LanaStock/iStock via Getty Images

When it comes to income plays, my top name in recent years has been Lumen Technologies (NYSE:NYSE:LUMN). The communication services company has had a more than 10% dividend yield at times, and the payout has been safe due to tremendous cash flow. On Monday, the company announced the completion of its second major asset sale for this year, setting up Lumen for its next stage.

Back in August, Lumen sold its Latin America business to Stonepeak for $2.7 billion in cash, before closing adjustments. This week’s sale was the larger one, selling its incumbent local exchange carrier business in 20 states to Brightspeed for pre-tax proceeds of $5.6 billion. These divestitures were seen as non-core assets, with the sales seen as a way to bring in significant new capital for debt repayments and potentially a few other uses.

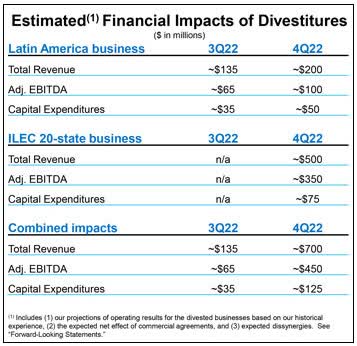

Investors were obviously curious how these two sales would impact results moving forward. As a reminder, my baseline for Lumen in recent years had the company running at around $3 billion in free cash flow annually and a little over $1 billion in dividend payments. About a month ago, management provided the following graphic to show the overall impacts of the asset sales.

Lumen Deal Impacts (Company Filings)

In last year’s Q4, revenues were around $4.85 billion, so that is a somewhat meaningful reduction in sales. Adjusted EBITDA came in at a little over $2 billion, so the impact felt on that metric will be a little greater. These figures obviously can be annualized to show the overall change, but just as sales and profits are reduced, so will expenses and capital expenditures to a degree.

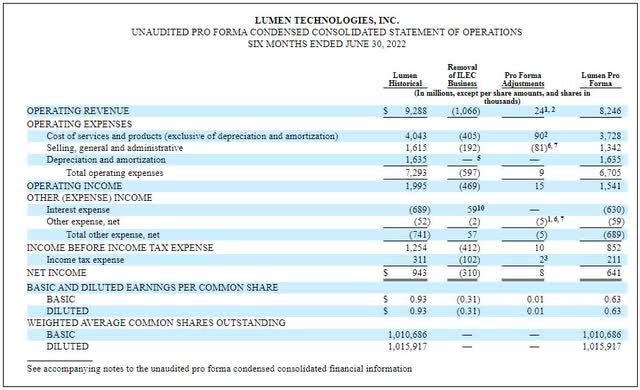

On Monday, we got a bit of different information from management when the transaction closure was announced. This time, we got pro forma information for what the balance sheet looks like as well as the income statement excluding Brightspeed, which can be seen in the graphic below. As a point of reference, all of the numbers below do not include the impact of the Latin America business sale.

Brightspeed Deal Impact (Company Filings)

Your first reaction might be to notice the significant drop in net income, and that’s quite reasonable. However, you also have to realize that the money coming in from the sale allows for a large amount of debt repayments, so the resulting reduction in interest expense will offset some of those net income losses. Unfortunately, a surge in LIBOR rates that has continued throughout this year is making the company’s variable rates more costly, but that’s an external item that’s not related to this specific deal.

With the deal set to close in early October, Lumen had sent out tender offers for almost $5.4 billion of its outstanding debt. On Monday, the company announced the results of those offers, with a little over $3 billion accepted. The result is about a $194 million annual saving in interest, or a little more than $48 million per quarter. Also, because some of the offers were at discounts to par, Lumen will save about $163 million on these repayments, which is rather nice. The interest and cash savings could have been higher if more notes had been tendered, but that means that it didn’t have to use the almost $5 billion to repay these particular debts.

The company’s capital allocation strategy will be in significant focus at the upcoming earnings report in about a month. I mentioned in my previous article that the dividend yield was back over 10%, and it closed Monday at nearly 13% (was even higher than that before the rally). With an annual yield so high, I’ve been arguing for share repurchases over bond repayments to some extent, so we’ll have to see if an announcement is made on that front. Buying back stock at these levels will save more on cash dividend payments than retiring debt will save on interest payments, but then total debt doesn’t come down as fast as some investors might want.

Generally speaking, when dividend yields get into double digits, investors worry that the payout will be cut. Even if these two asset sales result in free cash flow getting cut in half from the baseline I’m using, that would still put the company at $1.5 billion a year. Total dividend payments next year should be around $1.05 billion, when not including any buybacks, so I don’t see why the dividend would be cut. That would still leave some room for additional debt repayments to further lower interest expenses, holding all else equal. At the current stock price, the company would only need a little more than a billion dollars’ worth of share repurchases to get total dividend payments down to just $900 million a year.

As for Lumen shares, they recently fell to a low of $7.27 before bouncing a little on Monday. The average street price target remains over $11, so analysts see plenty of upside here. The name remains my top income pick for the long run, especially as it is yielding more than three times what fixed income will pay you on an annual basis (before any taxes). I’m personally waiting to see if the market hits new lows towards the end of this year on Fed rate hike concerns to potentially get an even higher yield from Lumen.

In the end, Lumen has finished off its two major asset divestitures in 2022. The sales have brought in significant fresh capital, which the company has already put to work reducing its large debt pile. It remains to be seen how overall results will eventually look, but I still believe the dividend is very safe. At a nearly 13% annual yield, income investors are doing much better here than fixed income when buying at these levels.

Be the first to comment