cookelma/iStock via Getty Images

Investment Thesis

I believe that Lumentum Holdings (NASDAQ:LITE) exhibits the signs of a company that is unable to scale operations. The company offers significantly important products that are widely used, but the company exhibits noteworthy customer concentration risk and a management team that is ineffective in allocating capital. This is evident in the company’s inability to transform peer group leading free cash flow margins into material shareholder value.

Company Background

The business of Lumentum Holdings (LITE) is optical and photonics distribution through its Optical Communications (OpComms) and Commercial Lasers businesses.

OpComms is comprised of many components, modules, and subsystems that provide access to local, metro (intracity), long-haul (city-to-city and international), and submarine (underwater) carrier networks. Commercial Lasers serves customers in the sheet metal processing, general manufacturing, biotechnology, graphics and imaging, remote sensing, and precision machining industries (PCB drilling, wafer singulation, glass cutting, and solar cell scribing).

For practically all commercial and government networks, Lumentum offers optical components and subsystems. Lumentum’s commercial lasers enable cutting-edge manufacturing techniques and a large array of applications, such as next-generation 3D sensing.

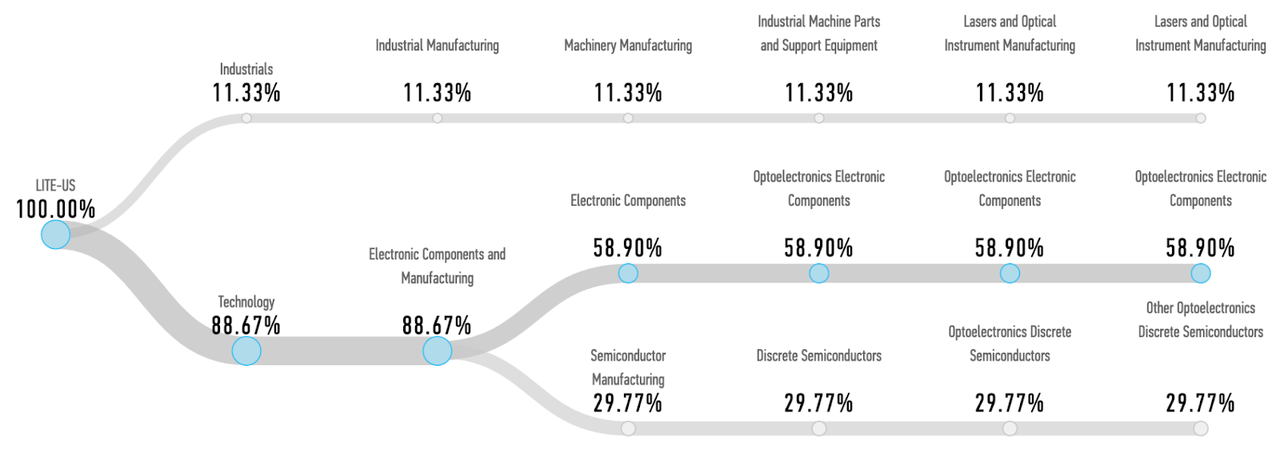

The first segment is titled “OpComms” (Operational Communications). This division accounts for 88.67% of the company’s overall sales. The consumer electronics, industrial, and telecommunications industries are target markets for this segment. The company sells numerous solutions that permit the transmission and transportation of video, audio, data, and other media using fibre optic lines. In addition to producing diode laser devices, this section is responsible for producing laser light sources that are incorporated into 3D sensing cameras for usage in a range of sectors. Numerous applications are realisable, including biometric identification, computational photography, virtual and augmented reality, and many others.

FactSet

The Lasers segment has contributed 11.33% to total revenue. This segment has continued to grow and management has noted that there is a strategic shift towards allocating more capital to this segment. According to the corporation, among the markets and applications supplied by this division’s products are sheet metal processing, general manufacturing, and biotechnology. OEM uses include gas lasers, diode lasers, fibre lasers, and solid-state lasers that are pumped by diodes. In addition, it is a manufacturer of incredibly rapid and powerful lasers used in both industry and research. In addition, the company offers a vast array of subsystems and components with outputs ranging from a few watts to several kilowatts and a spectrum of wavelengths comprising ultraviolet, visible, and infrared light. You can find these outputs and wavelengths in the company’s vast product portfolio.

Acquisitions

The company has continued to allocate capital to acquisitions in an effort to capitalise on the significant declines in company valuations. The most recent of these acquisitions is of Ipg Photonics Corp, a company that manufactures fibre lasers, amplifiers, and laser systems. The deal closed on 15 August 2022 and has been noted as a continued effort to increase the company offerings.

These acquisitions position us to accelerate long-term technology trends in advanced networking hardware in adjacent markets and to expand our share in the growing telecom infrastructure market. Since closing these acquisitions, we have even higher confidence in accomplishing our goals.

