alfexe

Lumentum Holdings Inc. (NASDAQ:LITE) is expected to benefit from investments in capital expenditures in the telecom industry. The need for faster communication is increasing with the emergence of many new industries. As a result, from now until 2030, LITE may find more and more demand for its products. There are some risks coming from lack of suppliers, client concentration, or failed M&A transactions. However, the current price mark fails to recognize the future stream of free cash flow.

Lumentum

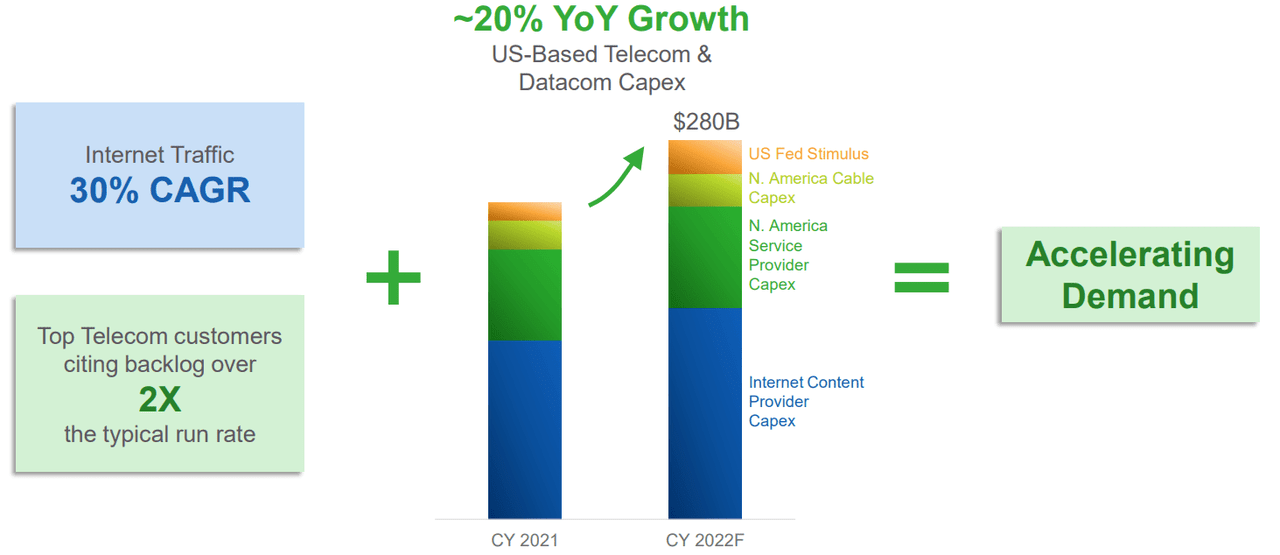

Lumentum Holdings Inc. provides optical and photonic products for optical communications and commercial lasers for manufacturing, inspection, and life-science applications. After checking some of the expectations for the year 2022, I became quite interested in Lumentum’s business model. Management believes that the US federal stimulus, capex from internet content providers, and service providers will likely accelerate demand for Lumentum’s products.

