sandsun/iStock via Getty Images

Macau’s casino industry couldn’t catch a lucky break in the last couple years.

It used to be the world’s biggest. It was so massive, and the second place was much so smaller in comparison that we can’t even call them peer competitors. The gambling revenue of Macau was six times that of Las Vegas as of 2019.

Then, COVID-19 happened, and Macau’s gambling revenue fell nearly 80% over the next 2 years. Today, Macau’s pandemic policies continue to closely mirror Mainland China, which is the world’s most draconian.

On top of this, and with timing that cannot be worse for Macau, China cracked down on the VIP junket business, which was the primary way for rich Chinese whales to move money out of China onto the baccarat tables in Macau casinos… Which also happened to be a big capital flight loophole that China wanted to plug.

This year, Macau’s gambling revenue crashed a further 44% compared to last year, which fell below Las Vegas. The remaining pittance now comprises almost entirely of money from Chinese nationals who are able to get funds out of Mainland China legally (under a limiting quota). There are very few foreigners as the zero-covid policies are still in place, so Macau’s border remains prohibitively difficult to cross for tourists from any foreign country and even from Hong Kong.

Once the gambling capital of the world, Macau is now a shadow of its former self. This situation is reflected in the shares of its 6 casino operators in the form of complete bloodbath.

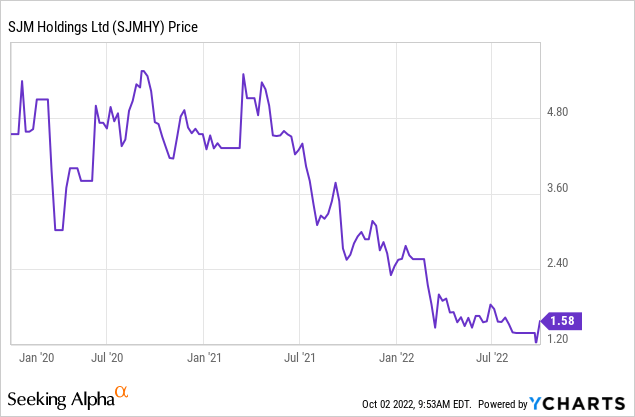

SJM Holdings (OTCPK:SJMHY) – the original casino operator and former monopoly of Macau before their market opened up – saw its shares decline close to 65% since the beginning of 2020.

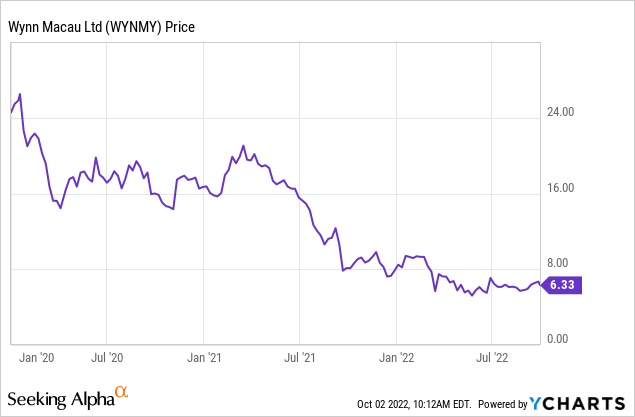

Shares of Wynn Macau (OTCPK:WYNMY) – the Macau-arm of US casino giant Wynn Resorts (WYNN) – collapsed 74% over the same period.

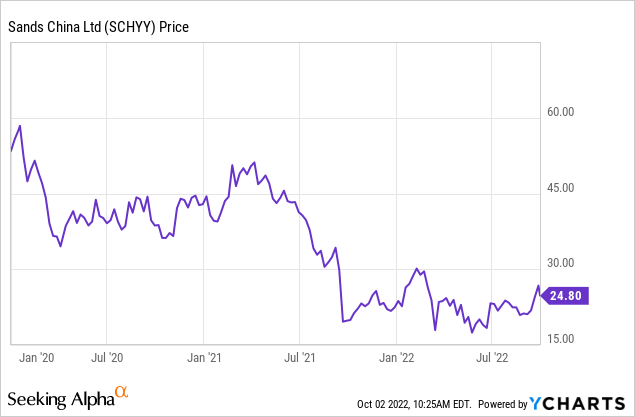

Sands China (OTCPK:SCHYY) – also a subsidiary of a big US player Las Vegas Sands (LVS) – faired a bit better with “only” a 55% decline.