Alan Lowe, CEO

Financial State of the Company

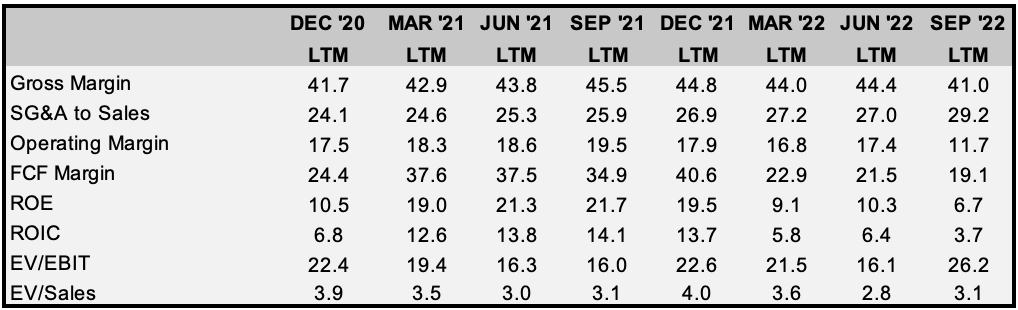

The company’s operating margin has decreased from 17.5% to 11.5% as a result of inflation’s negative impact on the company’s profitability. This demonstrates a lack of operating leverage and is the cause of the negative stock price movements in 2022. While LITE is not alone in its fight against inflation, investors must allocate capital to management teams that can demonstrate effective operating leverage during periods of inflation. This is a result of the empirically sticky nature of inflation and its long-lasting effects (paywall warning – article sourced).

Despite being below historical averages, the effective multiple paid by investors has not declined significantly in line with the market, and in the case of EV/EBIT, has continued to rise. This divergence between fundamentals and price is indicative of substantial downside risk.

FactSet, Author’s Work

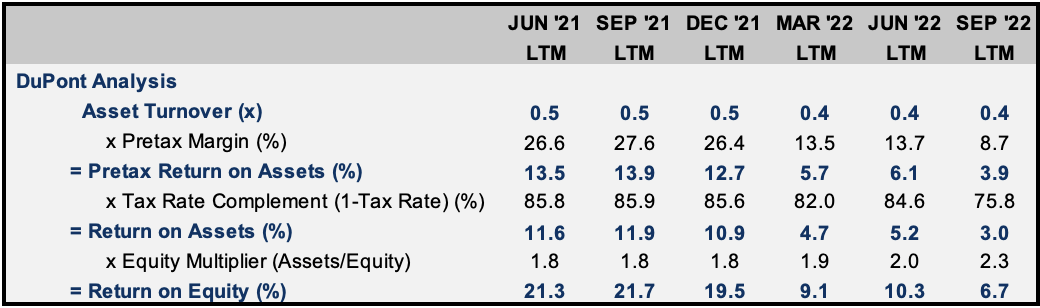

In recent months, the company’s return on equity has continued to decline sharply, and a DuPoint Analysis allows us to identify the contributing factors. As shown in the table below, the reduction in pre-tax margin to nearly a third of its previous level has significantly contributed to the decline in ROE. As stated previously, this decline is directly related to the decline in operating profits. While one could argue that the increase in the tax rate is a factor in the growth of ROE, this increase is negligible when compared to the significant reduction in pre-tax margins. Even more alarmingly, as equity leverage has increased by 28% over the same time period, ROE has continued to plummet. Keeping leverage at 1.8x would have resulted in a return on equity of 5.4%, a decrease of 20%.

FactSet, Author’s Work

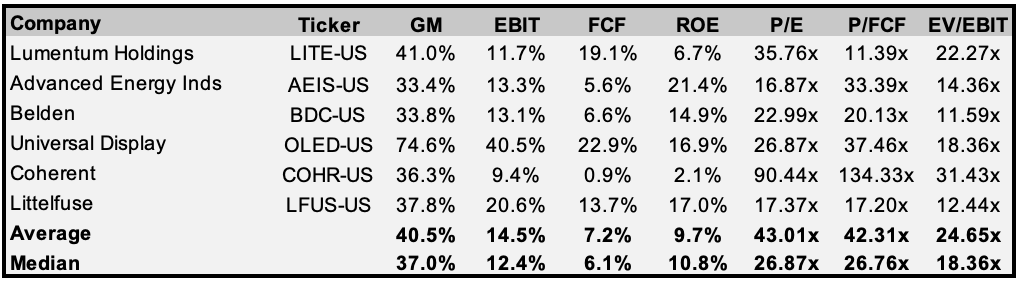

As demonstrated above, LITE does not trade at a discount to its historical self; it continues to exhibit similar characteristics when compared to a peer group. The sharp increase in the EV/EBIT multiple was caused by the company’s substantial increase in debt and decrease in operating income. The significant premium relative to its peer group in terms of price to earnings and enterprise value to operating profit indicates management’s inability to generate shareholder value from above-average free cash flow margins. This disparity between FCF margin and fundamental valuation multiples indicates a managerial red flag with regards to capital allocation decisions.

FactSet, Author’s Work

Customer Concentration Risk

Lumentum has a small customer base in certain industries, including 3D sensing and commercial lasers. If the company fails to acquire more customers, there is a significant risk of a revenue decline. However, Lumentum observes a lack of momentum in other fields where it has a presence, such as 3D sensing and industrial lasers. If the company is unable to acquire new customers, its revenue is likely to plummet dramatically. Even the loss of a handful of customers could have a devastating impact on the company’s bottom line. Apple (AAPL) was the company’s largest customer in 2021, contributing over 25% of revenue.

Final Thoughts

I believe the company’s financial condition indicates a fundamental lack of growth potential. In the context of a slowdown in economic growth in the countries where LITE conducts business, this is evident. In addition to the company’s fundamental issues, there is a significant customer concentration risk during a period in which customers (businesses) will seek to cut costs. While it is evident that LITE’s offerings may not be what companies turn to when attempting to cut costs, mega cap companies such as Apple are renowned for bringing functions in-house to save a small amount of money on production costs over time. I do not consider LITE a viable investment opportunity.

Be the first to comment