FinkAvenue/iStock Editorial via Getty Images

We recommend investors buy Lyft Inc. (NASDAQ:LYFT) on a potential takeout scenario. Lyft is an online transportation platform that connects riders with drivers. The ride-sharing industry was born to make transportation easy and bring taxi services into the 21 st century. While Uber (UBER)/Lyft are the first movers in this market, the market is highly competitive and fragmented, and the traditional taxi services also began adapting to the threat from Uber/Lyft. Hence, we believe in the USA market, Uber and traditional taxi services will remain dominant, and Lyft will likely suffer. Hence, we expect Lyft to be taken out sooner or later. In the near term, we expect the company’s business to recover from the pandemic lows, but sustaining the growth would be challenging for the company as the USA will likely enter a recession in 2023. Therefore, we expect the market to consolidate with Lyft getting acquired. The acquisition is the best outcome for Lyft investors, in our view.

The company faced a rough road during the pandemic with increased lockdowns and fear of using transportation due to COVID-19. While the pandemic has abated in the US/Canada, the business continues to recover, and the company’s profitability will continue to improve. However, we believe volatile oil prices and the challenging macroeconomic environment, possible new rules with hiring gig workers are increasing costs will impact the business eventually. Lyft derives most of its revenue from North America, where some regulations are enacted. The ride-sharing market is highly competitive, making it difficult to sustain high growth and profits consistently.

In addition to the macroeconomic struggles, we expect Lyft to face increased churn from the Labor Department’s decision, which makes it more difficult to classify gig workers as independent contractors. The Biden administration’s decision aims at protecting individuals who are classified as independent contractors but work as employees with none of the benefits. Lyft is not alone in its struggle with retaining its drivers as independent contractors; other technology platforms, including Uber, are also likely to face the brunt of the proposal. Yet, we believe Lyft is less equipped than its main competitor, Uber, to meet the churn and increasing costs.

We expect Lyft continue to lose momentum to Uber going forward. We believe Lyft would have to expand internationally and provide additional services to compete with Uber. We don’t believe Lyft can keep up with Uber or grow meaningfully within the market under current macroeconomic pressures and as it recovers from pandemic lows. To compete with Uber, Lyft would need to roll out more offerings. Eventually, we expect Lyft to lose drivers as they flock to Uber. Hence, we believe Lyft would need to either invest heavily or sell itself. Since the market is not receptive to growth companies that make losses or do not make sufficient profits, we expect Lyft will likely sell itself. Any acquirer will need to pay a premium to buy Lyft. Therefore, we recommend buying Lyft stock ahead of the likely acquisition.

Classifying drivers as employees is challenging for Lyft and Uber

Lyft runs a multimodal transportation network and relies heavily on riders and drivers. We are not too excited about Lyft’s long-term position as a ride-hailing company in the US and Canada. We expect the company to face increased costs if the Biden Administration’s proposal to classify gig workers as employees goes through. We expect the company to face trouble retaining its active driver growth as it’ll become increasingly expensive to afford drivers. We believe Uber is better positioned given its food delivery business and other businesses that can defray the costs of hiring drivers as employees

Not well equipped as Uber to weather the storm

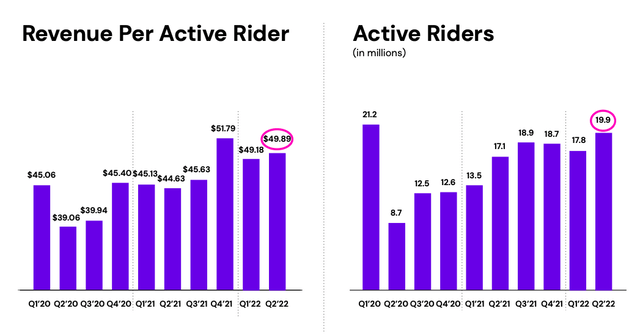

Current macroeconomic challenges are also hitting Lyft hard. While the company did enjoy an increase in active riders over the past quarter, reaching 19.9 million in 2Q22, we believe the increasing oil prices, inflationary pressures, and likely recession in 2023 will further pressure the company’s ride-hailing services. The following graph shows Lyft’s active riders stats in 2Q22.

We’re specifically worried about the macroeconomic impact on Lyft because the company operates in the US and Canada. Lyft has no global revenue streams to rely on or money for international expansion under current situations. We’re more constructive on Lyft’s main competitor, Uber, because we believe the company has the advantage of the worldwide market expansion that Lyft lacks. We expect Uber to gain momentum from Lyft towards 1H23. The unstable macroeconomic environment, inflationary pressures, and rising oil and gas prices leave us less optimistic about Lyft. Hence, Lyft will need to sell itself sooner than later.

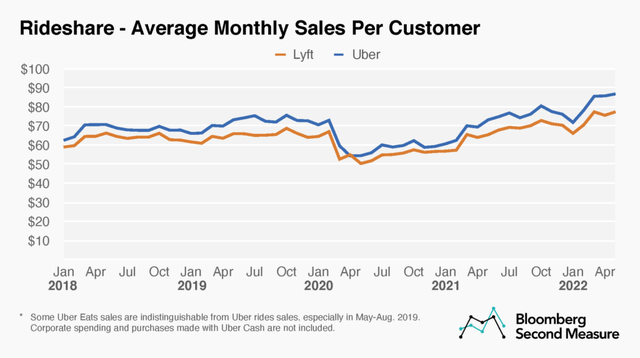

The following graph shows the average monthly sales per customer in rideshares between Uber and Lyft.

