alexsl

In this analysis of Lufax Holding Ltd (NYSE:LU), we examined the company following its poor performance in 2022 with its Q3 revenues down 22.5%. We compared it against the top 10 fintech companies based on its Q3 performance and guidance. Moreover, we then analyzed the Chinese market loan growth to understand if the debt crisis in China had affected the company. Finally, we analyzed its retail credit segment breakdown by loan volume, and customer and revenue growth and forecasted its revenue growth for the next 5 years.

Lufax Performed Poorly to Fintech Competitors

|

Q3 2022 Revenue (‘mln’) |

TTM Revenue (‘mln’) |

Revenue Growth YoY % |

Q3 % Analyst Revenue Difference |

Stock Price Change (Q4 2022) |

Q4 Guidance YoY |

Types |

|

American Express (AXP) |

50,831 |

24.0% |

-0.1% |

9.20% |

24.0% |

Card Network |

|

Visa (V) |

29,310 |

18.7% |

3.1% |

17.12% |

18.0% |

Card Network |

|

PayPal Holdings (PYPL) |

27,057 |

10.8% |

0.4% |

-18.02% |

9.0% |

Payment Facilitators |

|

Mastercard (MA) |

21,640 |

15.5% |

1.7% |

22.46% |

17.0% |

Card Network |

|

Fiserv (FISV) |

17,115 |

2.6% |

0.0% |

8.47% |

11.0% |

Merchant Acquiring |

|

Block, Inc. (SQ) |

16,964 |

17.6% |

1.1% |

14.42% |

19.0% |

Payment Facilitators |

|

FIS (FIS) |

14,483 |

2.7% |

-0.3% |

-10.22% |

6.5% |

Merchant Acquiring |

|

Intuit Inc. (INTU) |

13,319 |

29.5% |

3.8% |

0.49% |

11.0% |

Financial & Accounting Software |

|

Lufax Holding |

10,652 |

-25.5% |

-7.6% |

-23.62% |

-7.0% |

Online Lending |

|

Global Payments (GPN) |

8,691 |

-6.5% |

1.0% |

-8.08% |

10.5% |

Merchant Acquiring |

|

Average |

– |

9.0% |

0.31% |

1.22% |

11.90% |

Source: Lufax, Khaveen Investments

Based on the table above, the top 10 fintech companies had positive growth in Q3 2022 with an average of 9%. Only two companies which were Lufax and Global Payments had negative growth in the quarter.

In terms of analyst consensus expectations, the top 10 companies were on average in line with analyst estimates with 3 companies (American Express, Lufax and FIS Global) underperforming with a negative difference.

Furthermore, 4 companies’ stock prices declined in Q3 while the average stock price change was flat. Notwithstanding, the average revenue guidance for Q4 is positive and higher than the average revenue growth in Q3, thus indicating a potential acceleration in the top 10 companies’ growth outlook.

By Fintech types, the Card Network providers had the best performance in Q3 with an average revenue growth of 19.4% YoY in the period, higher than the top 10 companies’ average of 9%. Based on Insider Intelligence, Visa and Mastercard had strong cross-border volume growth of 44% and 38% respectively and boosted their volume growth. According to Visa, travel across the US was strong and Asia Pacific and Latin America recovered. Card network providers such as Visa earn international transaction revenue (33% of revenue) for cross-border transaction processing which…

arises when the country of origin of the issuer or financial institution originating the transaction is different from that of the beneficiary.

In comparison, other fintech companies such as Payment Facilitators like PayPal earn transaction revenues charged on merchants and have a lower exposure to international transactions with a low cross-border % of TPV of 16% in 2021.

Overall, despite the solid performance of the top 10 fintech companies, Lufax underperformed its competitors in Q3 2022.

