jetcityimage/iStock Editorial via Getty Images

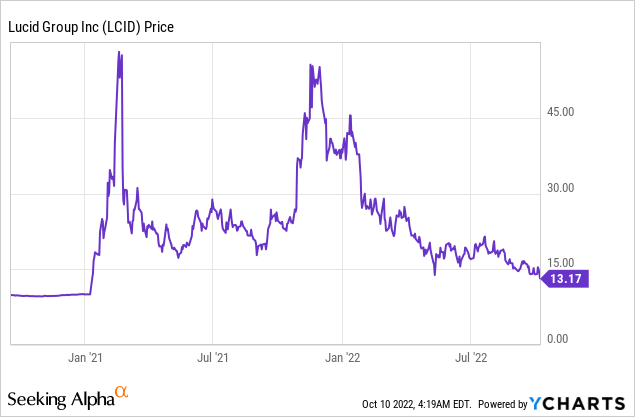

Lucid Group (NASDAQ:LCID) started in 2007 as a company called “Atieva”. The business was founded by an ex-Tesla VP Bernard Tse and former a Sales VP from Astoria Networks named Sam Weng. A key driving force behind the success of Lucid has been Peter Rawlinson, a British engineer who worked as the VP of Engineering for Tesla’s flagship Model S. Rawlinson transferred his knowledge/experience from Tesla to Lucid in 2013, when he became the Chief Technology Officer [CTO] and then CEO. The reason this story is interesting is Lucid has the Tesla design philosophy embedded throughout the business. However, the company is focusing on creating upmarket Luxury vehicles. There have been many reports online of Tesla having quality issues, from panels which don’t quite fit, to hair embedded in paint jobs. The CEO of Lucid admits “Tesla is innovative, but not high quality”. This makes sense as Elon Musk’s mission is to make an affordable EV for the masses. Therefore I believe Lucid, has a significant opportunity in the luxury EV market. In this post I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Business Model

The mission of Lucid is to “inspire the adoption of sustainable energy by creating advanced technologies and the most captivating luxury electric vehicles centered around the human experience”. Now although this mission is quite long it does embody everything the business does. The first part of the statement is very similar to Tesla’s mission to “inspire the world’s transition to renewable energy”. While the “luxury” part is a key element of the value proposition. The beauty of targeting high-end customers is it means you can focus on creating the best quality vehicle and often generate high margins, as you are not competing on price. Humans tend to judge the value of items based on simple heuristics. One of the mental shortcuts people use is “price”, often if the price of an item is higher customers automatically think “better quality”, this effect is most prominent in the sale of luxury brands.

Lucid (left) vs Tesla (right) (Lucid Group, Tesla Motors)

Analysts from Financial services company Cantor Fitzgerald, have recently put an “overweight buy” rating on Lucid stock. The analysts believe Lucid’s vehicles provide longer range, faster charging, and higher efficiency than many other industry peers. For example, the Tesla Model S has a range of 405 miles, whereas the Lucid Air Dream Edition has a range of 520 miles, firmly beating Tesla. Lucid is mainly competing with the Mercedes EQS which has a range of 450 miles and is one of the most beautiful luxury EVs on the market.

Lucid’s Air Grand Touring performance even clocked up the world record of the fastest production car at the Goodwood Festival of Speed with a time of 50.79 seconds. This fantastic result was driven by Lucid’s proprietary powertrain technology. Customer reviews state the Lucid Air vehicle has much more legroom relative to a Tesla. Therefore as a consumer, if I wished to buy a luxury EV, I would look no further than Lucid.

Growing Financials

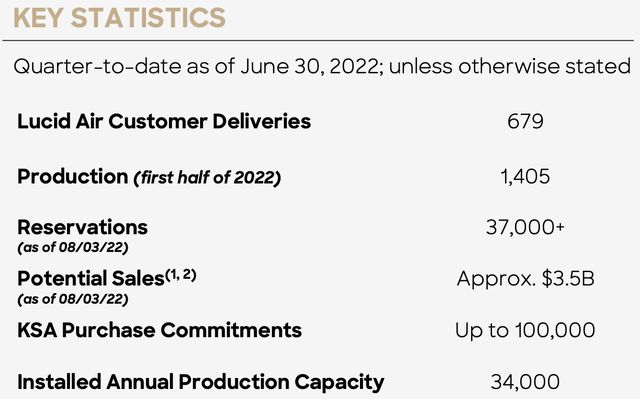

Lucid Group generated solid financial results for the second quarter of 2022. Revenue was $97.3 million, which did increase exponentially from the $200k revenues in the equivalent quarter last year. This was a result of 679 vehicles delivered in the quarter. Overall both revenue and deliveries may seem small (and they are). Tesla is on another level when it comes to production output, the company has sold around 1.9 million vehicles to date. The company also has 4 production models online, vs Lucid which has just one. The good news for Lucid is the business does have strong demand with over 37,000 vehicle reservations and estimated future sales of $3.5 billion. The company has also raised its production estimate for 2022 to between 6,000 and 7,000 vehicles.