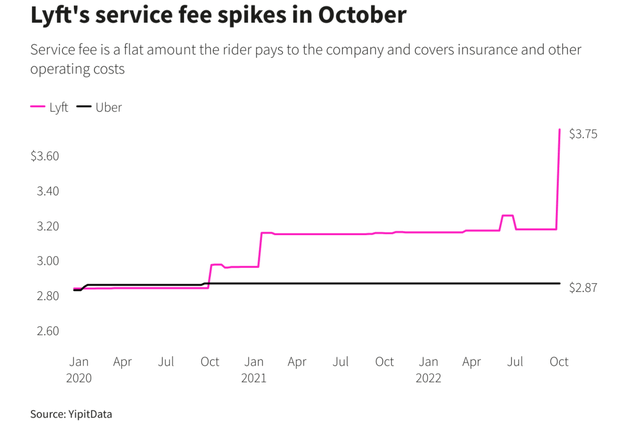

We believe Lyft will have to increase fees to offset the increased expenses from inflationary pressures and escalated oil prices. Indeed, we’ve already seen this unfold as Lyft announced increasing its service fee for rides in its US markets during October. We fear customers may use Uber instead of Lyft as Uber has yet to increase its service fees.

The following graph from YipitData outlines the service fee spike in October.

Stock Performance

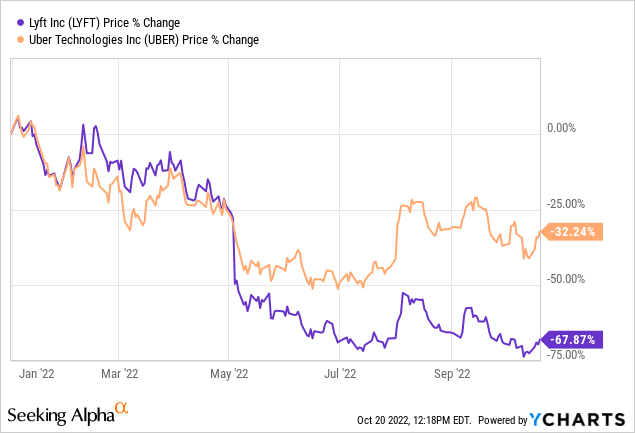

Lyft is down about 68% YTD, and underperforming competitor Uber fell around 32% during the same period. We believe Lyft will continue to face increasing competition from its primary competitor Uber, limiting the company’s growth and stock. We expect Lyft will likely have to sell itself or enter adjacent markets such as delivery to stay relevant. Therefore we recommend investors sell shares of Lyft

The following graph shows the YTD performance of Lyft and Uber stock.

Ycharts

Valuation

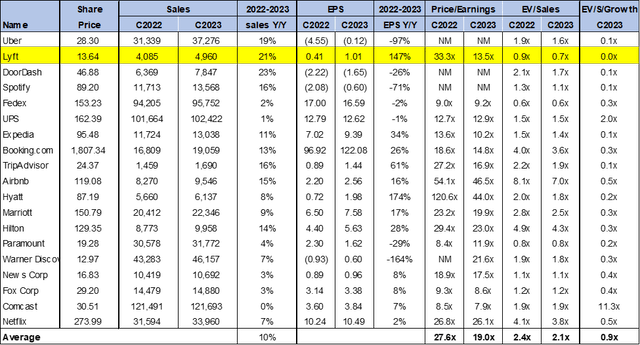

Lyft is relatively cheap. On a P/E basis, Lyft trades around 13x C2023 compared to the peer group at around 19x. On the EV/Sales basis, Lyft is trading 0.7x C2023 versus the peer group average of 2.1x. On an EV/S/Growth basis, Lyft is trading at 0.03x C2023 while the peer group is trading at 0.78x. While Lyft is cheap, we don’t believe it will work meaningfully in the near term and hence strongly recommend against buying fruitless weakness. Lyft will remain a trading stock and is not a long-term investment. Lyft remains a pure-play ride-sharing company and is slowly losing momentum to Uber and the traditional taxi service. It is better to stay away from Lyft.

The following chart illustrates LYFT’s valuation relative to its peer group.

Word on Wall Street

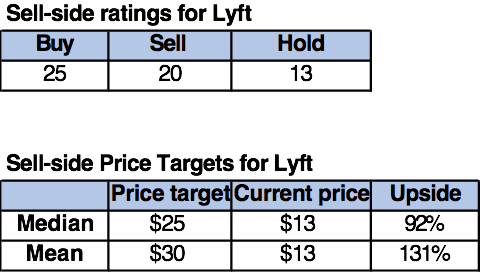

Of the 58 sell-side analysts covering the stock, 25 are buy-rated, 13 are hold-rated, and 20 are sell-rated. Lyft is currently trading at around $13. Median and mean sell-side price targets are $25 and $30, respectively, with a potential upside of 92-131%. The following charts illustrate the sell-side ratings and price targets for Lyft.

Refinitiv & Techstockpros

What to do with the stock

We are bearish/neutral on Lyft’s long-term prospects as Lyft continues to lose momentum to Uber. Lyft will remain an also-ran in the US and Canada, with most of the momentum residing with Uber. At some point, we expect Lyft to sell itself or would need to expand to newer countries. We believe Lyft is losing market momentum and are more constructive on Uber. Lyft’s recent quarter shows a mild recovery from pandemic lows with improved ride volumes. Yet, we believe Lyft is currently facing two battles as it recovers from the pandemic: the macroeconomic environment and the new Labor Department proposal. We don’t believe Lyft is well-equipped to face these challenges. We don’t see a favorable-risk reward profile in Lyft at current levels and recommend investors stay on the sidelines.

Be the first to comment