imaginima

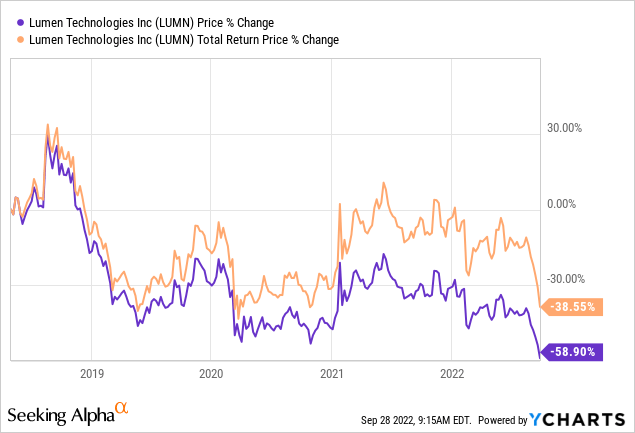

The market hasn’t helped, but Lumen Technologies (NYSE:LUMN) falling below 8 is mostly related to panic over the surprise retirement of respected CEO Jeff Storey. The telecom business has struggled to gain any traction under his leadership, questioning any selling pressure on his departure. My investment thesis remains Bullish here, with likely capital returns ahead to boost the gains from a large 13.2% dividend yield.

CEO Departure

Jeff Storey joined Lumen with the acquisition of Level 3 Communications back in 2017. Mr. Storey was designated to become the CEO of then CenturyLink at the start of 2019 in what appeared a positive move. The former CEO ended up retiring early, and Storey took over the CEO position in May 2018, but the stock has been down the whole time.

The executive doesn’t officially retire until November 7, when Kate Johnson takes over. An extended transition is usually a good sign the retirement isn’t being pulled forward due to anything nefarious at the company or looming bad results.

Ms. Johnson held key leadership roles across a variety of Fortune 100 companies, including the recent leadership role at Microsoft (MSFT). The lack of information on the new CEO while balanced with Storey not being able to really transform Lumen leaves a mixed picture, as new blood is potentially needed in the industry.

Focus On Cash Flows

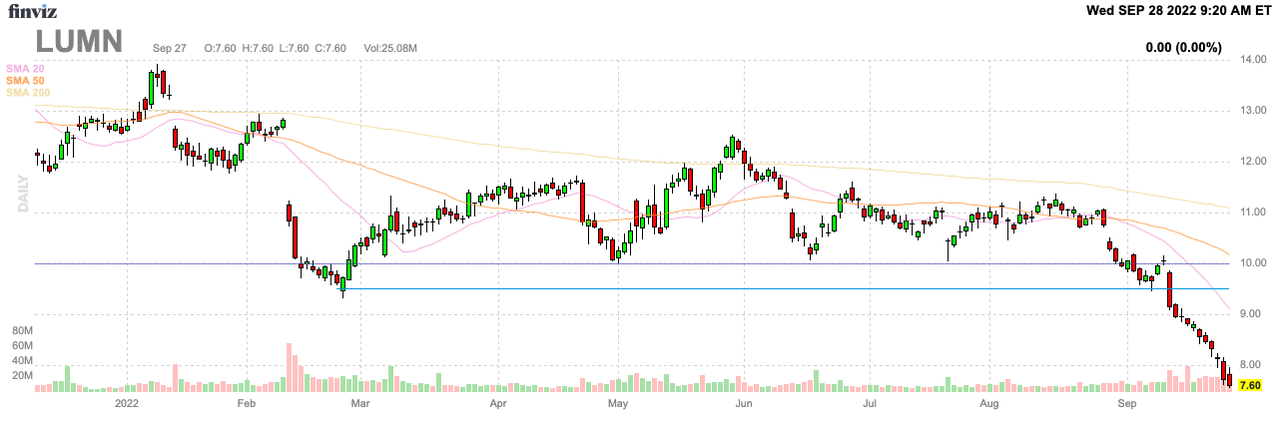

The large 13%+ dividend payout is very attractive to investors, but the real focus has to always be on the cash flows and profits. A big part of the dip from strong resistance at $10 to the current price of $8 is entirely related to fears the new CEO will cut the dividend.

FinViz

At the Goldman Sachs 2022 Communacopia Conference, CFO Chris Stansbury had the following to say about capital allocation plans in the future:

I do think the dividend is very important, right, to our investors today and that’s a very clear input to the decision that gets made. But the key criteria that the board is using that Jeff and, I’m sure, Kate will use and I’m using is — the goal is to drive long-term returns for the shareholders and what’s the best way to do that.

