Robert Way/iStock Editorial via Getty Images

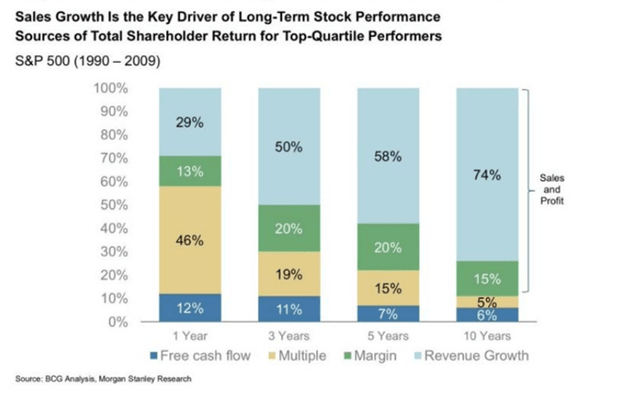

My goal as an investor is to find the best growth companies to hold for the long term and outperform the market. As a long-term investor, I focus on the two most important factors that drive stock market outperformance over the long term; revenue growth and margins.

Drivers of Long-Term Stock Performance in Top-Quartile Performers (BCG Analysis, Morgan Stanley Research)

This article will focus on these two key metrics (revenue growth & margins) to illustrate why I believe that Lululemon (NASDAQ:LULU) will continue to outperform the market over the medium term.

About Lululemon

Founded in Vancouver, Canada in 1998, Lululemon Athletica has grown to become a global designer, distributor and retailer of athletic apparel and accessories. The company’s primary market is premium female yoga and athletic apparel, with a growing menswear segment. The company primarily conducts its business through two channels, including Company-Operated stores and Direct-to-Consumer (e-commerce). Unlike many of its competitors, Lululemon does not have a significant wholesale business. This model allows for control over pricing, discounting, expenses, product assortment and marketing. Many competitors have to share margin with retailers and do not have control over their products being discounted or sold through unpopular channels. I believe this model has helped Lululemon preserve its status as a premium athletic apparel brand.

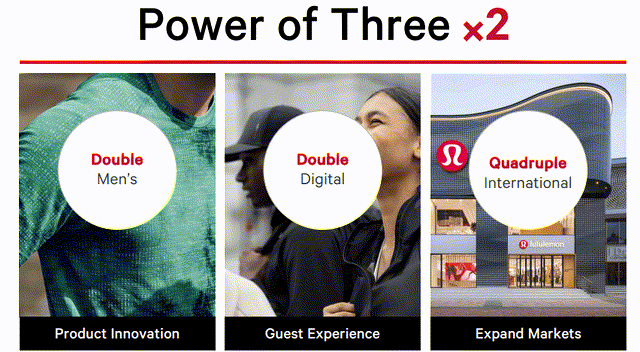

Lululemon laid out its “Power of Three x2” five-year plan in April 2022, which highlighted its three key priorities:

- Product innovation.

- E-commerce.

- International expansion.

Lululemon is aiming to double revenue growth by 2026 to US$12.5b. Whilst this goal is ambitious, it is worth noting that Lululemon achieved many of its 5-year targets set in 2019 with a few years to spare. This article will focus on these key growth pillars and their importance in driving future revenue growth and margin improvement.

“Power of Three x2” To Drive Robust Revenue Growth

There are several key metrics to track the execution of the “Power of Three x2” strategy. First, we need to look at product innovation and the focused expansion into men’s athletic apparel.

Lululemon channels innovation by consistently developing new fabrics for its products. Lululemon operates a whitespace research and development department of ~50 people that includes textile workers, scientists and engineers. Lululemon’s signature Luon fabric was developed 20 years ago and trademarked in 2005. Its product is differentiated from its competitors because it consists of a higher percentage of nylon microfibers than a traditional polyester blend. Its apparel is designed to be bacteria/smell resistant and survive more washes than typical products (something I can confirm as a product user). Whilst this material is significantly more expensive than traditional athletic apparel, Lululemon protects its brand integrity as a higher-quality producer at a higher price point.

