DINphotogallery

About To Enter The Final Earnings Season

We are going into the dreaded final earnings season of this calendar year, dreaded as we expect to begin observing the real impact from a global economy beginning to suffer from reduced consumer sentiment, while also being exposed to company specific forward guidances extending into the greatest macro uncertainty in a long while. Additionally, in this particular instance, we are dealing with a company who is also exposed to the energy crisis ongoing in Europe. During the latest earnings call, management was questioned on the topic, and pinned out, how based on last year’s revenue, only just above 10% of total revenue remained exposed to the energy uncertainty in Europe, due to revenue stemming from Germany and Italy.

LyondellBasell Industries N.V (NYSE:LYB) is expected to report Q3-2022 earnings on October 28th, but having already received 15 downwards EPS revisions during the last quarter, with only a single upwards revision, most of the downside risk at the current level is supposedly considered at this point. As a consequence, the stock is also down more than 30% from its most recent high, which was secured in early June.

Seeking Alpha Earnings Summary (Seeking Alpha)

As can be seen in the earnings history, LyondellBasell has a history of showing substantial deviations from the consensus estimates when it comes to its revenue. Being a provider of commodity chemicals and products, the company remains exposed to volatility on both input and output parameters in terms of underlying prices for refined oil- and plastic material prices. As such, the company has a tendency to under- or overshoot significantly, with the current trend being an ability to overshoot due to benefitting from an expansion in margins and output parameter. However, as is rather evident from the earnings history, the goods or bad times never last before the company finds itself in the opposite ditch.

As always with the stock market, it is forward looking, while reported earnings represent historical results. Therefore, the market will pay greater attention to the forward guidance than the immediate performance during a previous quarter. With that in mind, we may be about to witness management talking into the macro uncertainty, and if not during this quarterly performance, then I’d expect it to happen at the next earnings call during Q1 in 2023 (reporting Q4-2022), in conjunction with presenting the full year results. Having delivered strong earnings in recent quarters, the company will inevitably come up against a tough comparison baseline during 2023.

This expected development is also evident in the forward-looking expectations for Q1-23 and Q2-23 with an expected 28.9% and 34.5% YoY decline in EPS.

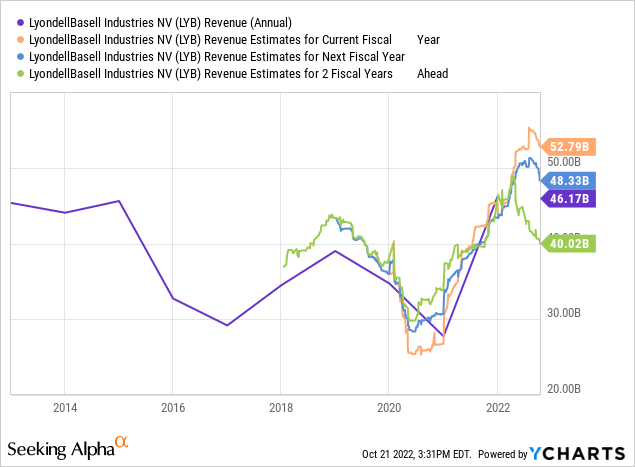

If we observe revenue in an extended period, the cyclicality becomes very evident and combining that with the forward estimates for both 2023 and 2024, we observe there is an estimated peak forming the coming years. Revenue estimates two years into the future are naturally highly uncertain, but it’s also a fact that revenue is coming in higher during these years, than any other time in the previous decade. Management has expanded the asset base over the recent decade, but not to the same tune as the peak we see forming these years in terms of revenue.

I’ve previously covered this company a couple of times, and I’m long the stock myself, but it’s also worth revisiting the company at times like these, where an earnings peak appears to be forming.

Consensus Estimates

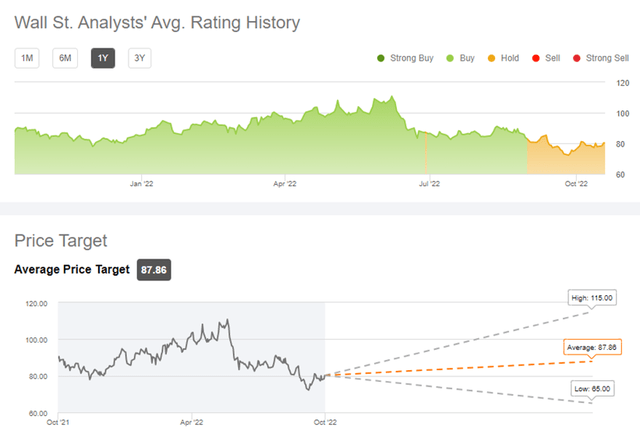

The last time around when I covered this company, back in October 2021, the Wall Street consensus one-year price estimates stood at $120 per share, something I heartedly disagreed with, as I believed the stock was worth acquiring at no higher than $90 per share, but preferably lower, with my own average share price coming in at $77.3. To my astonishment, the stock made it all the way to $112 per share when it peaked in June this year, having since seen its stock price crumble fast all the way back to roughly $80 per share.

