combination of all these positive factors have us very optimistic about ’22 and ’23. We continue to expect significant gains in occupancy, net operating income and cash flow through the remainder of this year and into next year.

So why has it dropped so much?

In short, MAC is a heavily leveraged mall REIT, and the market fears that we are headed into a recession.

Malls are perceived to be highly cyclical and when you add the threat of a recession and high leverage, it may seem like the MAC is headed for disaster.

Macerich

But it is not quite that simple, and besides, there has also been some very good news that appears to have been ignored by the markets.

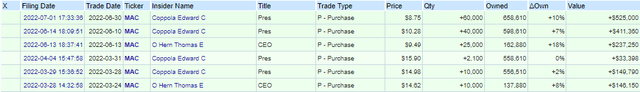

The President and the CEO of the company have been buying shares for the first time in 2 years, and the purchases have been quite significant.

In June, the President, Coppola Edward C. bought 100k shares for nearly $1 million. Earlier this year in May, he also bought 12.1k shares for nearly $200,000. It appears that he made much more aggressive additions after the share price dropped from $15 to below $10.

Similarly, the CEO bought about $150,000 worth of shares in March and then bought another ~$250,000 last month after the share price dipped below $10 per share.

I see this as very good news in the case of MAC because insider buying has been rare over the past years and these purchases are quite significant and coincide with the recent drop in share price.

But I would never buy something just because insiders are buying it. Being a company insider does not mean that you are a good investor and there may be some other reason why insiders are buying their stocks.

But in this case, I side with the insiders and think that the 50% drop in share price is a great buying opportunity.

That’s because Class A malls, such as those owned by MAC, are not nearly as cyclical as the REIT market appears to be, especially not today. Beyond that, MAC’s balance sheet is today much stronger than it was just a year ago and it is rapidly getting stronger.

Let’s start by discussing the cyclicality of malls:

Today, occupancy rates are still at a historic low as we emerge from the pandemic, but their tenant sales have already recovered to new record highs, tenant bankruptcies are at an all-time low, and retailer demand is at a level not seen since 2015.

How could that be? Aren’t malls dying from the growth of e-commerce?

Well, some are, but this actually benefits MAC since it owns the highest-quality malls in the nation. As weaker malls die, the strong ones get even stronger since traffic is consolidated towards them. Moreover, increasingly many retailers are consolidating their shops to the best malls as they adapt to the new omnichannel world. Finally, even digital native retailers are now opening new stores at Class A malls as it helps them increase sales, reduce costs, solve logistical issues, and boost brand recognition.

So yes, malls rely on discretionary spending and they are somewhat cyclical as a result, but the highest quality malls are not as cyclical as implied by MAC’s recent share price performance.

MAC is not a retailer. It is a REIT that earns steady rental income from leasing its high-quality malls and right now, there happens to be a lot of demand for high-quality retail space as consumers want to go and have fun in the post-COVID world and retailers rethink their footprint to refocus on the highest-quality malls.

Could leasing slow down a bit? It sure could. But recessions typically only last 1-2 years and retailers think long-term. Now they have an opportunity to lease space at MAC’s high-quality malls while their occupancy rate is still at a historic low.

Macerich Macerich

And then let’s also discuss MAC’s balance sheet.

It is a lot weaker than that its close peer, Simon Property Group (SPG), but it is now a lot stronger than just a year ago, and importantly, it is rapidly getting stronger.

Here’s what the management noted on the most recent conference call:

We continue to believe our financing pipeline is very manageable.

As a reminder, through 2023, our assets with maturing debt include some very high-performing and underleveraged assets, and those include assets like Scottsdale Fashion Square, Green Acres Mall, Green Acres Commons and Tysons Corner. In fact, we believe those assets alone could produce between $350 million to $400 million of excess liquidity and proceeds over and above the maturing loans. We look forward to reporting our continued progress on further refinancing and extension activity as the year progresses.

Including undrawn capacity of $424 million on our revolving line of credit, we have approximately $628 million of liquidity today. Debt service coverage, which for some reason does not get nearly the amount of focus that it should, stands at a healthy 2.7x. Net debt to forward EBITDA, excluding leasing costs at the end of the quarter was 8.7x. And let’s bear in mind the substantial progress that we’ve made in just 5 quarters alone is this metric has been reduced by almost 3 full turns from the mid-11s at the end of 2020 down to where we stand today. With an expected roughly $235 million of free cash flow after dividend and recurring CapEx in 2022, and given our expectation of operating cash flow and NOI growth, we continue to make great progress toward our longer range goal of 7 to 7.5 net debt to forward EBITDA.

So MAC actually isn’t that far from its long-term leverage target anymore.

It has plenty of free cash flow after its dividend to keep paying off debt and it also has some opportunities to unlock additional cash via pad sales in its portfolio. As its occupancy rate recovers, its leverage will also naturally come down. Remember that the current leverage metrics are based on historically low occupancy coming out of the pandemic.

MAC demonstrated its ability to survive the worst possible crisis ever in 2020 and 2021. Today, its malls are more productive than ever, demonstrating that they are here to stay, and its debt is already down substantially and the company is focused on reducing it further.

Therefore, we are not particularly worried about the solvency of the company at this moment. MAC is a lot riskier than most REITs (high-risk rating) but does its fundamental performance warrant a 50% drop in share price?

I don’t think so.

In the most recent investor presentation, the management noted that its share price is trading at an “extremely discounted valuation.” This was published when the share price was $12 per share and it has dropped another 20% since then:

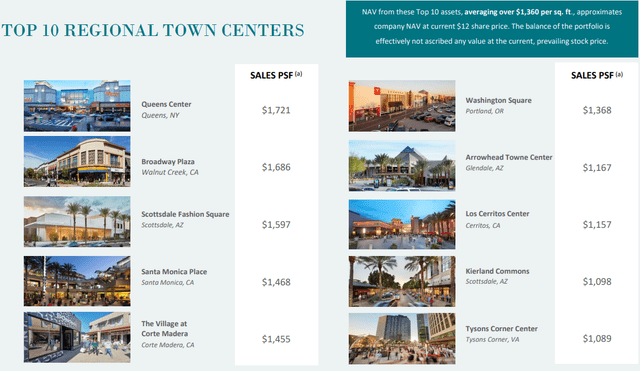

The management also noted that the NAV of its top 10 properties approximates $12 per share so you are essentially getting its 34 other properties for free, and a healthy 20% discount on its top assets:

We estimate that the company is currently priced at about 4x its normalized FFO per share run rate.

As MAC continues to fortify its balance sheet and it demonstrates the resilience of its assets in a coming recession, we expect its valuation multiple to double or triple in the coming years.

MAC’s portfolio of high-quality malls deserves to trade at a much greater multiple assuming that it can improve its balance sheet.

The management has millions of skin in the game and they have been buying more shares recently. A doubling or tripling of the share price may seem unlikely today, but it really isn’t based on its fundamentals, the current valuation, and the historic trading of the stock.

Not long ago, MAC traded at over $20 per share, and let’s not forget that SPG offered to buy it out at $95 back in 2015. MAC is today very different and we don’t expect it to get there, but could it return to $20-30 per share?

We believe so. While you wait for the upside, you earn a 6% dividend yield and the company continues to pay off debt, creating additional value for shareholders.

Be the first to comment