Key Statistics (Lucid)

Tesla has built out its vast production capability with “gigafactories” in California, Nevada, New York, and Shanghai. Recently Tesla has upgraded its Shanghai factory and sold a record 83,135 vehicles in China during September, smashing its prior record. Lucid has just one manufacturing facility in Arizona, which has an annual capacity of 34,000 Lucid Air Vehicles, which is expected to expand to 90,000 vehicles by Phase 2. Lucid is vertically integrated like Tesla, which means its core EV technology is manufactured in house. This is a positive strategy as it tends to give the business greater control over its supply chain and result in higher margins long term.

Lucid Manufacturing Plant (Lucid Investor Presentation)

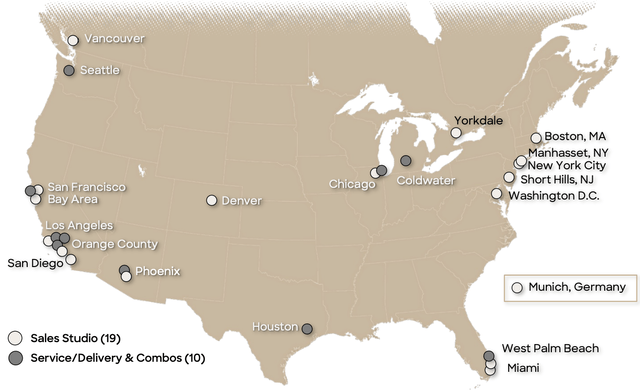

Lucid has also been inspired by Tesla on the sales front by offering a direct-to-consumer model. This enables greater control over the customer experience and higher margins long term. At the time of writing the business has 28 Studio and Service centers in North America and have recently opened a European Studio in Munich Germany.

Service Facilities (Lucid Investor Presentation)

Back to the financials, Lucid is still unprofitable and generated earnings per share -$0.13 which beat analyst estimates by $0.28 per share. The company also has a strong balance sheet with ~$4.3 billion in cash and short-term investments. In addition, the company has long-term debt of ~$1.99 billion.

Valuation?

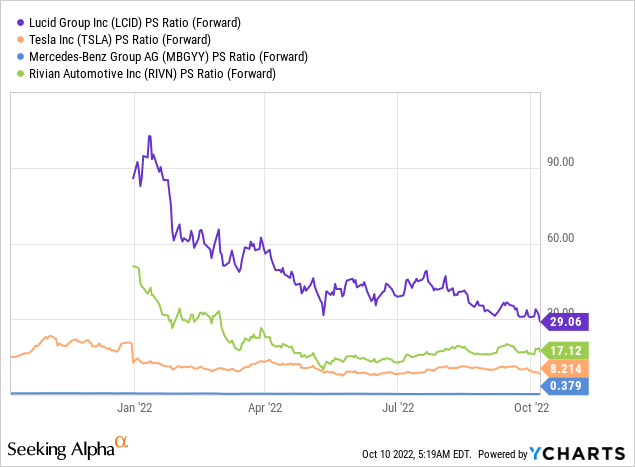

Valuing Lucid is fairly challenging given the company is still in the early part of its business cycle. The company trades at a forward Price to Sales ratio = 29, which is significantly cheaper than historic levels of over 90. However, this is still much more expensive than companies such as Tesla which trades at a PS ratio = 8 and Rivian which trades at a PS ratio = 17.

It should be noted that Lucid has a pipeline of orders which has a value $3.5 billion. Thus at the market capitalization of $22 billion, Lucid actually trades at a forward Price to Sales ratio = 6, which is slightly cheaper than Tesla. Per unit Lucid has the potential to generate higher margins than Tesla as its vehicles can be sold at a much higher price point, given the “luxury” branding. Overall the stock looks to be “fairly valued” at the current levels.

Risks

Production Scaling Issues

In past interviews Elon Musk has stated that making a prototype is relatively “easy”, but scaling manufacturing is the “hard part”. I tend to agree, as a former design engineer, manufacturing is the most challenging and capital-intensive part of the automotive business. Tesla is way ahead of the pack and Lucid is in the early stages of production and thus there is still a lot of uncertainty ahead.

Tesla Full Self Driving

As mentioned in the introduction, the reviews of Tesla vs Lucid, show Lucid wins hands down in the luxury EV market where the price is not a major issue. However, Tesla does have a secret weapon which is its full self-driving technology which is gradually improving over time. Tesla has the largest self-driving set of any vehicle manufacturer on the planet. Thus if/when Tesla finally achieves full autonomy with minimal errors, that will add an immense amount of value to the Tesla vehicle and the company. This is a strong moat that could blow competitors out of the water, even if they have slightly longer range or more leg room.

Final Thoughts

Lucid has created a tremendous product that is industry-leading when it comes to its specifications. The business has a great plan and a strong team ready to execute. However, much uncertainty still faces the business especially when it comes to scaling manufacturing which is the most difficult challenge. I have a theory that Lucid will sell cars and then get acquired years down the line by an incumbent auto manufacturing giant. I have labeled the stock as a “buy” but this stock should be in the speculative portion of your portfolio if investing.

Be the first to comment