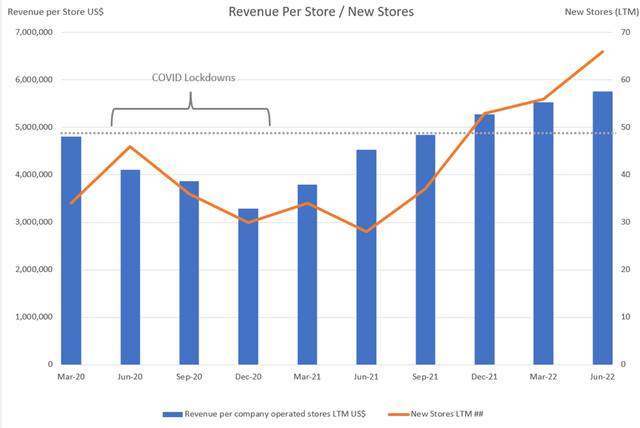

This superior product offering and high customer satisfaction have translated to incredible business performance. Despite the significant competition, Lululemon has experienced double-digit sales growth every year since 2003. Additionally, Lululemon has continued to grow and improve margins despite attempts from competitors to offer comparable products. Lululemon has achieved market-leading pricing on the back of this innovation and brand strength. Lululemon is one of the few apparel companies having success with its retail stores in the face of increasing e-commerce competition. Lululemon has increased its revenue per store whilst aggressively expanding its store count, with revenue per store now surpassing pre-covid levels and trending higher:

Author Created (Company Filings)

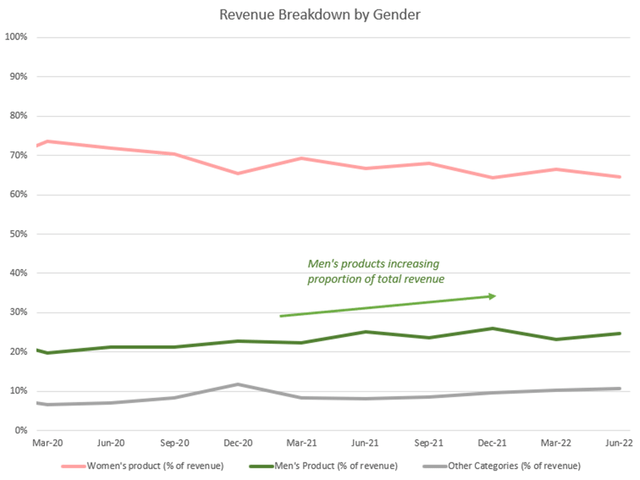

Reduced Dependence On Women’s Yoga Products

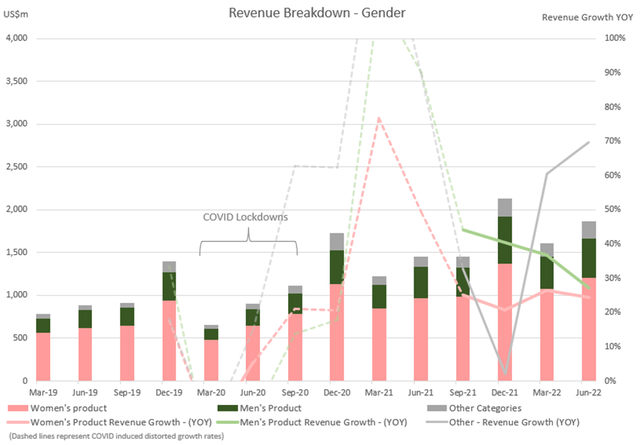

In recent years, Lululemon has reduced its dependence on women’s yoga pants and expanded its product offering, including growing its men’s segment (~25% of revenue), footwear, and fitness and leisure clothing for women. Lululemon’s targeted growth in the men’s business segment will help to expand its addressable market.

Author Created (Company Filings)

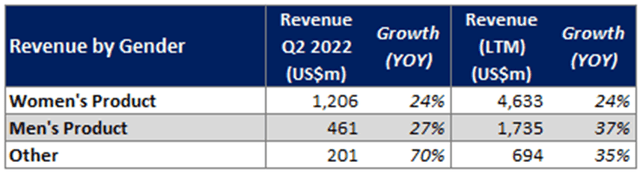

The recent Q2 2022 results highlighted that the men’s division continues to grow at a faster rate than the women’s segment (albeit the delta is decreasing). This is even more impressive when considering that the women’s segment continues to grow revenue at >20% YOY:

Author Created (Company Filings)

I expect to see the men’s product division continue to increase its proportion of revenue as it captures more market share. The success of the menswear business segment will be a key metric to watch moving forward, particularly to assess the first pillar of the “power of three x2 strategy”.