Investor Presentation

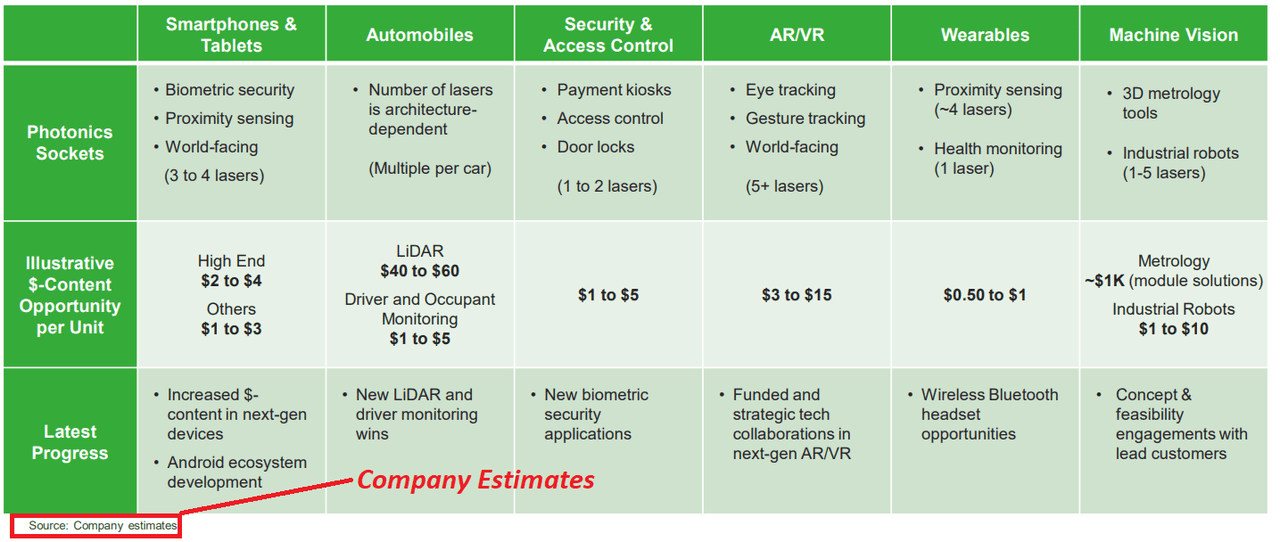

Estimates from Lumentum include a long list of products. The growing demand for Lumentum’s products will likely bring Lumentum’s revenue growth up. Automobiles, machine vision, biometric security, LiDAR, and driver monitoring are some of the new technologies to which Lumentum contributes.

Investor Presentation

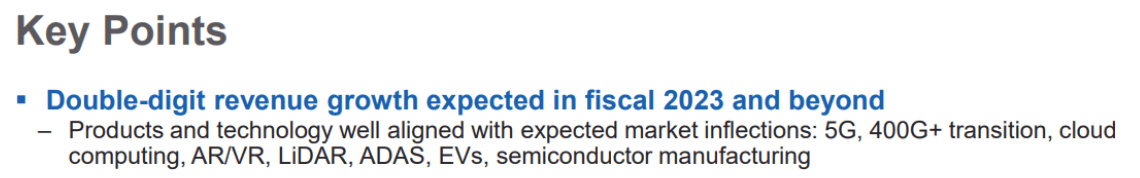

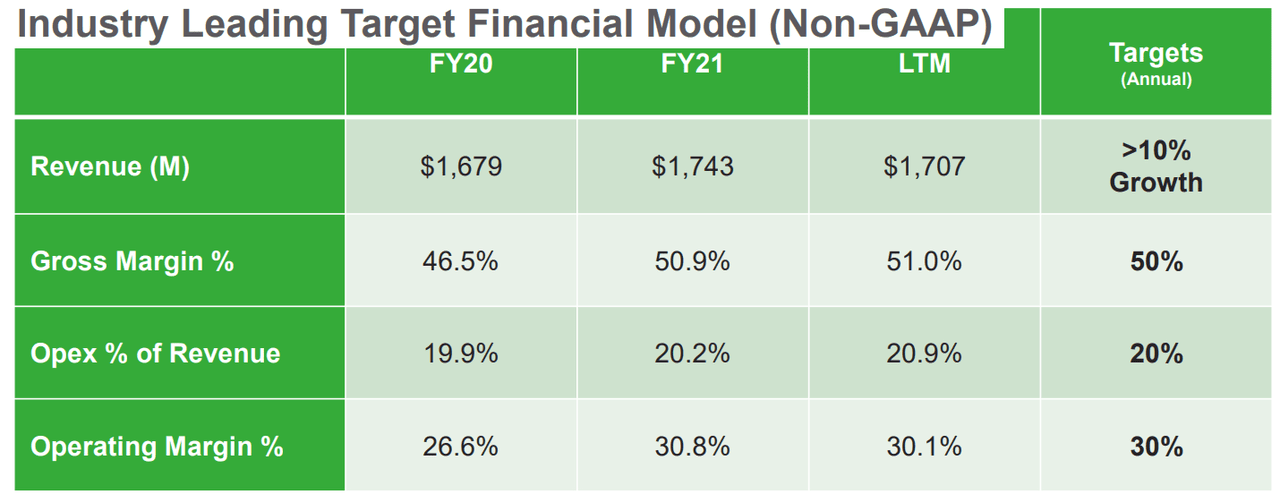

With the previous revenue growth catalysts, management expects double-digit sales growth in 2023 and beyond. The target stands close to 10% sales growth, 50% gross margin, and operating margin close to 30%-31%.