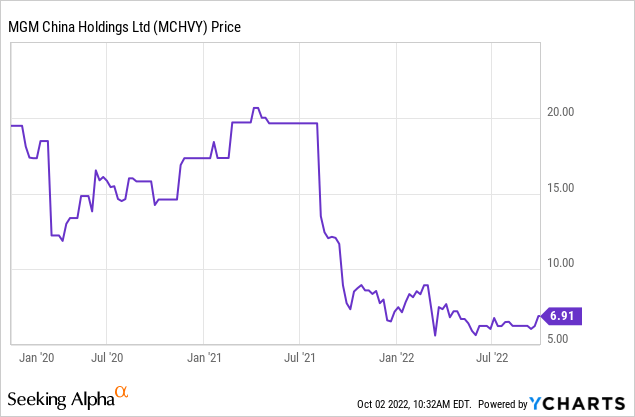

Then we have MGM China (OTCPK:MCHVY) of US’s MGM Resorts (MGM), who is down 64% from 2020.

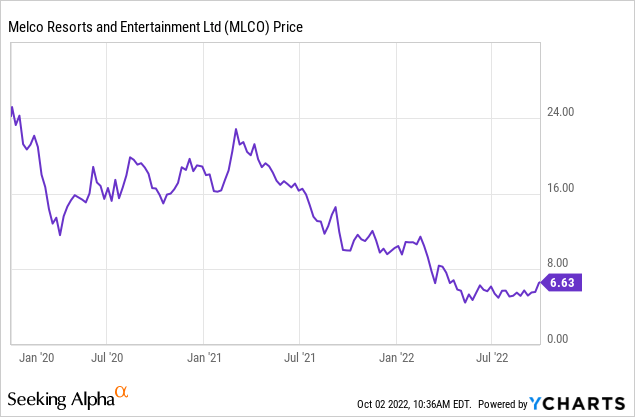

Melco Resorts & Entertainment (MLCO) – based in Hong Kong but listed on NASDAQ – is down a whopping 72%.

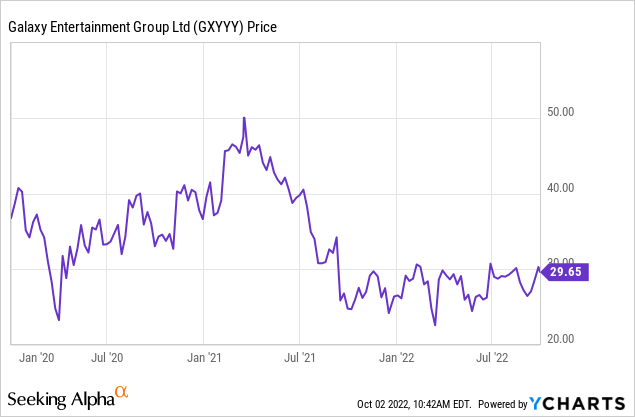

Finally, we have local operator Galaxy Entertainment (OTCPK:GXYYY), who held up well in comparison with only about a 20% decline.

But a turning point might be near as we start to see signs of policy relaxation on COVID-19.

It’s difficult to say for sure which direction China is going and when, as the Chinese Communist Party’s (CCP) decision-making process is famously opaque, but we’re starting to see some tea leaves arranging themselves in a particular pattern that might be constructive for Macau’s gaming industry.

Many commentators are saying that the CCP will probably not make any big drastic moves before the National Congress’s five-yearly meeting on Oct 16. Substantive changes in China, if any, will likely happen after the meeting.

But it was encouraging to see that Hong Kong – another special administrative region under “One Country Two Systems” – was recently able to cancel its hotel quarantine for inbound travelers (with Beijing’s blessing, no less). Every chatter indicates further relaxation of pandemic rules will be expected in Hong Kong over the coming weeks.

