Ildo Frazao/iStock via Getty Images

Loyalty Ventures (NASDAQ:LYLT), a company that is in the business of providing consumer loyalty solutions to businesses, is coming to the end of a year that, without a doubt, it’s glad is almost over.

Its share price fell off the cliff, dropping from a 52-week high of $34.17 on January 24, 2022, to a 52-week low of $0.7097 on October 24, 2022. Since then, it has rebounded to trade in an approximate range of $2.22 to $2.55 per share.

A mistake the company made was in offering luxury rewards when the market was looking more for home products and entertainment. The result was when customers redeemed the rewards, they were more costly because of inflation. And since redemptions were high because of pent-up demand for travel, it cut into the company’s earnings.

In this article we’ll look some of the numbers from its latest earnings report and how the company is responding to the challenges it faces as it heads into 2023.

Some of the numbers

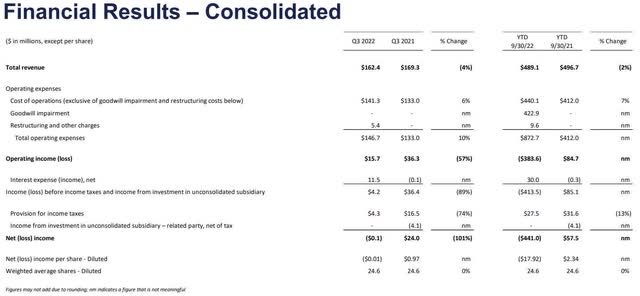

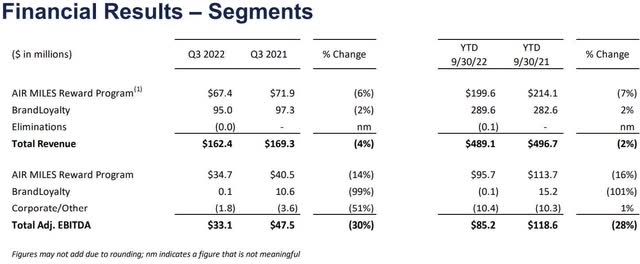

Revenue in the third quarter was $162 million, down 4 percent from the revenue of $169 million in the third quarter of 2021. For the first nine months of 2022 revenue came in at $489.1 million, down over $7 million from the $497 million in revenue for the first nine months of 2021.

Total operating expenses in the quarter were $146.7 million, up from the $133 million in operating expenses in the third quarter of 2021. For the first nine months of 2022 total operating expenses were $873 million, up from the $412 million in operating expenses in the first nine months of 2021.

Included in the operating expenses was a goodwill impairment of $423 million in the first nine months of 2022. Without it, total operating costs in the first nine months of 2022 would have been approximately $39 million more than the first nine months of 2021.

Net loss in the third quarter was $125,000, or (0.01) per share, compared to the $24 million gain in the third quarter of 2021, or $0.97 per share. Net loss for the first nine months of 2022 was $441 million, or (17.92) per share, compared to a gain of $57.1 million in the first nine months of 2021, or $2.34 per share.

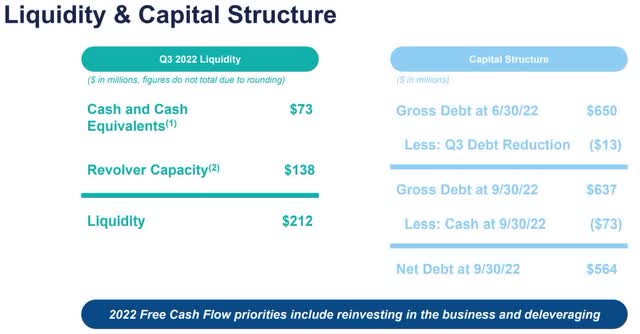

At the end of the third quarter the company had cash and cash equivalents of $73 million, compared to cash and cash equivalents of $167 million at the end of calendar 2021. Including its revolver, total liquidity at the end of the quarter stood at $212 million. Long term debt in the reporting period was $567.7 million, down by about $30 million from the end of calendar 2021. It has $610 million set aside for redemption settlements.

A significant blow to the company was the decision by Canadian grocery chain Sobeys to end its partnership with LYLT. The grocer accounted for about 10 percent of the company’s EBITDA. At the time of the announcement the share price plummeted by approximately 50 percent.

