jetcityimage

Introduction

3M (NYSE:MMM) is known as a large conglomerate that has been growing steadily for years and increasing its dividends year over year. Currently, the company future looks less rosy because of a lawsuit filed over malfunctioning earplugs. American soldiers suffer hearing loss and 230,000 jury lawsuits against 3M are demanding hefty damages. Bloomberg estimates the company could suffer up to $100B in losses and plaintiff’s lawyers are trying to limit 3M’s dividend payments.

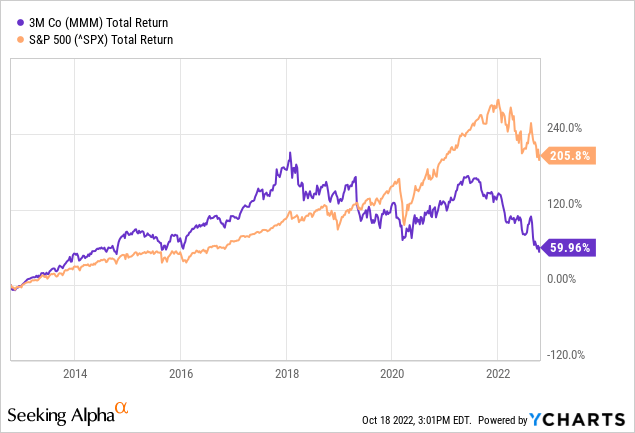

The stock has been punished hard as a result but had been in a bear market since 2018.

In 2018, the stock’s valuation was expensive; the PE ratio showed an all-time high of 33. The current PE ratio of 16 suggests the stock is attractively valued. Because 3M lacks growth catalysts and there is a good chance the company will have to pay hefty claims, I see little chance of the share price rising anytime soon.

Unlocking Value In A Volatile Business Environment

3M is an industrial conglomerate that provides industrial products and healthcare solutions to various sectors. In the second quarter, organic sales increased 1% year over year and non-GAAP EPS came in at $2.48, down 4.2% year over year. 3M updated its full-year outlook and expects organic sales growth of 1.5% to 3.5% and non-GAAP EPS of $10.30 to $10.80, an average annualized growth of 4%.

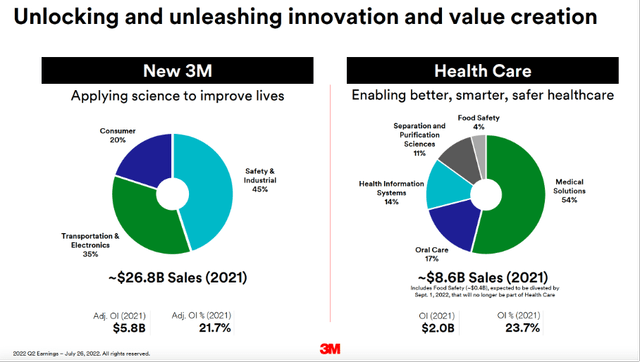

3M announced it is spinning off the Health Care business unit to create value for their shareholders. The new company will be a leading global diversified health technology company. This strategic move reduces the investment risk for 3M shareholders related to the lawsuit regarding their combat earplugs manufactured by their business unit Aearo Technologies.

New 3M and Health Care IPO (3M 2Q22 Investor Presentation)

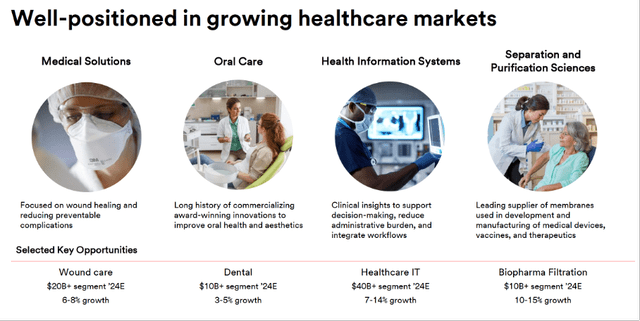

I see Health Care’s IPO as a positive catalyst for investors. If we look a little deeper into their Health Care solutions, we see that Medical Solutions provides the majority of sales. 3M expects growth within this segment mainly for wound care, this is expected to grow between 6% and 8%. I especially see a big opportunity in Health Information Systems, Healthcare IT is expected to grow 7% to 14% with a significant $40B+ opportunity.

Key Opportunities In Healthcare Markets (2Q22 3M Investor Presentation)

Major Risk: Combat Earplugs Litigation

The sharp drop in share price stems from the investor’s loss of confidence in 3M. 3M is facing more than 230,000 lawsuits over hearing loss caused by malfunctioning combat earplugs used by American soldiers. Bloomberg estimates the company will suffer about $100B in losses, an average claim of about $400,000 per soldier. With a market capitalization of $64 billion and a net cash position of -$13.3 billion and free cash flow of only $5.8 billion, this is a very significant claim.

The spin-off of the Health Care business unit will provide current investors a safe haven. Still, it will be some time before the Health Care division goes public.