Investor Presentation

Investor Presentation

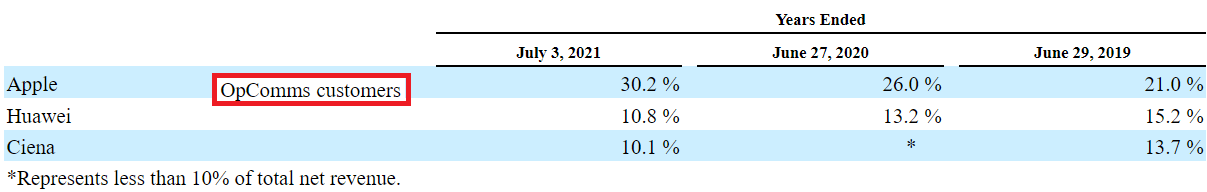

Balance Sheet: The Convertible Debt May Not Be Appreciated By Certain Investors

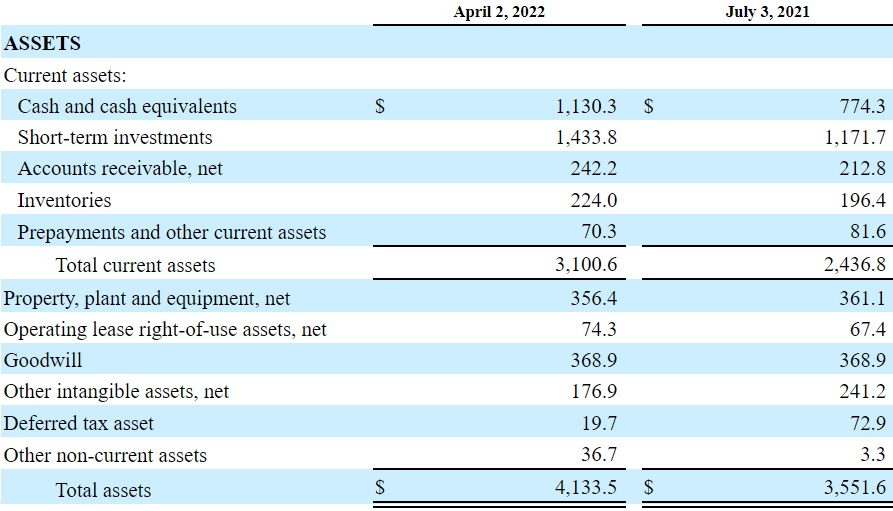

As of April 2, 2022, Lumentum reported $1.13 billion and $1.4 billion in short-term investments. The asset/liability ratio is close to 2x, so I believe that the company’s financial situation appears stable.

10-Q

Lumentum reports current convertible debt worth $406 million, and non-current convertible debt worth $1.44 billion. Certain investors don’t like convertible debt, so I decided to include certain features about the debt. Keep in mind that conversion of debt could lead to an increase in the share count, which may lower the intrinsic valuation of the stock.

The 2026 Notes bear interest at a rate of 0.50% per year, payable semi-annually in arrears on June 15 and December 15 of each year, beginning on June 15, 2020. The initial conversion rate is 10.0711 shares of common stock per $1,000 principal amount of the 2026 Notes. Source: 10-K