Wall Street Consensus Price Targets (Seeking Alpha)

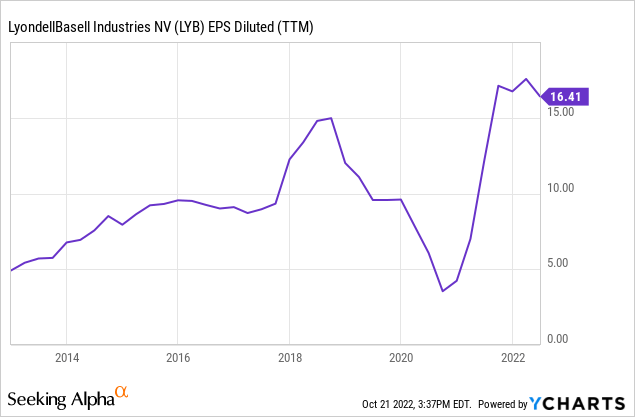

As can be seen from the illustration above, the consensus one-year estimates have changed a lot since October last year. This is a direct consequence of Wall Street expecting the earnings outlook to contract for LyondellBasell, but as the funnel shows, there is a great spread between the lowest and highest one-year estimates. Looking a couple of years ahead, and LyondellBasell is expected to showcase a totally different performance with a substantially reduced top line and if we observe the EPS over the past decade, it’s never been higher than right now.

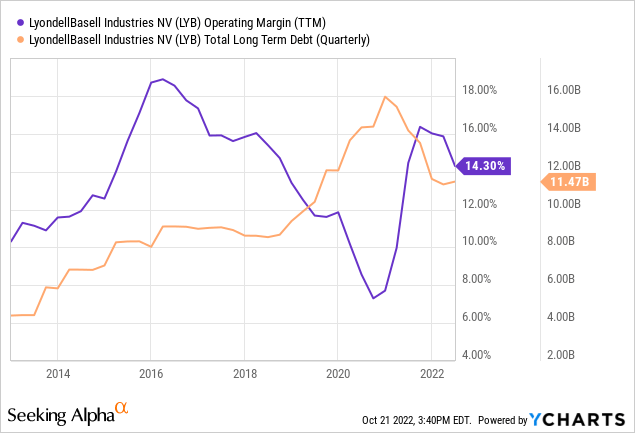

What I’m most interested in, is to understand the potential downside from here. Given the economic conditions, I’m primarily interested in understanding the debt burden as rising interest rates can cause havoc on earnings in situations where a company is straddled with debt, having to refinance a substantial amount of debt at much higher interest rates. Especially if that given company shows great volatility in earnings or comes with a low operating margin, meaning the rising interest rate expenses have a relatively higher impact on the bottom line.

Understanding The Potential Downside From An Income- & Balance Sheet Perspective

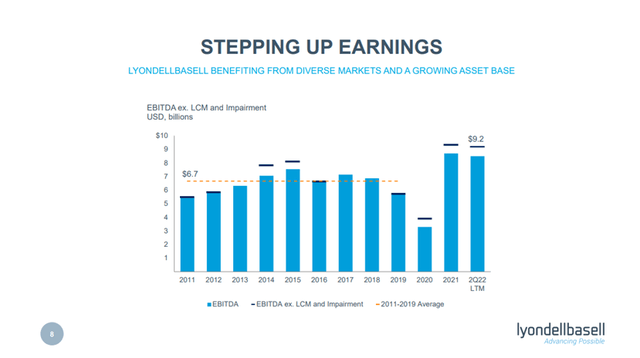

Right now, during this and the previous quarters, LyondellBasell is delivering a strong performance, as also evident from the Q2-22 quarterly statement. The business has for some time been benefitting from an expansion in margins causing a surge in profitability and cash generation, which is also the reason why shareholders received an additional dividend earlier this year. FY2021 the company reported $5.6 billion in net income, compared to $1.4 billion in 2020 and $3.4 billion in 2019

LyondellBasell Earnings Development (LyondellBasell Q2-2022 Quarterly Reporting)

Year to date, the company has continued the strong performance showcased in 2021, but as we also saw earlier, this isn’t expected to last. We often see this expected mean reversion, as good times never stick around forever. Perhaps they will last longer than we expect today, but the market will start pricing the company according to an outlook matching a reversion to the mean, and continue doing so, even if the good times last a little longer than expected. We’ve also witnessed this within shipping this year, where companies have looked incredibly cheap on for instance price to earnings multiples. Similarly, we can begin to witness such a scenario here, as I’ve already showed the significant volatility in earnings over just a couple of years.

