Roy Rochlin/Getty Images Entertainment

Investment Thesis

Lovesac (NASDAQ:NASDAQ:LOVE) has fallen over 73% from its all-time high in June 2021, as recession fears have plagued the furniture industry. However, the market is ignoring the unique business model of Lovesac, which generates an astronomical amount of repeat transactions, creating recurring revenue that looks like a Software as a Service (SaaS) business. With Lovesac trading at one of its lowest valuations in history, the market is ignoring a gem from within the furniture industry.

Company Overview

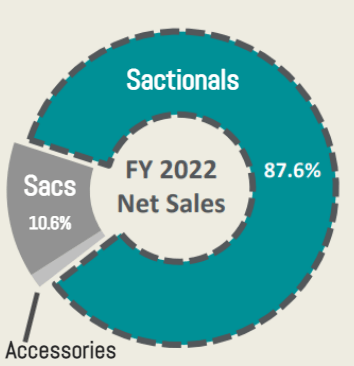

Lovesac is a furniture retailer which specializes in two main products: the “Sac” and the “Sactional”. You likely know Lovesac for their Sacs, which are the massive bean bags that appear in the picture above. However, contrary to popular belief, Sacs are not Lovesac’s biggest seller. Here is a look at Lovesac’s revenue breakdown for the calendar year 2021:

Lovesac

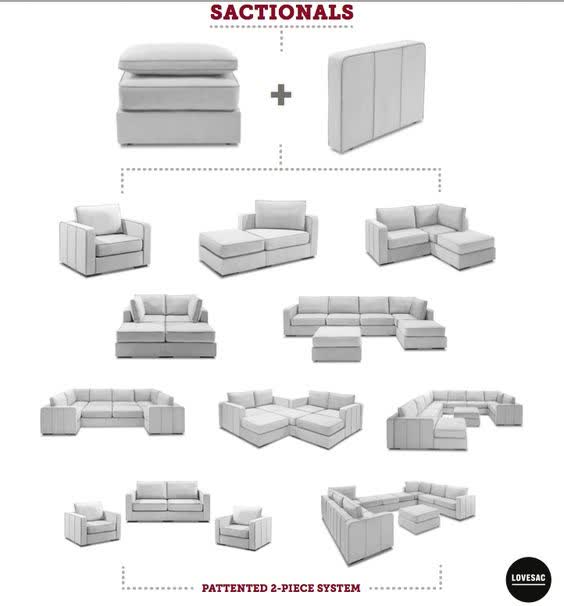

As you can see, Lovesac’s best-selling product is its patented Sactional, which makes up nearly 88% of total sales. Sactionals are comprised of two parts: a seat and a side. These seats and sides can be used to configure any number of furniture pieces: couches, chairs, loveseats, sectionals, beds, and whatever else you can think of. Here is a graphic from Lovesac to help visualize the Sactional:

Lovesac

By simply buying sides and seats, customers can create any number of furniture combinations within their homes. Why is this important? Because it allows for recurring revenue that looks more like a SaaS business than a furniture company!

Customer Loyalty

In general, the furniture industry is not well known for its customer loyalty. Many consumers simply buy furniture as a commodity, irrespective of the brand. In a study by Provoke Insights, only 1/3 of consumers said they were loyal to any particular furniture brand. Here’s a look at the data:

However, Lovesac has bucked the trend in terms of customer loyalty. This is largely due to the configurable, changeable, and upgradable nature of the Sactional. In an article by Forbes, Jackie Huba details how Lovesac has created such a loyal customer base. All Lovesac products come with a lifetime warranty, that ensures customers will not churn through products. This goes well with the configurable and changeable nature of the Sactionals. While most people want different furniture throughout their life, Sactionals can be heavily modified. Not only can they be configured into different furniture pieces, but they can also change appearance via interchangeable covers. Sactionals can also be upgraded with various accessories like drink holders, seat tables, couch bowls, roll arms, power hubs, and outdoor seats. It is for these reasons that Lovesac has created such a loyal furniture brand. This is reflected in its financials, as 41.6% of 2021 transactions came from repeat customers! After looking at La-Z-Boy, Hooker Furnishings, and Haverty Furniture, none of them even reported data on customer loyalty or repeat transactions. This is likely because they either don’t track that data or because they have poor customer loyalty. Either way, Lovesac is ahead of the game in terms of customer loyalty. Here are some more customer data points:

