imaginima

Shares of Lumen (NYSE:LUMN) saw a sharp revaluation to the downside lately, losing about half of their value since the end of August. The near-50% decline in market cap was driven in part by Lumen’s announcement to suspend its dividend and instead use some of its free cash flow for share buybacks and investments in its fiber business. I believe shares of Lumen are very attractively valued based off of earnings and free cash flow and the telecom’s stock may be set for a strong rebound!

Lumen: Suspending the dividend to focus on growth

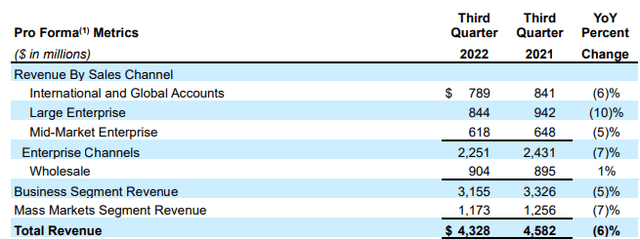

Dividend cuts rarely go over well for companies that have to bring the bad news to shareholders and Lumen would be a case in point. The telecom recently suspended its $0.25 per-share quarterly dividend which was becoming a burden for the company as it cost Lumen approximately $1.0B/year. This money could better be used elsewhere, for example to lower its massive debt or invest in its fiber business which is showing promising momentum. The fiber business is a bright spot for Lumen which continues to suffer from a challenged top line. In the third-quarter, Lumen’s revenues dropped 6.0% year over year to $4.3B. A key source of growth, however, is the fiber broadband business which generated 18.5% year over top line growth in Q3’22.

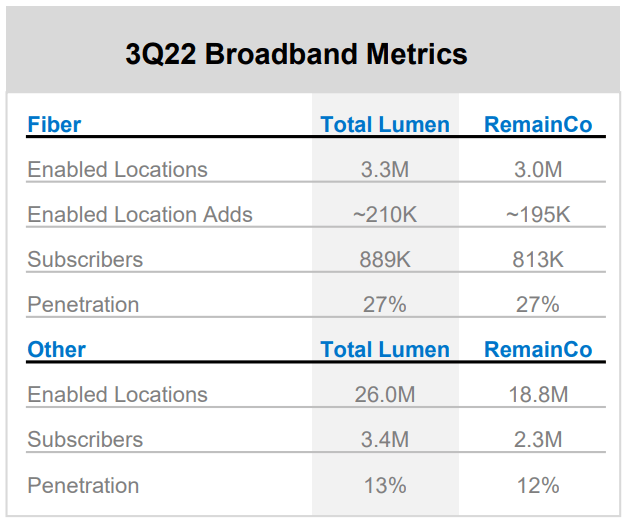

Lumen’s fiber business is rapidly expanding the number of enabled locations which helps support momentum in Lumen’s core business. The number of fiber enabled locations in Lumen’s RemainCo – the part of the fiber business that remains with Lumen after it divested some of its telecom assets this year – increased by 195 thousand in the third-quarter, up from 185 thousand in Q2’22 and 130 thousand in Q1’22.

Source: Lumen

Asset sales and developing core focus

The fiber business remains a key asset for Lumen going forward and this segment is likely going to see the majority of investments as well. Cash for new investments come from asset sales as well as free cash flow.

In the fourth-quarter, Lumen completed the sale of its 20-state incumbent local exchange carrier business to Brightspeed for $7.5B. In the third-quarter, Lumen closed the sale of its Latin American business to Stonepeak for which the company received $2.7B in cash. In total, business divestitures resulted in Lumen receiving approximately $10B in gross proceeds this year. In November, Lumen also announced the proposed sale of its EMEA business to Colt Technology Services for $1.8B. The asset sales will help Lumen streamline its business, pay down debt and focus more on its core broadband business.

Debt repayments, dividend suspension and share buybacks

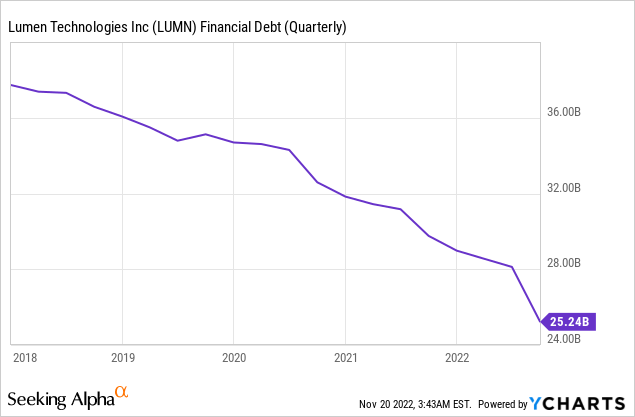

Considering that Lumen had $25.2B of financial debt on its balance sheet at the end of the September-quarter, I believe it makes sense for Lumen to sell non-core assets and suspend its dividend payments. Proceeds from asset sales and free cash flow could be better used to pay down debt and growing its broadband business. The debt situation has already improved greatly for Lumen, but I would like to see more repayments going forward.

The telecom’s board of directors also revised Lumen’s capital allocation policy lately and authorized a $1.5B share repurchase. At a current price of $5.87, Lumen could repurchase shares equal to 25% of the company’s market cap.

Lumen’s valuation is very attractive

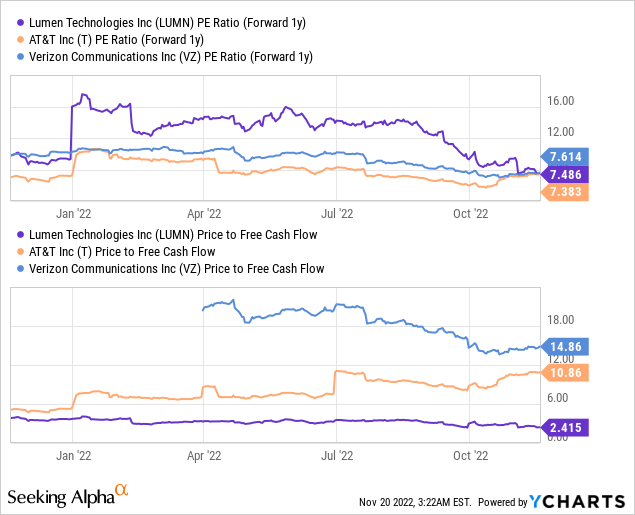

Lumen’s valuation is cheap based off of earnings and free cash flow. Lumen’s shares are valued at a P/E ratio of 7.5 X and at a P/FCF ratio of 2.4 X. I can see Lumen double its valuation over the next year as investors begin to realize that the dividend cut is actually a great way to return Lumen’s focus on growth. Lumen is also considerably cheaper than other telecom firms such as AT&T (T) and Verizon (VZ) based off of free cash flow. Besides Lumen, I especially like AT&T due to its high yield, good coverage and low valuation.

Risks with Lumen

There were a lot of risks with Lumen before the telecom suspended its dividend because the company spend a large amount of its free cash flow on shareholder payments while the balance sheet remained in urgent need of fixing. Going forward, Lumen will have to prove, however, that it cannot only drastically reduce its financial obligations but also that it can grow its fiber business profitably. If it can’t, shares of Lumen may continue to revalue to the downside.

Final thoughts

Major change is happening at Lumen: the telecom is selling non-core assets to raise cash and repay debt… and it has had success in doing so. The company also revised its capital allocation policy which will allow Lumen to focus on and grow its core broadband operations which is where the momentum is. Given Lumen’s low valuation based off of earnings and free cash flow, I believe Lumen could see a 100% revaluation to the upside over the next 12 months!

Be the first to comment