Author Created (Company Filings)

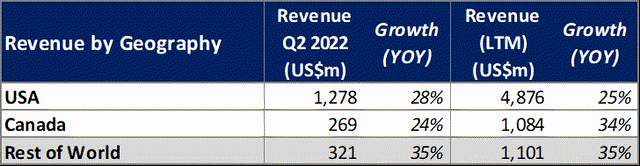

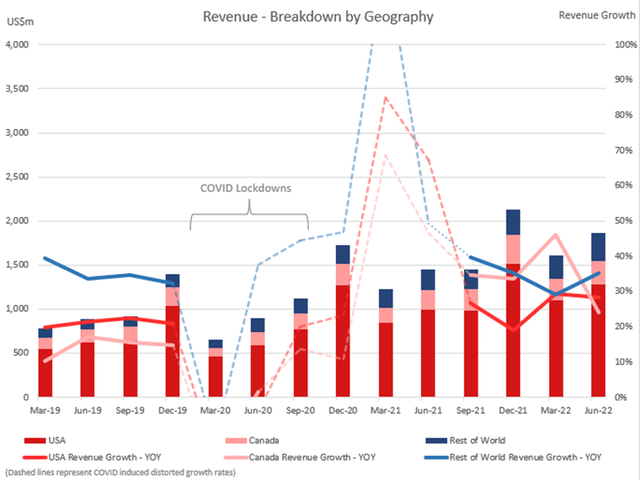

Successfully Executing International Expansion With A Focus On Asian Markets

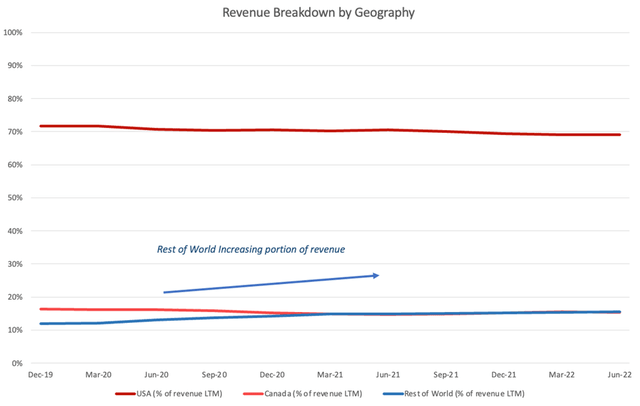

Another key opportunity for further revenue growth is Lululemon’s expansion outside of North America. Sales outside of North America are currently ~16% of revenue as of Q2 2022, although this number is likely to grow in the coming years with international revenue growing at a faster rate:

Author Created (Company Filings) Author Created (Company Filings)

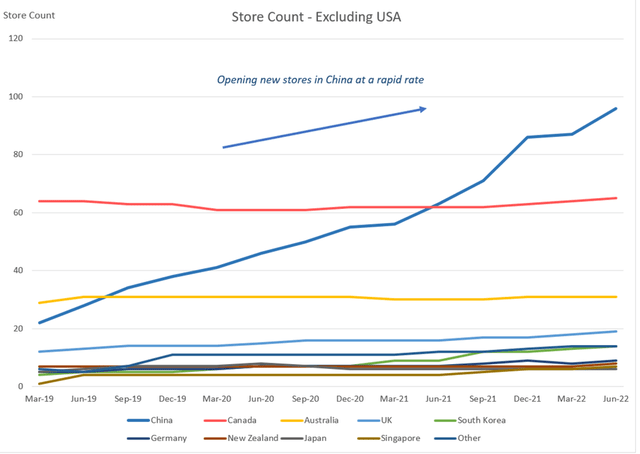

Lululemon is building its brand overseas and most promisingly in China, where it has a significant opportunity for new stores and online sales in the second-largest activewear market in the world. As we can see from the chart below, Lululemon is opening stores in China at a rapid rate and it now has 96 stores as of the recent quarter, behind only USA (331 stores).

Author Created (Company Filings)

I expect Lululemon to generate significant growth in China, where it has limited existing brand recognition and history. As Chinese Covid lockdowns subside and brand awareness grows, this aggressive expansion will likely drive robust revenue growth and increase the proportion of international revenue.