Customer Lifetime Value [LTV]: $2,840

Customer Acquisition Cost [CAC]: $549

LTV/CAC: 5.2x

The LTV/CAC ratio is a measure of profitability, that measures the relationship between the lifetime value of a customer and the cost of acquiring the customer. This is largely used by Subscription as a Service (SaaS) businesses, which have large amounts of recurring revenue. An LTV/CAC ratio of 3x is considered to be a good ratio for SaaS businesses. Lovesac, a furniture company, has an LTV/CAC ratio of 5.2x which would make many SaaS businesses jealous.

Growth Catalysts

In addition to the recurring revenue that strong brand loyalty brings, Lovesac continues to grow and add new customers. Here’s a graph with Lovesac’s new customers by year:

Using our LTV metric of $2,840, Lovesac just “onboarded” $341 million worth of lifetime customer value in 2021.

LTV ($2,840) * # of customers (120,351) = $341,796,840

With a 5-year revenue CAGR of 47.6%, Lovesac has been growing at a tremendous rate. This growth has been driven by the opening of new showrooms, an increase in digital penetration, an increase in Sactional sales, and tremendous same-store sales growth.

New Showrooms

At the end of Q2, Lovesac had 174 showrooms, a 41% increase from their 123 showrooms at the end of Q2 in 2021. They also had net sales growth of 45% over the same period and comparable sales growth of 31.1%. In 2021, Lovesac opened up 28 new showrooms and 8 new kiosks. In 2022, Lovesac plans to open up more than 25 new showrooms, and already opened 11 in Q2 alone. The economics of Lovesac’s showrooms are very strong as well. They target net sales of $1.4 -$1.5 million within the first year, with preopening expenses totaling $425 thousand dollars. On average, the payback period for a Lovesac showroom is less than 2 years! With a payback period of fewer than 2 years, it is no wonder that Lovesac continues to heavily invest in new showrooms.

Digital Penetration

From 2018 to 2021, Lovesac increased internet sales as a percentage of total revenue, from 19.9% to 30.2%. Here is a graphic that shows revenue by sales channel:

While internet sales decreased in the calendar year 2021 from 2020, this is simply due to the massive amount of internet sales in 2020 due to COVID. Increased digital sales allow for cheaper growth with higher margins. In addition, it strengthens Lovesac’s overall brand and customer loyalty.

Sactional Sales

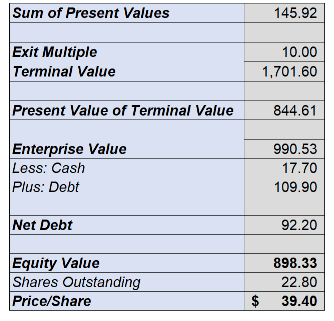

While Sactional sales may not seem to be a growth driver, an increase in Sactional sales has been one of the greatest growth drivers for Lovesac. As we stated at the beginning, the configurable nature of Sactionals creates brand loyalty that leads to repeat transactions. When Lovesac first started, the Sac was its first product and was its largest source of revenue for a long time. However, Sactional sales have slowly become the largest source of revenue for Lovesac. With Sactionals being the main driver for repeat purchases, the lifetime value of Lovesac customers has soared in recent years. Take a look:

The LTV of a Lovesac customer has nearly tripled since 2015 due to the increase in Sactional sales. This will continue to be a strong growth driver for Lovesac in the coming years.