Affected by Lockdowns and Regulations

|

Lufax Revenue Forecasts ($ mln) |

2019 |

2020 |

2021 |

2022F |

Average |

|

Retail Credit |

5,566 |

6,047 |

5,586 |

4,388 |

|

|

Growth rate % |

8.6% |

-7.6% |

-21.4% |

-6.8% |

|

|

Wealth Management |

369 |

270 |

341 |

285 |

|

|

Growth rate % |

-26.8% |

26.3% |

-16.3% |

-5.6% |

|

|

Other Income |

1,062 |

2,280 |

5,111 |

4,484 |

|

|

Growth rate % |

114.6% |

124.2% |

-12.3% |

75.5% |

|

|

Total Revenues |

6,997 |

8,597 |

11,038 |

9,157 |

|

|

Growth rate % |

22.9% |

28.4% |

-17.0% |

11.4% |

Source: Lufax, Khaveen Investments

In Q3 2022, Lufax’s revenue had declined by 25% YoY and by % YTD 2022. In the table above, we prorated the company’s segmental revenue breakdown from Q1 to Q3 2022 for its retail credit, wealth management and other income to obtain its full-year 2022 forecasted revenue which is a decline of 17% which is in contrast with its positive growth in the prior year and its 3-year average growth rate of 11.4%. From the table, our 2022 prorated revenue shows all 3 of its segments declining with retail credit having the highest decline. Its competitor Ant Group’s consumer financing unit also performed poorly with a decline in net profit by 63% in Q2 2022 according to Bloomberg.

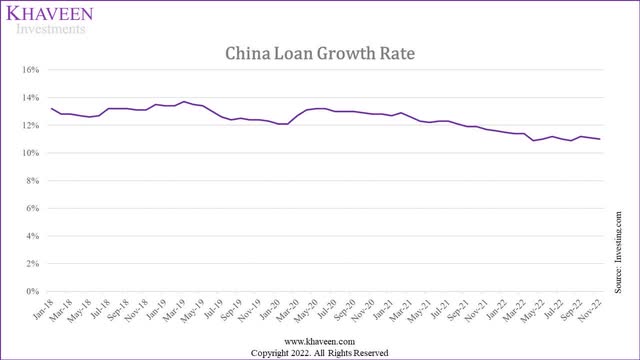

According to the company’s earnings briefing in Q3 2022, the company’s “revenue was negatively impacted by the economic environment”. Thus, we examined the loan growth rate in China to determine whether it was mainly affected by the macroeconomic environment.

Investing.com, Khaveen Investments

According to Investing.com, China’s loan growth rate had been decelerating in the past 5 years since 2018. The average loan growth rate in China in the past 5 years was 12.4% but had further declined to an average of 12.2% in 2021 and slowed down sharply in 2022 with an average of 11.1%. Thus, since China’s loan growth rate had slowed down in the past 5 years, we believe this not to be the main factor for Lufax’s slowdown.

Since 2020, China had imposed lockdowns across various cities in the country. In 2020, it imposed lockdowns in 19 cities but only 1 city was a sub-provincial city, Wuhan, with more than 11 mln population. Furthermore, in 2021, it reimposed lockdowns in Shijiazhuang and Xi’an with more than 8 mln population as its retail credit revenue contracted compared to 2020. In 2022, it imposed lockdowns on its largest city, Shanghai and Shenzhen as the company’s retail credit revenue decline accelerated in 2022.

Moreover, in 2022, China tightened regulations within the online lending market. According to the China Banking and Insurance Regulatory Commission (CBIRC), online lending platforms must contribute at least 30% of “funding for loans they offer in partnership with traditional banks”. Moreover, based on SCMP, online lending platforms contribute only between 2% to 4% for loans on average. Thus, this requires companies such as Lufax to bear more risk by contributing more of their own capital for its loan funding.

