ivanastar

Introduction

On December 7th, Lowe’s Companies, Inc. (NYSE:LOW) held its 2022 investor & analyst conference, providing us with additional information for future growth and financial expectations. This seemed like a great moment for me to write my initial thesis on Lowe’s Companies, as the stock has been an important holding in my portfolio for many years now.

With the economy under serious pressure, interest rates rising, a deteriorating housing market, less consumer spending, and a possible recession, it is crucial to see how management views the market. With Lowe’s being the second-largest home improvement company, they heavily depend on the general home improvement market growth for revenue growth. Where many investors and analysts do not have a very positive view of the market for next year with the threat of a recession, Lowe’s continued to remain very positive about market resiliency and explained several catalysts supporting the home improvement market. As a result, Lowe’s maintained its FY22 financial targets and gave a small insight into expectations for next year.

In addition to market strength, Lowe’s has several plans in place for capital spending to improve its market share, moat, and financial performance. Where Lowe’s remained careful with next year’s projections for revenue, it is projecting another year of margin expansion. Margin expansion will be driven by investing in its omnichannel, improving the supply chain, investing in technology, and increasing penetration in the Pro segment.

I remain confident in the performance of Lowe’s going forward, and the company seems to be more resilient than granted by many. With the home improvement market projected to grow by over a 4% CAGR until 2028 and Lowe’s increasing market share and improving margins, they seem to be in a great position for growth and strong shareholder returns.

As this article is my initial coverage of Lowe’s Companies, I will provide an in-depth analysis by using its recent investor & analyst conference to see whether Lowe’s is a buy at current prices when taking into consideration the market outlook, company-specific growth plans, valuation, and risks.

Let’s get to it!

Lowe’s Companies Inc.

Lowe’s is an American retail company specializing in home improvement products for both professionals and DIY. The company is headquartered in Mooresville, North Carolina, and operates a chain of retail stores spread across both the US and Canada. Despite owning way over 2000 retail stores, with little less than 2200 stores, the company is only the second largest home improvement chain, behind rival Home Depot (HD).

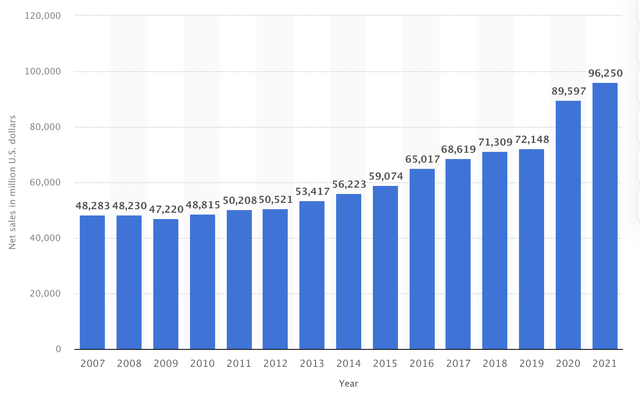

Lowe’s is one of the rare dividend kings after having increased its dividend for over 50 consecutive years in a row. The company proudly serves over 19 million customer transactions every week. Lowe’s has an incredible moat, as the company is spread across all of North America and is one of the most important home improvement store chains. The home improvement industry has been a growing one over the last decade, and as Lowe’s keeps increasing its business and strengthening its moat, growth has been steady since 2007. The company did not manage to improve its revenues in the period during and after the financial crisis. In the period between 2007 until 2010, the company saw pretty much no growth at all. Yet at the same time, revenue also did not drop away significantly. The home improvement market in general is expected to be very sensitive to consumer spending and economic growth.

The home improvement market did see a strong boost in growth during the covid-19 pandemic as people started improving their own homes, as they had free time and were spending more time at home. This is clearly visible in the revenue growth for Lowe’s, which can be seen below. Revenue got a massive boost to $89.6 billion in 2020 from just $72.1 billion in 2019. Growth continued into 2021 as covid lockdowns endured and people were sitting on cash they could not spend on activities. Thanks to this, the company managed to report 36% sales growth in the period between 2018-2022. Over the same period, margins improved by 440bps, and EPS growth was 169%. The stock returned a massive $43 billion to shareholders over just these 4 years.

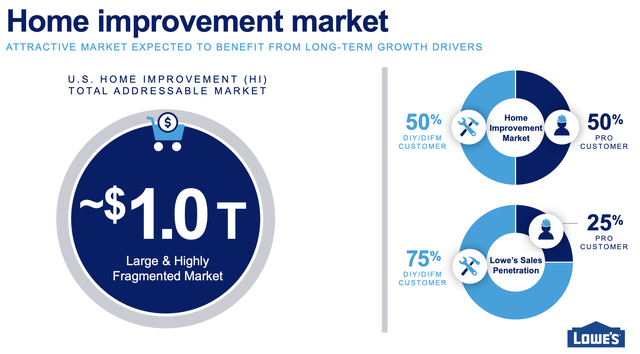

The main worry now is for growth to slow down significantly for Lowe’s as people have spent enough on their homes and this revenue will now drop away. In addition to this, a potential recession is not helping investor sentiment towards the industry, and Lowe’s specifically. With interest rates rising, home builders are taking a step back, as buying a house becomes less appealing. From an economic standpoint, the growth outlook for Lowe’s does not look great. But if we start looking for the long-term, the home improvement market is still expected to grow at a 4.6% CAGR until 2028 to reach close to $1.1 trillion in market value. This growth will be an obvious tailwind for Lowe’s over the next years as one of the largest players.