Valuation

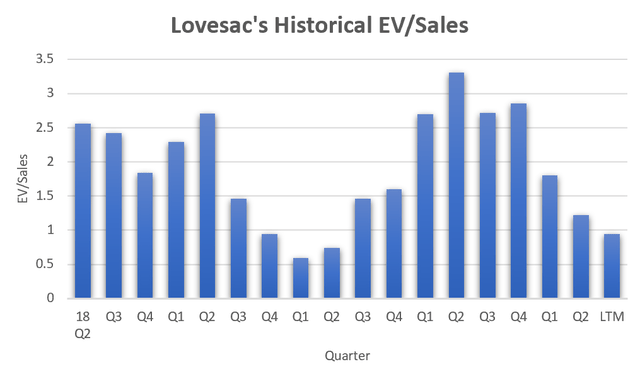

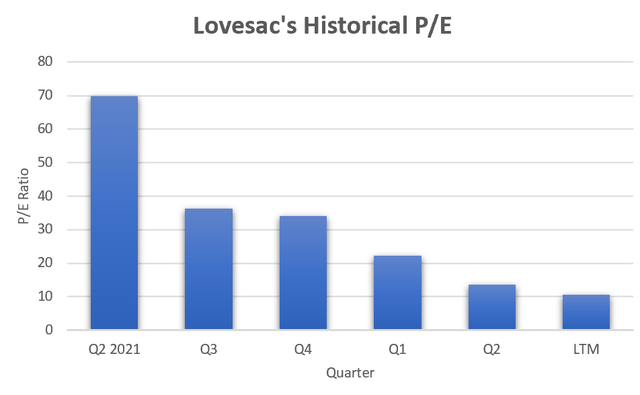

With a 47.6% revenue CAGR, you would expect Lovesac to be trading at quite a high valuation multiple. In addition, their strong brand loyalty and competitive moat within the furniture industry further justify a higher valuation. However, Lovesac is currently trading a P/E ratio of around 9x. Here are some graphs that look at Lovesac’s valuation using historical multiples:

As you can see, Lovesac is trading on the lower end of its historical valuation. Since Lovesac just recently became profitable in 2021, we don’t have a lot of historical data to look at for earnings ratios. However, since their IPO, Lovesac has had a median EV/Sales of 1.8x (Median of average valuation throughout the quarter) and is currently trading at 0.9x. An upside of roughly 100% to their historic median.

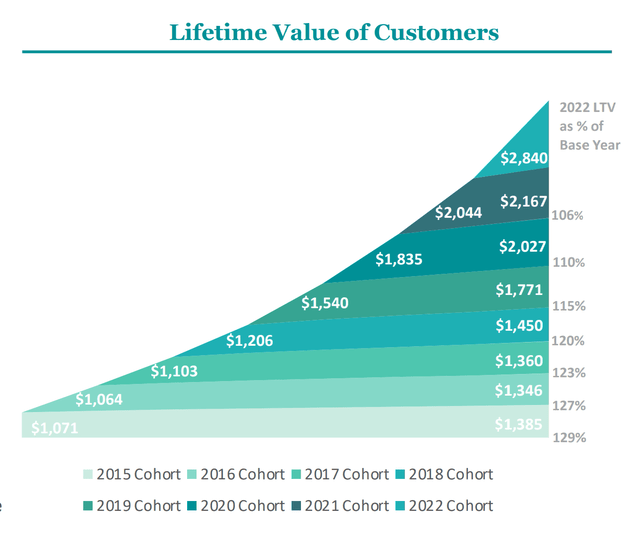

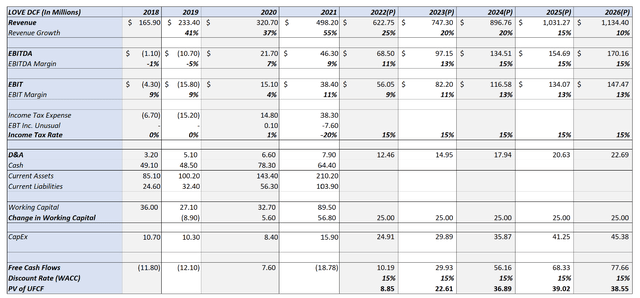

Discounted Cash Flow

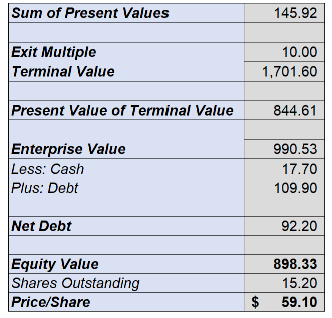

DCFs can be massaged and changed to essentially show whatever you want. So while I don’t put too much weight on them, they’re still nice to have. Here’s a look at a DCF for Lovesac:

In this model, I used revenue and EBITDA margin estimates that are mainly in line with analyst estimates. We used a 15% income tax rate (Lovesac just turned profitable, so they’re benefitting from loss carry forward laws), CapEx of 4% of sales, and a discount rate of 15%. I used the 15% discount rate to be conservative and to provide us with a larger margin of safety. With a current share price of roughly $27, this DCF implies an upside of approximately 115%.