Response to the changing market

The immediate response by the company to the changing marketplace was to focus on cost containment. One of its major moves is to cut its workforce by about 20 percent, resulting in a more streamlined company.

One thing I think of when those types of cuts are made is this: How is the company able to cut that high of a percentage if it wasn’t bloated in employee numbers already? Why did it take so long for them to make the move in the easily visible economic environment it was operating in?

In other words, if management is confident it can operate and grow with about 20 percent less staff, what were they hired for in the first place? The obvious answer to me is management miscalculated its growth potential and was attempting to position the company for expected growth. The other probability is in a tight labor market they didn’t want to be caught in a worker shortage if more people were required to generate the growth. Whatever the reason, management is confident it can execute its strategy with about 20 percent less workers. That will of course lower costs and improve the bottom line of the company, assuming revenue will at least be level with where it has been recently. If revenue improves, it should improve the bottom line more.

Management said in its earnings report that in response to higher cost inputs it has “reorganized our business processes to focus on faster speed to market, end-to-end responsibility and a more flexible workforce. This approach will result in a reduction of our staffing of about 20% this year, leading us next year to a more efficient dynamic business.”

Another thing the company starting to do is to strengthen its balance sheet by working on reducing debt. If it can generate enough free cash flow to be somewhat aggressive with that, it’ll be a big plus for the company in a high interest rate environment that will continue through 2023.

The company has also announced changes it has made in its Air Miles and BrandLoyalty programs.

BrandLoyalty

In its BrandLoyalty program, a major thing catching the company off guard with was in regard to consumers transitioning from luxury rewards to more everyday “kitchen” items, such as “bakeware, dinnerware, barware, storage containers and cutlery.”

Not only will that be more relevant to its customer base in its key markets, but it’ll also be much less expensive when redeemed because of the higher input costs associated with luxury items.

With redemption levels being higher in the recent past because of pent-up demand for travel, it has resulted in higher redemption costs. Transitioning to lower-cost practical items will cut costs while providing rewards better serving customer preferences.

It is also adding more entertainment themes to its BrandLoyalty rewards program.

The combination of an improved product mix resulting in serving customer needs and wants better, along with lower costs to the company, is expected to result in a better overall performance in the segment. This should produce lower inventory levels going forward.

Air Miles

As mentioned earlier, the pent-up demand for travel has resulted in high redemption increases, which carried over into the second half of 2022. The company said there was a 79 percent increase in redemptions in travel-related miles compared to 2021. In 2023 the company expects this to normalize to near past levels.

For now, management believes the $610 million set aside for redemption settlements is enough to cover the times when redemptions are higher than usual without having an impact on its liquidity. In regard to changes the company is making in Air Miles, it is transitioning to a more open and flexible go-to-market model that provides businesses with the ability participate in the program on their own terms, which LYLT believes will give them a better ROI. At the same time, it will give the company’s collectors more options to choose from.

With less constrictions in regard to exclusivity, the company had limitations on what it could do or not do in specific verticals. With a more flexible and open model the company believes by removing barriers it’ll allow it to go to market at a faster speed than it has been able to in the past.

Conclusion

LYLT has been struggling throughout the year, partly from macro-economic conditions outside of its control, as well as being slow to identify and respond to changing customer preferences – with businesses and consumers. It has made the changes it believes it needed to in order to address the things it has control over. As for markets, the company is going to concentrate on the EMEA market, even though it’s under more economic pressure than the other markets it competes in. The reason why it’s doing so is because it’s by far its largest market, accounting for about 76 percent of its business.

Even with more economic headwinds there, the company says it will focus on that market in the near term because its “campaigns are well known to the retailers and consumers in this area.”

Being its biggest market by far, it’s understandable why management made this decision, but it also comes with more challenges than other markets, which could get worse in the first half of 2023.

When all is said and done concerning LYLT, the big question is whether or not it has found a sustainable bottom now that it’s trading in a range of the low to mid $2s over the last several weeks.

I tend to think it’s at a good entry point now, but considering the business of Sobeys, it means it’s highly susceptible to negative news that appears somewhat disproportionate to its general performance.

With that in mind, I do think LYLT is oversold, but at the same time it could easily take another big hit on negative news.

It looks like the risk/reward is in favor of investors at this time, with a lot of potential upside in the years ahead. I would be careful with position size if considering taking a position in the company and use a dollar-cost averaging strategy to product the cost basis if the stock goes south again.

Be the first to comment