Customer Base Growing But Loan Growth Lagging

|

Retail Credit Facilitation |

2017 |

2018 |

2019 |

2020 |

2021 |

2022F |

|

Number of cumulative borrowers (‘mln’) |

7.5 |

10.3 |

12.4 |

14.5 |

16.8 |

19.3 |

|

Growth % |

37.3% |

20.4% |

16.9% |

15.9% |

15.1% |

|

|

Volume of new loans facilitated ($ bln) |

50.9 |

60.1 |

71.5 |

81.9 |

100.5 |

82.7 |

|

Growth % |

15.5% |

24.4% |

14.4% |

14.8% |

-14.1% |

|

|

Volume of new loans per borrower ($) |

6,783 |

5,836 |

5,763 |

5,645 |

5,981 |

4,275 |

|

Growth % |

-14.0% |

-1.2% |

-2.0% |

5.9% |

-28.5% |

|

|

Retail Credit Revenue as % of Loans |

4.5% |

7.4% |

7.8% |

7.4% |

5.6% |

5.3% |

|

Retail Credit Revenue ($ mln) |

2,269 |

4,478 |

5,566 |

6,047 |

5,663 |

4,388 |

|

Growth % |

8.6% |

-6.4% |

-22.5% |

Source: Lufax, Khaveen Investments

Based on the table above, we prorated the company’s customer growth, the volume of loans and revenue in 2022 to obtain its full-year data. The company’s retail credit segment’s customer base had been continuously growing strongly in the past 5 years but had slowed down slightly in 2021 and 2022. Moreover, the company’s volume of loans facilitated had been growing positively in the past 5 years except in 2022. However, the company’s new loan volume per borrower had declined since 2017. Moreover, the company’s retail credit revenue as a % of loans had also decreased since 2019. Thus, the declining loan volume per borrower and revenue per loan volume impacted its revenue growth negatively in 2022.

Based on its earnings briefing, the company highlighted its strategy of “focus on well-rated small business owners in more resilient cities” as well as its direct sales force channel. It also stated that it expects the increased focus to impact its revenue in the medium term.

In the near term, we expect this adjusted strategy will generate new loan facilitation volumes at approximately 2/3 of the volumes we have generated in recent years. – Yong Suk Cho, Co-CEO & Chairman

|

Retail Credit Facilitation |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Number of cumulative borrowers (‘mln’) |

16.8 |

19.3 |

21.7 |

24.1 |

26.4 |

28.8 |

|

Growth % |

15.9% |

15.1% |

12.2% |

10.9% |

9.8% |

9.0% |

|

Volume of new loans facilitated (USD bln) |

100.5 |

82.7 |

85.4 |

87.2 |

88.1 |

88.3 |

|

Growth % |

14.8% |

-14.1% |

3.3% |

2.1% |

1.1% |

0.3% |

|

Volume of new loans per borrower |

5,981 |

4,275 |

3,935 |

3,621 |

3,333 |

3,067 |

|

Growth % |

5.9% |

-28.5% |

-8.0% |

-8.0% |

-8.0% |

-8.0% |

|

Retail Credit Revenue as % of Loans |

5.6% |

5.3% |

5.3% |

5.3% |

5.3% |

5.3% |

|

Retail Credit Revenue |

5,663 |

4,388 |

4,533 |

4,627 |

4,677 |

4,690 |

|

Growth % |

-6.4% |

-22.5% |

3.3% |

2.1% |

1.1% |

0.3% |

Source: Lufax, Khaveen Investments

We projected the company’s retail credit facilitation segment revenue in the table above, First, we forecasted its borrowers through 2026 based on its past 5-year average borrower increase of 2.37 mln per year. Moreover, we forecasted its volume of new loans per borrower at a 5-year average of -8% as a conservative assumption due to the poor outlook from management. Additionally, we based its revenue as a % of loan volume based on its 2022 figure of 5.3% to derive our revenue forecast at a 5-year average of -3.2%.

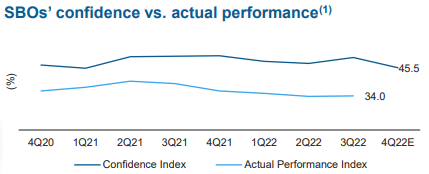

Risk: Declining SMB Customers’ Business Confidence

Lufax

We believe one of the risks of the company is the declining business confidence of its target customer group. As seen above, the SMB confidence index deteriorated in Q4 2022 compared to the previous quarter and we believe could pose a risk to Lufax’s revenue growth.

Verdict

All in all, despite the solid performance of the top 10 fintech companies, Lufax underperformed its competitors in Q3 2022. Furthermore, we believe the company was impacted by the Covid lockdowns across large cities in China as well as the new regulations on online lenders in China which require higher funding for loans as retail credit revenue declined in 2021 and 2022. We derived our revenue forecast at a 5-year average of -3.2% which we believe is appropriate with the poor outlook by management. Based on analyst consensus, the company has an average price target of $2.74, which is around the current stock price.

Be the first to comment