Risks

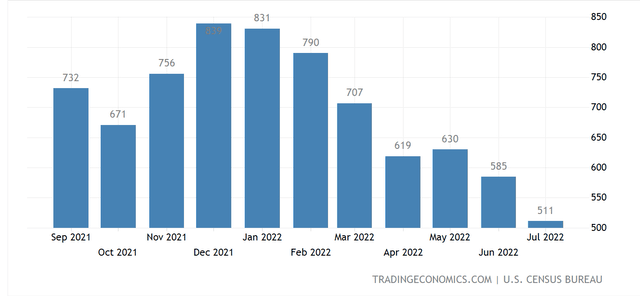

While there appears to be substantial upside here, there are substantial risks as well. CPI data for August just came out, increasing the likelihood of another 75 bps rate hike. Stubborn inflation coupled with rising interest rates creates a very unfriendly environment for discretionary spending. The furniture industry is highly discretionary in nature, given the expensive price tags that come along with new furniture. The furniture industry has also been proven to be strongly correlated with the housing market. Here is a graph showing new home sales in the United States:

As you can see, US home sales have been falling drastically in recent months, a bad omen for the furniture industry.

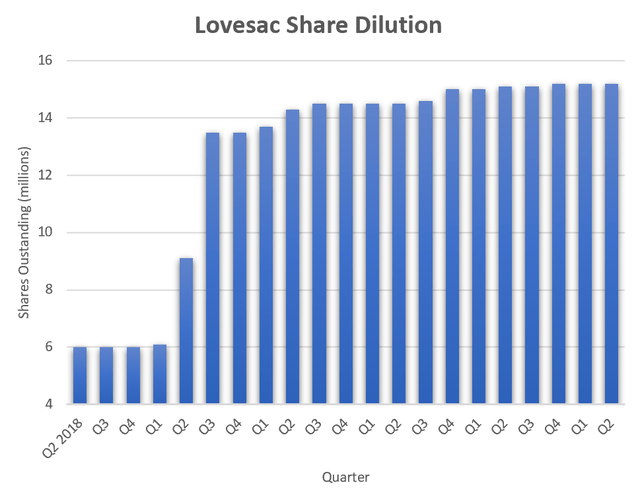

An additional risk we see for Lovesac is its use of share issuance to help fuel growth. Rather than take on large amounts of debt, Lovesac has issued new shares, diluting shareholders in the process. Here is a graph showing share outstanding for Lovesac since their IPO:

Since its IPO in Q2 of 2018 (4 years), Lovesac has increased its shares outstanding by 150%. That’s not great news. However, as you can see in the graph, Lovesac has tremendously slowed its share issuance since Q3 of 2019. Additionally, since Lovesac hit profitability in Q2 of 2021, they have increased shares outstanding by <1%. Hopefully, now that Lovesac has reached profitability, they should be able to support most of their expansion through FCFs. Nonetheless, here is a modified DCF, with a 50% increase in shares outstanding by the end of the forecast period:

Author

Even with the increased shares outstanding, the DCF still gives us an implied upside of nearly 50%. This is why it’s important to have a large margin of safety.

Opportunity

I believe that the market is overlooking Lovesac’s “recurring revenues” and brand loyalty, coming from the configurable nature of the Sactional. Instead, the market is viewing Lovesac as just another furniture company, which is reflected in its low valuation. While Lovesac is exposed to the same risks as the broader furniture industry, its recurring revenues will help protect them in an economic downturn. Lovesac customers will continue shopping at Lovesac, rather than pursuing cheaper options. Couple with Lovesac’s astronomical growth, Lovesac deserves a much higher valuation than the market is giving it. I believe that over the next 5-10 years, Lovesac will be a multi-bagger investment through a combination of earnings growth and multiple expansion. Therefore, I recommend dollar cost averaging into a long position and plan on holding for the long term.

Be the first to comment