10-Q

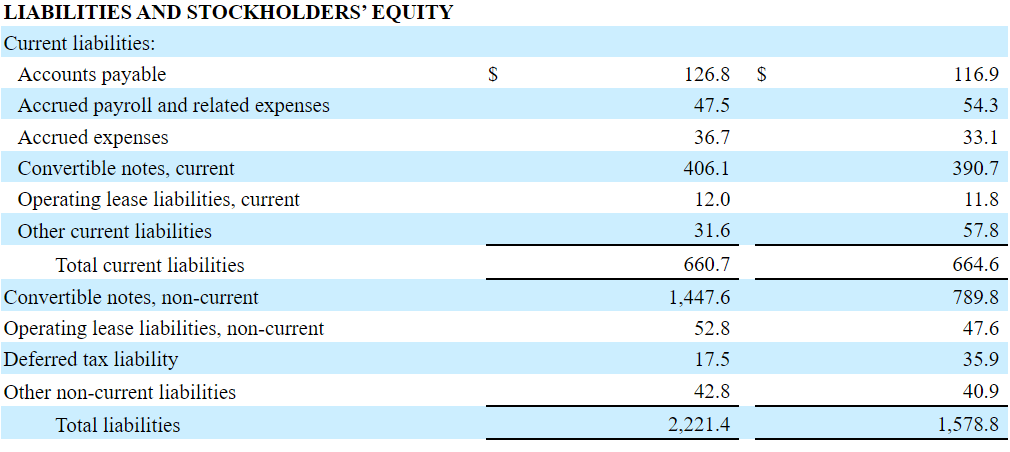

With that, about the convertible debt, let’s note that the company’s contractual obligations don’t seem very significant until about five years. In my view, Lumentum has a lot of time to build valuable assets, and pay its debts.

10-K

The Fair Price Could Stand Close To $164 Per Share

Under normal circumstances, Lumentum will likely benefit from the increase in needs for higher data transmission speeds. With larger data centers around the world and new industries demanding fast communications, Lumentum’s products will likely find more demand. As a result, I expect revenue growth and free cash flow growth from now to 2030.

The OpComms markets we serve are experiencing continually increasing needs for higher data transmission speeds, fiber optic network capacity and network agility. This is driven by rapid growth in both the number of higher bandwidth broadband applications such as high-definition video, online gaming, cloud computing and the number and scale of datacenters that require fiber optic links to enable the higher speeds and increased scale necessary to deliver high bandwidth video and other services. Source: 10-K

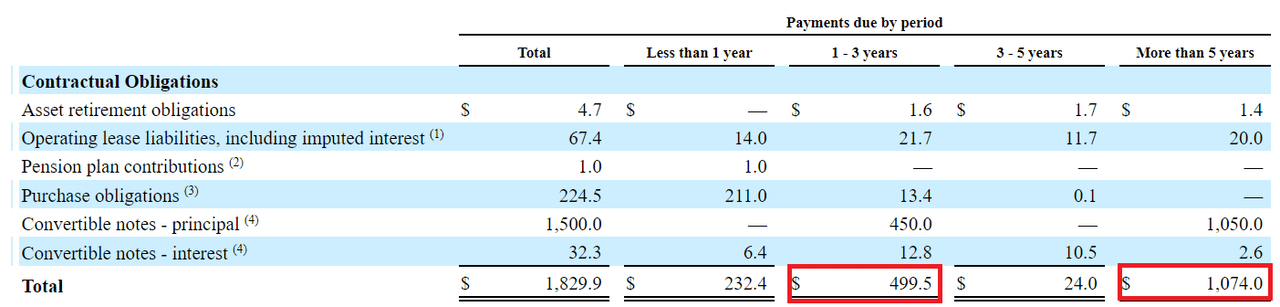

I also assumed that Lumentum will likely continue to offer innovative technology thanks to scalable manufacturing and operations along with more partners. Considering that massive clients do work with the company, others may also be interested in Lumentum’s new technological innovations:

In our OpComms segment, we are focused on technology leadership through innovation with our customers, cost leadership and functional integration. We endeavor to align the latest technologies with industry leading, scalable manufacturing and operations to drive the next phase of optical communications technologies and products for Telecom and Datacom applications that are faster, more energy efficient, more agile and more reliable, making us a valuable business and technology partner for NEMs, consumer electronic companies, cloud service providers and data center operators. Source: 10-K

10-K

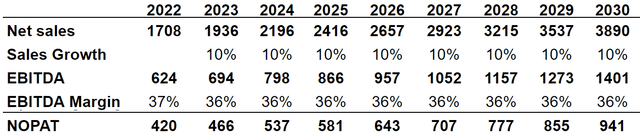

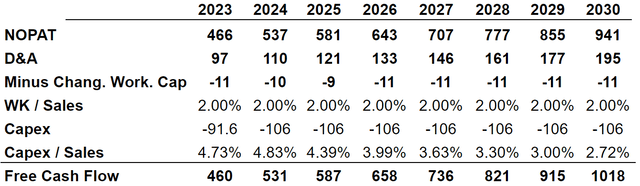

Under my discounted cash flow model, I used sales growth of 10% from 2022 to 2030, an EBITDA margin of 36%, and an operating margin of 31%. With these assumptions, which are close to that given by management, 2030 NOPAT would stand at $941 million.