The vulnerability will start to show itself within a contracting income structure, and here it’s interesting to then have a look at the debt burden carried by the company. It’s often seen that companies utilise the good times to take on substantial debt, only for that increased debt to become a burden once earnings contract, requiring a larger part of earnings allocated to containing the debt, limiting the flexibility of its operations and potentially causing a need to downsize the business in order to level the ship, which would represent a worst-case scenario.

As with many other companies, LyondellBasell has utilised the low interest rate environment to take on debt, facilitating an opportunity to invest in the business, but fortunately, management has also made use of the supernormal profits to not only line the pockets of shareholders, but also cut the peak off the debt burden. As a shareholder, I believe that’s the right prioritisation, not least because of the aforementioned potential EPS peak.

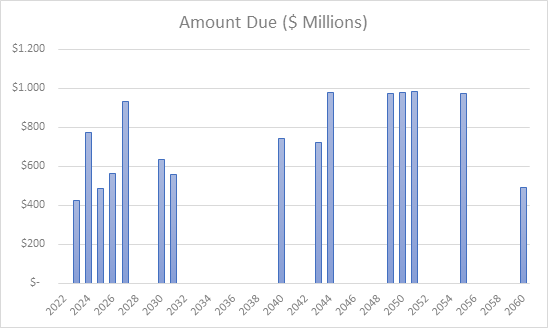

If we dive into the company 10-K, end of FY2021 showed a long-term debt position of $11.2 billion (p. 90). I’ve inserted the total debt position combined with individual due dates, in the table below, to provide a visual illustration of how LyondellBasell may be exposed to a need for refinancing in the coming years.

LyondellBasell Total Debt Development (Authors Own Creation From Company 10-K)

The notes which are due from 2030 and beyond, are primarily financed with an interest rate between 2.2% and 4.2%. The notes due prior to 2030, come in at a total of $3.17 billion with rates as low as 0.8% but also as high as 5.75%, expect for a single outlier with a rate of 8.1%, which is considered negligible as it represents less than 10% of the total burden due prior to 2030. This information stems all the way back to the early days of this calendar year, but if we look at the recent quarterly reporting, we can see that long-term debt currently stands at $11.06 billion, meaning little to no change has occurred.

My main concern, being at the peak of an earnings cycle, was that LyondellBasell could be hit by a double whammy, from both reduced margins in general, as well as a need to refinance a substantial amount of debt in coming years, causing an upwards spike in interest rate related expenses, due to the higher interest rate environment today, compared to a year ago.

LyondellBasell have provided shareholders with an extraordinary dividend payment this year, meaning the cash available on the balance sheet is currently lower than the typical average. However, management would only do so, if confident the business could generate sufficient cash to meet its obligations, and having benefitted from strong cash generation, and still doing so, management should have ample opportunity to ensure the company will land at a sustainable debt level, with little impact on the income statement from the potential need for refinancing.

As a shareholder, I’m pleased to know the company should experience little balance sheet stress over the coming years, as that type of uncertainty can be very unpleasant for the market cap. My expectation is that management might refinance some of the burden due prior to 2030 if cash is better used for investments, but that due to the strong cash generation, that management will simply pay down the debt for a large chunk of then notes due in coming years, as to avoid having to refinance at significantly higher rates. LyondellBasell is led by Peter Vanacker, and while new to the company, he has an extensive career within the industry, meaning that him and the management team has witnessed these expansions and contractions before, giving me ease of mind that they know when to keep the cash in the pocket and when not to.