Despite a difficult economic outlook, Lowe’s continues to project flat growth YoY for FY22, which, considering tough comparable quarters, is very impressive with the world fully reopened (in the regions for Lowe’s). I think this is very impressive and makes me feel confident about how management handles the situation. I do remain cautious. Analysts are currently projecting only a slight decrease of 3% in revenue for next year.

Where I am projecting some industry-specific problems in the case of a recession, Lowe’s continues to keep a very positive view of the market. According to Lowe’s, the age of housing and undersupply of homes are tailwinds to the industry. Disposable income for homeowners also remains strong, with $1.5 trillion in excess savings and a record average $330 thousand in homeowner equity. These factors could work in favor of the home improvement market and could prevent a slowdown. In addition to these points, it was also pointed out that 50% of people still work from home, making it more attractive for those people to invest in their homes.

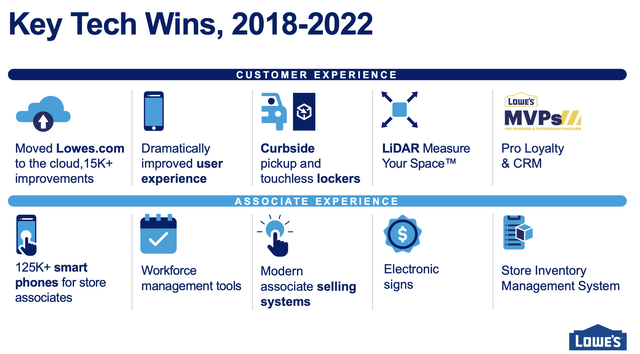

As for company-specific growth, the company believes it can improve its market position by investing in its online channels. As a part of investing in its online systems, Lowe’s also continues to retire legacy omnichannel systems, and through this wants to improve sales, expand inventory visibility, improve customer service, and unlock productivity. All these improvements will contribute to margin expansion and improve shareholder returns. I appreciate Lowe’s focusing on these areas for investment, as it is an excellent way to drive up margins. This does please me as a shareholder. Investing in technology solutions has proven to be fruitful over the last few years, with key tech wins as pictured below.

In addition to technical growth, improving penetration in the Pro segment is a focus point for Lowe’s as it has been over the last couple of years. It plans to leverage Pro CRM to expand its wallet share and use a data-driven method. Where Pro grew by 76% over the last three years, growth so far stands at 6% YoY, outpacing other company segments. Lowe’s targets to grow the Pro segment by 2x the market rate.

To summarize, Lowe’s is staying very positive about both the home improvement market and growth for the company itself. I think the company has strong capital allocation plans by focusing on digital and technological improvements, which should improve sales and margins going forward. A focus on the Pro segment should also be a revenue driver for Lowe’s as the company remains to have a lot of market share to gain here compared to competitor and rival Home Depot. By focusing on this, Lowe’s tries to transition to a more stable sales mix between DIY and Pro. This should make the company less sensitive to consumer spending. The current sales mix for Lowe’s is 75% to DIY and just 25% of revenue comes from Pro, leaving plenty of room for improvement.

Now, how does this reflect in the financial targets for Lowe’s?

To start with, Lowe’s reaffirmed its FY22 guidance. This means Lowe’s expects to end the year with $97-$98 billion in revenues and an operating margin of 13%. Shareholder returns will total approximately $13 billion and ROIC will come in at a massive 37%. It is great to see Lowe’s yet again comforting its shareholders and managing to report flat growth YoY while the economy is taking a downturn. As a result of the confidence management has in its growth prospects and financial results, the board of directors authorized a new $15 billion share repurchase program. This new program will be on top of the existing share repurchase program of which $6.4 billion is remaining as of December 6. This brings the total to $21.4 billion in share repurchases authorized.

The 2023 outlook for Lowe’s is less of a good news story and management takes a careful stance towards it by projecting three possible scenarios as the economic situation remains a difficult one to predict. Lowe’s is projecting revenue to be between $87-$92 billion for FY23, with operating margins of 13.3%-13.9%. Where revenue is expected to be lower for next year, margins are expected to increase under any situation as management continues to execute on innovation plans.

Management is being careful with its projections and is preparing for an economic downturn resulting in a recession. Lowe’s plans on defending its margins by keeping near-term inventory down and lowering advertisement spending.