I also included growing D&A from $85 million to $195 million and change in working capital/sales of 2%. Finally, with capex/sales close to 5%-2%, my resulting free cash flow would grow from $402 million in 2022 to $1 billion in 2030.

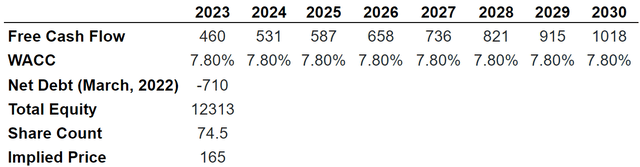

Like other financial analysts, my CAPM model included a weighted average cost of capital of 7.8%, beta of 1.09, cost of debt after tax of 4.7%, and cost of equity of 8.9%. If we assume a conservative exit multiple of 10x and a share count of 74.5 million, the fair price would be $164 per share. In the light of these results, I believe that Lumentum is quite undervalued at the current stock price.

Risks From Mature Markets

Lumentum reports that certain markets in which it operates are already mature. As a result, peers may push pricing down, which could lower Lumentum’s EBITDA margins down, and lower the company’s intrinsic valuation. Management reported this risk in the last annual report.

The market for optical communications products in particular has matured over time and these products have increasingly become subject to commoditization. Both legacy competitors as well as new entrants, predominantly Asia-based competitors, have intensified market competition in recent years leading to pricing pressure. Source: 10-K

Risks From Concentration Of Clients

Lumentum reports a small number of customers in some markets like 3D sensing and commercial lasers. If the company does not find more clients, there is a risk of significant decline in revenue. If one or two clients decide to leave the firm, revenue from certain business segments would decline rapidly:

We have consistently relied on a small number of customers for a significant portion of our sales and in certain of our markets, such as 3D sensing and commercial lasers, this customer concentration is particularly acute. We expect that this customer concentration will continue in the future, and we expect that our growth prospects will continue to depend in part on a small number of customers. Source: 10-K

Risk From Shortage Of Raw Materials

Lumentum declares that the company obtains certain raw materials from one source. Besides, the company does not report long-term agreements with suppliers, so they may decide to increase their prices. In the worst case scenario, I believe that Lumentum may suffer production breaks, or may suffer a decline in the company’s EBITDA margins. Reputational damage would likely lead to a decline in the stock price as revenue would lower.

We purchase raw materials, packages and components from a limited number of suppliers, who are often small and specialized. Additionally, some of our suppliers are our sole sources for certain materials, equipment and components. We depend on the timely and continued supply and quality of the materials, packages and components that our suppliers supply to us. We have not entered into long-term agreements with many of these suppliers. We do not have a guarantee of supply from these suppliers and as a result, there is no assurance that we would be able to secure the equipment or components that we require, in sufficient quantity, quality and on reasonable terms. Our business and results of operations have been, and could continue to be, adversely affected by this dependency. Source: 10-K

Transactions, Divestitures, And M&A Activity Could Fail, Which Would Lead To Lower Free Cash Flow Than Expected

The divestiture of Datacom, the sale of Lithium Niobate product lines, or the acquisition of Oclaro could fail. Management may obtain less synergies than expected, key employees may leave the firm, or certain customer relationships may break. As a result, equity researchers may notice these factors, which would lead to a decline in the company’s valuation:

In the fourth quarter of fiscal year 2019, we completed the divestiture of our Datacom module business in Japan, and in the second quarter of fiscal year 2020 we sold the assets associated with certain Lithium Niobate product lines manufactured by our San Donato, Italy site. Such divestitures involve risks, such as difficulty separating portions from our other businesses, distracting employees, incurring potential loss of revenue, negatively impacting margins, and potentially disrupting customer relationships. Source: 10-K

Conclusion

With governments out there increasing the amount of capital investments in the telecom industry, Lumentum will likely enjoy demand for its products. A simple discounted cash flow model with assumptions close to that of management reveals that the company is significantly undervalued by the market. Yes, there are many risks, which may diminish future sales growth. However, I believe that a small position in the stock will likely be profitable as free cash flow comes out until 2030.

Be the first to comment