Valuation

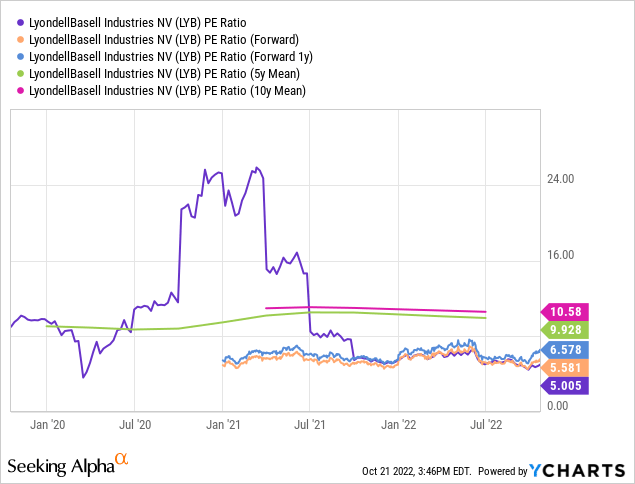

Being a mature and stable company, the price to earnings multiple is of relevance when observing LyondellBasell. However, we also have to consider how depreciations impact earnings accounting wise, and therefore, the price to earnings multiple shouldn’t be allowed to stand on its own.

Observing the P/E multiple, and we can see that LyondellBasell immediately appears to be trading at a discount, as its current and future P/E ratio indicates a valuation well below the long-term mean. However, if we simply observe the P/E ratio over the past ten years, it becomes evident that Mr. market has consistently pushed the P/E ratio ever lower. This means, that while LyondellBasell rarely has been as cheap as it is today in the past decade, that I’d be doubtful of the market participants accepting the valuation should return all the way to its former mean.

Considering there is no immediate potential balance sheet stress, it could be justified the company traded at a higher valuation when considered from a first glance, as it can make do with contracting earnings for a period. However, this is where we witness the uncertainty tied to earnings, given that if earnings decline more than currently expected, it will elevate the forward P/E ratio. We saw earlier, how a lot of negativity is already baked into the forward EPS, raising the question of how much worse it can get outside of a major recession.

Here we also have to factor in, that LyondellBasell plays a role in the energy value chain, including limited exposure to the messy European energy market during these unfortunate times. This inevitably dampens valuations prospects to some degree.

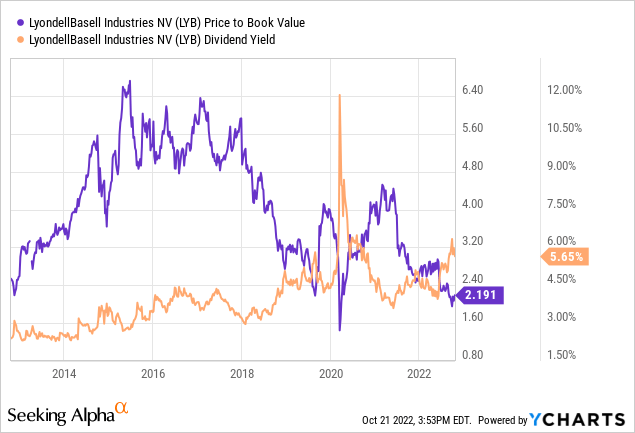

Two other ways of observing the valuation, would be through the price to book multiple, indicating that LyondellBasell is trading at a low. The yield is also currently at a high point, compared to where it’s traditionally traded.

Typically, I’d also consider such a company from a free cash flow standpoint, but with cash flows being at peak levels, I find it less meaningful to consider for this specific scenario.

Concluding Thoughts

LyondellBasell has enjoyed a strong couple of years and earnings are expected to cool in the coming quarters and years, putting pressure on the stock price, similarly to the rest of the market. Management has not resorted to empire building during the good times, but instead deleveraged aggressively, securing a healthy balance sheet with a Debt/EBITDA ratio well below 2. Management paid a special dividend to shareholders earlier this year, and wouldn’t have done so, if the balance sheet couldn’t withstand it.

Earnings are peaking and so is the cash conversion, meaning investors must accept a declining EPS going forward. The company has paid a growing dividend for the past eight years, currently providing a forward yield of 6%, meaning it requires only a small stock price appreciation to provide returns similarly to the long-term market averages, which is what I believe is fair when operating in the basic materials sector. On top, the company is defensive in nature, playing a critical role as producer of essential industrial input materials, sitting on top of a well-diversified portfolio.

The company is generation more cash now, than it will in the coming years, with free cash flow expected to decline in 2023, meaning the effective payout ratio is difficult to estimate, however I don’t believe the dividend is at risk given the healthy status of the balance sheet as well as special dividend issued earlier this year.

I stick by my observation a year ago, that I prefer to add below $80 per share, but that I find it acceptable to add in the $80-$90 per share range. Given how the market is currently behaving, we know that unclear communication or potentially weak guidance comes with a punishment, so I would only nibble going into the earnings, and instead await the outcome.

Be the first to comment