jetcityimage

While Lyft (NASDAQ:LYFT) has fallen to all-time lows, the company has actually started producing solid financial results. The transportation network has returned to pre-covid financial peaks, yet the company is being questioning on solvency providing a clear opportunity for the long term. My investment thesis is Bullish on the strong prospects of the already highly profitable business.

Pre-Covid Peaks

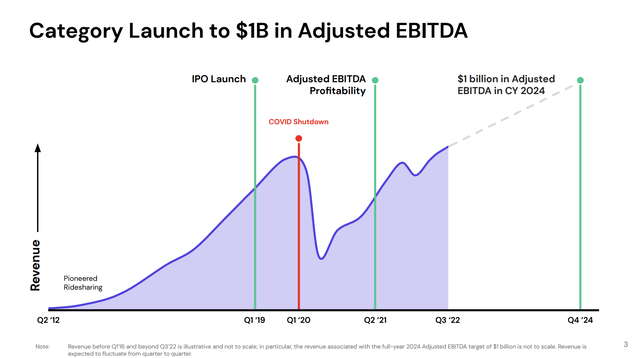

Lyft reported Q3’22 adjusted EBITDA of $66 million and guided to between $80 to $100 million of positive EBITDA in Q4. The transportation platform is starting to deliver solid EBITDA profits, but the market completely ignored this progress by selling off the cheap stock following earnings.

As the below chart highlights, Lyft has already topped the EBITDA profits of 2019. The company has a plan to reach $1 billion in adjusted EBITDA by 2024, which is only 2 years from now.

Source: Lyft Dec. ’22 presentation

A lot of investors don’t appear to understand the adjusted EBITDA figure any more. The non-GAAP financial measure is a way to strip out non-cash charges like stock-based compensation and any one-time charges impacting the ability to compare financial numbers for a corporation.

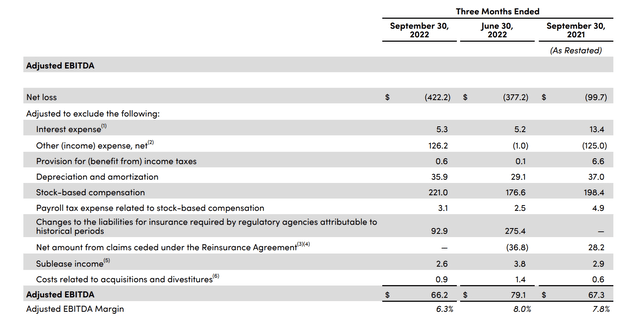

Anyone looking at the Q3’22 GAAP loss of Lyft might conclude a dour view for the company. The transportation network lost a whopping $422 million in the quarter, but the loss is vastly overstated considering the adjusted EBITDA profits.

The primary issue is stock-based compensation amounting to $221 million in the quarter. Whether or not one includes SBC in expenses, the non-cash amount clearly doesn’t impact bankruptcy risk and the issuance of stock options can actually provide a boost to cash as the company collects the exercise price. The secondary issue is the $135 million impairment charge for an equity investment. Again, an investor in a company like Lyft should want a financial measure focused on the operations of the business, not this one-time investment loss.

Source: Lyft Q3’22 earnings release

The major adjustment to EBITDA that has significance is the $93 million charge for insurance liabilities from October 2018 and September 2021. Insurance is a problem for Lyft including an $82 million additional charge during Q4 for the new insurance policy starting on October 1, though the company forecasts the shift from a fuel surcharge to a service charge won’t impact rider costs.

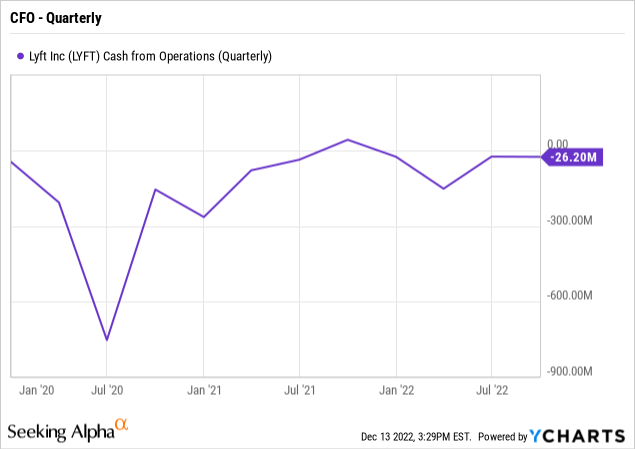

The biggest issue with Lyft is the cash flow situation. While Lyft has a case for why investors should view the profit picture based on the adjusted EBITDA number, the company still has negative operating cash flow in Q3’22 at $26 million.

The transportation network burned $178 million in the 1H of the year, so the Q3’22 numbers were a huge step forward. For investors to really care about EBITDA, the numbers have to start correlating with positive cash flows.

Again, Lyft guided to Q4’22 adjusted EBITDA of ~$90 million for an 8% margin. The company has to generate positive cash flows off what amounts to major positive EBITDA on revenues of $1.155 billion.

Either way, a company with $1.8 billion in cash and short-term investments along with another $1.0 billion in restricted investments isn’t going to just file for bankruptcy with such limited cash burn.

Real Value

The real question is where the stock should trade based on the improving financials of the company. A company with $1 billion in adjusted EBITDA and $700 million in positive free cash flow in 2024 would have an equity valuation far above the current level of just $4.2 billion.

A company forecast with 10% to 15% revenue growth and strong leverage forecast for adjusted EBITDA to grow from $290 million in 2022 to $1 billion in 2024, the stock would easily trade at 15x to 20x EBITDA targets. The stock would have substantial multiple expansion from 4x 2024 EBITDA targets to a 15x+ target.

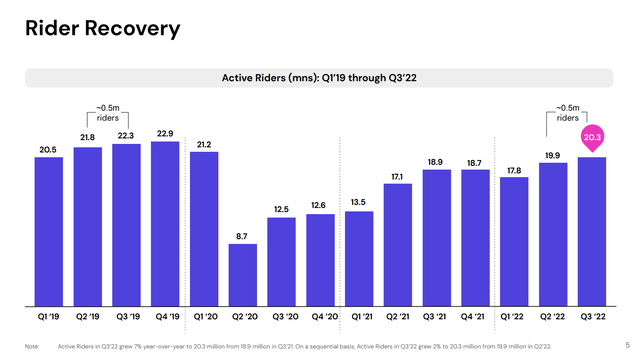

The business hasn’t even returned to pre-covid rider levels with only 20.3 million riders in Q3. Lyft has already reached record revenues at $1.054 billion in Q3’22 due to much higher revenue per active rider at $51.88, up from a Q1’20 peak of $45.06. The long-term prospects are that AVs will drive additional riders to the service and lower costs for the industry.

Source: Lyft November ’22 presentation

Of course, Lyft still has to prove the company can triple EBITDA in just 2 years. Plus, multiple quarters of positive operating cash flow will change the negative view sending the stock to only $11 here.

Takeaway

The key investor takeaway is that Lyft appears set for a very profitable future bolstered by a cash balance of $1.8 billion. The transportation network ultimately has potential market expansion as AVs are implemented to reduce driver costs.

Investors should use the current weakness to build a position in Lyft.

Be the first to comment