3M tried to stop the lawsuits and open a new round of negotiations with soldiers by placing their manufacturer of combat earplugs Aearo in Chapter 11 bankruptcy. This is not unusual, J&J tried to stop lawsuits from 40,000 cancer patients because of an increased risk of ovarian cancer after using their talc products. Earlier, J&J set aside nearly $4B for talc lawsuits. US Bankruptcy Judge Jeffrey J. Graham refused to stop lawsuits accusing Aearo of selling malfunctioning battle earplugs. Three US Court of Appeals judges in Chicago sided with Aearo to hear the appeal in months instead of the normal process that can take years.

The lawsuit against combat earbuds is being led by trial lawyer Mark Lanier, he is strong in litigation and is known for the lawsuits against J&J talcum powder, artificial hip, opioids and the EpiPen MDL.

3M is trying to save its shareholders by divesting its Healthcare division and filing Chapter 11 bankruptcy of its Aearo business unit. I expect the lawsuit against earbuds to have dramatic consequences for 3M, regardless of the positive developments it has taken for its investors. Since it is still unclear how high the damages claim will be, regardless of expected sales growth, I do not see any further growth catalysts for the coming years.

3M’s Dividends And Share Repurchases

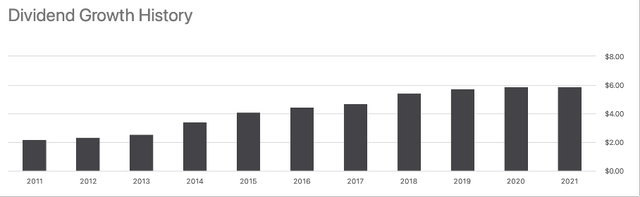

3M’s management is very shareholder-friendly, increasing its dividends year after year. In addition to a solid growing dividend, 3M has been repurchasing shares, increasing dividends per share by an average of 6% per year for the past 5 years.

Dividend Growth History (Seeking Alpha 3M’s Ticker Page)

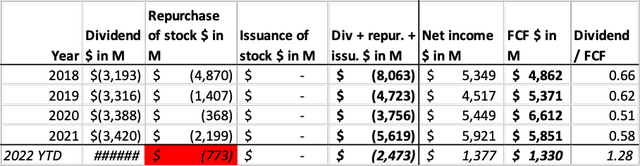

Last quarter, however, there was no dividend increase. Cash flow before dividends was $848M in the second quarter, while 3M paid out $858M in the same period last year. The share buyback program was also put on hold in the second quarter. Free cash flow fell year-on-year from $1493M last year to $743M this year in the current quarter. Putting the share repurchase program on hold makes sense.

3M’s Cash Flow Highlights (SEC and Author’s Own Calculations)

MMM Stock Valuation Metrics

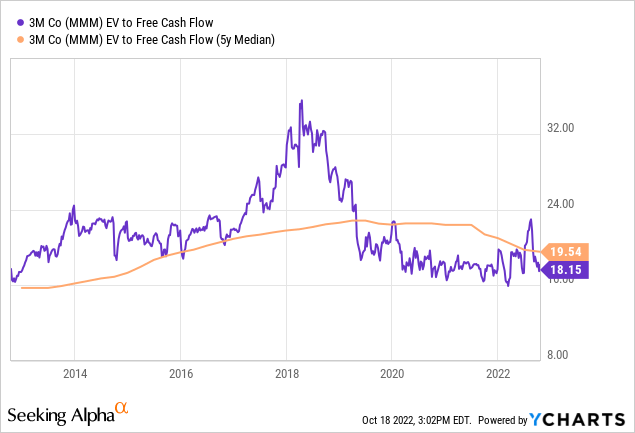

To map equity valuation, I choose the enterprise value to free cash flow. The enterprise value takes cash, debt and market value into the free cash flow comparison.

Over the past 10 years, we can see from the chart that the ratio is at a favorable level, below the 10-year median. However, the enterprise value can change significantly if 3M has to pay a hefty damage claim that makes the company not so attractive on the market after all.

3M is a highly profitable conglomerate that is currently experiencing significant headwinds. The shareholder-friendly nature of management appeals to me and I like to see the company in my portfolio.

3M is sailing into a severe storm, and for now it is unknown how long it will last and how severe the storm is. For now, I will leave 3M for what it is and wait until the storm passes or when more clarity develops around the lawsuit.

Conclusion

3M is a large conglomerate focused on industrial products and healthcare. The company is highly profitable and its growth prospects are strong. The stock has been hit hard because of the lawsuit over malfunctioning combat earbuds. 230,000 jury trials are demanding hefty damages and Bloomberg estimates that the company will bear some $100B in losses. Compared to its stock market value of $64B, this is a significant claim. The lawsuit is being led by trial lawyer Mark Lanier, a strong lawyer who also assisted in the lawsuit against J&J talcum powder. 3M is trying to save its shareholders by divesting the Health Care division and filing a Chapter 11 bankruptcy for their combat earbuds division called Aearo Technologies. The Chapter 11 bankruptcy filing has been disallowed, but the court proceedings will accelerate. It is unclear how high the claim will be, but this will have a strong negative impact on 3M’s share valuation. Despite the fact that the stock valuation currently looks favorable, the revenue outlook is positive, and management is shareholder-friendly, I believe the stock is a sell.

Be the first to comment