Now, it would be naive to expect Macau to follow Hong Kong’s suit. As mentioned earlier, Macau’s comatose economy depends solely on Mainland gamblers to keep it alive (unlike Hong Kong, whose economy still very much depends on international finance and travelers). Any relaxation of international borders will put Macau in conflict with China’s zero-covid policy and jeopardize the free-flow of people from Mainland.

So Macau can’t really open up until China opens up… On that front, there’s a bit of encouraging sign. As recently as last Saturday, Xi Jinping and other senior leaders went face-commando at a gathering during the National Day celebration. This is in contrast to just a week before, where Xi and senior leaders all wore masks during another major event on September 27th. Speculative? Definitely, but encouraging nonetheless.

Another upcoming catalyst is the renewal of the gambling licenses in December.

Here we have a bit of a Russian roulette situation. The gambling concessions for all 6 casino operators in Macau expire this year, so they must all renew. But there is an additional unexpected bid from a newcomer which threw a wrench into all of the Macau casino execs’ best-laid plans, as now there are 7 operators bidding for 6 available spots.

The newcomer is a firm related to Malaysia’s Genting Group – a giant operator of casinos, cruises, and resorts in the Southeast Asia region, usually going by the Resorts World brand.

Most analysts expect that the concessions will go to one of the 6 incumbents, given their experience with the city and how much they have invested there already. I beg to differ – I feel there is a better than even chance that one of the existing US operators may not make the cut.

The current geopolitical situation between US and China is just too volatile to assume China will let Americans keep all existing 3 of the 6 gambling concessions in Macau. I believe there is a significant risk that one of them will be cut to make room for Genting for some diversification from China’s perspective. The loser may need to liquidate their properties in Macau at fire-sale prices.

Moreover, the government intends to diversify into mass market, broad-based, non-gambling tourism, which Genting is a good fit for. For example, Macau wanted to build theme parks – none of the existing operators took them up on the plan, but Genting has indicated interest.

Regardless, we will know which companies win the bids by the beginning of December of this year, which should remove a cloud of uncertainty and boost the stocks of all the players – except for the loser.

The takeaway is that it’s too difficult to pick winners among the 3 US operators in Macau.

We can debate merits among Wynn, Sands, and MGM all day, but the risk/reward is just not there as the penalty for being wrong on their Macau entities (not their parent companies in US) is that they could go to zero.

For the US operators that do remain, there is also a possible risk that China will force terms on them that may be viewed as unfair, drastically less profitable, or requiring exorbitant capital expenditure.

The 3 incumbent local operators are unlikely to be cut given their Chinese/Hong Kong ownership structure – barring somebody there saying something very stupid or getting into political trouble with the CCP between now and December.

Of those 3, Morgan Stanley analysts consider SJM to have the weakest balance sheet; Galaxy is richly valued at 16x EV/EBITDA (per MS’s estimate) – not surprising as their stock fell the least over the last few years; and Melco has the fairest valuation after a 72% decline in stock price since 2020.

However, we should take any analyst’s fundamental analysis for Macau’s gaming industry with a grain of salt at this point – the landscape has fundamentally changed since the last time they were profitable in 2019. Not only is the end of zero-covid uncertain, they also have to deal with the loss of customers from VIP junkets, and the impact from a set of revamped regulations with an emphasis on more family-oriented, mass-market activities. What is considered “normal” has changed, and will completely change again in a few months – any analyst estimate of how the economics will look even 1 year from now is highly imprecise.

That said, an operator stands out with the best risk/reward – Melco Resorts and Entertainment. It is local majority owned, reasonably valued, and its shares have better liquidity than the rest as it is the only Macau pureplay listed on NASDAQ (they have some revenues from the Philippines and Cyprus, but mostly from Macau). In addition, being US-listed, they are collaborating US auditors on audit inspections, which should further enhance US investors’ comfort relative to the other 5 companies.

Bold investors may want to start a small speculative position in Melco at these prices, as there is potential for significant return when some of the catalysts mentioned in this article actualize.

Be the first to comment