The executives appear to understand the dividend is important to shareholders, but most investors would probably prefer better total returns. The company clearly understands the last dividend cut cratered the stock, so any decision to cut the dividend again would require an extremely impressive opportunity to generate far better returns.

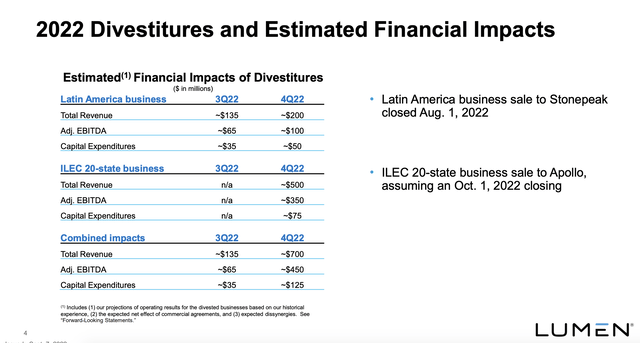

The closing of the recent divestitures will have a significant impact on the capital allocations. Lumen forecasts $7 billion in net discretionary cash and the remaining portion of the $10 billion in deal value in assumed debt. The combined divestitures will impact revenues by ~$700 million in Q4’22 with an outsized $450 million EBITDA hit.

Lumen ’22 Divestitures Presentation

The problem with these divestitures is that the reduction in the financials adds to the view of the business in constant decline. The ILEC business was an EBITDA machine, whether in terminal decline or not.

The network provider only delivered $1.81 billion in adjusted EBITDA during Q2’22. The Q4 number dips to only ~$1.36 billion once excluding these divestiture estimates.

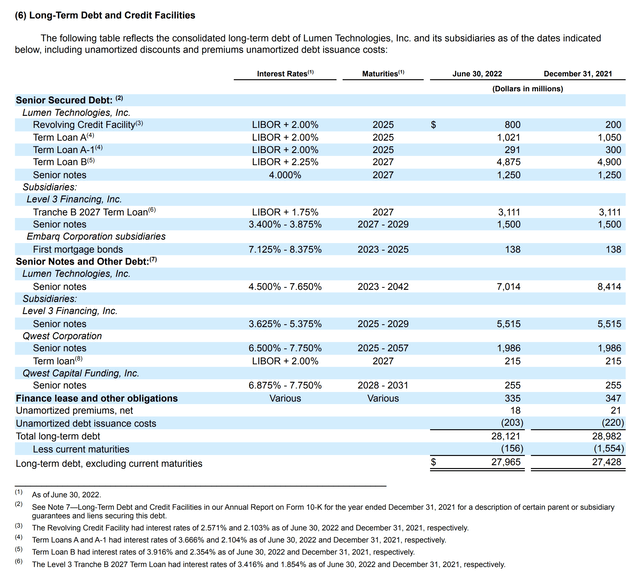

Lumen states net debt of $29.4 billion ending Q2’22, but the below chart shows $28.1 billion in debt. The company has around $10.3 billion in variable interest debt subject to large LIBOR rate increases this year. With the Fed already hiking rates 3 percentage points this year and threatening more hikes, the telecom faces higher interest expenses.

The big question is how the company handles the $7 billion in net cash from these divestitures. The amount is enough alone to cover the dividend payment for 7 years, but Lumen is likely to repay debt to lower interest expenses.

Every percentage point increase to LIBOR adds ~$100 million to annual interest expenses while a $10 billion cut to debt with an average cost of 5% reduces the interest expenses by $500 million.

Lumen should generate around $5.4 billion in adjusted EBITDA based on the current business, with solid growth prospects based on quantum fiber build-outs. The stock trades at just 1.5x EBITDA targets and has an EV/EBITDA target of below 5x.

Free cash flow should easily top $1.5 billion, making the dividend payout of $1.0 billion easy to cover, especially considering Lumen will have $7.0 billion in cash hitting the balance sheet.

Takeaway

The key investor takeaway is that the big selloff on Lumen is absurd. Jeff Storey is well-respected in the telecom space, but he has failed to turn around Lumen during 4 years as the CEO. The company should easily handle the higher interest rates, making the stock a strong buy here on irrational fears.

Be the first to comment