Author Created (Company Filings)

E-commerce Tailwinds To Drive Higher Margins

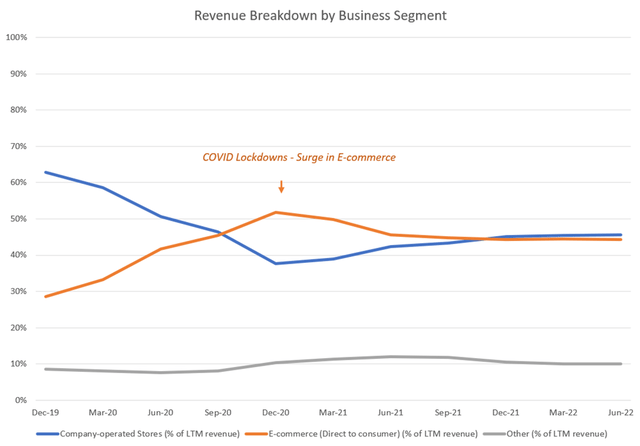

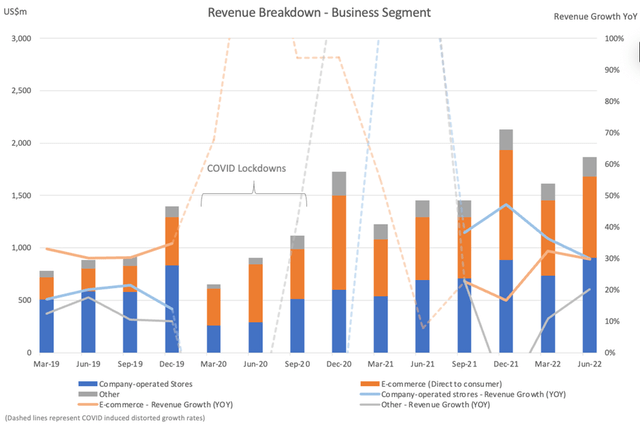

Lululemon’s e-commerce division was boosted by the pandemic which has increased its importance. It now accounts for ~45% of total revenue, which is proportional to in-store sales.

Author Created (Company Filings) Author Created (Company Filings)

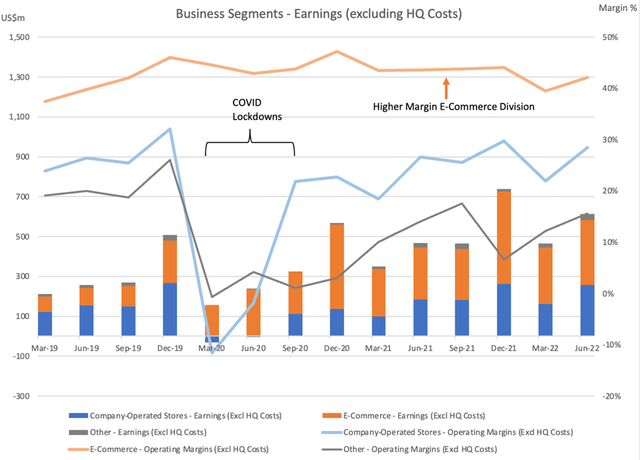

I expect that e-commerce sales will become the predominant source of revenue in the coming years as e-commerce sales grow at a superior rate to traditional brick-and-mortar sales. This is particularly important because the company’s e-commerce division is higher margin than the company-operated store division. As we can see from the chart below, which illustrates the business segments earnings excluding headquarter costs, the e-commerce division delivers a majority of the company’s earnings despite currently making up a relatively similar proportion of revenue to the company-operated store’s division:

Author Created (Company Filings)

Lululemon has increasingly invested in its digital capabilities (buy online, pick up in-store), new products and growing its loyalty program. I expect the strong growth of e-commerce sales to drive higher margins over the long term as the proportion of online sales increases over time.

Summary Of Medium-Term Revenue Drivers & Margin Improvement:

- Lululemon’s track record of product innovation and its continued expansion into menswear will support strong revenue growth.

- Lululemon’s international expansion (most importantly China) will increase Lululemon’s addressable market and gain exposure to the 2nd largest activewear market.

- The pandemic accelerated shift to e-commerce sales will support strong revenue growth and drive higher margins.

