Bim

Thesis

Leading chemicals player LyondellBasell Industries (NYSE:LYB) stock remains close to its July lows after plunging about 30% from its May highs. We believe this de-rating is justified as LYB’s valuation was not attractive at those highs, given potentially falling revenue growth through FY24.

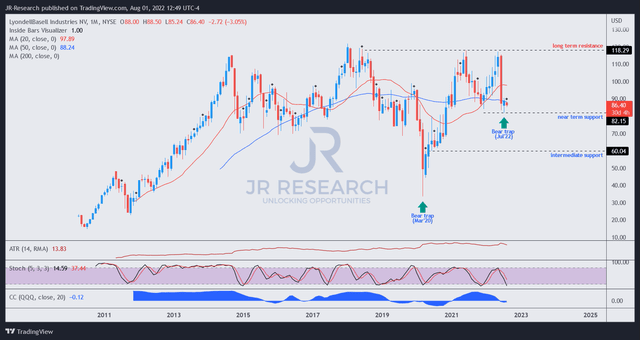

Furthermore, LYB traded close to its long-term resistance levels at its May highs; therefore, we were not surprised to observe significant selling pressure.

Notwithstanding, we observed a near-term bottom that may offer an attractive mean-reversion opportunity for a directionally-bullish set-up for investors/traders.

Our valuation model suggests a much-improved valuation that could support a market-perform return (adjusted for dividends) over the next four years. Coupled with its constructive price action, we encourage investors to capitalize on its near-term downside volatility to add exposure.

Accordingly, we rate LYB as a Buy, with a medium-term price target (PT) of $100.

Q2 Results Demonstrate The Resilience Of Its Well-Diversified Operating Model

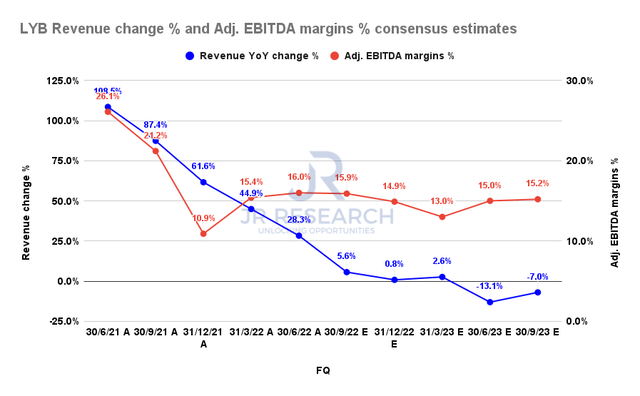

LYB revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

LYB reported revenue growth of 28.3% in FQ2, down from FQ1’s 44.9%. However, its adjusted EBITDA margins remain resilient, despite also getting hit by ongoing cost headwinds and reduced demand, given worsening macros, particularly in Europe. CEO Peter Vanacker highlighted (edited):

LyondellBasell’s global portfolio of businesses delivered strong earnings and cash generation driven by record results from our Intermediates & Derivatives segment and exceptional refining margins. While North American demand for products used in consumer packaging end markets remained strong, the company’s volumes in Europe decreased due to downtime at the cracker in France and moderating regional demand near the end of the quarter. In China, markets remained weak due to zero-COVID measures and logistical challenges. Advanced Polymer Solutions results continued to be hindered by automotive production constraints. (LYB Q2 release)

Furthermore, the consensus estimates (bullish) continue to see headwinds that could impact its revenue growth through FY23. However, its margins are still expected to be robust, helping LYB to undergird its valuations.

However, management remains cautious over its near-term margins, as macro headwinds (heightened costs for feedstocks and energy) could continue to impinge on its near-term profitability. However, we believe such headwinds are transitory and should mitigate some of those pressures as they moderate in the face of a looming recession.

LYB’s Valuation and Price Action Is Constructive

Notwithstanding, LYB is also not immune to an economic downturn, despite owning a profitable and well-diversified operating model. As a result, we believe the market de-rated LYB in May, even though it traded at a FY25 free cash flow (FCF) yield of about 13%. We believe the market has been asking for higher yields to compensate for the inherent cyclical risks of holding LYB through a potential recession.

As a result of the 30% hammering, LYB’s FY25 FCF yields have improved to nearly 19% at its July lows with an NTM dividend yield of 5.22%.

We modeled LYB with a market-perform rating (adjusted for dividends) and believe that it should be able to meet our blended hurdle rate of 10%. Therefore, LYB’s valuation also seems attractive.

LYB price chart (monthly) (TradingView)

Furthermore, we also observed a potential bear trap (indicating the market decisively denied further selling downside) on its long-term chart at its July lows.

Coupled with LYB’s reasonable valuation, we believe it lends further credence to our price action thesis that LYB should be able to hold its July bottom resiliently.

Is LYB Stock A Buy, Sell, Or Hold?

We rate LYB as a Buy, with a medium-term PT of $100.

The 30% hammering in June sent LYB into attractive valuation zones and formed a bullish reversal signal on its long-term chart.

Therefore, we encourage investors to leverage the short-term downside volatility to add exposure and partake in a potential mean-reversion opportunity back up.

Be the first to comment