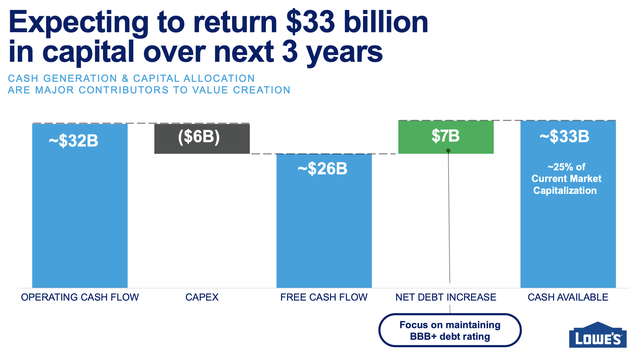

In the end, all these improvements should contribute to better shareholder returns. Lowe’s plans on increasing shareholder value through increased productivity, significant cash flow generation, and optimized capital allocation. Management expects to generate significant cash to strengthen the business over the next three years as shown below. Lowe’s aims to keep a strong BBB+ balance sheet and targets a 35% dividend payout ratio, which should be well able to reward shareholders and grow the dividend in the future.

Balance sheet and valuation

According to Yahoo Finance, Lowe’s held $3.96 billion in total cash as of the latest financial quarter. Total debt was $38.31 billion, giving the company a significant net debt position. Lowe’s does not require a lot of Capex with the company being very mature. Lowe’s can generate significant cash flows and therefore I do not see debt as a significant problem. The company holds a BBB+ financial rating and has plenty of cash-generating ability to buy back its shares, increase dividends, and lower its debt over the following years.

Analysts are projecting Lowe’s to report a revenue decrease of close to 3% for next year and to rebound to low to mid-single-digit growth over the following 5 years. EPS growth is projected to be a lot stronger as Lowe’s increases profitability. EPS is expected to keep growing next year by just 3%, but to speed up again to double-digit growth in the years after. This will be driven by a reduction in share count, and Lowe’s improving its margins. This puts the current valuation at a forward P/E of 15, which is 17% below its 5-year average valuation and 21% above the sector median. As for comparison, Home Depot is valued at a forward P/E of 19.2, significantly higher than Lowe’s.

I believe Lowe’s is currently very close to fair value when factoring in a potential recession in 2023. I also think that the strong dividend history of Lowe’s in combination with its resiliency proven by recessions in the past should command Lowe’s to deserve a higher valuation. For that reason, despite the stock not being very cheap and close to fair value, I think the stock is a buy considering the valuation. This leaves plenty of upside potential over the next decade, supported by increasing margins, share buybacks, and increasing dividends. Lowe’s does not need to grow its topline massively in order to be an attractive investment.

Also, despite its strong financial performance so far this year, the stock is down by 19% YTD, making it a lot cheaper when compared to the start of the year. Yes, expectations have come down as well regarding growth for next year, but being valued at just 13x FY24 EPS does not look expensive to me for a company such as Lowe’s.

I do want to add to this, that near-term weakness in the share price is very much possible and so, as for any company right now, the stock price could very well get more attractive. Still, the current share price allows investors to slightly increase their position or initiate a small position in the company.

Dividend

Lowe’s has an incredible dividend history and is a dividend king following over 50 consecutive years of dividend growth. The company has survived many recessions and even managed to grow the dividend through these difficult times, which should tell us something about its resiliency. Lowe’s has been paying and growing the dividend for a whopping 59 years in a row.

Lowe’s currently pays a forward dividend yield of 2.03%. This is not remarkably high, but I prefer a lower yield with more safety and growth potential. Yield is currently standing 15% above its 5-year average making it very attractive.

Lowe’s has been growing the dividend at a strong pace over the last few years with a divided growth CAGR of close to or over 20% for the last 10, 5, and 3 years. This is very impressive growth, and the most recent increase was even higher at 32%.

Despite these very impressive growth rates and the many years it has been growing already, the payout ratio still only stands at 31%, allowing Lowe’s to increase the dividend going forward as it aims for a 35% dividend payout ratio.

Conclusion

Lowe’s Companies, Inc. is an incredible company, with a very impressive history. It has survived many recessions and is very well-positioned for a potential recession by next year. Lowe’s has a very strong BBB+ financial rating, a safe dividend payout, and a strong cash position. Management remains confident in industry resiliency and strong performance for next year. The company has strong capital spending plans in place which should increase sales and margins over the next decade and reward investors.

I remain confident in the performance of Lowe’s as a long-term investment, as I feel like stock returns could very well outpace the broad market. I do also remain careful, with the economy taking strange turns and remaining volatile.

As I mentioned before, I think the current valuation and stock price allows for a nice buying opportunity to take advantage of long-term growth plans. At the same time, I do recommend adding to your Lowe’s position slowly, as more downside is very much possible.

I rate Lowe’s a buy at the current share price of around $206.

Be the first to comment