Risks

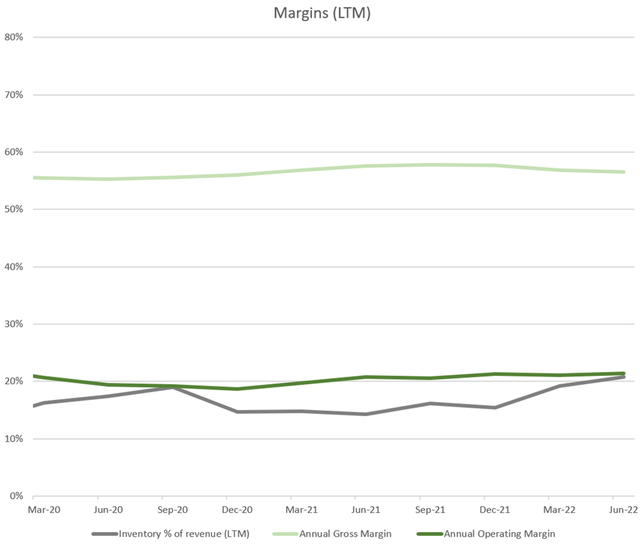

Like many other retail companies, Lululemon has faced supply issues and is seeing elevated inventory levels in recent quarters.

Author Created (Company Filings)

Lululemon also faces the risk of reduced consumer spending due to widespread and persistent inflation. Whilst these risks are potentially significant in the short term, the effects on Lululemon’s long-term business will likely be limited.

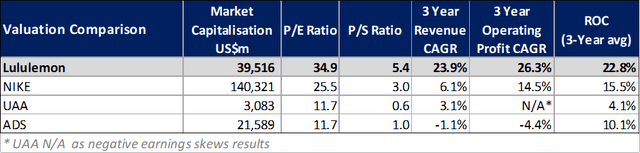

Valuation

Given that Lululemon is currently optimized for profits, the best valuation metric is the price-to-earnings (P/E) ratio. Lululemon’s P/E ratio is ~34 as of the date of this article, which is high in comparison to its peers but reasonable for Lululemon’s recent history.

Whilst its valuation appears significantly higher than its peers it is important to overlay the superior quality and performance of Lululemon:

Author Created (Capital IQ Data)

Historical performance

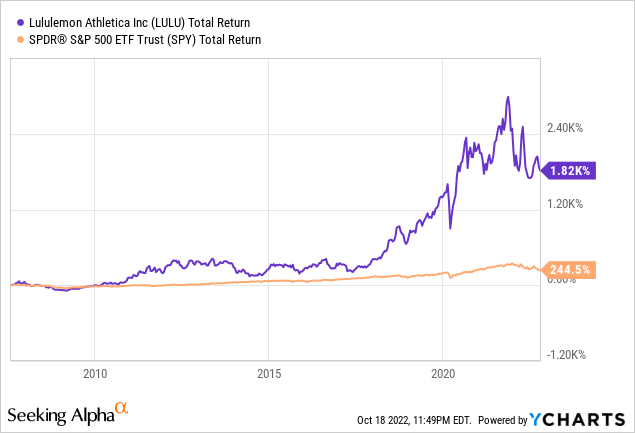

The company’s revenue has increased more than 10,000% over the past 17 years (to $6.3 billion in 2021 from $41 million in 2004). As evidence of its competitive advantage, Lululemon’s adjusted ROICs including goodwill have averaged 36% over the past decade. Unsurprisingly this stellar operating performance has translated to exceptional stock-market performance, with a CAGR of ~24.7% since its IPO in 2007.

Moat

Lululemon’s key moat source is its brand value, which I believe continues to strengthen. Lululemon has successfully established a “premium brand” reputation, evidenced by its women’s leggings, its key product, which typically retail for $90-$150 USD, which is ~20% higher than its closest major competitor Athleta (owned by GAP). From 2019 to 2021, Lululemon gained more market share than any of its competitor’s (Source: NPD Group). This trend remained prevalent in the recent Q2 earnings call, with NPD data illustrating that Lululemon “remained the largest share gainer for the quarter”. Lululemon’s brand stands to strengthen further if it can successfully expand internationally. Morningstar believes Lululemon has developed a narrow economic moat through its brand strength, meaning they believe Lululemon can sustain its competitive advantage (brand) for at least the next 10 years, providing qualitative support to my thesis.

Conclusion

Lululemon has been a long-term winner since its IPO in 2007 and looks set to continue its outperformance on the back of its three key growth initiatives. I am looking to take advantage of any upcoming market volatility and will look for a cheaper valuation before starting a position. I am aiming to start my position at a P/E ratio of ~28 which would imply a stock price of < $240, which I acknowledge may not eventuate. I believe this introduces a margin of safety, which I consider important in this instance given the current macroeconomic headwinds. However, I believe that with a long-time horizon (~10 years) Lululemon will outperform the broader market, even from current levels (hence my buy rating).

Be the first to comment